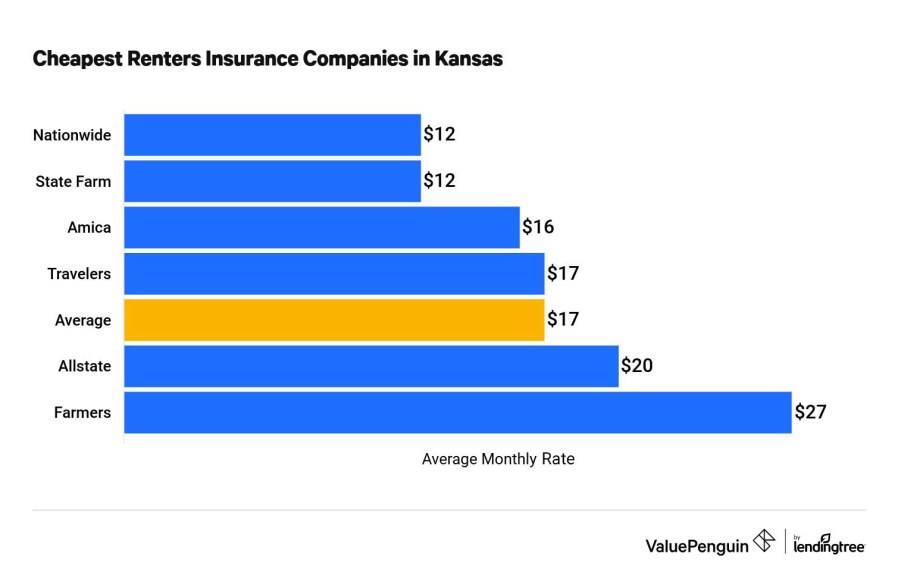

The average cost of renters insurance in Kansas is around $16 to $25 per month. Renters insurance rates in Kansas can vary based on factors like the coverage amount, location, and the insurance provider.

Renters insurance provides protection for your personal belongings and liability coverage in case of damage or theft in your rental property. It’s a smart investment for renters to safeguard their possessions and provide financial security in case of unexpected events.

Many renters find the peace of mind and protection that renters insurance offers to be well worth the affordable monthly cost. If you’re renting a property in Kansas, it’s essential to consider purchasing renters insurance to protect your belongings and provide liability coverage.

The Importance Of Renters Insurance

Protection For Personal Belongings

Renters insurance safeguards your personal items like electronics and furniture.

Liability Coverage For Accidents

Coverage for accidents that occur within your rented space is vital.

Additional Living Expenses

Assistance with living expenses if your rented home is uninhabitable.

Factors Affecting Renters Insurance Costs

Renting a home comes with many benefits, but it’s crucial to protect your belongings with renters insurance. The cost of renters insurance can vary based on several key factors:

Location

The location of your rental property plays a significant role in determining the cost of renters insurance. Urban areas with higher rates of crime or natural disasters may result in higher premiums.

Coverage Limits

The amount of coverage you choose for your renters insurance policy will directly impact the cost. Higher coverage limits will typically lead to higher premiums.

Deductibles

The deductible is the amount you pay out of pocket before your insurance kicks in. Opting for a higher deductible can lower your monthly premium.

The Type Of Building

The type of building you are renting, such as a single-family home, apartment complex, or condominium, can affect the cost of renters insurance. Factors like building age and security features may also influence pricing.

Average Costs Of Renters Insurance In Kansas

The average cost of renters insurance in Kansas is around $173 per year, which is relatively affordable compared to other states. Factors such as the coverage amount and the location within Kansas can influence the final cost, but overall, renters insurance is a valuable investment to protect your belongings.

The average costs of renters insurance in Kansas can vary depending on various factors, including location, coverage level, and insurance provider. Understanding these average rates can help you make an informed decision when it comes to protecting your belongings and personal liability. In this article, we will explore the average costs of renters insurance in Kansas and provide valuable insights into the comparison to national averages. We will also discuss the average costs based on different coverage levels, giving you a clear idea of what to expect when shopping for renters insurance in Kansas.Understanding The Average Rates

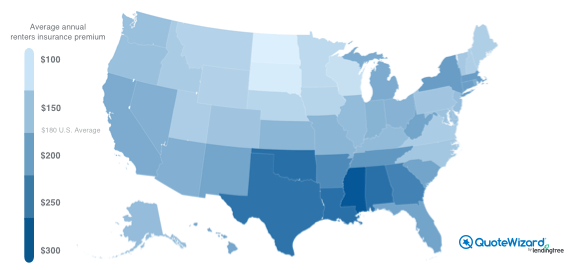

Kansas residents can expect to pay an average of $164 per year for renters insurance, according to the latest data. This rate is slightly lower than the national average of $180 per year. Renters insurance offers valuable coverage for your personal belongings, liability protection, and additional living expenses in case of a covered loss. When it comes to renting a home or apartment in Kansas, it’s important to safeguard your possessions against unexpected events like theft, fire, or water damage. Renters insurance provides financial protection, giving you peace of mind knowing that your belongings are covered.Comparison To National Averages

Compared to the national averages, Kansas residents can benefit from slightly lower rates when it comes to renters insurance. The average annual premium in Kansas is $16 lower than the national average, saving you money while still receiving essential coverage for your rented space. It’s worth noting that insurance rates can vary significantly depending on your location within Kansas. Factors such as crime rates, natural disaster risks, and the overall cost of living in your area can influence the rates you’ll be quoted.Average Costs Based On Coverage Levels

The average costs of renters insurance in Kansas can also differ depending on the coverage levels you choose. Here is a breakdown of the average annual premiums based on different coverage levels:- Minimum Coverage: If you opt for minimum coverage, which typically includes $10,000 in personal property coverage and $100,000 in liability coverage, you can expect to pay around $136 per year.

- Standard Coverage: For a higher level of protection, you may choose standard coverage, which usually includes $20,000 in personal property coverage and $100,000 in liability coverage. This level of coverage typically costs around $164 per year.

- Comprehensive Coverage: If you want comprehensive coverage to provide even greater protection, including $30,000 or more in personal property coverage and higher liability limits, you can expect to pay upwards of $200 per year, depending on the specific coverage options you choose.

Credit: quotewizard.com

Tips For Finding Affordable Renters Insurance

Renting a place comes with a set of responsibilities, one of which is ensuring your belongings are protected through renters insurance. However, you don’t have to break the bank to secure coverage. With these tips, you can find affordable renters insurance that offers the protection you need:

Shop Around And Compare Quotes

Begin your search for renters insurance by obtaining quotes from multiple providers. Comparing quotes allows you to find the best rates and coverage options for your specific needs.

Bundle Insurance Policies

Consider bundling your renters insurance with other policies, such as auto insurance. Many insurance companies offer discounts for bundling, helping you save on overall premiums.

Consider Higher Deductibles

If you’re comfortable with assuming more financial risk, opting for higher deductibles can lower your monthly premiums. Just make sure you can afford to pay the deductible if the need arises.

Look For Discounts

Many insurers offer discounts for various reasons, such as having a security system in your rental unit or being a non-smoker. Look for these discounts to reduce your insurance costs without sacrificing coverage.

Common Mistakes To Avoid With Renters Insurance

Renters insurance is an essential safeguard that provides financial protection for your personal belongings and offers liability coverage against covered perils. However, to ensure that you make the most out of your renters insurance policy, it’s crucial to steer clear of common mistakes that renters often make. These errors can lead to inadequate coverage and financial hardships in the event of an unforeseen disaster.

Underestimating The Value Of Belongings

Many renters make the mistake of underestimating the value of their belongings when purchasing renters insurance. Oftentimes, people fail to realize the cumulative worth of their possessions, which could lead to insufficient coverage in the event of theft, fire, or other covered perils.

Neglecting Liability Coverage

Another common mistake is neglecting liability coverage. Renters insurance not only protects your personal property but also provides liability coverage in case someone is injured while on your rental property. Failing to include liability coverage in your policy can leave you vulnerable to legal and medical expenses.

Failing To Update The Policy

It’s important to regularly update your renters insurance policy to reflect changes in your living situation and the value of your belongings. Failing to update your policy can lead to being underinsured, as the coverage may not adequately reflect the current value of your possessions, leaving you exposed to financial risk.

Not Reading The Policy Carefully

One of the most crucial mistakes to avoid is not carefully reading and understanding the policy. Some renters overlook the details of the coverage, which may result in misunderstandings or overlooked exclusions and limitations. Reading the policy carefully ensures that you are fully aware of what is and isn’t covered, preventing any surprises when filing a claim.

Credit: quotewizard.com

Steps To Take When Filing A Renters Insurance Claim

When filing a renters insurance claim, it’s important to follow these steps to ensure a smooth process. From gathering evidence and contacting your insurance provider to documenting damages and submitting necessary paperwork, taking these steps can help you receive the appropriate compensation for your losses.

Experiencing damage or loss to your rented property can be a stressful situation. However, having renters insurance can provide you with the financial security and peace of mind you need during such times. When it comes to filing a renters insurance claim, following the right steps is crucial. In this article, we will outline the essential steps you should take to ensure a smooth claims process.

Document The Damage Or Loss

Before contacting your insurance provider, it is important to document the damage or loss as evidence for your claim. Take photographs of the affected area or belongings, making sure to capture the extent of the damage. If possible, gather any receipts or documents related to the damaged items to support your claim. By documenting the damage or loss, you provide concrete evidence to your insurance provider, which will help expedite the claims process.

Contact Your Insurance Provider

Once you have gathered documentation of the damage or loss, the next step is to contact your insurance provider as soon as possible. Report the incident to them, providing all necessary details such as the date and time of the incident, the cause of damage, and the items affected. It is important to accurately describe the situation and provide any additional information requested by your insurance provider. By promptly contacting your insurance provider, you can initiate the claims process and minimize any potential delays.

File A Police Report (if Necessary)

In cases of theft, vandalism, or other criminal activities, filing a police report is often required to support your renters insurance claim. Contact your local authorities and provide them with all the relevant details of the incident. Cooperate with the police and obtain a copy of the filed report, as it will serve as evidence for your claim. Including a police report with your claim strengthens your case and increases the chances of a successful reimbursement for your losses.

Submit The Claim

Once you have documented the damage or loss, contacted your insurance provider, and filed a police report (if necessary), it is time to submit your renters insurance claim. Be thorough when filling out the claim form, providing accurate and detailed information. Include all supporting documentation, such as photographs, receipts, and the police report, to strengthen your claim. Double-check that you have included all required information before submitting your claim to ensure a smooth processing.

By following these steps diligently, you can navigate the renters insurance claim process smoothly and increase the likelihood of a successful reimbursement. Remember, in case of any uncertainty or questions, always reach out to your insurance provider for guidance and assistance.

Understanding Renters Insurance Exclusions

If you’re considering renters insurance, it’s crucial to understand the policy exclusions that outline what is not covered. Here’s a closer look at some common scenarios where renters insurance might not provide coverage.

Damage From Natural Disasters

Renters insurance typically excludes damages caused by natural disasters like earthquakes, floods, and hurricanes.

Additional coverage may be needed to protect against these events.

Negligent Or Intentional Acts

Intentional damage or negligence resulting in property loss may not be covered by renters insurance.

Be mindful of your actions to avoid potential coverage gaps in such situations.

Certain High-value Items

High-value items such as jewelry, art, and expensive electronics may have limited coverage under renters insurance.

Consider adding a separate policy or rider to ensure adequate protection for these items.

Pest Infestations

Renters insurance typically does not cover damages caused by pest infestations like termites or rodents.

Regular maintenance and pest control can help prevent such issues.

The Benefits Of Renters Insurance

Renters insurance in KS provides affordable protection for personal belongings and liability coverage. The cost varies depending on factors such as location and coverage amount, with an average price of around $15 to $30 per month. It offers peace of mind in case of unforeseen events like theft or fire.

Peace Of Mind

Renters insurance provides assurance that your belongings are protected.

Financial Protection

In the event of theft or damage, renters insurance offers financial security.

Legal Coverage

Renters insurance can assist with legal expenses related to accidents on your property.

Credit: http://www.doorloop.com

Frequently Asked Questions On How Much Is Renters Insurance Ks

Why Is Renters Insurance Important For Ks Residents?

Renters insurance is crucial for Ks residents as it protects personal belongings and provides liability coverage in case of accidents. It offers peace of mind and financial security in the event of unforeseen circumstances.

What Does Renters Insurance In Ks Typically Cover?

Typically, renters insurance in Ks covers personal property, liability protection, additional living expenses, and medical payments. It also provides coverage for theft, fire, vandalism, and other covered disasters.

How Much Does Renters Insurance Cost In Ks?

The cost of renters insurance in Ks varies depending on factors like coverage limits, deductibles, and location. On average, the monthly premium can range from $15 to $30, making it an affordable means of protecting valuables.

Can Renters Insurance In Ks Be Customized To Specific Needs?

Yes, renters insurance in Ks can be tailored to individual needs. You can add endorsements or riders to the policy to cover specific high-value items or enhance coverage for certain risks, providing a personalized level of protection.

Conclusion

Renters insurance in Kansas offers crucial protection for tenants at an affordable cost. It safeguards your personal belongings, liability, and additional living expenses in case of unforeseen events such as theft, fire, or natural disasters. By understanding the value of having renters insurance, you can gain peace of mind knowing that you are financially protected.

So don’t hesitate to explore your options and find the right coverage that suits your needs.

Leave a comment