Yes, Fire Insurance Zauba Corp provides fire insurance coverage. Fire Insurance Zauba Corp offers fire insurance policies to protect businesses and individuals against the financial losses caused by fire accidents.

With their insurance plans, clients can ensure that their assets are safeguarded and receive compensation in case of a fire incident. This type of insurance can provide peace of mind and financial security in the event of a fire-related disaster.

Whether it’s to protect commercial properties, residential homes, or valuable belongings, Fire Insurance Zauba Corp offers reliable fire insurance solutions tailored to meet the specific needs of policyholders.

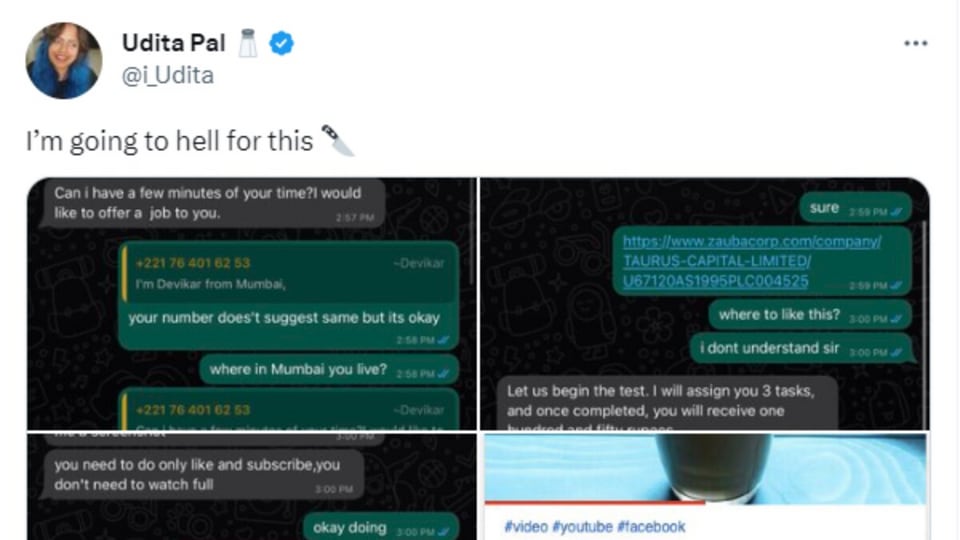

Credit: tech.hindustantimes.com

The Importance Of Fire Insurance

Fire insurance is crucial for businesses to protect their assets and ensure continuity.

Protecting Your Business Assets

Fire insurance shields your property and inventory against the devastating effects of fire.

Ensuring Business Continuity

In the event of a fire, having insurance helps sustain your operations and financial stability.

Understanding Zauba Corp

Zauba Corp provides detailed insights into companies and their operations, including their financials and other vital details. When considering fire insurance, understanding Zauba Corp’s data can help assess the risk and make informed decisions. With this information, companies can better protect themselves and their assets.

Understanding Zauba Corp. Company Profile Zauba Corp is a leading provider of fire insurance services in India. With a strong presence in the insurance industry, it has gained a reputation for its commitment to delivering reliable and comprehensive coverage to its customers. Zauba Corp has been operating for over a decade and has established itself as a trusted name in the market. Services Offered Zauba Corp offers a range of fire insurance services tailored to meet the specific needs of individuals and businesses. Their team of experienced professionals works closely with clients to understand their requirements and design insurance policies that provide optimal coverage. Whether it’s safeguarding your home or protecting your business property, Zauba Corp offers flexible and competitive insurance solutions. One of the key services provided by Zauba Corp is property insurance, which ensures that your assets are protected against fire-related risks. With their extensive knowledge and expertise, they help you assess the value of your property and determine the coverage needed to adequately protect it. In addition, Zauba Corp also offers specialized insurance for commercial properties, ensuring that businesses are well-equipped to handle fire-related losses. Zauba Corp believes in providing personalized service to its customers. They understand that every individual or business has different requirements, and their team goes the extra mile to tailor insurance solutions accordingly. By combining their industry expertise with a client-centric approach, Zauba Corp aims to simplify the insurance process and provide hassle-free coverage. When it comes to making claims, Zauba Corp ensures a smooth and efficient process. Their dedicated claims team works closely with customers to guide them through the necessary steps and provide support throughout the claims settlement process. With their prompt response and transparent communication, Zauba Corp strives to make the claims experience stress-free for their valued customers. In conclusion, Zauba Corp is a reputable insurance provider specializing in fire insurance services. With their comprehensive coverage, personalized service, and efficient claims handling, they are a trusted choice for individuals and businesses looking for reliable protection against fire-related risks.Benefits Of Fire Insurance For Zauba Corp

Fire insurance provides essential protection for Zauba Corp, safeguarding their assets in the event of a fire, assisting with rebuilding or replacement costs, and ensuring business continuity. With fire insurance, Zauba Corp can focus on their operations with peace of mind, knowing that they are covered against potential fire-related losses.

Financial Protection

“` In the world of business, uncertainties are inevitable, and for a company like Zauba Corp, safeguarding against potential risks is crucial. One major risk that businesses face is the possibility of a fire wreaking havoc on their property, resulting in severe financial losses. That’s where fire insurance comes into play, offering invaluable financial protection to Zauba Corp in the event of fire-related damages. “`htmlRisk Mitigation

“` Fire insurance provides more than just financial security; it also plays a key role in mitigating risks. By being covered with fire insurance, Zauba Corp can minimize the potential impact of fire incidents on their operations, allowing the company to continue its business activities without facing the full brunt of financial setbacks caused by property damage. With fire insurance in place, Zauba Corp not only ensures financial protection against unforeseen fire-related damages but also effectively mitigates the risks associated with such incidents. This translates to greater peace of mind and a more secure future for the company.

Credit: tech.hindustantimes.com

Key Considerations For Fire Insurance Selection

Coverage Options

Fire insurance offers various coverage options to protect your business against financial losses resulting from fire damage. Common coverage options include property damage, business interruption, and inventory replacement. It’s crucial to assess your business’s specific needs and ensure that the insurance policy provides adequate coverage for your property, equipment, and assets.

Policy Terms

When selecting fire insurance, carefully review the policy terms to understand the duration of coverage, exclusions, deductibles, and claim procedures. Pay attention to the policy’s terms and conditions to ensure that you are aware of any limitations or restrictions on coverage. Additionally, consider the insurer’s reputation, financial stability, and customer service to ensure a reliable and efficient claims process in the event of a fire-related loss.

Steps To Obtain Fire Insurance For Zauba Corp

Fire insurance is an essential aspect of protecting your business, and obtaining it for Zauba Corp is no exception. In order to ensure the safety of your assets, it is crucial to follow these steps in procuring fire insurance:

Assessment Of Risk

The first step in obtaining fire insurance for Zauba Corp is to assess the risk factors that may lead to a fire incident. Evaluate the nature of your business operations, the materials and equipment used, as well as the fire safety measures in place. This assessment will help insurance providers determine the appropriate coverage for your organization.

Consulting With Insurance Providers

Once the risk assessment is complete, the next step is to consult with insurance providers to find the most suitable fire insurance policy for Zauba Corp. It is important to choose a reputable and experienced insurance provider that specializes in fire insurance to ensure comprehensive coverage.

To begin the process, reach out to multiple insurance providers and request quotes based on the assessed risk factors. This will allow you to compare the terms, coverage limits, and premiums offered by different providers. Take the time to carefully review and understand each policy before making a decision.

During the consultation process, be prepared to provide comprehensive information about Zauba Corp, including the size of the property, type of occupancy, and details of any existing fire safety systems. This will assist insurance providers in accurately gauging the level of risk involved and tailoring the coverage accordingly.

While consulting with insurance providers, it is also advisable to inquire about any additional coverage options apart from basic fire insurance. These may include coverage for business interruption, contents, and equipment, which can further protect Zauba Corp in the event of a fire-related incident.

Remember, the goal is to find a fire insurance policy that offers the optimal combination of coverage, cost, and quality of service for Zauba Corp.

Securing A Fire Insurance Policy

Once you have selected the most suitable insurance provider and fire insurance policy, the final step is to secure the policy for Zauba Corp. This involves completing the necessary paperwork, providing accurate information, and paying the premium as determined by the insurance provider.

Review the policy document thoroughly to ensure all the terms and conditions are clearly stated. Take note of any exclusions or specific requirements that need to be fulfilled to maintain the coverage. Keep a copy of the policy in a secure location and inform relevant employees or departments about the insurance coverage obtained.

Regularly review the fire insurance policy to ensure it remains adequate for the evolving needs of Zauba Corp. As the business grows or changes, there might be a need to adjust the coverage and update the insurance provider accordingly.

By following these steps, Zauba Corp can obtain the necessary fire insurance coverage to protect its assets and operations from the possible financial impact of a fire-related incident.

Case Studies Of Fire Incidents And Recovery

In examining Case Studies of Fire Incidents and Recovery, it is essential to draw insights from real-world examples to understand how businesses can bounce back from such crises.

Lessons Learned

Identifying vulnerabilities: Every fire incident reveals weak points that need fortification to prevent future disasters.

Importance of planning: Adequate precautions and emergency plans can minimize the impact of fires.

Quick response: The swiftness of the response team greatly influences the extent of damage incurred.

Effective Strategies

Investing in safety: Proactive measures and safety protocols prove to be valuable investments in the long run.

Employee training: Ensuring that staff knows how to respond in case of a fire can save lives and property.

Utilizing technology: Implementing fire detection systems and early warning devices enhances preparedness.

Expert Insights On Fire Insurance Zauba Corp

Here are some industry insights and future outlook regarding Fire Insurance Zauba Corp.

Industry Trends

The fire insurance industry is witnessing innovative solutions to cater to evolving risks and challenges.

- Adoption of advanced technology for risk assessment and claims processing.

- Focus on providing tailored coverage options for niche industries.

- Partnerships with data analytics firms to enhance underwriting accuracy.

Future Outlook

The future of fire insurance looks promising with emerging trends and market developments.

- Rise of parametric insurance models for faster claims disbursement.

- Integration of IoT devices to prevent and mitigate fire-related risks.

- Expansion into untapped markets through digital distribution channels.

Credit: http://www.scribd.com

Frequently Asked Questions On Can Fire Insurance Zauba Corp

What Is Fire Insurance For Zaubacorp?

Fire insurance for Zaubacorp is a type of insurance that provides financial protection against the damage or loss caused by fire to the property and assets of the company.

How Does Fire Insurance Protect Zaubacorp?

Fire insurance protects Zaubacorp by providing coverage for the cost of repairing or replacing damaged property, equipment, and inventory due to fire incidents. It helps the company to recover from the financial loss caused by fire damage.

Why Does Zaubacorp Need Fire Insurance?

Zaubacorp needs fire insurance to safeguard its assets and investments from the potential risks of fire accidents. It offers financial security, allowing the company to resume operations and mitigate losses in case of fire-related damages.

What Does Fire Insurance For Zaubacorp Cover?

Fire insurance for Zaubacorp covers the cost of repairing or replacing the property, machinery, equipment, and inventory damaged by fire. It also includes protection against business interruption and additional expenses incurred due to fire incidents.

Conclusion

Protecting your property against unforeseen events like fires is crucial, and having fire insurance with Zauba Corp can provide you with the peace of mind you need. By offering comprehensive coverage and timely claims settlement, Zauba Corp ensures that you are financially protected in the event of fire damage.

Don’t leave your property vulnerable; invest in fire insurance with Zauba Corp today.

Leave a comment