Group health insurance provides coverage to a group of people, typically through an employer-sponsored plan. This type of insurance offers significant advantages in cost savings and comprehensive benefits for employees.

Group health insurance is a popular choice for employers looking to provide valuable benefits to their workforce while maintaining affordable premiums. By spreading the risk among a larger pool of participants, group plans offer better coverage options and lower costs compared to individual policies.

In addition, group health insurance often includes wellness programs and preventative care services to promote employee health and productivity. With the rising importance of employee well-being in the workplace, group health insurance plays a crucial role in attracting and retaining top talent.

Credit: http://www.papartnerships.org

Why Group Health Insurance?

Group Health Insurance is a valuable benefit for both employers and employees. Let’s explore the key benefits it offers.

Benefits For Employers

- Cost-Effective: Provides affordable coverage for employees.

- Enhances Recruitment: Attracts top talent with comprehensive benefits.

- Improved Productivity: Healthy employees lead to higher productivity levels.

- Tax Deductions: Qualify for tax advantages on premiums paid.

Benefits For Employees

- Healthcare Access: Affordable access to quality healthcare services.

- Financial Security: Protection against unexpected medical expenses.

- Wellness Programs: Encourages health and wellness through wellness programs.

Key Components Of Group Health Insurance

Group health insurance offers a range of benefits to employees, providing coverage for medical expenses and promoting overall well-being. Understanding the key components of group health insurance is essential for both employers and employees to make informed decisions.

Premiums And Contributions

Premiums: The cost of group health insurance is shared between the employer and employees, with the premium typically paid on a monthly basis.

Contributions: Employees may be required to contribute a portion of the premium, which is deducted from their paycheck. Employers may also contribute towards these costs.

Covered Services

Covered Services: Group health insurance plans outline the medical services and treatments that are covered, such as doctor visits, prescription medications, and preventive care.

- Doctor Visits

- Prescription Medications

- Preventive Care

Networks And Providers

Networks: Group health insurance plans often come with networks of healthcare providers, including doctors, hospitals, and specialists, that offer services at discounted rates.

Providers: Employees can choose healthcare providers within the network for their medical needs, ensuring they receive quality care while controlling costs.

“` This HTML content provides a concise and informative overview of the key components of group health insurance, focusing on premiums and contributions, covered services, and networks and providers, in a format suitable for a WordPress blog post.Types Of Group Health Insurance Plans

When it comes to providing healthcare coverage for your employees, it’s important to understand the different types of group health insurance plans available. Whether you’re a small business owner or an HR manager, choosing the right plan can have a significant impact on the well-being of your employees and the success of your organization.

Health Maintenance Organization (hmo)

An HMO, or Health Maintenance Organization, is a common type of group health insurance plan. With an HMO, employees have access to a network of healthcare providers that have agreed to provide services at reduced rates. This network is often referred to as a “panel” or “panel of physicians.” Within the HMO network, employees typically choose a primary care physician (PCP) who oversees and coordinates their healthcare. In most cases, referrals from the PCP are required before an employee can see a specialist. HMO plans often require employees to choose an in-network primary care physician and obtain referrals for specialist visits.

Preferred Provider Organization (ppo)

A PPO, or Preferred Provider Organization, is another type of group health insurance plan. With a PPO, employees have more freedom in choosing healthcare providers. While PPOs also have a network of participating providers, employees have the option to visit out-of-network providers, albeit with reduced coverage and higher out-of-pocket costs. PPO plans typically do not require employees to select a primary care physician or obtain referrals for specialist visits. This flexibility can be appealing for employees who prefer a more hands-on approach to managing their healthcare.

Point Of Service (pos)

A POS, or Point of Service, is a hybrid type of group health insurance plan that combines elements of both HMO and PPO plans. With a POS plan, employees have the choice to receive care from either in-network or out-of-network providers. However, if they choose to see an out-of-network provider, they will typically have higher out-of-pocket costs. Similar to an HMO, employees are required to select a primary care physician within the network. This PCP serves as the point of contact for all healthcare needs and is responsible for providing referrals to specialists.

High Deductible Health Plans (hdhp)

A High Deductible Health Plan (HDHP) is a type of group health insurance plan designed to lower monthly premium costs by shifting a higher portion of the expenses onto employees. With an HDHP, employees are responsible for paying a higher deductible amount before the insurance coverage kicks in. These plans are often paired with a Health Savings Account (HSA) that allows employees to save and use pre-tax dollars to cover qualified medical expenses. HDHPs can be an attractive option for both employers and employees seeking to reduce healthcare costs and maximize tax savings.

Credit: http://www.linkedin.com

Factors To Consider When Choosing Group Health Insurance

Choosing the right group health insurance plan for your employees is a decision that requires careful consideration. It’s crucial to weigh several key factors to ensure that the selected plan meets the needs of both the company and its employees. Here are some essential factors to consider when evaluating group health insurance options:

Cost

Cost is a significant consideration while choosing group health insurance. Assess the premiums, co-pays, deductibles, and potential out-of-pocket expenses associated with each plan. Ensure that the plan provides comprehensive coverage without imposing excessive financial burdens on the company or its employees.

Plan Flexibility

Plan flexibility is another vital factor. Look for a plan that allows customization to accommodate the diverse needs of your employees. Evaluate if the plan offers options for different coverage levels, such as individual, family, or employee-plus-spouse coverage.

Coverage

Coverage is paramount in group health insurance. Ensure that the plan comprehensively covers essential medical services, including preventive care, hospitalization, specialist visits, and mental health services. Evaluate if the plan also includes coverage for dental, vision, and additional wellness programs.

Provider Network

Consider the provider network associated with the plan. Verify that the plan includes a wide network of healthcare providers, ensuring that employees have access to quality medical care from trusted physicians and specialists in their area.

Prescription Drug Coverage

Evaluate the prescription drug coverage included in the plan. Confirm that the plan provides access to a broad formulary of medications at affordable co-pays, ensuring that employees can afford essential prescription drugs without any significant financial strain.

Compliance And Legal Requirements

When it comes to group health insurance, compliance and legal requirements are crucial factors that employers must consider. Understanding and adhering to these regulations is necessary to ensure the well-being and protection of employees while avoiding potential legal ramifications.

Employer Mandate

Under the Employer Mandate, applicable large employers must provide affordable and adequate health insurance coverage to their full-time employees. Failure to comply with this regulation may result in penalties and fines.

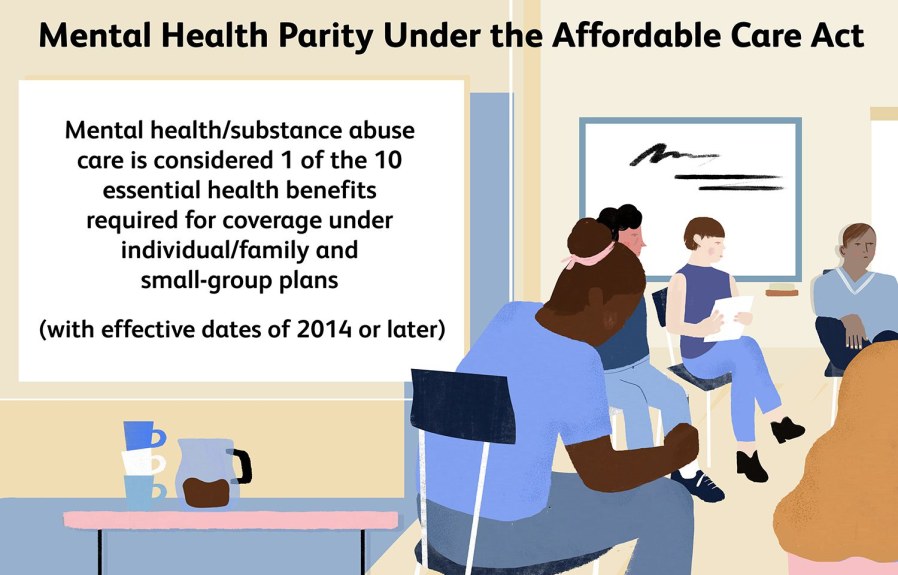

Affordable Care Act (aca) Compliance

The Affordable Care Act (ACA) sets forth comprehensive guidelines for employers regarding the provision of health insurance benefits. This includes essential health benefits, preventive care services, and limits on cost-sharing requirements, among other provisions.

Erisa Regulations

ERISA, the Employee Retirement Income Security Act, imposes strict compliance requirements on employers offering group health insurance plans. This includes providing plan information to employees, fiduciary responsibilities, and reporting and disclosure obligations.

Employee Communications And Education

Employee communications and education play a vital role in the success of a group health insurance program. By ensuring that employees understand their benefits, have the information they need during open enrollment, and are aware of wellness programs, companies can empower their workforce to make informed decisions about their health and well-being. This in turn leads to improved employee satisfaction, higher engagement, and ultimately, a healthier and more productive workforce.

Understanding The Benefits

Understanding the benefits of a group health insurance plan is crucial for employees. It empowers them to make the most of their coverage and access the necessary healthcare services when needed. Providing clear and concise information about the benefits, such as coverage details, network providers, and copayment amounts, helps employees navigate the sometimes complex world of healthcare. Additionally, educating employees about their rights and responsibilities under the plan ensures that they are aware of what is expected of them in terms of premium payments, claim procedures, and utilization of services.

Open Enrollment

Open enrollment is an important time for employees to review and potentially make changes to their health insurance coverage. Communication during this period is key to ensure that employees are well-informed about their options and any changes to the plan. Clear communication channels, such as emails, newsletters, and employee portals, should be utilized to provide employees with the necessary information, including any updates to coverage, premium costs, and enrollment deadlines. Providing guidance and assistance during this time can help employees make informed decisions that best meet their healthcare needs.

Wellness Programs

Wellness programs are becoming increasingly popular in group health insurance plans. These programs aim to promote employee health, prevent illness, and reduce healthcare costs. Communicating the availability and benefits of wellness programs is essential to encourage employee participation. Whether it’s offering discounted gym memberships, providing access to preventive care screenings, or offering initiatives such as health challenges and wellness workshops, educating employees about the various opportunities for improving their health and well-being can have a positive impact on their overall wellness. This, in turn, can help reduce absenteeism, increase productivity, and create a healthier work environment.

The Role Of Insurance Brokers

The Role of Insurance Brokers:

Benefits Of Using An Insurance Broker

Insurance brokers play a crucial role in helping businesses navigate the complexities of group health insurance.

Choosing The Right Broker

Selecting the right broker ensures tailored solutions and cost-effective group health insurance plans.

- Expert Advice

- Customized Solutions

- Cost Savings

- Industry Experience

- Client References

- Transparency in Communication

Credit: http://www.facebook.com

Managing Costs And Controlling Premium Increases

Group health insurance is vital for businesses to safeguard their employees’ well-being. In the realm of managing costs and controlling premium increases, several strategies can be leveraged to enhance efficiency.

Healthcare Cost Management Strategies

- Implement preventive care measures to discourage high-cost treatments.

- Encourage generic drug usage to reduce medication expenses.

Employee Wellness Programs

- Introduce fitness challenges to promote a healthier workforce.

- Offer mental health resources to support overall well-being.

Negotiating With Insurance Providers

- Compare quotes from various insurers for competitive pricing.

- Seek to customize plans to suit your employees’ specific needs.

Frequently Asked Questions For Group Health Insurance About

What Is Group Health Insurance?

Group health insurance is a policy that covers a group of people, typically provided by an employer. It offers a range of coverage options and often lower premiums due to the collective purchasing power of the group.

How Does Group Health Insurance Differ From Individual Plans?

Group health insurance is offered to a group of people, often through an employer, while individual plans are purchased on the open market. Group plans typically have lower costs and broader coverage options due to the collective bargaining power.

What Are The Key Benefits Of Group Health Insurance?

Group health insurance offers cost-effective health coverage, often with lower premiums and comprehensive benefits. It also provides a sense of security and support for employees’ health needs, contributing to overall satisfaction and retention.

Who Is Eligible For Group Health Insurance Coverage?

Eligibility for group health insurance varies but typically includes full-time employees, part-time employees, and sometimes, their dependents. Some policies may extend coverage to include contractors or freelance workers affiliated with the group.

Conclusion

Group health insurance is a valuable asset for businesses and their employees. It provides comprehensive coverage, cost-sharing benefits, and promotes workforce well-being. With the current healthcare landscape, having access to group health insurance can greatly reduce financial burdens and ensure access to quality healthcare services.

By partnering with a reputable insurance provider, businesses can offer a competitive benefits package and attract and retain top talent. Prioritizing the health and well-being of employees is not only essential for their overall satisfaction but also contributes to the success of the business as a whole.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is group health insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance is a policy that covers a group of people, typically provided by an employer. It offers a range of coverage options and often lower premiums due to the collective purchasing power of the group.” } } , { “@type”: “Question”, “name”: “How does group health insurance differ from individual plans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance is offered to a group of people, often through an employer, while individual plans are purchased on the open market. Group plans typically have lower costs and broader coverage options due to the collective bargaining power.” } } , { “@type”: “Question”, “name”: “What are the key benefits of group health insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance offers cost-effective health coverage, often with lower premiums and comprehensive benefits. It also provides a sense of security and support for employees’ health needs, contributing to overall satisfaction and retention.” } } , { “@type”: “Question”, “name”: “Who is eligible for group health insurance coverage?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Eligibility for group health insurance varies but typically includes full-time employees, part-time employees, and sometimes, their dependents. Some policies may extend coverage to include contractors or freelance workers affiliated with the group.” } } ] }

Leave a comment