Renters Insurance Xlsx is a spreadsheet file format used for organizing and analyzing data related to renters insurance policies. This format allows for easy access and manipulation of information regarding coverage, premiums, and claims.

Renters Insurance Xlsx provides a comprehensive view of all aspects of renters insurance policies in a structured and manageable format. Renters insurance is an essential financial safety net for anyone renting a property. It provides protection against unexpected events such as theft, fire, or water damage to personal belongings.

With Renters Insurance Xlsx, policy details can be easily tracked and managed for better understanding and decision-making. This versatile file format simplifies the complexities of insurance coverage, ensuring renters have the necessary information at their fingertips. Understanding the ins and outs of renters insurance is crucial for safeguarding one’s assets and ensuring peace of mind in the face of unforeseen circumstances.

Credit: http://www.fastbound.com

Understanding Renters Insurance

Renters insurance is a crucial aspect of safeguarding your belongings and providing liability coverage for unexpected mishaps. Understanding renters insurance is essential for renters to make informed decisions and protect themselves financially. Let’s delve into the details of what renters insurance is, its importance, and why it is a smart investment for tenants.

What Is Renters Insurance?

Renters insurance is a type of insurance policy that offers financial protection to individuals renting a house or apartment. It provides coverage for personal belongings, liability protection, and additional living expenses in the event of a covered loss.

Importance Of Renters Insurance

Renters insurance is crucial for tenants as it protects their personal property and covers liability concerns. Without renters insurance, individuals risk facing significant financial losses in case of theft, fire, or other unforeseen events. Additionally, it offers liability coverage, safeguarding renters from potential legal and medical expenses if an accident or injury occurs within their rented premises.

Coverage Details

When determining the right renters insurance policy for you, understanding the coverage details is crucial. It’s important to know what is protected under your policy and how you can benefit from it. Let’s delve into the coverage details:

Property Coverage

Property coverage in renters insurance generally protects your personal belongings from covered perils such as theft, fire, or vandalism. It includes items like furniture, electronics, clothing, and more.

Liability Coverage

Liability coverage protects you in case someone is injured on your rented property and you’re found liable. It can help cover legal fees, medical expenses, and damages you are legally responsible for.

Key Benefits

Renter’s insurance is an essential investment that provides a range of key benefits to tenants. By understanding these benefits, you can protect yourself financially and gain peace of mind. Here are some of the most important advantages of having renter’s insurance:

Protection Against Theft And Vandalism

One of the primary benefits of renter’s insurance is that it offers crucial protection against theft and vandalism. Your personal belongings, such as electronics, furniture, and clothing, are covered in the event of theft. This means that if your apartment is broken into and your valuables are stolen, you will be reimbursed for their value up to the policy limit. Additionally, renter’s insurance also covers damages caused by vandalism, ensuring that any repairs or replacements needed will be taken care of.

Liability Protection For Accidents

Renter’s insurance doesn’t just protect your belongings; it also offers liability coverage. Accidents happen, and if someone gets injured while visiting your apartment, you could be held financially responsible. Renter’s insurance safeguards you against liability by covering the medical expenses and legal costs that might arise from such incidents. Whether the person slips and falls or is injured by a pet, this coverage provides you with the necessary financial protection.

Policy Considerations

When it comes to renters insurance, there are a few key policy considerations that you should be aware of before making a decision. Understanding these factors will help you choose the right coverage and ensure that you are adequately protected in case of unexpected events. In this article, we will explore two important policy considerations: deductibles and personal property inventory.

Understanding Deductibles

Deductibles play a crucial role in renters insurance. A deductible is the amount of money you need to pay out of pocket before your insurance coverage kicks in. It is important to have a clear understanding of how deductibles work because they can have a significant impact on the amount of money you receive from your insurance claim.

Typically, renters insurance policies have two types of deductibles: a perils deductible and a property deductible. A perils deductible applies to specific types of losses, such as fire or theft, while a property deductible applies to all other types of losses. It’s important to know which deductibles apply to your policy and what the specific amounts are.

When choosing a deductible, it’s important to strike a balance between the amount you can afford to pay out of pocket and the cost of your insurance premium. Higher deductibles often result in lower premiums, but you need to be comfortable with the amount of money you would need to pay in case of a claim.

Personal Property Inventory

Creating a comprehensive inventory of your personal belongings is essential when it comes to renters insurance. This inventory helps you determine the value of your possessions and ensures that you have adequate coverage.

To create a personal property inventory, go through each room in your rental and make a detailed list of all the items you own. Include descriptions, purchase dates, and estimated values. Don’t forget to also document any valuable items, such as jewelry or electronics.

It can be helpful to take photos or videos of your belongings as supporting documentation. Storing this inventory in a secure location, such as a cloud-based storage service, ensures that you can access it even if your physical inventory gets damaged or lost in an incident.

Regularly updating your personal property inventory is crucial, especially if you acquire new belongings or get rid of old ones. This will help ensure that your coverage accurately reflects the value of your possessions at all times.

Choosing The Right Policy

When it comes to choosing the right renters insurance policy, it’s important to assess your coverage needs and compare quotes for the best value.

Assessing Coverage Needs

Assess your belongings and potential liabilities to determine coverage needs.

- Consider personal property value.

- Evaluate potential risks like theft or natural disasters.

Comparing Quotes

Get quotes from multiple insurance providers to find the best policy.

- Compare coverage limits and deductibles.

- Review additional benefits like liability protection.

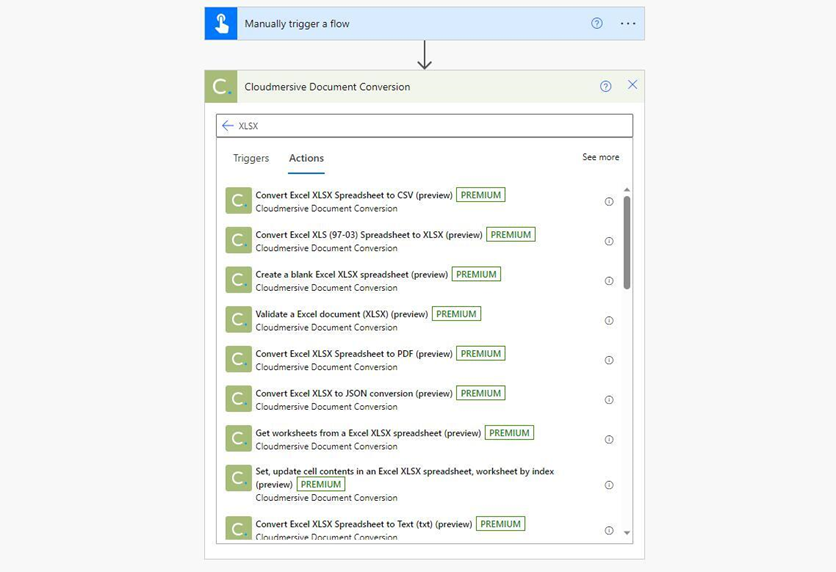

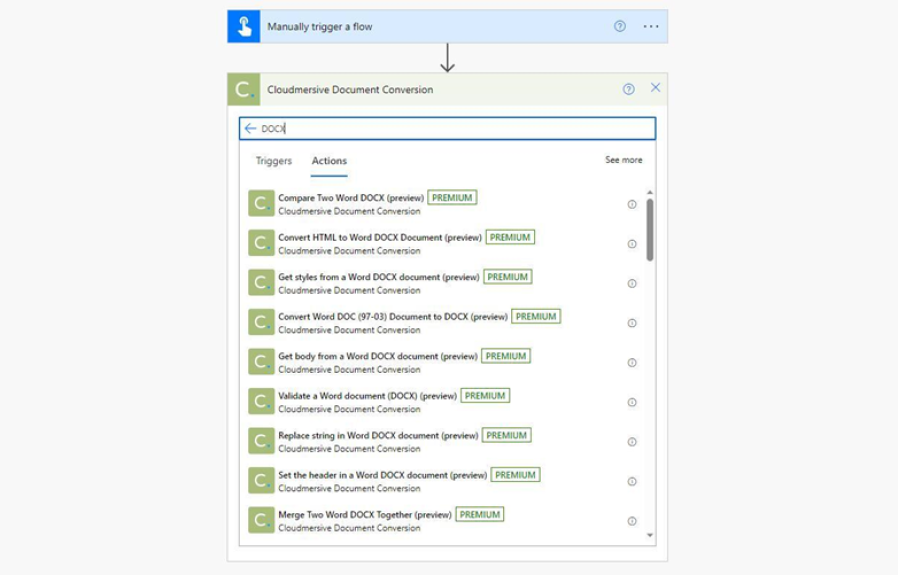

Credit: cloudmersive.com

Filing A Claim

When it comes to renters insurance, understanding the process of filing a claim is essential for ensuring a smooth and successful experience during a difficult time. Being prepared and knowing what to expect can simplify the process and help you recover from a loss more quickly.

Understanding The Claims Process

Before filing a claim, it’s important to understand the claims process. Contact your insurance company as soon as possible after an incident. Most insurance companies have a specific time frame in which you must file your claim. Provide all necessary information, such as the date, time, and details of the incident.

Documentation And Evidence

When filing a claim, proper documentation and evidence are crucial. Gather all relevant documentation related to the incident, including police reports, receipts, and any necessary forms provided by your insurance company. Take photos or videos of the damage or loss to provide visual evidence. Organize and securely store all documentation for easy access during the claims process.

Common Misconceptions

Renters insurance Xlsx is often misunderstood due to common misconceptions. It is crucial to understand that this type of insurance provides coverage for personal belongings and liability protection, ensuring peace of mind for renters. Don’t overlook the importance of renters insurance Xlsx and protect yourself from unexpected events.

Common Misconceptions When it comes to renters insurance, there are some common misconceptions that may prevent individuals from obtaining the essential protection they need. Let’s debunk these myths to ensure a clear understanding of the importance and benefits of renters insurance.My Landlord’s Insurance Covers Me

It’s a common belief that a landlord’s insurance policy will provide coverage for a tenant’s personal belongings. However, this is a misconception. A landlord’s insurance typically only covers the physical structure of the rental unit and any appliances or fixtures provided by the landlord. Your personal belongings, such as furniture, electronics, and clothing, are not covered under your landlord’s policy. Therefore, it’s crucial to acquire renters insurance to protect your own possessions in the event of theft, fire, or other covered perils.I Don’t Have Enough To Insure

Many renters underestimate the value of their belongings and assume that they don’t have enough to justify purchasing renters insurance. However, it’s important to realize that the cost of replacing all of your possessions can add up quickly. While you may not have high-value items like expensive jewelry or designer furniture, the collective worth of your belongings is likely more than you think. Obtaining renters insurance ensures that you have financial protection in the event of a loss, regardless of the total value of your possessions. In conclusion, understanding the common misconceptions about renters insurance is essential to making an informed decision about obtaining this valuable form of protection. By debunking these myths, individuals can recognize the true benefits of renters insurance for safeguarding their personal belongings.

Credit: cloud.google.com

Frequently Asked Questions Of What Renters Insurance Xlsx

What Are The 4 Parts Of Coverage For Renters Insurance?

The 4 parts of renters insurance coverage include personal property, liability protection, additional living expenses, and medical payments.

What Is Typically Not Covered By Renters Insurance?

Renters insurance typically doesn’t cover floods, earthquakes, and negligence. Expensive items may need additional coverage.

What Are 3 Examples Of Things That Could Occur That Renter’s Insurance Would Not Cover?

Renter’s insurance won’t cover damages from earthquakes, flooding, or intentional harm by the renter.

What Are The 3 Kinds Of Protection That Renter’s Insurance Provides You With?

Renter’s insurance offers three types of protection: personal property coverage, liability coverage, and additional living expenses coverage. Personal property coverage protects your belongings, liability coverage covers accidents and injuries, and additional living expenses coverage helps with temporary housing costs.

Conclusion

Obtaining renters insurance provides valuable protection for your belongings and peace of mind. Don’t overlook the importance of safeguarding your assets against unforeseen events. Remember, renters insurance can be a valuable investment in securing your financial well-being. Choose wisely and stay protected.

Leave a comment