To ensure proper protection, consider getting motorcycle insurance coverage that includes liability, collision, comprehensive, and uninsured/underinsured motorist coverage. Riding a motorcycle can be exhilarating, but it also comes with inherent risks.

Accidents, theft, and damage to your bike can result in financial and legal troubles. By having liability coverage, you are financially protected if you cause injury or property damage to others. Collision coverage pays for repairs or replacement if your bike is damaged in an accident.

Comprehensive coverage covers non-accident related damages, such as fire, theft, or vandalism. Uninsured/underinsured motorist coverage protects you if you are involved in an accident with someone who has insufficient or no insurance. Obtaining these coverages will provide you peace of mind and financial security in unforeseen circumstances.

Importance Of Motorcycle Insurance

The importance of motorcycle insurance cannot be overstated. It provides crucial protection and peace of mind for riders in various situations.

Protect Your Investment

Motorcycle insurance safeguards your valuable asset by covering repair costs in case of damage or theft.

Without insurance, you risk covering these expenses personally, which can be financially burdensome.

Legal Requirements

Motorcycle insurance is a legal requirement in most states to ensure financial responsibility in case of accidents.

Failure to have insurance can result in fines, license suspension, or other legal consequences.

Types Of Motorcycle Insurance Coverage

Explore the essential types of motorcycle insurance coverage to secure your ride. From liability to comprehensive options, choose the policy that suits your needs for a worry-free riding experience. Prioritize coverage for bodily injury, property damage, and theft to stay protected on the road.

When it comes to protecting yourself and your bike on the road, having the right motorcycle insurance coverage is essential. As a rider, you need to be prepared for any unexpected events that may occur while you’re out enjoying the freedom of the open road. There are several types of motorcycle insurance coverage available, each designed to safeguard you and your bike from different risks and situations.

Liability Coverage

Liability coverage is the most basic and crucial type of motorcycle insurance coverage every rider should have. It protects you financially in case you’re at fault in an accident that causes injury or property damage to someone else. It typically includes two components: bodily injury liability, which covers the medical expenses and lost wages of the other party involved, and property damage liability, which covers the repair or replacement costs of their vehicle or any other damaged property. Maintaining a sufficient level of liability coverage is not only a legal requirement in most states but also a responsible action that ensures you won’t bear the financial burden if you cause an accident.

Collision Coverage

Collisions can happen unexpectedly, even to the most experienced riders. This is where collision coverage steps in. It helps pay for the repair or replacement of your own motorcycle if it gets damaged or totaled in an accident, regardless of fault. Whether it’s a collision with another vehicle, object, or even if you tip your bike over, collision coverage gives you the peace of mind knowing that you won’t have to dig deep into your pockets to get your bike back on the road. It’s important to note that collision coverage typically carries a deductible, which is the amount you must pay out of pocket before your insurance kicks in. You can adjust your deductible to balance your premium and financial responsibility to find the right fit for your needs.

Comprehensive Coverage

Comprehensive coverage provides protection for your motorcycle from non-collision-related incidents, such as theft, vandalism, fire, or natural disasters. Just like collision coverage, comprehensive coverage carries a deductible. It covers the cost of repairing or replacing your bike, up to its current market value, in case of a covered event. Having comprehensive coverage not only saves you from the financial burden of unexpected damages but also offers a sense of security knowing that your motorcycle is protected whether you’re riding it or not.

Uninsured/underinsured Motorist Coverage

In addition to the three main types of motorcycle insurance coverage, uninsured/underinsured motorist coverage is an important supplement. This coverage comes into play when you’re involved in an accident caused by a driver who doesn’t have insurance or doesn’t have enough coverage to fully compensate you for your injuries or damages. Uninsured/underinsured motorist coverage ensures that you’re still protected in these situations, allowing you to receive the necessary medical treatment and repair costs without having to rely solely on the responsible party.

Medical Payments Coverage

Motorcycle accidents can result in serious injuries that require medical attention. Medical payments coverage, also known as MedPay, helps cover the cost of medical expenses resulting from an accident, regardless of who is at fault. It can help pay for hospital bills, doctor visits, surgeries, and rehabilitation, providing you with the necessary financial support to recover from your injuries and get back on your feet.

Now that you’re familiar with the various types of motorcycle insurance coverage available, you can determine which ones suit your needs and budget. Remember, every rider and every bike is unique, so it’s important to evaluate your personal circumstances and make an informed decision. Having the right combination of coverage ensures that you can enjoy the thrill of riding while being protected from the unforeseen challenges of the road.

Factors To Consider When Choosing Coverage

When it comes to selecting the right motorcycle insurance coverage, it’s crucial to consider various factors that will influence your decision. By taking into account aspects such as your motorcycle type, riding habits, and budget, you can ensure that you obtain the most suitable coverage for your needs. Let’s delve into these essential elements and how they can impact your choice of motorcycle insurance coverage.

Motorcycle Type

Your motorcycle type significantly influences the kind of coverage you should consider. Whether you own a sportbike, cruiser, touring bike, or a custom motorcycle, the insurance options that best suit your needs may vary.

Riding Habits

Consider your riding habits when determining the most appropriate coverage. If you frequently ride in heavy traffic or on busy highways, you may require additional comprehensive coverage. On the other hand, if you ride infrequently or only during certain seasons, you may have different insurance needs.

Budget

Setting a clear budget is essential when selecting motorcycle insurance coverage. Whether you have financial constraints or are willing to invest in comprehensive protection for your bike, your budget plays a crucial role in determining the type and extent of coverage you can afford.

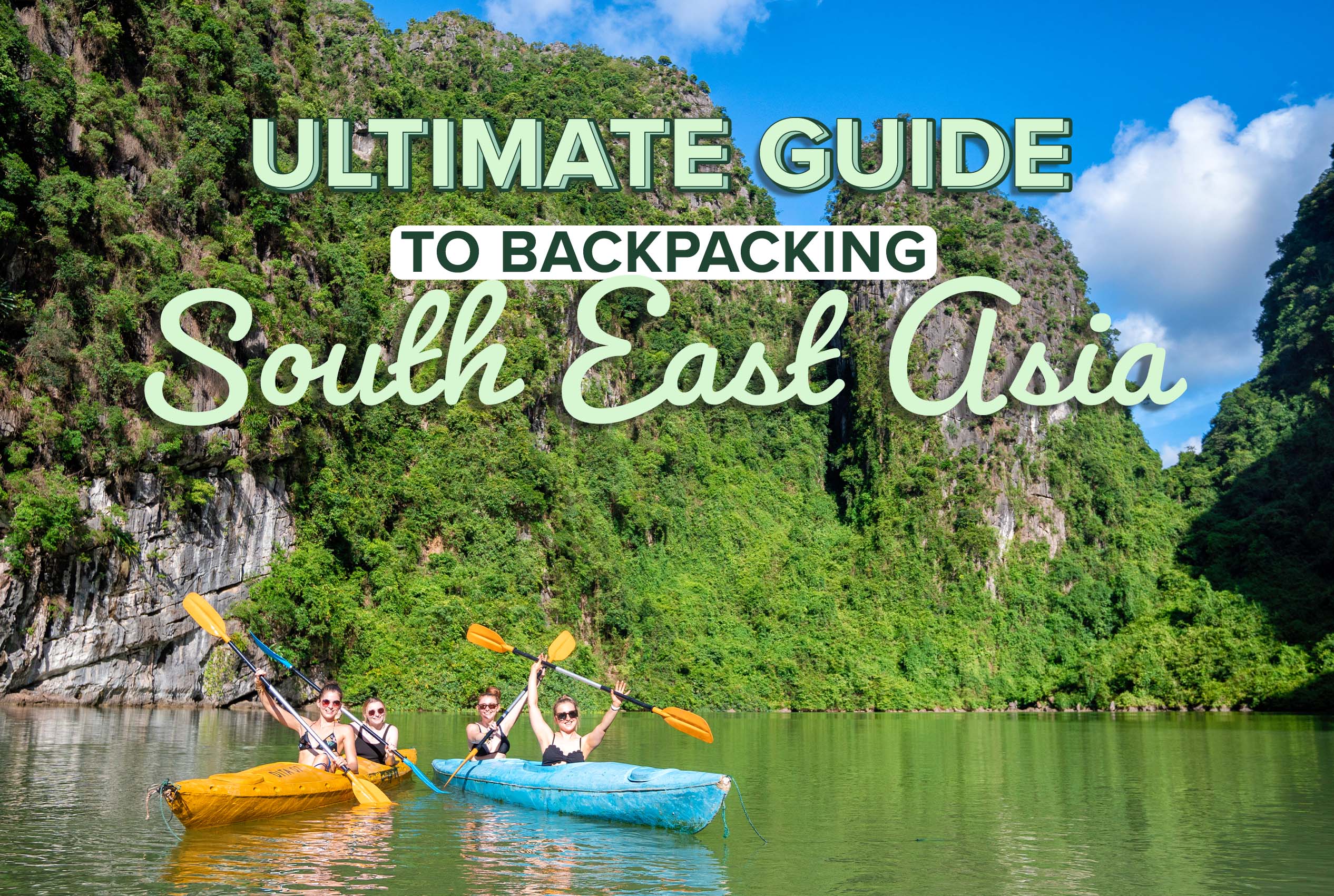

Credit: http://www.introtravel.com

Additional Coverage Options

When considering motorcycle insurance, it’s essential to understand the different additional coverage options that are available. These additional coverage options can provide extra protection and financial security in various situations. Two crucial additional coverage options to consider are Uninsured/Underinsured Motorist Coverage and Medical Payments Coverage.

Uninsured/underinsured Motorist Coverage

With Uninsured/Underinsured Motorist Coverage, you’re protected in case you’re involved in an accident with a driver who doesn’t have insurance or doesn’t have enough insurance to cover the damages. This coverage can help pay for medical expenses, lost wages, and other costs associated with the accident. It’s an important safeguard to consider, especially in areas where there may be a higher prevalence of uninsured or underinsured motorists.

Medical Payments Coverage

Medical Payments Coverage, also known as MedPay, provides coverage for medical expenses resulting from a motorcycle accident, regardless of who is at fault. This may include hospital bills, surgery, X-rays, and other medical-related costs. Having Medical Payments Coverage can provide additional peace of mind knowing that medical expenses are covered without having to wait for a liability determination.

Customizing Coverage For Your Needs

When it comes to motorcycle insurance, it’s crucial to have coverage that is tailored to your unique needs. By customizing your coverage, you can ensure that you have the right protection in place in case of accidents, theft, or other unexpected events. Two important types of coverage you should consider when customizing your motorcycle insurance are Custom Parts and Equipment Coverage and Accessory Coverage.

Custom Parts And Equipment Coverage

If you are a motorcycle enthusiast who loves to personalize your ride, Custom Parts and Equipment Coverage is a must-have. This coverage provides protection for any aftermarket parts or modifications you have added to your bike. Whether you have installed a custom exhaust, added chrome accessories, or upgraded your bike’s performance, having this coverage will ensure that you are financially protected if any of these enhancements are damaged or stolen.

While standard motorcycle insurance policies typically only cover the factory-installed components of your bike, Custom Parts and Equipment Coverage extends your protection to include all the customizations you have made. This means that if your bike is stolen or involved in an accident, you can be reimbursed for the cost of replacing or repairing those aftermarket parts.

Accessory Coverage

In addition to custom parts, many motorcycle riders also have various accessories that they use while out on the road. These accessories, such as helmets, communication devices, riding gear, and saddlebags, can add up to a significant investment. To protect these accessories, you should consider adding Accessory Coverage to your motorcycle insurance policy.

With Accessory Coverage, you can rest easy knowing that your expensive riding gear and accessories are protected. If any of your accessories are damaged, lost, or stolen, this coverage will reimburse you for the cost of replacing them. By having this coverage in place, you can enjoy the peace of mind that comes with knowing that your gear and accessories are financially protected.

When customizing your motorcycle insurance coverage, it’s important to carefully consider your needs and the value of your customizations and accessories. By adding Custom Parts and Equipment Coverage and Accessory Coverage to your policy, you can ensure that you are adequately protected in all situations. Talk to your insurance provider today to learn more about how you can customize your coverage to fit your unique needs.

Tips For Lowering Insurance Premiums

When considering what motorcycle insurance coverage to get, it’s essential to explore options for lowering insurance premiums. By taking advantage of discounts based on your safe riding record and completing motorcycle safety courses, you can save money while ensuring you have adequate coverage.

Safe Riding Record Discounts

Insurers often offer discounts to riders with a clean safe riding record. By avoiding accidents and traffic violations, you demonstrate responsible riding behavior, which can lead to significant savings on your insurance premiums.

Motorcycle Safety Course Discounts

Completing a certified motorcycle safety course not only enhances your riding skills but also makes you eligible for discounts on your insurance. These courses provide valuable knowledge and practical training, making you a safer rider in the eyes of insurers.

Common Insurance Mistakes To Avoid

When it comes to motorcycle insurance, making the right decisions can help protect your investment and provide peace of mind. However, there are common insurance mistakes that riders often make, which can have serious consequences. By being aware of these mistakes and taking proactive measures, you can avoid potential pitfalls and ensure that you have the adequate coverage you need.

Underinsuring Your Motorcycle

Underinsuring your motorcycle is a mistake that many riders make without realizing the potential risks. Motorcycle insurance should adequately cover not only the cost of repairing or replacing your bike in the event of an accident, but also potential medical expenses or damages you might be responsible for. By selecting coverage that is too low, you may find yourself personally liable for significant expenses.

To avoid underinsuring your motorcycle, it’s important to assess the value of your bike and consider any additional accessories or modifications that you’ve made. Taking these factors into account will help you choose an appropriate coverage amount that adequately protects you and your motorcycle.

Neglecting To Update Your Policy

Your motorcycle and your insurance needs can change over time. Neglecting to update your policy can leave you underinsured or paying for coverage you no longer need. It’s important to review and update your insurance policy regularly to ensure it accurately reflects your current situation.

If you’ve made modifications to your bike, such as adding new accessories or increasing its value, it’s crucial to inform your insurance provider and adjust your coverage accordingly. Failure to update your policy in these situations can result in insufficient coverage if you need to file a claim.

Additionally, changes in your personal circumstances, such as moving to a different location or getting married, can also impact your insurance needs. Updating your policy to reflect these changes will help ensure that you have the right coverage in place.

| Mistake | Consequences |

|---|---|

| Underinsuring your motorcycle | Risk of personal liability and insufficient coverage in case of accidents |

| Neglecting to update your policy | Being underinsured or paying for coverage you no longer need |

Avoiding these common insurance mistakes is key to ensuring that you have the right motorcycle insurance coverage. By understanding the risks and consequences associated with underinsuring your bike and neglecting to update your policy, you can make informed decisions that protect both your investment and your financial well-being.

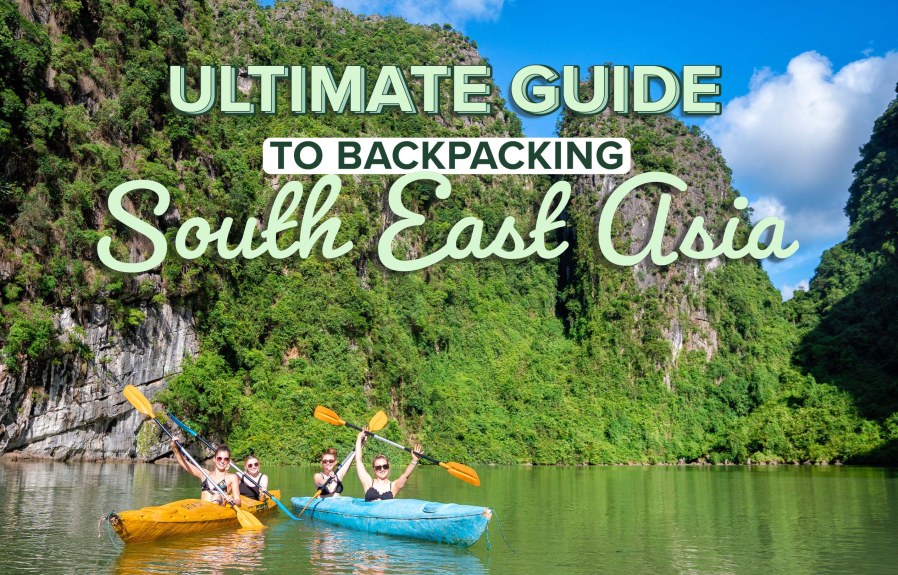

Credit: http://www.aiunited.com

Reviewing And Updating Your Coverage Regularly

Ensuring your motorcycle insurance coverage is up-to-date is essential for protecting yourself and your bike. Reviewing and updating your coverage regularly helps to ensure you have the necessary protection for your individual needs. From an annual policy review to adjusting coverage based on changes in your circumstances, keeping your coverage current is crucial.

Annual Policy Review

Each year, take the time to review your motorcycle insurance policy. Check for any changes in laws or regulations that may affect your coverage needs. Consider adjustments based on how much you’re riding and any new accessories or modifications you’ve made to your bike since purchasing the policy.

Adjusting Coverage Based On Changes

Any significant changes in your life, such as a new job, relocation, or changes in your financial situation, may also necessitate adjustments to your coverage. If you’ve added new riders to your policy or are now using your motorcycle for different purposes, it may also be time to update your coverage.

Credit: http://www.lonelyplanet.com

Frequently Asked Questions For What Motorcycle Insurance Coverage Should I Get

What Does Motorcycle Insurance Cover?

Motorcycle insurance typically covers bodily injury and property damage liability, medical payments, collision, comprehensive, and uninsured/underinsured motorist coverage.

How Much Motorcycle Insurance Do I Need?

The amount of motorcycle insurance you need depends on factors like your state’s requirements, your bike’s value, and your financial situation. It’s important to carry enough coverage to protect yourself and your assets.

Can I Get Motorcycle Insurance With A Dui?

Yes, you can still get motorcycle insurance with a DUI, but it may be more expensive. Some insurers specialize in high-risk drivers and can offer coverage tailored to your specific situation.

Do I Need Special Insurance For A Custom-built Motorcycle?

Yes, you may need special insurance for a custom-built motorcycle. Standard insurance may not provide sufficient coverage for custom parts and equipment that enhance the bike’s value. Be sure to discuss your needs with an insurance agent.

Conclusion

It’s essential to have the right motorcycle insurance coverage to protect yourself, your bike, and others on the road. By understanding the various types of coverage available, you can tailor your policy to meet your specific needs. Whether it’s liability coverage, collision coverage, or comprehensive coverage, make sure you choose the options that provide the best protection for your motorcycle.

Safeguard your investment and ride with peace of mind.

Leave a comment