A disability insurance company provides coverage for individuals who are unable to work due to an injury or illness. Disability insurance offers financial protection by providing a percentage of the insured individual’s income, helping to replace lost earnings during the period of disability.

These policies typically have a waiting period before benefits begin, and they can be obtained through employers or purchased individually. Disability insurance is crucial for those who rely on their income to support themselves and their families, as it ensures financial stability during times of disability.

Whether obtained through a group plan or a private policy, disability insurance provides essential protection in the event of unforeseen circumstances that prevent individuals from working.

Credit: m.facebook.com

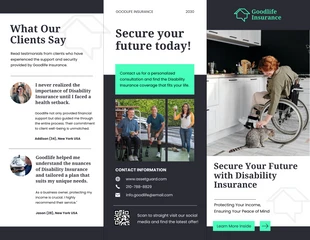

The Importance Of Disability Insurance

Understanding the importance of disability insurance is crucial for safeguarding your financial stability in unforeseen circumstances.

Protecting Your Income

Disability insurance protects your income by providing financial support if you are unable to work due to injury or illness.

Coverage For Unexpected Events

Disability insurance ensures coverage for unexpected events, offering peace of mind and security in times of crisis.

Credit: venngage.com

Understanding Disability Insurance

Disability insurance is an essential form of protection that provides financial support when an individual becomes unable to work due to a disability. Whether it is a temporary or long-term disability, having the right coverage can help individuals maintain their quality of life and meet their financial obligations.

Definition And Types

Disability insurance can be broken down into two main types: short-term disability insurance and long-term disability insurance.

Short-Term Disability Insurance

Short-term disability insurance typically provides coverage for a period of a few months up to a year. It offers protection if an individual is unable to work due to an injury or illness that is expected to recover within a shorter timeframe. This type of insurance can help replace a portion of the individual’s income during the period of disability.

Long-Term Disability Insurance

On the other hand, long-term disability insurance provides coverage for an extended period of time, often until the individual reaches retirement age. It is designed for disabilities that are expected to last longer than a year or have a permanent impact on the individual’s ability to work and earn an income. This type of insurance offers financial support to help individuals meet their daily living expenses and maintain their quality of life.

Who Needs It

Disability insurance is not only important for individuals in physically demanding jobs but also for those in sedentary occupations. A disability can occur due to various reasons, including accidents, illnesses, or chronic conditions. It is crucial for everyone, regardless of their profession or age, to consider disability insurance as a means of protecting their financial stability in case the unexpected happens and they are unable to work.

Here are a few categories of individuals who specifically need disability insurance:

- Self-employed individuals who rely on their income to support their business and personal expenses.

- Salaried employees who do not have comprehensive coverage through their employer’s group disability insurance.

- Individuals with dependents who rely on their income to meet their family’s financial needs.

- Professionals with specialized skills that cannot easily be transferred to other occupations.

- Young professionals who have just started their careers and may not have significant savings to rely on in case of a disability.

By understanding disability insurance and recognizing the importance of having appropriate coverage, individuals can protect themselves from the financial consequences of a disability and ensure their financial well-being in the long run.

Benefits Of Disability Insurance

Disability insurance is a crucial form of coverage that provides financial security and peace of mind in the event an individual becomes unable to work due to a disability. In this article, we will explore the benefits of disability insurance, focusing on the essential aspects that make it an invaluable resource for individuals and families.

Financial Security

Disability insurance offers vital financial security by replacing a portion of an individual’s income if they are unable to work due to a disability. The policy ensures that individuals can maintain their standard of living and meet their financial obligations even when facing unexpected health challenges.

Moreover, disability insurance can provide a crucial safety net, allowing individuals to focus on their recovery without the added stress of financial instability.

Peace Of Mind

One of the most significant benefits of disability insurance is the peace of mind it offers. Knowing that they are protected by disability coverage allows individuals to navigate life’s uncertainties with confidence. This sense of security can alleviate anxiety and provide reassurance for both the policyholder and their loved ones.

Furthermore, disability insurance grants individuals the freedom to pursue medical treatments or rehabilitation without worrying about the financial implications, thereby enabling them to prioritize their well-being.

Credit: http://www.facebook.com

Choosing The Right Disability Insurance Company

When it comes to safeguarding the financial stability of you and your loved ones, choosing the right disability insurance company is paramount. With so many options available, it’s essential to carefully evaluate the financial stability, reputation, and customer service of each provider. By doing so, you can rest assured knowing you’ve selected a reliable company that will support you in the event of a disability.

Financial Stability

Financial stability is a critical factor to consider when selecting a disability insurance company. You want to ensure that the company has the funds to pay out claims promptly. Look for a company with a strong financial rating and a history of financial security. Consider reviewing their financial statements or seeking guidance from a financial advisor to assess their stability more accurately.

Reputation And Customer Service

It’s imperative to evaluate the reputation and customer service of a disability insurance company. Research customer reviews, seek recommendations, and inquire about their claims process. A company with a positive reputation and excellent customer service is more likely to provide efficient and compassionate support when you need it most.

Key Features To Look For

A disability insurance company needs to have key features like comprehensive coverage, flexible policies, fast claims processing, reliable customer support, and competitive pricing to provide financial security and peace of mind to policyholders. Such features ensure that individuals are protected in case of a disability that prevents them from working and earning income.

Key Features To Look For In A Disability Insurance Company

When it comes to choosing a disability insurance company, it’s essential to consider various key features that can greatly impact your coverage and peace of mind. Understanding the coverage options, waiting periods, and benefit periods are crucial in making an informed decision. Below, we explore these vital features in detail, providing you with the necessary information to evaluate and choose the right disability insurance company for your needs.

Coverage Options

One of the first factors to consider is the coverage options offered by the disability insurance company. Look for a company that provides comprehensive coverage tailored to your specific needs. Here are some important coverage options to consider:

- Income replacement: Ensure the policy provides a percentage of your income if you become disabled and are unable to work.

- Own occupation coverage: Opt for a policy that defines disability based on your inability to perform the duties of your own occupation rather than any occupation.

- Recurrent disability coverage: Check if the policy provides coverage for disabilities that reoccur after a period of recovery.

- Partial disability coverage: Look for a policy that covers partial disabilities, allowing you to receive benefits even if you can work partially.

Consider your personal circumstances and professional requirements while evaluating these coverage options, as they can significantly impact the benefits you receive.

Waiting Periods And Benefit Periods

Waiting period and benefit period are two crucial aspects of disability insurance coverage. The waiting period refers to the amount of time you must wait after becoming disabled to be eligible for benefits. On the other hand, the benefit period determines how long you will receive benefits once you qualify. Consider the following when evaluating these periods:

- Short waiting period: Opt for a disability insurance company that offers a short waiting period, typically ranging from 30 to 90 days, to minimize the financial impact during the waiting period.

- Long benefit period: Look for a policy with a longer benefit period, such as two years or until retirement age, to ensure extended coverage in case of long-term disability.

- Elimination periods: Consider elimination periods, which may be a combination of the waiting and benefit periods, and choose a policy that suits your financial stability during this period.

Understanding waiting and benefit periods is crucial for determining the length of coverage and when you can expect financial support in case of disability.

Filing A Claim

When filing a claim with a Disability Insurance Company, it is important to understand the process and provide the necessary documentation for a smooth experience.

Documentation Required

Medical records are essential, along with a completed claim form provided by the insurance company.

Claim Process

- Submit required documents promptly.

- Insurance company will review and assess the claim.

- Claimant may need to undergo medical examination as part of the process.

- Approval or denial of the claim will be communicated to the claimant.

Common Mistakes To Avoid

Disability insurance companies often make mistakes that policyholders should avoid. Understanding the policy details, submitting accurate information, and being proactive about claims can prevent complications in the future. Educating oneself on the terms and conditions is essential for a smooth insurance experience.

Common Mistakes to Avoid Many people make errors when choosing disability insurance. Here are some common mistakes you should avoid.Underestimating Coverage Needs

Understand your expenses and income to avoid underestimating coverage needs.Neglecting Policy Details

Read through policy details thoroughly to avoid any misunderstandings or unforeseen surprises.Final Thoughts

The security and well-being of you and your family are paramount. Investing in disability insurance offers a comprehensive layer of protection, ensuring financial stability during times of uncertainty. Let’s explore the significance of this coverage through the following perspectives:

Planning For The Future

Disability insurance is a critical component of future planning, providing a safety net in unforeseen circumstances. The ability to maintain financial stability in the face of unexpected health challenges ensures a peace of mind that directly impacts long-term financial goals.

Peace Of Mind For You And Your Family

By securing disability insurance, you are not only safeguarding your own financial security but also providing reassurance to your loved ones. In the event of a disability, this coverage ensures that your family’s needs are also met, alleviating the burden of uncertainty and allowing you to focus on recovery.

Frequently Asked Questions Of What Is Disability Insurance Company

What Is Disability Insurance And How Does It Work?

Disability insurance provides income protection if you’re unable to work due to an illness or injury. It typically pays a percentage of your salary and can be short or long-term, offering financial security during tough times.

Why Do I Need Disability Insurance?

Without it, you risk losing income if you’re unable to work due to disability. Disability insurance provides a safety net, ensuring that you can meet your financial obligations even if you’re unable to work.

How Do I Choose The Right Disability Insurance Company?

Consider the company’s reputation, financial strength, policy features, and customer service. Look for a company that offers comprehensive coverage, strong financial stability, and excellent customer support to ensure peace of mind.

Conclusion

To sum it up, disability insurance is a crucial safety net that offers financial protection in case of unexpected loss of income due to a disability. It provides peace of mind by ensuring that individuals are not left in a vulnerable financial condition during such challenging times.

By carefully considering their needs and exploring different options, individuals can find the right disability insurance company to safeguard their future. Remember, planning ahead is always a wise decision.

Leave a comment