Fire insurance covers losses from fire damage, helping policyholders recover financially. For example, a business property damaged in a fire could be restored with fire insurance.

Fire insurance provides peace of mind by protecting against costly damages caused by fires. In the event of a fire, policyholders can file a claim to receive compensation for repairs or replacements. By having fire insurance, individuals and businesses can mitigate the financial impact of fire-related disasters.

Having fire insurance is crucial to safeguard assets and ensure a swift recovery after fire incidents. By understanding the importance of fire insurance, individuals can protect their properties and investments effectively.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Credit: http://www.investopedia.com

Understanding Fire Insurance

Definition And Purpose

Fire insurance is a policy that protects individuals or businesses from financial losses due to fire-related damages. It covers the cost of repairing or replacing property destroyed by fire.

Key Features

- Provides financial protection against fire damage

- Premiums are calculated based on the property’s risk factors

- Typically includes coverage for structures, personal belongings, and additional living expenses

Coverage And Exclusions

| Coverage | Exclusions |

|---|---|

| Structures such as buildings and homes | Intentional acts of setting fire |

| Personal belongings inside the property | Natural disasters like earthquakes or floods |

| Alternative living arrangements if the property is uninhabitable | Property used for illegal activities |

:max_bytes(150000):strip_icc()/basics-to-help-you-understand-how-insurance-works-4783595_final-9cf74d5b66d14f88a21ab29ddb290e2d.png)

Credit: http://www.thebalancemoney.com

Types Of Fire Insurance Policies

Fire insurance policies encompass various types such as Standard Fire Policy and Comprehensive Fire Policy. For instance, standard fire insurance covers basic fire-related damages, while comprehensive fire insurance offers additional coverage for other perils like floods and earthquakes.

Welcome to the World of Fire Insurance Policies!Standard Fire Insurance

Basic coverage for property damage due to fire.

Comprehensive Fire Insurance

Provides coverage for fire damage as well as other perils like theft and liability.

Burglary And Fire Insurance

Combines coverage for theft and fire damages into one policy.

Understanding the different types of fire insurance can help you make informed decisions when protecting your assets. From Standard Fire Insurance to Comprehensive Fire Insurance and Burglary and Fire Insurance, each policy offers unique coverage benefits tailored to different needs.

Whether you seek basic fire protection or comprehensive coverage, there is a fire insurance policy that can safeguard your valuable possessions from the unexpected.

Importance Of Fire Insurance

Fire insurance is a crucial aspect of protecting your property and ensuring financial security. It provides coverage in case of fire-related damages and losses. Understanding the importance of fire insurance can help you make informed decisions to safeguard your assets. This article delves into the significance of fire insurance, focusing on the key areas of protection it offers, financial security, and legal requirements.

Protection Of Property

Fire insurance plays a vital role in safeguarding your property against the perils of fire. In the event of a fire outbreak, your property, belongings, and valuable assets are exposed to significant risks. Fire can quickly engulf buildings, causing irreparable damage. With fire insurance, you can mitigate the financial burden of rebuilding or repairing your property. It ensures that you can restore or replace damaged or destroyed assets without incurring substantial costs. By providing coverage for structural repairs, renovations, and the replacement of contents, fire insurance offers a safety net that protects your property and allows you to recover swiftly from fire-related disasters.

Financial Security

Fire accidents can have devastating financial implications. The costs associated with fire damage can be astronomical, from reconstruction expenses to lost business revenue. Fire insurance provides financial security by covering these costs, allowing you to recover your losses and regain stability. It safeguards your investment in your property, preventing financial hardship and ensuring that your business operations can resume smoothly. By relieving the burden of fire-related expenses, fire insurance enables you to focus on rebuilding and getting back on your feet. It gives you peace of mind, knowing that you have a financial safety net in place to address any fire-related emergencies that may arise.

Legal Requirements

In addition to the protection it provides, fire insurance may be a legal requirement in many jurisdictions. It is often obligatory to carry fire insurance, especially for commercial properties or rental spaces. Compliance with these legal requirements not only ensures that you avoid potential penalties or fines but also demonstrates your commitment to risk management. Having fire insurance in place can give you a competitive edge in the market, as it signifies to clients, partners, and stakeholders that you take the safety of your property seriously. By meeting these legal obligations and obtaining fire insurance coverage, you demonstrate your commitment to responsible business practices and protect yourself from potential legal liabilities.

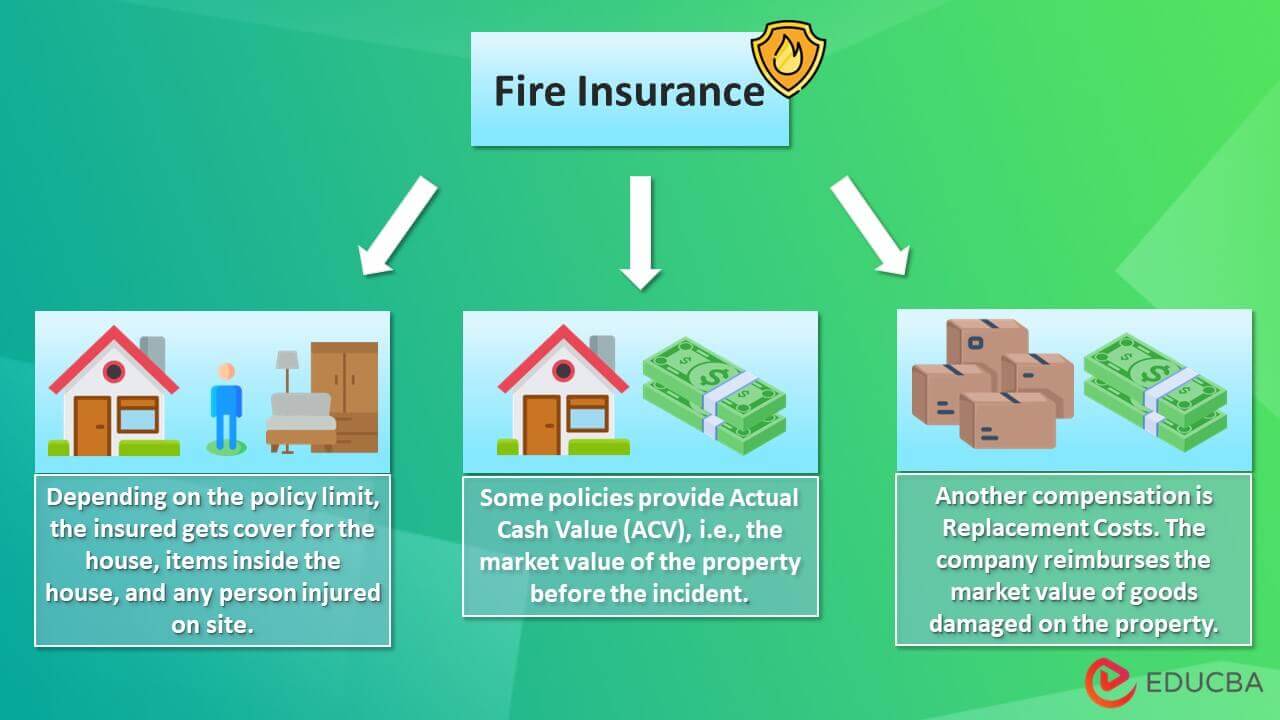

Credit: http://www.educba.com

Factors Affecting Fire Insurance Premiums

Fire insurance example is essential for property owners to protect against fire damage. Factors affecting fire insurance premiums include property location, building materials, and proximity to fire hydrants. Insurance rates depend on these variables.

Factors Affecting Fire Insurance Premiums The cost of fire insurance premiums is influenced by several key factors. Understanding these elements can help property owners make informed decisions when choosing a fire insurance policy. Among the pivotal factors impacting fire insurance premiums are the location and building construction, fire safety measures, and previous claims history. Location and Building Construction The location and construction of the building are significant determinants in calculating fire insurance premiums. Urban areas with a dense population and high property values generally have higher insurance rates due to the increased risk of fire. Additionally, building materials and the presence of fire-resistant features, such as sprinkler systems and fire-resistant materials, also impact the premium. Fire Safety Measures The implementation of fire safety measures plays a crucial role in determining fire insurance premiums. Properties equipped with fire alarms, extinguishers, and sprinkler systems are viewed favorably by insurance companies, often leading to lower premiums. Conversely, the absence of these safety measures may result in higher insurance costs. Previous Claims History The previous claims history of a property directly affects fire insurance premiums. Properties with a history of fire-related claims are perceived as having a higher risk, thus resulting in elevated insurance costs. Conversely, properties with a clean claims history may benefit from lower premiums. In summary, these factors are taken into consideration when determining fire insurance premiums. Proactively addressing these elements can help property owners mitigate risk and potentially reduce insurance expenses. “`html| Factors Affecting Fire Insurance Premiums |

|---|

| Location and Building Construction |

| Fire Safety Measures |

| Previous Claims History |

How To Choose The Right Fire Insurance Policy

When it comes to protecting your property from the devastating impact of a fire, having the right fire insurance policy in place is crucial. By carefully assessing property value, comparing coverage and premiums, and evaluating the insurer’s reputation, you can ensure that you choose the most suitable fire insurance policy for your needs.

Assessing Property Value

Before selecting a fire insurance policy, it’s essential to accurately assess the value of your property. Consider factors such as the cost of rebuilding or repairing the property in the event of a fire. Ensure that the insurance policy covers the full value of the property to avoid being underinsured in the event of a fire.

Comparing Coverage And Premiums

When comparing different fire insurance policies, closely examine the coverage and premiums offered by each insurer. Look for comprehensive coverage that includes protection against damage caused by fire, smoke, and related perils. Ensure the premiums are affordable and within your budget while providing adequate coverage for your property.

Evaluating Insurer’s Reputation

Evaluating the reputation of the insurer is vital when choosing a fire insurance policy. Check customer reviews and ratings to gain insight into the insurer’s reliability, responsiveness, and claims settlement process. Emphasize finding an insurer with a strong track record of providing excellent service and prompt claims processing in the event of a fire.

Fire Insurance Claims Process

When it comes to a fire insurance policy, it’s crucial to understand the claims process in case of an unfortunate fire incident. In this section, we will delve into the steps involved in the fire insurance claims process. By familiarizing yourself with these steps, you can ensure a smooth and efficient handling of your fire insurance claim.

Contacting The Insurer

Once a fire incident occurs, the first step is to contact your insurance provider immediately. Notify them about the fire incident and provide all relevant details about the location and time of the fire. Your insurance policy number should be readily available for reference. The insurer will guide you through the claims process and provide further instructions.

Documentation And Evidence

During the fire insurance claims process, it is crucial to gather all necessary documentation and evidence to support your claim. This includes providing the insurer with a detailed account of the events leading up to the fire, as well as any photographs or videos of the damaged property. Additionally, you should keep copies of all correspondence with the insurer, as well as any receipts or invoices related to repairs or replacements.

Claim Settlement

After you have provided all the necessary documentation and evidence, the insurer will begin the evaluation process. They will assess the extent of the damage, determine the coverage offered by your policy, and calculate the amount of compensation you are entitled to. Once the evaluation is complete, the insurer will present you with a settlement offer. If you agree to the offer, the claim settlement will be made, and you will receive the agreed-upon compensation. In case of any disagreements or disputes regarding the settlement, it is advisable to consult an attorney or a public insurance adjuster for assistance in resolving the matter.

In conclusion, understanding the fire insurance claims process is essential for every policyholder. By promptly contacting your insurer, providing thorough documentation and evidence, and ensuring a fair claim settlement, you can navigate the often complex process with confidence and receive rightful compensation for your fire-related losses.

Frequently Asked Questions On What Is Fire Insurance Example

What Does Fire Insurance Cover?

Fire insurance typically covers damage to property caused by fire, lightning, and explosion. It may also provide coverage for smoke damage, water damage from firefighting efforts, and damage caused by other perils related to a fire.

How Much Does Fire Insurance Cost?

The cost of fire insurance varies depending on factors such as the location and value of the property, the level of coverage, and the insurance company. Generally, the average cost for fire insurance can range from a few hundred to a few thousand dollars annually.

Why Is Fire Insurance Important?

Fire insurance is crucial to protect property owners from financial loss due to fire damage. It provides financial security and peace of mind, ensuring that the property can be repaired or replaced in the event of a fire, mitigating potential devastation and economic hardship.

Conclusion

Fire insurance is a crucial protection for homeowners, business owners, and property owners. It offers financial security against the devastating impact of fire-related incidents. By purchasing a fire insurance policy, individuals can have peace of mind knowing that their valuable assets are covered.

It is important to understand the terms and conditions of the policy and choose the right coverage that suits individual needs. Don’t let unexpected fire damage leave you financially drained – invest in fire insurance today.

Leave a comment