The best Unit Linked Insurance Plan in India is subjective, as it depends on individual needs and preferences. However, researching and comparing factors like fund performance, charges, and customer satisfaction can help in selecting the most suitable plan.

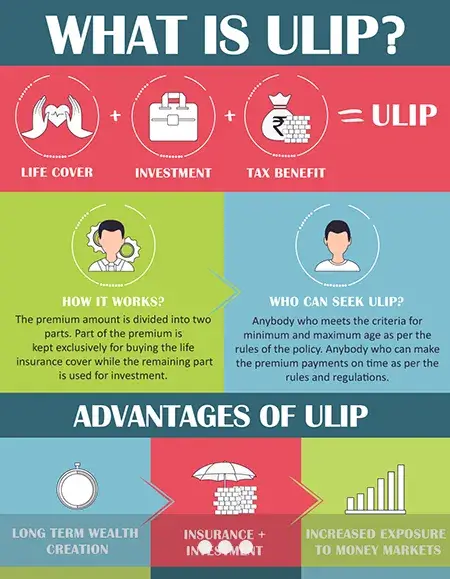

Unit Linked Insurance Plans (ULIPs) offer the dual benefit of insurance coverage and investment opportunities. The plans invest a portion of the premium in various funds, such as equity, debt, or balanced funds, based on the policyholder’s risk appetite and financial goals.

ULIPs provide potential returns as well as life cover, making them a popular choice among individuals looking for both investment growth and insurance protection.

Credit: http://www.cnn.com

Key Features Of Ulips

ULIPs offer a unique blend of investment and insurance components, providing individuals with the opportunity to grow their wealth while ensuring financial security.

The insurance component of ULIPs offers protection and coverage against unforeseen events, ensuring the policyholder’s peace of mind.

ULIPs provide flexibility in investment options, allowing policyholders to choose between various funds based on their risk appetite and financial goals.

Factors To Consider

When evaluating the best Unit Linked Insurance Plan in India, consider factors like performance track record, fund options, charges, flexibility, and financial goals. Investment horizon, risk appetite, and insurance needs play a crucial role in selecting the most suitable ULIP for individuals.

When it comes to choosing the best Unit Linked Insurance Plan (ULIP) in India, there are several factors that you need to take into consideration. By evaluating these factors, you can make an informed decision that aligns with your financial goals and requirements. Here are four key factors that you should consider:

Charges Involved

One of the first factors to consider when selecting a ULIP is the charges involved. ULIPs typically have various charges, including premium allocation charges, policy administration charges, fund management charges, mortality charges, and surrender charges. It’s important to carefully review and compare the charges across different ULIPs to ensure they are reasonable and do not erode your investment returns.

Fund Performance

Fund performance is another crucial factor to consider when choosing a ULIP. The performance of the funds associated with the ULIP can have a significant impact on the growth of your investment. Look for ULIPs that have a consistent track record of delivering good returns across different market cycles. It’s also advisable to diversify your investment across different fund options to mitigate risk.

Customization Options

ULIPs offer a range of customization options, and it’s important to consider these when making your decision. Look for ULIPs that provide flexibility in terms of switching between funds, changing the sum assured, and altering the policy term. The ability to customize your ULIP based on your changing financial needs and priorities can be a valuable feature.

Claim Settlement Ratio

The claim settlement ratio is a vital factor to consider when selecting a ULIP provider. This ratio represents the percentage of claims settled by the insurance company compared to the total number of claims received. A higher claim settlement ratio indicates a more reliable and trustworthy ULIP provider. Ensure that the ULIP provider you choose has a consistently high claim settlement ratio to ensure a hassle-free claims process when the need arises.

Comparison Of Top Ulips

When it comes to choosing the best Unit Linked Insurance Plan (ULIP) in India, conducting a detailed comparison of the top ULIPs is crucial. This allows potential investors to make an informed decision based on various factors such as performance, charges, benefits, flexibility, and returns. In this article, we will compare three top ULIPs – ULIP A, ULIP B, and ULIP C – to provide a comprehensive overview of their key features and performance.

Ulip A: Performance And Features

The performance and features of ULIP A play a significant role in determining its suitability for potential investors. This includes factors such as the fund performance, investment options, lock-in period, and premium allocation charges. The ability of ULIP A to provide consistent returns and offer a diverse range of investment opportunities will be thoroughly analyzed.

Ulip B: Charges And Benefits

Understanding the charges and benefits associated with ULIP B is essential for investors to assess the overall cost and potential returns. This will involve a detailed comparison of various charges such as premium allocation charges, policy administration charges, fund management fees, and mortality charges. Additionally, the benefits offered by ULIP B, including life cover, tax benefits, and flexible payout options, will be evaluated.

Ulip C: Flexibility And Returns

The flexibility and returns offered by ULIP C can significantly impact an investor’s decision. This section will focus on the flexibility in switching between funds, partial withdrawals, and additional premium allocation. Furthermore, the potential returns and growth of the investment over the long term will be analyzed, considering various market conditions and the overall performance of ULIP C.

Credit: http://www.bankbazaar.com

Expert Opinions

Financial Advisor’s Perspective

“` When considering the best Unit Linked Insurance Plan (ULIP) in India, seeking advice from a financial advisor can provide valuable insights. Advisors assess the performance, fund options, and charges associated with various ULIPs. They consider factors such as the track record of the insurance provider, the transparency of the plan, and the flexibility it offers. Comparing these aspects helps in determining the most suitable ULIP for an individual’s financial goals. Customer Reviews and Ratings “`htmlCustomer Reviews And Ratings

“` Customer reviews and ratings serve as a crucial resource for evaluating the best ULIP in India. Real-life experiences shared by policyholders can offer insights into the convenience of the plan, the ease of claim settlement, and the overall satisfaction with the insurance provider. By analyzing customer feedback and ratings, prospective buyers can gauge the reliability and efficiency of the ULIP, enabling them to make informed decisions about their investments.Tips For Choosing The Best Ulip

When it comes to investing in a Unit Linked Insurance Plan (ULIP), it’s essential to choose the right plan that aligns with your financial goals and risk tolerance. Here are some important tips to keep in mind while selecting the best ULIP for your investment needs:

Goal-based Investment Approach

When selecting a ULIP, it is crucial to have a goal-based investment approach. Determine your financial objectives, whether it’s saving for your child’s education, buying a house, or planning for retirement. Understanding your financial goals will help you choose a ULIP that offers investment options suited to achieve your specific objectives.

Understanding Risk Appetite

One of the key factors to consider when choosing a ULIP is your risk appetite. Every investor has a different tolerance for risk, and it is important to assess it before investing. ULIPs offer different fund options ranging from equity funds, balanced funds, and debt funds, each carrying a varying level of risk. Assess your comfort level with market volatility and choose a ULIP that aligns with your risk appetite.

Monitoring And Reviewing Investment

Investing in a ULIP does not stop at the initial purchase. Continuous monitoring and reviewing of your investment is essential to ensure it remains on track to meet your financial goals. Evaluate the performance of your ULIP regularly, and consider making changes if needed. Stay updated with market trends and economic conditions that may impact your ULIP. Regular monitoring and reviewing will help you make informed decisions and keep your investment on the right track.

Credit: http://www.fibe.in

Case Studies

Success Stories From Ulip Investors

John’s Return on ULIP: After 5 years, John’s ULIP investment yielded 12% returns annually.

Learnings From Unsuccessful Ulip Investments

Anna’s Mistake: Anna withdrew her ULIP prematurely, incurring high surrender charges.

Key Learnings:

- Stay invested for the long term

- Avoid frequent fund switching

- Understand charges and policy terms

Frequently Asked Questions For Which Is The Best Unit Linked Insurance Plan In India

What Are The Key Features Of A Unit Linked Insurance Plan?

A Unit Linked Insurance Plan offers the dual benefit of insurance and investment. It allows policyholders to invest in equity and debt funds and provides life cover. ULIPs offer flexibility in choosing the investment options according to one’s risk appetite.

How Does The Lock-in Period Work For Unit Linked Insurance Plans?

The lock-in period for a Unit Linked Insurance Plan is five years, during which the policyholder cannot surrender or withdraw the funds. After the lock-in period expires, the policyholder can make partial withdrawals or surrender the policy.

What Are The Tax Benefits Of Investing In A Unit Linked Insurance Plan?

Investing in a Unit Linked Insurance Plan offers tax benefits under Section 80C of the Income Tax Act. The premiums paid towards a ULIP are eligible for tax deductions, and the maturity amount is also tax-free under Section 10(10D) of the Income Tax Act.

Conclusion

To summarize, selecting the best Unit Linked Insurance Plan (ULIP) in India requires careful consideration of various factors. Analyzing the insurance company’s reputation, reviewing the policy’s charges and benefits, and understanding one’s investment and insurance needs are crucial steps. Remember, ULIPs can provide dual benefits of investment growth and protection, making them an attractive option.

Ultimately, it is essential to conduct thorough research and consult with financial experts to make an informed decision that aligns with your financial goals and risk appetite.

Leave a comment