You can buy an endowment policy online to secure your financial future and achieve long-term financial goals as per your convenience and comfort. Endowment policies are a popular investment option that combines life insurance coverage with regular savings towards a specific goal, providing a lump sum amount at maturity.

With the convenience of online platforms, purchasing an endowment policy has become easier and more accessible than ever before. Whether you want to save for your child’s education, plan for retirement, or any other financial goal, buying an endowment policy online can offer a convenient and hassle-free way to secure your future.

By comparing different policies, understanding the terms and conditions, and choosing the right plan that suits your needs, you can take a proactive step towards building a stronger financial foundation.

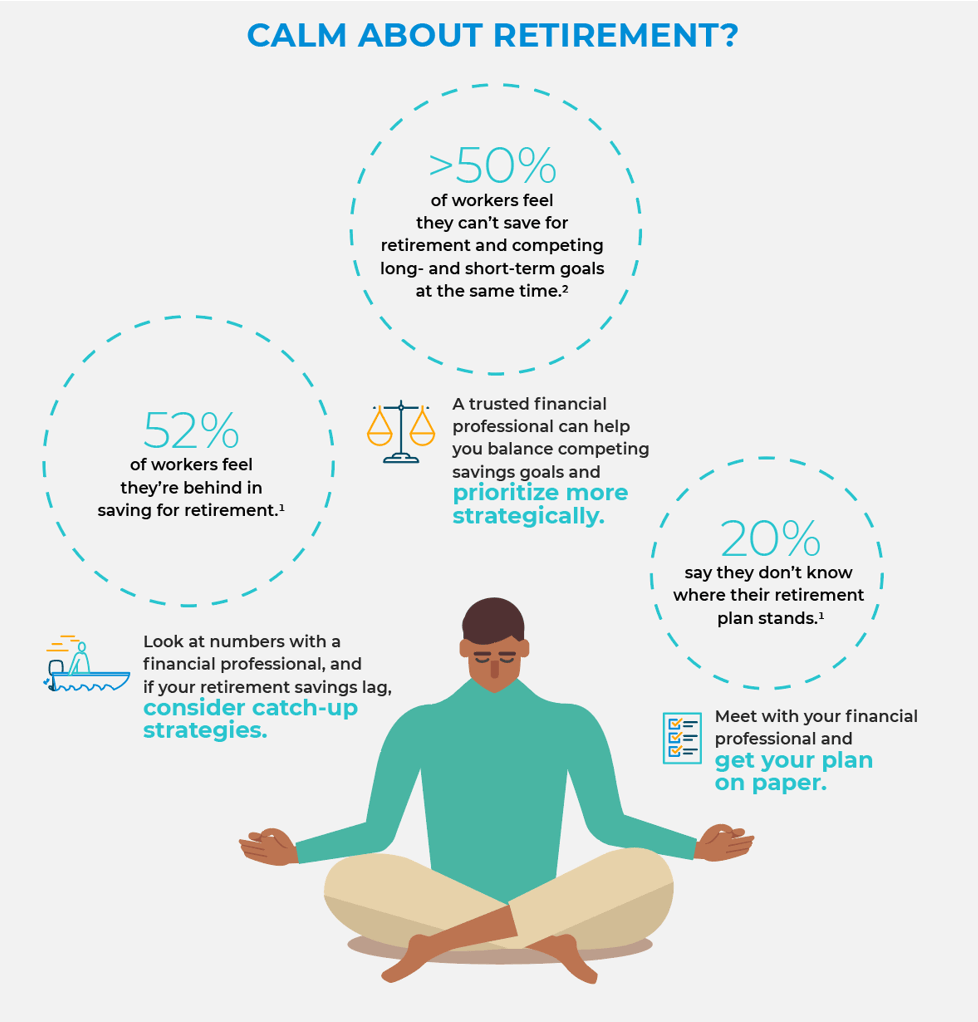

Credit: endowment.org

Importance Of Endowment Policies

Endowment policies are essential financial tools that provide a dual benefit of insurance coverage and savings. These policies help individuals achieve their long-term financial goals by offering a lump sum payout at maturity.

Endowment policies serve as a disciplined way to save money while ensuring financial security for the policyholder or their beneficiaries.

Benefits Of Endowment Policies

- Guaranteed lump sum payout at maturity

- Financial protection for your loved ones

- Forced savings habit with disciplined premium payments

- Tax benefits on premiums paid and maturity amount

Risks To Consider

- Lower returns compared to pure investment instruments

- Potential penalties for early surrender

- Dependency on insurance company’s financial stability

Choosing The Right Endowment Policy Online

When it comes to securing your financial future, an endowment policy can be a valuable investment. With the convenience and flexibility of online options, choosing the right policy has never been easier. However, it is important to approach this decision with careful consideration, ensuring that you select an endowment policy that aligns with your financial goals and provides the necessary coverage.

Assessing Your Financial Goals

Before diving into the world of endowment policies, it is essential to assess your financial goals and determine how an endowment policy can help you achieve them. Consider factors such as your desired savings amount, the length of time you plan to invest for, and your risk tolerance. By understanding your financial goals, you can make a more informed decision when selecting an endowment policy online.

Understanding Policy Terms And Conditions

When choosing an endowment policy online, take the time to thoroughly read and understand the policy terms and conditions. Pay close attention to details such as the policy period, premium payments, maturity benefits, and surrender value. Familiarize yourself with any exclusions, limitations, or additional features. Ensure that the policy aligns with your expectations and provides the necessary coverage for your financial needs.

Comparing Different Providers

When it comes to making a decision, it is crucial to compare different providers to find the endowment policy that suits you best. Look for reputable insurance companies with a track record of excellent customer service and reliable payouts. Compare policy features, benefits, and premiums to find the best value for your money. Additionally, read customer reviews and feedback to gain insight into the experiences of others who have purchased endowment policies from various providers.

By assessing your financial goals, understanding policy terms and conditions, and comparing different providers, you can ensure that you choose the right endowment policy online. Remember, this is a long-term commitment that can provide financial security, so take the time to research, evaluate, and make an informed decision that aligns with your needs.

How Endowment Policies Work

An endowment policy is a long-term life insurance contract that provides both a death benefit and a savings component. It combines insurance protection with investment, offering a specific maturity date and guaranteed returns. Understanding how endowment policies work is crucial for individuals considering this option for financial planning.

Premium Payments And Policy Term

Policyholders make regular premium payments, which are invested by the insurance company. The policy term determines the duration for which the premiums are paid and when the endowment policy matures. The policyholder receives the maturity value at the end of the policy term, providing a lump sum amount for financial goals.

Accruing Cash Value

As the policy accumulates, it builds cash value over time. This cash value represents the savings element of the policy, which can be accessed through policy loans or withdrawals. It provides a form of financial security and can be utilized for various purposes such as education funding or retirement planning.

Maturity And Payout Options

Upon maturity, the policyholder has the option to receive the accumulated amount as a lump sum or utilize various payout options like annuitization for a regular income stream. These options allow flexibility in utilizing the funds and meeting financial needs post-maturity.

Factors To Consider Before Investing

When considering investing in an endowment policy online, there are several important factors to take into account. It’s crucial to carefully evaluate each aspect to make an informed decision that aligns with your financial goals and needs. Let’s delve into the key considerations before investing in an endowment policy online.

Risk Appetite And Investment Horizon

Before investing in an endowment policy online, it’s essential to assess your risk appetite and investment horizon. Determine the level of risk you are comfortable with and the length of time you intend to hold the investment. This evaluation will help in choosing an endowment policy that aligns with your risk tolerance and investment timeframe.

Inflation Protection

Another crucial factor to consider before investing in an endowment policy online is inflation protection. It’s important to ensure that the policy offers adequate protection against the impact of inflation, safeguarding the value of your investment over time.

Tax Implications

Assessing the tax implications of an endowment policy is vital before making an investment decision. Understand the tax treatment of the policy, including any tax benefits or liabilities. It’s advisable to seek professional tax advice to comprehend the potential tax implications associated with the endowment policy.

Managing Your Endowment Policy Online

Manage your endowment policy conveniently online, keeping track of its progress and making adjustments as needed. Stay in control of your investment with ease and efficiency.

Managing Your Endowment Policy Online As a savvy policyholder, it’s essential to stay informed about your endowment policy’s performance. With the ability to manage your endowment policy online, you have access to valuable tools and resources that allow you to track and optimize your policy’s performance in just a few clicks. Monitoring Policy Performance To ensure your endowment policy aligns with your financial goals, take advantage of the online platform to regularly monitor its performance. By analyzing key metrics such as premium growth, investment returns, and policy value, you can stay informed and make informed decisions about your policy’s future. Adjusting Premiums if Needed Life circumstances can change, and so can your financial needs. Utilize the online platform to easily adjust your premiums if necessary. Whether you’re looking to increase your contributions for greater benefits or seeking to lower them due to budget constraints, the online interface provides a seamless process for making these adjustments according to your needs. Contacting Customer Support In case you have any queries or require assistance with your endowment policy, the online platform offers a direct line to the customer support team. Whether you need clarification on policy terms, assistance with transactions, or guidance on optimizing your policy, reaching out to customer support is just a few clicks away. By making the most of managing your endowment policy online, you can stay proactive in maximizing the benefits of your policy while ensuring it stays aligned with your evolving financial goals.Common Myths About Endowment Policies

Endowment policies are often misunderstood, surrounded by a cloud of common myths that prevent individuals from fully benefiting from this investment option. In this section, we will debunk these myths and shed light on the truth behind endowment policies. Let’s explore the two most prevalent misconceptions:

Endowment Policies Only For The Wealthy

Contrary to popular belief, endowment policies are not exclusively designed for the wealthy. While it’s true that they offer significant financial benefits, endowment policies are accessible to individuals from all income brackets. These policies are flexible and customizable, allowing you to choose the premium amount that aligns with your financial goals and affordability.

Myth: Endowment policies are reserved for the rich.

Fact: Endowment policies are accessible to individuals from all income brackets.

Endowment policies serve as a reliable long-term investment tool, providing you with a disciplined savings approach and the opportunity to accumulate wealth over time. By breaking this myth, it becomes clear that endowment policies offer the benefits of financial security and growth to anyone willing to embark on this journey.

Lack Of Flexibility In Investment Options

Another common misconception surrounding endowment policies is the belief that they lack flexibility when it comes to investment options. However, this is far from the truth. Endowment policies offer a diverse range of investment options tailored to suit your risk appetite and financial goals.

Myth: Endowment policies have limited investment options.

Fact: Endowment policies provide a wide range of investment options.

Whether you prefer a conservative approach with low-risk investments or seek the potential for higher returns through equity investments, endowment policies allow you to choose from a variety of investment instruments. This flexibility enables you to align your investment strategy with your risk tolerance and growth aspirations.

It’s important to dispel these common myths surrounding endowment policies to help individuals make informed decisions about their investments. By understanding the realities, you can tap into the full potential of endowment policies and reap the benefits they offer, regardless of your income bracket or investment preferences.

Case Studies: Success Stories

Endowment policies have proven to be a valuable financial tool for many individuals. Let’s explore how these policies have made a positive impact on people’s lives through real-life success stories.

Real-life Examples Of Endowment Policy Benefits

- John, a middle-aged individual, invested in an endowment policy and reaped the benefits when it matured, providing him with a significant financial cushion during his retirement.

- Sarah, a young professional, utilized an endowment policy as part of her long-term financial planning, securing her financial future and enabling her to achieve her goals.

How Endowment Policies Helped In Financial Planning

- Endowment policies offer a structured approach to saving and investing, assisting individuals in building a stable financial foundation for the future.

- By incorporating endowment policies into their financial strategy, individuals can ensure a balanced portfolio and mitigate financial risks effectively.

Credit: http://www.canarahsbclife.com

Final Thoughts And Next Steps

As you consider how an Endowment Policy can enhance your financial stability, it is essential to review your current financial strategy and take proactive steps to secure your future.

Reviewing Your Current Financial Portfolio

Start by evaluating your existing investments and savings to ascertain whether an Endowment Policy aligns with your goals.

Taking Action To Secure Your Financial Future

Once you have reviewed your portfolio, take the necessary steps to safeguard your finances by choosing a reputable provider for your Endowment Policy.

Credit: http://www.pacificlife.com

Frequently Asked Questions For Will Endowment Policy Online

What Is An Endowment Policy?

An endowment policy is a life insurance and savings plan that provides a lump sum payout at the end of the policy term, or upon the policyholder’s death. It offers financial protection and can be used as an investment tool for the future.

How To Buy An Endowment Policy Online?

To buy an endowment policy online, research reputable insurance providers, compare policies, and consider your financial goals. Fill out the online application, provide necessary personal information, and choose a suitable policy based on your needs and budget. Complete the purchase process securely and efficiently.

What Are The Benefits Of An Endowment Policy?

Endowment policies offer financial security, potential for high returns, tax benefits, and a disciplined saving habit. They create a corpus for future needs, such as funding education, buying a home, or retirement. Additionally, the policy provides life cover, ensuring your loved ones’ financial stability.

Can I Surrender My Endowment Policy Online?

Yes, endowment policies can be surrendered online by contacting the insurance company’s customer service or visiting their website. Consider the surrender value, potential penalties, and future financial implications before proceeding. Ensure that you understand the terms and conditions for policy surrender before making a decision.

Conclusion

Opting for an endowment policy online offers a convenient and efficient way to secure the financial future. With its easy application process and the ability to compare multiple options, individuals can find the most suitable policy to meet their specific needs.

Moreover, the online platform ensures transparency and access to valuable resources. Embrace the digital age and make the most of endowment policies conveniently available online.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is an endowment policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “An endowment policy is a life insurance and savings plan that provides a lump sum payout at the end of the policy term, or upon the policyholder’s death. It offers financial protection and can be used as an investment tool for the future.” } } , { “@type”: “Question”, “name”: “How to buy an endowment policy online?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To buy an endowment policy online, research reputable insurance providers, compare policies, and consider your financial goals. Fill out the online application, provide necessary personal information, and choose a suitable policy based on your needs and budget. Complete the purchase process securely and efficiently.” } } , { “@type”: “Question”, “name”: “What are the benefits of an endowment policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Endowment policies offer financial security, potential for high returns, tax benefits, and a disciplined saving habit. They create a corpus for future needs, such as funding education, buying a home, or retirement. Additionally, the policy provides life cover, ensuring your loved ones’ financial stability.” } } , { “@type”: “Question”, “name”: “Can I surrender my endowment policy online?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, endowment policies can be surrendered online by contacting the insurance company’s customer service or visiting their website. Consider the surrender value, potential penalties, and future financial implications before proceeding. Ensure that you understand the terms and conditions for policy surrender before making a decision.” } } ] }

Leave a comment