Renters insurance typically covers theft, providing financial protection for stolen belongings. Renters insurance is a necessary safeguard that covers more than just your personal belongings; it also offers liability protection and additional living expenses in the event of theft, fire, or other covered disasters.

While most people understand the importance of renters insurance, they may be unsure if it covers theft specifically. Theft falls under the personal property coverage of renters insurance, meaning that if your personal belongings are stolen from your rental property or even while you are away, renters insurance will typically provide coverage to help replace those items.

Renters insurance can be essential to recover financially after a theft and offers the peace of mind that your possessions are protected.

Importance Of Renters Insurance

Secure your belongings with renters insurance. It provides coverage for theft, offering peace of mind for renters. Be prepared and protected against potential losses.

Financial Protection

Renters insurance offers financial protection against theft by covering the cost of replacing stolen items.

In the event of theft, renters insurance ensures you are not burdened with the cost of replacing your belongings.

Peace Of Mind

Having renters insurance can provide peace of mind knowing your personal possessions are covered in case of theft.

With renters insurance, you can rest assured that even if theft occurs, you have protection.

Renters insurance is essential for protecting your personal belongings in case of theft.

It offers financial protection and peace of mind, ensuring you are covered against unforeseen events like theft.

Credit: http://www.nationwide.com

Understanding Theft Coverage

When it comes to protecting your belongings as a renter, understanding theft coverage is crucial. Renters insurance provides financial protection in case your belongings are stolen or damaged due to theft. It’s essential to know what is covered and what is not covered under your policy so that you can make informed decisions to safeguard your possessions.

What Is Covered?

Renters insurance generally covers theft of personal belongings both inside and outside your home. This means that if your laptop, jewelry, or other valuable items are stolen from your apartment or while you are traveling, your insurance policy can help reimburse you for the loss.

In addition to personal belongings, some renters insurance policies may also provide coverage for theft of items from your car. This can be particularly beneficial if you often store valuable items in your vehicle.

Furthermore, theft coverage typically includes protection for damage caused by a break-in. So, if a thief damages your door, window, or locks during the act of theft, your policy may cover the cost of repairs.

What Is Not Covered?

While renters insurance offers valuable protection against theft, it’s important to note that certain items and situations may not be covered. Here are a few examples:

- Cash: Most policies have limits on cash coverage, so if a large sum of money is stolen, it may not be fully reimbursed.

- Expensive Jewelry: If you own high-value jewelry, such as engagement rings or heirlooms, you may need additional coverage, as there is usually a dollar limit on coverage for theft of jewelry.

- Roommate’s Belongings: Renters insurance typically only covers your own belongings, so your roommate would need their own policy to protect their possessions.

- Acts of Negligence: If you fail to take reasonable precautions, such as leaving your door unlocked, your claim for theft may be denied.

Remember, every insurance policy is different, so it’s crucial to read and understand the terms and conditions of your own policy to know the specific coverage and exclusions regarding theft.

Key Factors To Consider

When considering renters insurance and theft coverage, it is important to understand the key factors that can impact your policy. Paying attention to policy limits, deductibles, and premiums will help you make an informed decision.

Policy Limits

Policy limits determine the maximum amount of coverage provided for theft. It’s crucial to review and understand these limits to ensure that your belongings are adequately protected. Be sure that the policy limits align with the value of your possessions to avoid being underinsured in the event of a theft.

Deductibles And Premiums

Deductibles are the out-of-pocket expenses that you must pay before your insurance coverage kicks in. Choosing a higher deductible can lower your premiums, but it’s essential to assess whether you can afford the deductible in the event of a theft. Weight the trade-off between deductible and premium to find the optimal balance for your budget and peace of mind.

Steps To Take After Theft

In the event of theft, renters insurance typically provides coverage for stolen belongings. After a theft, report the incident to the police and your insurance provider promptly. Keep records of stolen items and documentation for your insurance claim.

Steps to Take After Theft Contacting Insurance Provider In the unfortunate event of theft, the first step to take is to notify your insurance provider. This should be done as soon as possible to start the claims process. Ensure to provide the necessary details such as policy number, date and time of theft, and a list of stolen items. Filing a Police Report After contacting the insurance provider, the next crucial step is to file a police report. This official report serves as evidence for your insurance claim and increases the likelihood of recovering your stolen items. Be sure to provide accurate information and obtain a copy of the report for your records. Remember, quick and thorough action can help ease the process of dealing with theft and navigate the insurance claims process swiftly. By following these steps, you can expedite the process of recovering from theft and ensure your insurance claim is processed smoothly.Common Misconceptions

Renters insurance is a vital investment for anyone living in a rented property. While it provides coverage for a variety of incidents, there are some common misconceptions that people often have regarding theft coverage. Let’s debunk these misconceptions and explore the truth.

Assuming Landlord’s Insurance Covers Theft

One common misconception is that the landlord’s insurance will cover theft of personal belongings. However, this is not the case. Landlord’s insurance typically only covers the building structure and liability for the landlord, not the personal property of the tenant. It is crucial to understand that in the event of theft, the landlord’s insurance will not reimburse you for your losses.

Believing Personal Property Is Not Valuable

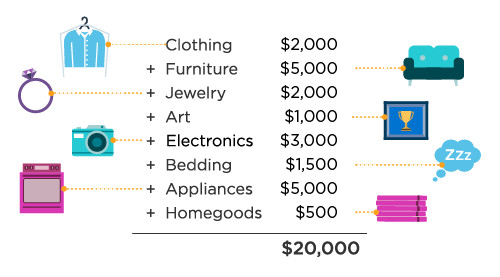

Another misconception people have is believing that their personal property is not valuable enough to warrant renters insurance. They may think that their belongings are not worth much and therefore do not need coverage. However, when you consider the cost of replacing items such as furniture, electronics, clothing, and appliances, the value can quickly add up. Renters insurance ensures that even if the stolen items may not be of great financial worth individually, their cumulative value is protected.

By understanding these common misconceptions about theft coverage under renters insurance, you can make informed decisions about protecting your personal belongings. Renters insurance provides peace of mind and financial security in the event of theft, ensuring that you are not left with the burden of replacing stolen items on your own.

Tips For Maximizing Protection

Maximize your protection with these essential tips for ensuring your renters insurance covers theft.

Creating Inventory Of Possessions

Compile a detailed list of your belongings to aid in the event of a theft claim.

- Photograph or videotape your items and store the inventory in a secure location.

- Include descriptions, serial numbers, and receipts for high-value possessions.

Adding Riders For High-value Items

Consider adding specialized coverage for expensive items that exceed your policy limits.

- Contact your insurance provider to inquire about additional riders for valuable possessions.

- Appraise high-end jewelry, electronics, or artwork to determine the need for extra coverage.

Protect your belongings comprehensively by following these essential renters insurance tips.

Comparing Policies

When comparing renters insurance policies, it’s important to consider the variations in coverage and conduct a cost-benefit analysis to determine the best option for your needs. Let’s break down the key considerations to help you make an informed decision.

Coverage Variations

Coverage for theft can vary between renters insurance policies. Some policies may offer broader coverage for theft incidents, including not only personal belongings inside your rented space but also items stolen outside of your home, such as a bicycle or electronics while you are away from home. It’s essential to carefully review the coverage details and limitations of each policy to ensure that you are adequately protected in case of theft.

Cost-benefit Analysis

Conducting a cost-benefit analysis involves considering the premium costs against the coverage benefits provided by each renters insurance policy. While a policy with more comprehensive theft coverage may come with a higher premium, it could offer better protection and peace of mind. Consider the value of your belongings and the potential financial impact of a theft when evaluating the cost-benefit of each policy.

Credit: m.facebook.com

Conclusion And Final Thoughts

Renters insurance typically covers theft, providing financial protection for stolen belongings. It’s important to review the policy details and understand the coverage limits and exclusions to ensure adequate protection.

Ensuring Comprehensive Coverage:

Renters insurance is a vital investment for anyone living in rental properties. It not only provides protection against theft but also covers your personal belongings from other perils such as fire, water damage, vandalism, and more. By obtaining renters insurance, you can avoid financial stress and have peace of mind knowing that you are protected in case of any unfortunate events.

Benefits of Renters Insurance:

Renters insurance offers numerous benefits that go beyond covering theft. It provides liability coverage, which protects you if someone gets injured in your rental unit and decides to sue you. Additionally, renters insurance can help with temporary living expenses if your rental becomes uninhabitable due to a covered event, such as a fire or flood. This coverage is known as “loss of use.” Moreover, renters insurance is usually affordable, with rates starting at just a few dollars a month, making it a wise investment for tenants of all budgets.

Remember, not all policies are created equal. When choosing a renters insurance policy, it’s important to review the coverage options and limits. Some policies may have exclusions or limitations that you need to be aware of, so it’s essential to read the fine print. Additionally, taking an inventory of your belongings before purchasing renters insurance can help determine the appropriate coverage amount to ensure that you are adequately protected.

| Key Takeaways: |

|

Credit: http://www.facebook.com

Frequently Asked Questions Of Does Renters Insurance Cover Theft

Is Theft Covered By Renters Insurance?

Yes, renters insurance typically covers theft of personal belongings, providing financial protection and peace of mind for tenants. This coverage includes items stolen from your rental property or elsewhere. It’s essential to understand the policy details regarding theft coverage.

What Types Of Theft Are Covered By Renters Insurance?

Renters insurance can cover various types of theft, including burglary, robbery, and even theft outside the rental property. However, coverage may vary depending on the policy. It’s advisable to review your policy to understand the extent of theft coverage it provides.

How Does Renters Insurance Compensate For Theft?

In the event of theft, renters insurance may reimburse you for the value of the stolen items based on your policy limits and deductibles. It’s crucial to keep a record of your belongings and their value to ensure proper compensation in case of theft.

Conclusion

Renters insurance provides coverage for theft, offering peace of mind to tenants. It safeguards their personal belongings in case of theft, ensuring financial protection. This type of coverage not only protects against the loss of valuable items but also covers the cost of repairing any damage caused during a break-in.

Investing in renters insurance is a smart decision to safeguard your possessions and enjoy a worry-free renting experience.

Leave a comment