Motorcycle insurance can range from $100 to $3,000 per year, depending on factors such as the rider’s age, location, and driving record. If you’re a brand-new rider with a sport bike, you can expect to pay higher premiums compared to an experienced rider with a cruiser.

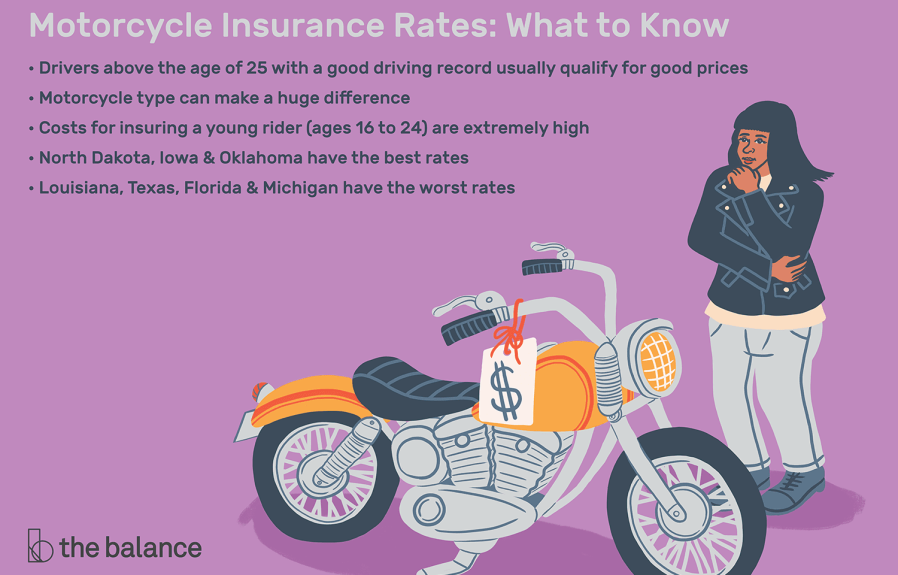

Motorcycle insurance is an essential expense for riders as it protects them financially in case of accidents or theft. However, the cost of this insurance can vary significantly depending on various factors. These factors include the age of the rider, their location, driving history, type of motorcycle, and even the specific insurance provider.

Consequently, it is crucial for riders to understand the different elements that influence motorcycle insurance rates in order to make informed decisions. This article will explore the factors that affect motorcycle insurance costs and provide insights into obtaining the best coverage at a reasonable price.

Credit: http://www.coverhound.com

Factors Affecting Motorcycle Insurance Cost

Factors affecting motorcycle insurance costs include the type of motorcycle, rider’s age and driving record, location, and coverage options. Generally, the cost varies based on these factors, with the average annual premium ranging from $200 to $500. It’s important to compare quotes to find the best rate for motorcycle insurance.

Type Of Motorcycle

The type of motorcycle you ride directly impacts insurance rates.

Rider’s Age And Experience

Young riders often pay higher premiums due to less experience.

Coverage Options

Comprehensive coverage will raise costs, but provides better protection.

Understanding Insurance Premiums

Understanding insurance premiums is crucial when it comes to determining motorcycle insurance costs. Discover how much you can expect to pay for coverage based on various factors such as your age, driving history, and the type of motorcycle you have.

Understanding Insurance Premiums When it comes to motorcycle insurance, understanding the factors that influence your premium is essential. Insurance premiums are the amount of money you pay to the insurance company to keep your coverage active. Several factors are taken into consideration when calculating motorcycle insurance premiums. By understanding these factors, you can better evaluate the cost of your insurance and find ways to save money. In this article, we will discuss premium calculation methods and discount opportunities.Premium Calculation Methods

Insurance companies use different methods to calculate premiums for motorcycle insurance. The two most common methods are:- CC Rating method

- Motorcycle Category method

Discount Opportunities

Despite the various calculation methods, there are several discount opportunities that can help lower your motorcycle insurance premium. Insurance companies offer different discounts based on factors like:- Driving record: A clean driving record with no accidents or traffic violations may make you eligible for a safe driver discount.

- Multiple policies: Combining your motorcycle insurance with other policies such as auto or home insurance can lead to multi-policy discounts.

- Motorcycle safety courses: Completing a motorcycle safety course demonstrates your commitment to being a responsible rider, making you eligible for discounts.

- Anti-theft devices: Installing anti-theft devices on your motorcycle can reduce the risk of theft, leading to discounts on your premium.

Comparing Insurance Providers

When comparing insurance providers for motorcycle coverage, it’s crucial to research different companies thoroughly and read customer reviews to make an informed decision. Researching different companies allows you to gain insight into their offerings, while reading customer reviews provides valuable information about their service quality.

Researching Different Companies

When researching different insurance providers, consider factors such as coverage options, pricing, discounts, and customer service. Comparing these factors across various companies can help you determine which provider best suits your needs.

Reading Customer Reviews

Reading customer reviews can offer valuable perspectives on an insurance provider’s reliability and customer satisfaction. Look for feedback on claims processing, communication, and overall customer experience to gauge the quality of service.

Tips For Lowering Motorcycle Insurance Costs

Motorcycle insurance can be a significant expense for riders, but there are several strategies you can use to lower your costs without sacrificing coverage. By implementing these tips, you can secure the protection you need while saving money on your motorcycle insurance policy.

Increasing Deductibles

Increasing your deductible can lower your motorcycle insurance premium. By opting for a higher deductible, you take on more financial responsibility in the event of a claim, which can lead to reduced insurance costs.

Bundling Insurance Policies

Consider bundling your motorcycle insurance with other policies, such as auto or homeowners insurance. Insurance companies often offer discounts for customers who have multiple policies with them, providing an opportunity to save money on your overall insurance costs.

Taking Safety Courses

Participating in motorcycle safety courses can demonstrate to insurance providers that you are a responsible rider. Many insurers offer discounts for completing these courses, which can result in lower insurance premiums.

State-specific Insurance Requirements

When it comes to obtaining motorcycle insurance, it’s important to understand that each state has its own specific requirements. Some states have minimum coverage mandates, while others offer additional optional coverages. It’s crucial to be aware of these requirements to ensure you have the necessary insurance protection in case of an accident or unforeseen event.

Minimum Coverage Mandates

In most states, there are certain minimum coverage mandates that riders must adhere to. These mandates typically include:

- Bodily Injury Liability: This coverage provides financial protection if you injure someone else in a motorcycle accident. It helps cover medical expenses, lost wages, and legal fees.

- Property Damage Liability: Property damage liability coverage helps pay for any damages you may cause to someone else’s property in an accident.

- Uninsured/Underinsured Motorist: This coverage protects you if you’re involved in an accident with an uninsured or underinsured driver. It helps cover your medical expenses and damages.

These minimum coverage mandates vary from state to state, with each state setting its own required minimum limits. It’s important to familiarize yourself with your state’s specific requirements to ensure you meet the legal obligations.

Additional Optional Coverages

In addition to the minimum coverage mandates, riders have the option to purchase additional coverages to enhance their insurance protection. These additional optional coverages may include:

- Collision Coverage: Collision coverage pays for damages to your motorcycle caused by a collision with another vehicle or object.

- Comprehensive Coverage: Comprehensive coverage provides protection for damages to your motorcycle that are not caused by a collision, such as theft, vandalism, fire, or natural disasters.

- Medical Payments: Medical payments coverage helps cover your medical expenses if you’re injured in a motorcycle accident, regardless of who is at fault.

- Personal Injury Protection: Personal injury protection (PIP) coverage is similar to medical payments coverage but may also cover lost wages and other related expenses.

- Accessory Coverage: Accessory coverage helps protect any added accessories or modifications you have made to your motorcycle, such as custom paintwork, sidecars, or aftermarket exhaust systems.

These optional coverages can provide extra peace of mind and ensure you are adequately protected in various situations. Consider your individual needs, budget, and the value of your motorcycle when deciding which additional coverages to include in your insurance policy.

Credit: http://www.ebay.com

Special Considerations For Custom Motorcycles

Custom motorcycles require special attention when considering insurance costs due to unique modifications. Insurance rates are determined by a combination of factors like the bike’s value, rider experience, and coverage requirements. Riders should customize their insurance policy to match their motorcycle’s specific needs for adequate protection.

Special Considerations for Custom Motorcycles Creating a unique motorcycle is exhilarating, but insuring it comes with special considerations. Custom motorcycles require detailed appraisal and specialized coverage options. Appraisal Process Appraising a custom motorcycle involves assessing its unique features and modifications to determine its true value for insurance purposes. Specialized Coverage Options For custom bikes, standard insurance may not suffice. Consider specialized coverage for custom parts and enhanced customization protection.Insurance Coverage For Motorcycle Gear

When it comes to motorcycle insurance, ensuring your gear is protected is essential. Motorcycle gear coverage provides financial support in case your protective gear, luggage, or accessories are damaged.

Protective Gear Coverage

Motorcycle insurance can cover helmet, riding jackets, pants, gloves, and boots. Protective gear coverage helps replace damaged or stolen gear.

Luggage And Accessories

Insurance may extend to aftermarket luggage, tank bags, saddlebags, and other accessories. It offers protection against loss or damage to these items while riding.

Credit: http://www.facebook.com

Frequently Asked Questions On How Much Is Motorcycle Insurance

What Factors Determine Motorcycle Insurance Costs?

Motorcycle insurance costs depend on factors like the rider’s age, driving record, and type of bike. Younger riders and high-performance bikes tend to have higher premiums.

How Can I Lower My Motorcycle Insurance Premium?

You can lower your motorcycle insurance premium by taking a safety course, bundling with other policies, and choosing a higher deductible.

Is Motorcycle Insurance Mandatory?

Yes, in most states, motorcycle insurance is mandatory. It provides financial protection in case of accidents, injuries, or damage to property.

Conclusion

Motorcycle insurance premiums vary based on several factors like location, driving history, and type of bike, making it difficult to estimate an exact cost. However, by considering these variables and comparing quotes from different insurance providers, riders can find a policy that fits their budget and provides adequate coverage.

Remember, it’s crucial to strike a balance between price and protection. So, before hitting the open road, ensure you have the right motorcycle insurance in place to enjoy a worry-free riding experience. Safe travels!

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What factors determine motorcycle insurance costs?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Motorcycle insurance costs depend on factors like the rider’s age, driving record, and type of bike. Younger riders and high-performance bikes tend to have higher premiums.” } } , { “@type”: “Question”, “name”: “How can I lower my motorcycle insurance premium?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “You can lower your motorcycle insurance premium by taking a safety course, bundling with other policies, and choosing a higher deductible.” } } , { “@type”: “Question”, “name”: “Is motorcycle insurance mandatory?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, in most states, motorcycle insurance is mandatory. It provides financial protection in case of accidents, injuries, or damage to property.” } } ] }

Leave a comment