Yes, homeowners insurance is necessary to protect your home and belongings from potential dangers and financial loss. It provides coverage for property damage and theft, ensuring that you are not burdened with significant expenses in case of unforeseen events.

Additionally, it may also cover liability claims if someone is injured on your property. Without homeowners insurance, you would bear the full financial responsibility for repairing or replacing your home and belongings, which can be a considerable burden. Therefore, homeowners insurance is a vital investment that offers peace of mind and protection for your most valuable assets.

Importance Of Homeowners Insurance

Homeowners insurance is essential to protect your home and belongings. It provides coverage for different risks, including liability. Let’s delve into the significance of having homeowners insurance.

Protection For Your Home And Belongings

Homeowners insurance safeguards your property in case of damages from disasters or theft. It ensures that your residence and possessions are financially protected.

Coverage For Liability Risks

Homeowners insurance also covers liability risks, such as accidents occurring on your property. It shields you from legal and medical expenses resulting from injuries to others.

Credit: http://www.facebook.com

Understanding Homeowners Insurance Policies

When it comes to protecting your home and belongings, homeowners insurance is a must-have. It provides financial security and peace of mind in the event of unexpected damage or loss. Understanding the intricacies of homeowners insurance policies is crucial to making informed decisions and obtaining appropriate coverage.

Types Of Coverage Available

Homeowners insurance policies typically offer several types of coverage to meet different needs. The most common types include:

- Dwelling coverage: This type of coverage protects the structure of your home in case of damage from covered perils such as fire, windstorms, or vandalism.

- Personal property coverage: This coverage protects your belongings inside the home, including furniture, electronics, and clothing, against damage or theft.

- Liability coverage: Liability coverage helps protect you financially if someone gets injured on your property and sues you for damages.

- Additional living expenses coverage: Also known as loss of use coverage, this provides financial assistance for temporary living arrangements if your home becomes uninhabitable due to a covered peril.

It’s important to evaluate your needs and choose the appropriate types and amounts of coverage to ensure adequate protection.

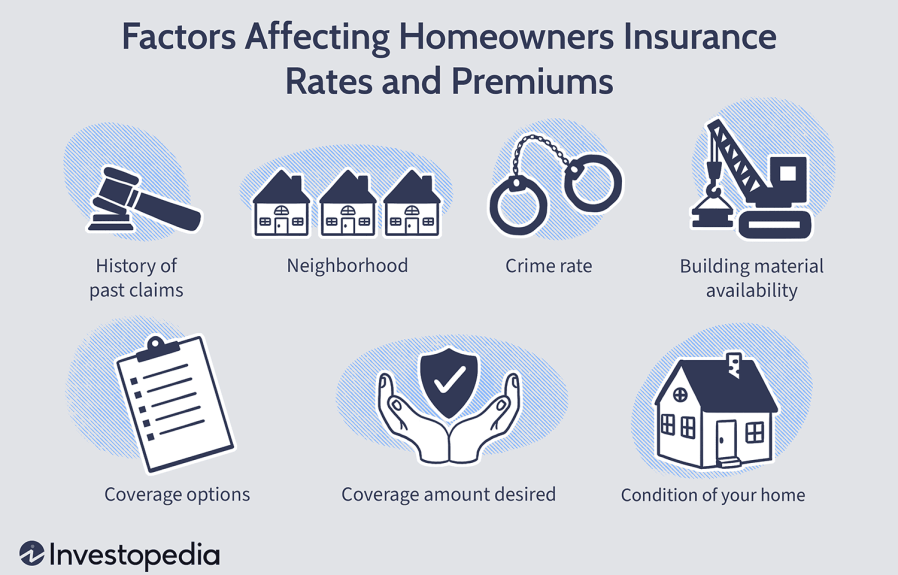

Factors Influencing Premiums

Homeowners insurance premiums are determined by various factors, which can impact the cost of your policy. Some common factors influencing premiums include:

- Location: The location of your home plays a significant role in determining your insurance premium. Certain factors, such as proximity to coastlines or areas prone to natural disasters, can increase the risk of damage and result in higher premiums.

- Home value and replacement cost: The value of your home and the cost to rebuild it in the event of a total loss affect your premiums. Higher-valued homes typically have higher premiums.

- Claims history: Your claims history can impact your insurance premium. If you have a history of frequent claims, insurers may consider you a higher risk and charge higher premiums.

- Deductible: The deductible is the amount you pay out-of-pocket before your insurance coverage kicks in. Choosing a higher deductible can lower your premium but increases the amount you would have to pay in the event of a claim.

Understanding these factors can help you make informed decisions and potentially lower your homeowners insurance premium.

Assessing Your Insurance Needs

Assessing your insurance needs is a crucial part of being a homeowner. Understanding the value of your property and identifying potential risks will help you determine the necessity of homeowners insurance.

Evaluation Of Property Value

Before purchasing homeowners insurance, it’s vital to evaluate the value of your property. Determine the replacement cost of your home, including the materials used and construction expenses. Take into account the value of your personal possessions inside the property.

Identification Of Potential Risks

Identifying potential risks is essential in assessing the need for homeowners insurance. Consider the geographical location of your home – is it prone to natural disasters such as floods, earthquakes, or hurricanes? Assess the crime rate in your area and determine the likelihood of theft or vandalism.

:max_bytes(150000):strip_icc()/whats-difference-between-renters-insurance-and-homeowners-insurance-v2-2694bc76e944405aa55fe2784c373999.png)

Credit: http://www.investopedia.com

Comparing Insurance Providers

When it comes to protecting your home, having the right homeowners insurance is essential. However, with so many providers to choose from, it’s crucial to compare insurance companies to ensure you’re getting the best coverage at the best price. Here’s how to go about it:

Researching Reputation And Financial Stability

Before obtaining quotes, research the reputation and financial stability of potential insurance providers. Look for customer reviews, ratings, and any complaints filed against the company. Check their financial strength and stability ratings through independent rating agencies like A.M. Best, Standard & Poor’s, or Moody’s. This step will help ensure you are dealing with a reputable and financially secure insurance provider, giving you peace of mind in the event of a claim.

Obtaining Multiple Quotes

Once you’ve narrowed down your list of potential providers, obtain quotes from at least three different insurance companies. This will allow you to compare coverage options and premiums, ensuring you get the best value for your money. When requesting quotes, make sure to provide the same information to each company so you can make an accurate comparison. Consider the coverage limits, deductibles, and any additional endorsements offered by each provider.

Making Informed Decisions

When it comes to homeowners insurance, making informed decisions is crucial. This type of insurance provides protection for your home and its contents, giving you peace of mind knowing that you are financially covered in case of unexpected events.

Customizing Coverage To Suit Your Needs

One of the primary benefits of homeowners insurance is the ability to customize coverage to suit your unique needs. Every home is different, and your insurance policy should reflect that. By customizing your coverage, you can ensure that you are adequately protected in case of a disaster.

When customizing your homeowners insurance policy, several factors should be taken into consideration:

- The location of your home

- The value of your home and its contents

- Any additional structures on your property, such as a shed or garage

- Any specific risks or hazards associated with your area

By considering these factors, you can determine the appropriate coverage limits for your policy. For example, if you live in an area prone to natural disasters, you may want to consider additional coverage for flood or earthquake damage. On the other hand, if you own valuable jewelry or collectibles, you may want to increase your coverage limits for these items.

Considering Additional Riders Or Endorsements

In addition to customizing your coverage, it is important to consider additional riders or endorsements that can provide extra protection. These are additional coverage options that can be added to your homeowners insurance policy to address specific needs.

Common riders or endorsements include:

| Rider/Endorsement | Description |

|---|---|

| Flood Insurance | Covers damage caused by flooding, which is typically not included in standard homeowners insurance policies. |

| Personal Umbrella Policy | Provides additional liability coverage beyond the limits of your homeowners insurance policy. |

| Jewelry or Fine Arts Coverage | Increases coverage limits for valuable items such as jewelry, artwork, or antiques. |

By considering these additional coverage options, you can ensure that you have comprehensive protection that aligns with your specific needs.

In conclusion, homeowners insurance is not only necessary but also essential for safeguarding your home and belongings. By making informed decisions and customizing your coverage to suit your needs, you can have the peace of mind knowing that you are financially protected against unexpected events.

Avoiding Common Pitfalls

Homeowners insurance is vital for safeguarding your home and belongings against unforeseen events. Protect yourself from common pitfalls by securing the necessary coverage that ensures peace of mind and financial security.

Underinsuring Your Property

Not having enough coverage can lead to financial strain in case of an incident.

Ignoring Special Coverage Needs

Specific items or risks might require additional protection not included in basic policies.

Tips For Lowering Insurance Costs

If you’re looking to reduce your homeowners insurance costs, consider implementing the following tips:

Increasing Home Security Measures

Installing a security system can lower insurance premiums by deterring burglaries and minimizing risks.

Utilize smart technology like video doorbells to enhance home security and potentially qualify for discounts.

Raising Deductibles Wisely

Increase deductibles cautiously to balance lower premiums with manageable out-of-pocket expenses.

Consult with your insurance provider to determine the optimal deductible amount for your situation.

Credit: m.facebook.com

Reassessing Your Policy Regularly

Homeowners insurance is not a one-time decision; it’s an ongoing process that requires regular review and updates. As your life changes, so do your insurance needs. It’s crucial to regularly reassess your policy to ensure that you have the right coverage for your current situation.

Updating Coverage As Your Needs Change

Life is dynamic, and your insurance coverage should reflect that. Regularly reviewing your policy allows you to update your coverage as your needs change. Whether you’ve made major purchases, acquired valuable items, or undergone lifestyle changes, it’s essential to ensure that your policy adequately protects your assets and liabilities.

Reevaluating After Home Improvements

Home improvements can significantly increase the value of your property. Reassessing your homeowners insurance after making these improvements can help you determine if your coverage limits need adjusting to protect your newfound investments. Whether you’ve renovated your kitchen, added a new room, or upgraded your electrical system, it’s important to ensure that these enhancements are adequately covered.

Frequently Asked Questions Of Is Homeowners Insurance Really Necessary

What Does Homeowners Insurance Cover?

Homeowners insurance typically covers damage to your home and personal property caused by certain perils, as well as liability for any injuries or property damage you or your family members cause to others.

Is Homeowners Insurance Mandatory?

Homeowners insurance is not legally required but may be required by your mortgage lender. It’s essential for protecting your investment in your home and providing financial security.

How Can I Save Money On Homeowners Insurance?

You can reduce your premium by increasing your deductible, bundling insurance policies, improving home security, maintaining a good credit score, and shopping around for the best rates.

What Factors Affect Homeowners Insurance Rates?

The cost of homeowners insurance depends on factors such as the location of your home, its age and building materials, your credit score, claims history, and the coverage and deductible you choose.

Conclusion

All in all, homeowners insurance is a must-have for anyone who wants to protect their investment and have peace of mind. From covering damage to your property and belongings to liability protection, it ensures that you’re financially secure in the face of unexpected events.

Don’t overlook the importance of homeowners insurance – it’s an essential safeguard for your home and everything it holds.

Leave a comment