Home insurance payouts in Canada are generally not taxable, as they are considered a reimbursement for loss or damage to your property. Home insurance provides homeowners with financial protection in case of unexpected events such as theft, fire, or natural disasters.

However, a common concern among homeowners is whether the payouts received from insurance claims are subject to taxation. Understanding the tax implications of home insurance payouts is crucial for homeowners to accurately manage their finances. In Canada, home insurance payouts are typically not taxable, as they are seen as reimbursements for the loss or damage to the insured property.

This means that homeowners do not have to worry about additional tax burdens when receiving funds to replace or repair their damaged homes. However, it’s important to be aware of any specific circumstances or exceptions that could potentially affect the tax status of insurance payouts, as these may vary in certain situations.

The Basics Of Home Insurance Payouts

Introduction:

When it comes to home insurance payouts in Canada, it’s crucial to understand if these payouts are taxable. Before delving into the specifics, let’s first grasp the basics of home insurance payouts.

Taxable Income Rules

Understanding the taxable income rules surrounding home insurance payouts is essential. In general, home insurance proceeds are not considered taxable income in Canada.

Types Of Losses Covered

Home insurance typically covers various types of losses, including fire damage, theft, vandalism, and natural disasters. These losses are usually covered under the policy, providing financial protection to homeowners.

Credit: http://www.medisysdata.com

Taxability Of Home Insurance In Canada

In Canada, home insurance payouts are typically not taxable, providing valuable financial support to homeowners in times of need. The funds received can help cover repairs or replacement costs without adding to the tax burden on the property owner. This tax-friendly feature offers peace of mind to Canadian homeowners.

Income Tax Act Provisions

Under the Income Tax Act of Canada, home insurance payouts are generally considered non-taxable. This means that if you have to make a claim on your home insurance policy, you will not be required to pay taxes on the amount you receive. This rule applies to both the building and its contents, providing peace of mind for homeowners.

Exceptions To Taxable Payouts

While home insurance payouts are typically non-taxable, there are certain exceptions to this rule. It’s important to be aware of these exceptions to ensure you understand the potential tax implications.

One exception is if you receive a payout for business-related damages. If you operate a business from your home and have a separate insurance policy covering your business activities, any payout related to those damages may be subject to taxes. This is because the damages are related to income-generating activities.

Another exception is if you receive a payout for lost rental income. If you rent out part of your home and receive rental income, any payout for lost rental income may be considered taxable. The reasoning behind this is that the rental income is a source of income for you.

Additionally, if you claim a home insurance payout as a tax deduction on your tax return, any subsequent payment you receive from the insurance company for the same claim will be considered taxable. This is to prevent individuals from double-dipping and receiving a tax deduction and a non-taxable insurance payout for the same expense.

It’s important to consult with a tax professional to understand the specifics of your situation and how it may impact your taxes.

To summarize, while home insurance payouts in Canada are generally non-taxable under the Income Tax Act, there are exceptions to this rule. It’s crucial to be aware of these exceptions, particularly if you have a home-based business, rental income, or if you have claimed a tax deduction for the claimed damages. Always consult with a tax professional to ensure you meet your obligations and optimize your tax situation.

Navigating Specific Scenarios

When it comes to home insurance payouts in Canada, understanding the tax implications can be crucial for homeowners. Navigating specific scenarios related to home insurance payouts requires a clear understanding of how tax regulations apply. From total loss versus partial loss situations to secondary residence insurance, each scenario can have different tax implications.

Total Loss Vs. Partial Loss

A total loss in a home insurance claim typically occurs when the property is completely destroyed or damaged beyond repair. In such cases, the insurance payout is often tax-free, providing financial relief to homeowners facing significant loss.

In contrast, a partial loss involves damage to the property that can be repaired or replaced. In these scenarios, the insurance payout may be subject to taxation, as it is intended to cover the costs of restoring the property to its pre-loss condition. Homeowners should consult with a tax professional to understand the tax implications of their specific partial loss situation.

Secondary Residence Insurance

For individuals who own a secondary residence, such as a vacation home or rental property, it’s important to consider the tax implications of insurance payouts. In the event of a loss at a secondary residence, the tax treatment of the insurance payout may differ from that of the primary residence.

Homeowners should be aware that the tax rules for secondary residence insurance can vary based on factors such as rental income, personal use of the property, and the extent of the loss. Seeking guidance from a tax advisor can help ensure that homeowners understand the tax implications of insurance payouts for their secondary residence.

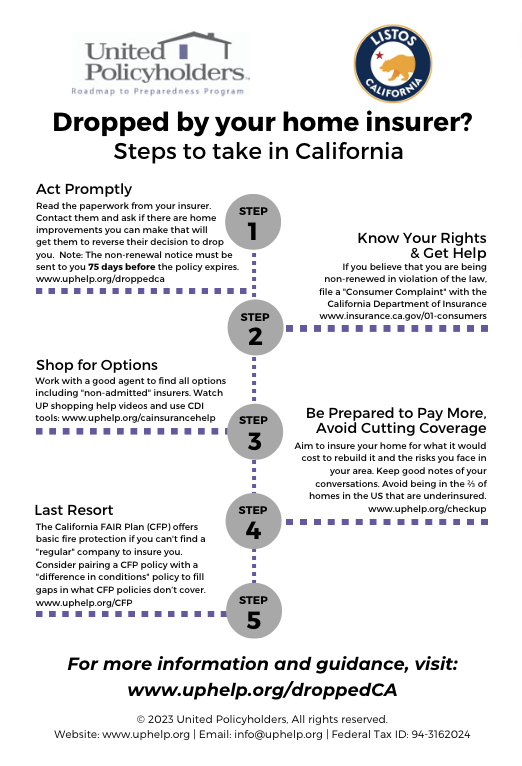

Credit: uphelp.org

Impact On Premiums And Deductions

Home insurance payouts are generally not taxable in Canada, as they are considered reimbursements for loss or damage. Premiums and deductions may have an impact, but the payouts themselves are not subject to taxation.

Impact on Premiums and Deductions When it comes to home insurance payouts, many Canadians wonder about the tax implications. One of the key areas to consider is the effect on future premiums and tax deductibility of premiums. Understanding these aspects can help homeowners make informed decisions about their insurance coverage and tax obligations. Effect on Future Premiums Home insurance payouts can impact future premiums in Canada. Insurers may adjust premiums based on the number and value of previous claims. A history of frequent and high-value claims can lead to higher premiums, as it suggests a higher risk for the insurer. On the other hand, minimal or no previous claims may result in lower premiums. Tax Deductibility of Premiums Home insurance premiums are generally not tax-deductible in Canada if the policy is for personal use, covering the homeowner’s primary residence. However, there are exceptions, such as if part of the home is used for business purposes, which may allow for a portion of the premiums to be deducted as a business expense. Impact of Home Insurance Payouts on Premiums and Deductions – Increased future premiums can result from a history of significant claims. – Minimal or no previous claims may lead to lower future premiums. – Home insurance premiums are typically not tax-deductible for personal use, except under specific circumstances such as business use. In conclusion, understanding the implications of home insurance payouts on future premiums and tax deductibility is crucial for Canadian homeowners. By being aware of these factors, homeowners can make informed decisions regarding their insurance coverage and tax planning.”Reporting Home Insurance Payouts

In Canada, home insurance payouts are generally not taxable. This is because they are considered to be reimbursement for damage or loss, rather than actual income. However, there may be exceptions for certain types of coverage or specific circumstances. It’s always best to consult a tax professional for personalized advice.

Filing Requirements

In Canada, reporting home insurance payouts is an essential task for homeowners who have experienced a loss or damage covered by their insurance policy. It is important to understand the filing requirements to ensure compliance with tax laws and avoid any potential penalties.

When it comes to reporting home insurance payouts, homeowners must include the details of the payout in their income tax return. The amount received from the insurance company should be reported as “Other Income” on the tax return form. This applies to all types of home insurance payouts, including those for property damage, theft, or liability claims.

Documentation Needed

When filing your taxes and reporting home insurance payouts, it is crucial to gather the necessary documentation to support your claims. This documentation will help you accurately report the amount and provide proof of the insurance payout to the tax authorities if required.

The documentation needed may vary depending on the nature of the insurance payout. However, it typically includes the following:

- A copy of the insurance policy

- A statement or letter from the insurance company detailing the amount of the payout

- Any receipts or invoices related to repairs or replacements done as a result of the insured event

- Photographs or videos documenting the damage or loss

It is essential to keep these documents safe and organized, as they may be required by the tax authorities for auditing purposes. Failure to provide the necessary documentation can lead to delays in processing your tax return or potential penalties.

Expert Insights And Tips

When it comes to home insurance payouts in Canada, understanding the tax implications is essential. After all, nobody wants their hard-earned money to be diminished by excessive taxes. To help you navigate this complex topic, we have gathered expert insights and tips from tax professionals who have in-depth knowledge of the subject matter.

Advice From Tax Professionals

It’s always wise to seek advice from tax professionals when dealing with home insurance payouts and potential tax liabilities. These experts are well-versed in the intricacies of tax laws and can provide valuable guidance tailored to your specific situation. They can help you determine whether the payout you receive from your insurer is subject to taxation and how to accurately report it on your tax return.

When consulting tax professionals regarding your home insurance payout, make sure to provide them with all the necessary documentation, including your insurance policy terms, the amount received, and any relevant information about the loss or damage that triggered the claim. By doing so, you enable them to better assess the tax implications and offer you sound advice tailored to your circumstances.

Strategies For Minimizing Tax Impact

While home insurance payouts may be subject to taxation, there are several strategies available to help minimize the tax impact. By implementing these strategies, you can keep more of your insurance settlement in your pocket. Here are a few tips:

- 1. Capital Gains Exemption: In certain situations, you may be eligible for a capital gains exemption on the sale of your principal residence. This exemption can help reduce or eliminate any tax liability connected to your home insurance payout.

- 2. Proper Documentation: Keeping detailed records of any repair or rebuilding expenses related to your home insurance claim is crucial. These expenses can be deductible, effectively reducing the taxable amount of your insurance payout.

- 3. Deductible Loss: If your insurance payout is less than the value of the loss or damage, you may be eligible to deduct the difference as a loss on your tax return.

- 4. Tax-Free Investments: Consider investing a portion of your insurance payout in tax-free vehicles like a Tax-Free Savings Account (TFSA) or Registered Retirement Savings Plan (RRSP). By doing so, you can grow your money without incurring additional taxes.

Remember, every taxpayer’s situation is unique, and it’s crucial to consult with a tax professional for personalized advice on minimizing the tax impact of your home insurance payout. By taking advantage of their expertise and implementing the right strategies, you can ensure your hard-earned money remains as intact as possible.

Recent Developments And Case Studies

Recent Developments and Case Studies:

Updates In Tax Laws

Canadian home insurance payouts have specific tax implications.

Recent changes in tax laws have influenced how these payouts are treated.

- Exemptions may apply for certain scenarios.

- Understanding tax laws is crucial for homeowners.

Real-life Examples

Real-life case studies provide valuable insights into how taxes affect insurance payouts.

Example 1: Jane received $50,000 for home damages and consulted a tax expert.

Example 2: Mark’s insurance payout was taxed due to specific circumstances.

Conclusion And Recommendations

As we have explored the tax implications of home insurance payouts in Canada, it is crucial for policyholders to understand how these payouts may affect their tax obligations. To summarize the key points and provide actionable recommendations, let’s delve into the summary of tax implications and the key takeaways for policyholders.

Summary Of Tax Implications

When a policyholder receives a home insurance payout in Canada, the amount received is typically not considered taxable income. This applies to both property damage and personal belongings coverage. However, there are exceptions in cases where the insurance payout exceeds the adjusted cost base of the property or if the payout is for any additional living expenses. In such scenarios, consulting with a tax professional is advisable to ensure compliance with Canadian tax regulations.

Key Takeaways For Policyholders

- Home insurance payouts in Canada are generally not subject to taxation, except in specific circumstances.

- Policyholders should maintain documentation and receipts related to their insurance claims to substantiate any taxable or non-taxable portions of the payouts.

- It is prudent for policyholders to seek guidance from tax professionals or accountants when dealing with complex insurance payouts to ensure compliance with tax laws.

- Understanding the tax implications of home insurance payouts can help policyholders make informed decisions when filing their tax returns and managing their financial affairs.

Credit: http://www.marketwatch.com

Frequently Asked Questions On Are Home Insurance Payouts Taxable In Canada

Are Home Insurance Payouts Taxable In Canada?

No, generally, home insurance payouts are not taxable in Canada because they are intended to reimburse for property damage or loss. However, there are exceptions for any interest earned on the insurance payout. Consult a tax professional for specific circumstances.

Conclusion

To summarize, home insurance payouts in Canada are generally not taxable. However, there are certain circumstances where portions of the payout may be subject to tax. It’s important to consult with a tax professional to understand the specific rules and exemptions applicable to your situation.

By staying informed and taking necessary steps to ensure compliance, homeowners can make the most of their insurance coverage without any tax-related surprises.

Leave a comment