Healthy Paws is the best pet insurance provider in the UK. They offer comprehensive coverage, competitive prices, and excellent customer service.

Pet insurance gives pet owners peace of mind by providing financial protection for unexpected veterinary expenses. In the UK, there are several pet insurance providers to choose from. However, when it comes to finding the best one, Healthy Paws stands out from the competition.

With their comprehensive coverage options, affordable premiums, and a reputation for superior customer service, Healthy Paws is the top choice for pet owners in the UK. We will explore why Healthy Paws is the best pet insurance provider in the UK and why it is important to have pet insurance for your furry friend.

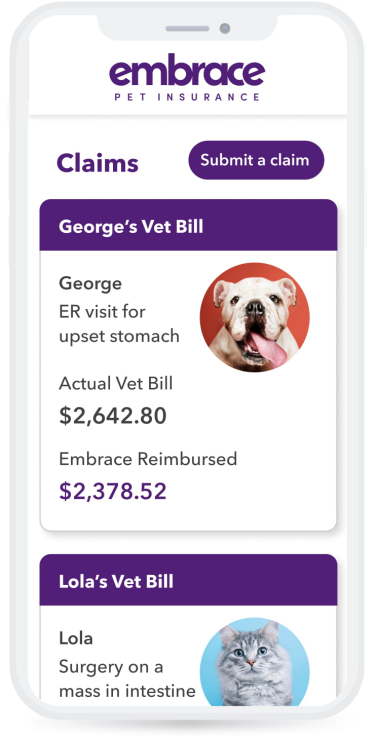

Credit: http://www.embracepetinsurance.com

Factors To Consider

Look for plans that cover accidents, illnesses, and preventive care.

Compare costs and benefits to ensure you get the best value for your money.

Read feedback to gauge customer satisfaction and service quality.

Top-rated Pet Insurances In The Uk

Looking for the best pet insurance in the UK to provide your furry friend with the protection they deserve? We’ve got you covered! In this guide, we’ll discuss the top-rated pet insurances in the UK that offer comprehensive coverage and a range of benefits for your beloved pets.

Company A: Coverage And Benefits

Company A is a leading pet insurance provider in the UK, offering a wide range of coverage options and benefits for pet owners. With Company A, you can expect:

- Accident and illness coverage to protect your pet from unexpected medical expenses.

- Emergency veterinary care to ensure your furry friend receives prompt medical attention when needed.

- Coverage for diagnostic tests and treatments, including surgeries, medications, and rehabilitation.

- Optional add-ons such as dental coverage and routine care packages to enhance your pet’s overall well-being.

With Company A, you can have peace of mind knowing that your pet will receive the best possible care without breaking the bank.

Company B: Coverage And Benefits

When it comes to pet insurance, Company B is a top contender in the UK market. They offer a range of coverage options and benefits, including:

- Comprehensive accident and illness coverage to protect your pet from unexpected medical expenses.

- Emergency veterinary care, ensuring that your furry friend can receive immediate medical attention when the need arises.

- Coverage for diagnostic tests, treatments, surgeries, medications, and rehabilitation.

- Optional extras like dental coverage and alternative therapies to cater to your pet’s specific needs.

With Company B, you can rest assured that your pet’s health will be taken care of, allowing you to focus on creating wonderful memories together.

Company C: Coverage And Benefits

Company C is known for its comprehensive coverage and attractive benefits, making it a popular choice among pet owners. Here’s what you can expect:

- Accident and illness coverage to protect your pet from unexpected medical expenses.

- Emergency veterinary care, ensuring that your furry friend receives prompt medical attention during emergencies.

- Coverage for diagnostic tests, treatments, surgeries, medications, and rehabilitation.

- Optional add-ons such as dental coverage and pet travel insurance to cater to your pet’s unique needs and lifestyle.

Company C is committed to providing top-notch care for your pet, ensuring that they stay happy, healthy, and well-protected.

Comparison Of Top Insurers

When choosing a pet insurance provider, it’s essential to compare the top insurers in the UK to find the best coverage, cost, and customer satisfaction. Understanding the differences between these insurers can help you make an informed decision that suits your pet’s needs and your budget.

Coverage Comparison

When it comes to coverage, it’s crucial to assess the range of medical treatments and services included in the policies. Some insurers offer comprehensive coverage for accidents, illnesses, and hereditary conditions, while others may have limitations on certain treatments or preventive care. Ensure the policy covers consultations, diagnostics, surgeries, medication, and emergency care.

Cost Comparison

Comparing the costs of different pet insurance policies is essential to find the most affordable option that meets your pet’s needs. Consider the monthly premiums, co-pays, deductibles, and maximum annual coverage limits. Keep in mind that lower premiums may come with higher deductibles, so calculate the overall cost of the policy over time to determine the best value for your budget.

Customer Satisfaction Comparison

Understanding customer satisfaction with each insurer is vital for a hassle-free claims process and reliable customer service. Look for customer reviews and ratings to gauge the satisfaction level among policyholders. A responsive and helpful customer support team can make a significant difference when navigating through the claims process and seeking assistance for any pet-related concerns.

Credit: http://www.forbes.com

Tips For Choosing The Best Pet Insurance

Choosing the best pet insurance for your furry friend can be a daunting task. With a multitude of options available in the UK market, it’s important to consider several factors before making a decision. To help you find the most suitable coverage for your pet, here are some essential tips for choosing the best pet insurance.

Assessing Your Pet’s Needs

Before selecting a pet insurance policy, assess your pet’s specific needs. Consider factors such as their age, breed, existing health conditions, and anticipated future healthcare requirements. This evaluation will guide you in determining the most appropriate level of coverage for your pet.

Understanding Policy Terms

Take the time to thoroughly understand the policy terms and conditions. Pay attention to details such as coverage limits, deductibles, and reimbursement methods. Ensure the policy aligns with your pet’s healthcare needs, and that you are well-informed about the coverage offered for both routine care and unforeseen emergencies.

Checking For Exclusions

Be meticulous in checking for any exclusions within the policy. Ensure that you are aware of any conditions or treatments that may not be covered, as well as any waiting periods. Understanding these exclusions is vital in avoiding unexpected expenses and ensuring comprehensive coverage for your pet.

How To Make A Claim

Search for the best pet insurance in the UK by comparing coverage, premiums, and customer reviews. Making a claim is simple; contact the insurance provider, submit necessary documents, and await approval for your pet’s medical expenses.

Step-by-step Guide To Filing A Claim

When it comes to making a claim on your pet insurance policy, following the correct process is crucial. Below, we provide a step-by-step guide on how to navigate the claim process smoothly:- Contact your pet insurance provider as soon as possible after the incident or illness occurs. The sooner you notify them, the better.

- Gather all the necessary documentation required for the claim. This may include veterinary records, diagnosis details, and any receipts for treatments or medications.

- Fill out the claim form provided by your insurer with accurate and detailed information. Make sure to include the incident date, description, and any supporting evidence you have.

- Submit your claim form along with the supporting documents. You can do this through various channels, such as online portals, email, or fax. Check with your provider for the preferred method.

- Review the claim submission confirmation from your insurer. This will let you know that your claim and documents have been received.

- Keep track of your claim’s progress. Most pet insurance companies provide online portals where you can check the status of your claim at any time.

- Once your claim is processed, you will receive a reimbursement. The amount you receive depends on your policy’s coverage and deductibles.

- If you have any questions or concerns during the process, don’t hesitate to reach out to your pet insurance provider for assistance.

Common Mistakes To Avoid When Claiming

During the claim process, it’s important to avoid making common mistakes that could slow down the process or lead to claim denials. Here are some mistakes to be aware of:- Failing to read your policy documents thoroughly: Before making a claim, it’s essential to understand the terms and conditions of your policy. This will help you know what is covered and what is not, reducing any surprises or misunderstandings.

- Missing deadlines: Make sure to report incidents or illnesses to your insurer promptly. This will ensure that your claim is within the required timeframe and increases the chances of a successful reimbursement.

- Incomplete or inaccurate information: When filling out the claim form, provide all the necessary details accurately. Incomplete or inaccurate information can lead to delays or claim denials.

- Not keeping a record of documentation: Maintain copies of all the paperwork you submit, including claim forms, receipts, and veterinary records. This will help you track your claim and provide proof if necessary.

- Not following up: If you don’t receive any updates or reimbursement within a reasonable time frame, contact your insurer for an update. Following up shows your commitment and ensures that your claim is not overlooked.

Future Trends In Pet Insurance

- AI-driven claim processing to enhance efficiency.

- Mobile apps for easy policy management.

- Stricter guidelines to protect pet owners.

- Transparency in pricing for better consumer understanding.

Credit: http://www.telegraph.co.uk

Frequently Asked Questions For Which Pet Insurance Is The Best Uk

What Factors Should I Consider When Choosing Pet Insurance?

When choosing pet insurance in the UK, consider the level of coverage for accidents, illnesses, and preventative care. Look at the policy’s annual limits, deductibles, and waiting periods. Take note of additional benefits such as dental care and behavioral therapy.

How Do I Compare Different Pet Insurance Options In The Uk?

To compare pet insurance options in the UK, evaluate the coverage, limits, and exclusions of each policy. Consider the monthly premium and any additional fees. Check out customer reviews and ratings to get an idea of the overall satisfaction with the company.

Can I Cover Multiple Pets Under One Pet Insurance Policy?

Yes, many pet insurance providers in the UK offer multi-pet discounts and incentives for covering multiple pets under one policy. It’s a convenient and cost-effective way to ensure comprehensive coverage for all your furry friends while managing expenses.

Conclusion

Based on a thorough analysis of the top pet insurance providers in the UK, it is clear that there is no one-size-fits-all answer to the question of which pet insurance is the best. Each provider offers unique coverage options, pricing, and customer service.

To make an informed decision, it is vital to evaluate your pet’s specific needs and compare different policies. Remember, investing in pet insurance ensures peace of mind and financial protection for unexpected veterinary costs. Happy pet parenting!

Leave a comment