Unit Linked Insurance Plans (ULIPs) are investment-cum-insurance products that offer dual benefits of protection and wealth creation. In today’s dynamic financial market, individuals are increasingly seeking investment options that not only provide a safety net for their loved ones but also offer the potential for growth.

Unit Linked Insurance Plans (ULIPs) precisely fulfil this need by combining the benefits of a life insurance policy with the scope for investment in diverse asset classes such as equities, bonds, and mutual funds. Unlike traditional insurance plans, ULIPs provide policyholders with the flexibility to customize their investment portfolio based on their risk appetite and financial goals.

This means that ULIPs not only offer financial security but also provide an opportunity to build wealth over the long term. We explore the key features, benefits, and considerations to keep in mind while investing in ULIPs.

Credit: http://www.canarahsbclife.com

What Are Ulips?

What are ULIPs?

Ulips Definition

ULIPs, short for Unit Linked Insurance Plans, are hybrid financial products that combine insurance and investment components.

How Ulips Work

ULIPs work by allowing policyholders to invest in various investment options while also providing life insurance coverage.

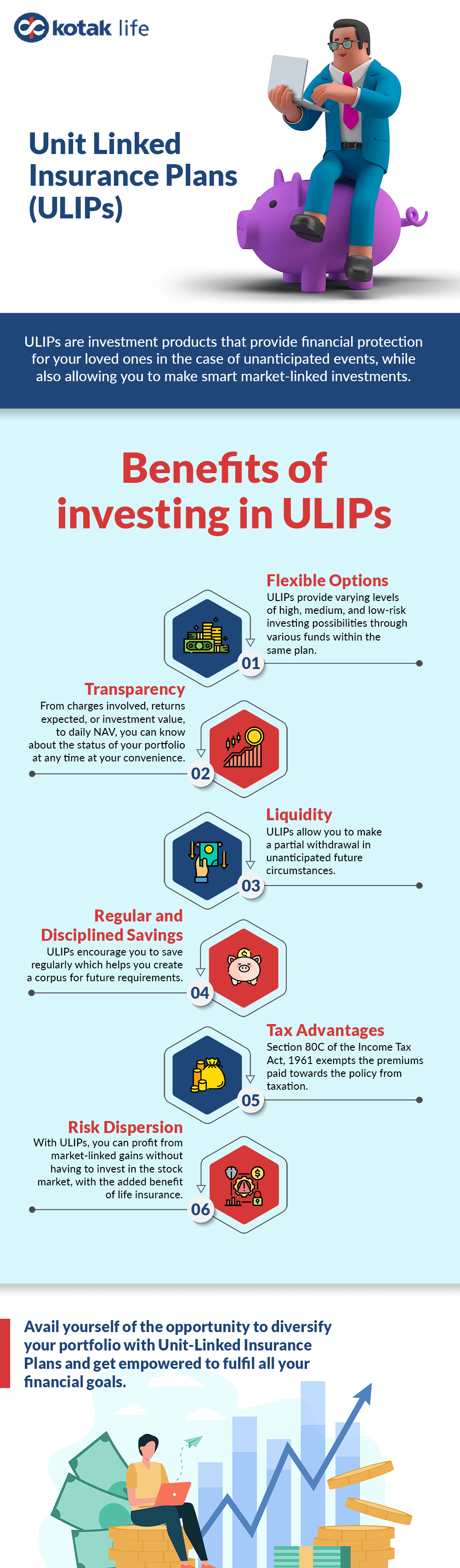

Benefits Of Ulips

Unit Linked Insurance Plans (ULIPs) offer the unique advantage of both investment and insurance, making it a smart choice for individuals looking to achieve their financial goals while protecting their loved ones. With ULIPs, you can enjoy the benefits of long-term wealth creation and insurance coverage combined. Let’s explore the key advantages of ULIPs:

Investment And Insurance Combo

ULIPs provide an excellent investment opportunity while ensuring life coverage. By investing a portion of your premium in different investment options, such as equity, debt, or balanced funds, ULIPs allow you to grow your wealth over time. Simultaneously, a portion of the premium goes towards providing life insurance coverage, giving you and your family financial security.

With this dual benefit, you don’t need to purchase separate investment and insurance products, simplifying your financial planning. ULIPs offer a convenient and cost-effective solution by combining the advantages of investment and insurance in a single plan.

Flexibility In Investment Options

ULIPs provide flexibility in choosing your investment options based on your risk appetite, financial goals, and investment horizon. You can choose between equity funds, debt funds, or a combination of both, depending on your preference. This flexibility allows you to align your investments with your financial objectives and market conditions.

Additionally, ULIPs offer the option to switch between different funds based on changing market dynamics or personal circumstances. This feature enables you to optimize your investment portfolio to maximize returns and manage risk effectively.

In conclusion, Unit Linked Insurance Plans (ULIPs) offer the benefits of both investment growth and life coverage, making them an attractive choice for individuals seeking long-term financial stability. With the flexibility to choose investment options and the convenience of a combined investment and insurance product, ULIPs provide a holistic solution to meet your financial objectives and ensure the well-being of your loved ones.

Factors To Consider Before Investing In Ulips

Before investing in Unit Linked Insurance Plans (ULIPs), there are several important factors to consider to make an informed decision and maximize the benefits. Understanding the various aspects, such as premium allocation charges and fund performance, is crucial for potential investors.

premium Allocation Charges

ULIPs typically have associated premium allocation charges, which are deducted from the premium paid by the policyholder. These charges cover the expenses for policy issuance, administration, and distribution. It’s essential to carefully assess the impact of these charges on the overall returns and compare them across different ULIP offerings to make a well-informed decision.

fund Performance

One of the key aspects to evaluate before investing in ULIPs is the fund performance. ULIPs offer various fund options, including equity, debt, and balanced funds. Assessing the historical performance of these funds and understanding their investment strategy is crucial to align the investment with your financial goals. It’s advisable to compare the fund’s performance with relevant benchmarks and analyze its consistency over different market cycles.

Comparison With Traditional Insurance Plans

Unit Linked Insurance Plans (ULIPs) have emerged as a popular investment option that combines insurance and investment in a single product. When comparing ULIPs with traditional insurance plans, two key types that come to mind are Term Insurance and Endowment Plans. This section will outline the differences between ULIPs and these traditional insurance plans.

Ulips Vs. Term Insurance

Term Insurance is a simple type of insurance that provides coverage for a fixed period. The policyholder pays regular premiums, and in the event of their unfortunate demise within the policy term, the nominees are paid the sum assured. Unlike ULIPs, Term Insurance does not offer any savings or investment component. Traditional Term Insurance policies focus solely on providing pure life cover.

On the other hand, ULIPs not only provide life insurance but also allow policyholders to invest in various financial instruments such as equity, bonds, or mutual funds. ULIPs offer investors the flexibility to switch between funds based on their risk tolerance and market conditions. This unique feature caters to individuals who wish to have an investment component alongside their insurance coverage.

While Term Insurance enables individuals to obtain high coverage at an affordable premium, ULIPs provide the added advantage of wealth creation and potentially higher returns on investment over the long term. However, it is crucial to note that ULIPs come with certain charges and a lock-in period, which means you cannot withdraw your funds before a specified duration.

Ulips Vs. Endowment Plans

Endowment Plans, like ULIPs, are a combination of insurance and investment. However, these traditional insurance plans differ from ULIPs in terms of the underlying investment strategy.

An Endowment Plan is a type of savings-oriented insurance policy that provides life coverage and returns a lump sum amount after a predetermined period, either on maturity or in the event of the policyholder’s unfortunate demise. Endowment Plans aim to secure the policyholder’s finances by offering both protection and savings benefits.

On the other hand, ULIPs offer policyholders the flexibility to invest in a wide range of investment options, allowing them to potentially earn higher returns based on their risk appetite and market performance. ULIPs also provide the opportunity to switch between funds, providing an element of flexibility based on changing investment objectives.

| ULIPs | Term Insurance | Endowment Plans |

|---|---|---|

| Combine insurance and investment | Focus on pure life cover | Savings-oriented with life coverage |

| Invest in various financial instruments | No investment component | Offer returns on maturity or demise |

In conclusion, while both Term Insurance and Endowment Plans serve specific insurance needs, ULIPs stand out for individuals who seek both insurance coverage and the potential for wealth creation through investments. ULIPs provide the flexibility to adapt to changing market conditions and investment objectives. It is essential to assess your financial goals and risk appetite before choosing between ULIPs and traditional insurance plans.

Understanding Charges In Ulips

Understanding Charges in ULIPs plays a crucial role in making informed decisions about investing in Unit Linked Insurance Plans. Being aware of the different charges involved can help you evaluate the overall cost of the policy and select the most suitable ULIP that aligns with your financial goals. In this article, we will explore the main types of charges in ULIPs, including Premium Allocation Charges and Fund Management Charges.

Premium Allocation Charges

Premium Allocation Charges are deducted from your premium amount to cover various expenses such as commissions, administration costs, and underwriting costs associated with your ULIP policy. This charge is deducted upfront and lowers the amount available for investment in the chosen funds of your policy. It is important to note that premium allocation charges are generally highest during the initial years of the policy and gradually decrease over time.

Fund Management Charges

Fund Management Charges are levied to cover the expenses incurred in managing the investment funds of your ULIP. These charges are deducted on a regular basis and are calculated as a percentage of the value of your funds. The fund management charges are meant to compensate the insurance company for the professional management of the funds and other administrative services related to investment management.

Credit: http://www.kotaklife.com

Tips For Maximizing Returns With Ulips

Regularly Reviewing Investment Portfolio

When you have ULIPs, keep reviewing your investments to stay on track.

Adjust your portfolio as per changing financial goals and market conditions.

Understanding Risk Appetite

Know your risk tolerance to choose the right ULIP fund options.

Diversify investments according to your risk appetite and financial goals.

Ulips As A Tax-saving Instrument

Unit Linked Insurance Plans (ULIPs) have gained popularity as an efficient tax-saving instrument, offering dual benefits of insurance protection and investment growth. Understanding the tax implications of ULIPs is crucial for making informed financial decisions. This post delves into the tax benefits provided by ULIPs as well as the tax treatment on maturity proceeds.

Tax Benefits On Premiums Paid

One of the key advantages of ULIPs is the tax benefits associated with the premiums paid. Under section 80C of the Income Tax Act, 1961, the premiums paid towards ULIPs are eligible for a tax deduction of up to Rs. 1.5 lakhs per annum. This deduction allows policyholders to reduce their taxable income, leading to lower tax liabilities. Furthermore, the proceeds received on maturity or surrender are also exempt from tax, subject to certain conditions.

Tax Treatment On Maturity Proceeds

When it comes to the maturity proceeds of ULIPs, the tax treatment is favorable for policyholders. As per Section 10(10D) of the Income Tax Act, the maturity proceeds or death benefits received from ULIPs are completely tax-free in the hands of the policyholder, provided the premiums do not exceed a certain percentage of the sum assured. This tax exemption enhances the overall returns for investors, making ULIPs an attractive long-term investment choice with tax benefits.

Ulips – A Long-term Wealth Creation Tool

Unit Linked Insurance Plans (ULIPs) are a valuable tool for creating long-term wealth through a combination of insurance and investment. With ULIPs, investors can benefit from the potential of high returns over time.

Power Of Compounding

Compounding allows your investments to grow exponentially over a period of time. The longer you stay invested in ULIPs, the more significant the impact of compounding on your wealth accumulation.

Goal-based Investment Approach

ULIPs offer a goal-based investment approach, enabling investors to align their financial goals with their investment strategy. This helps in achieving objectives such as education funds, retirement planning, or wealth creation.

Credit: http://www.blog.megafina.com

Frequently Asked Questions For Unit Linked Insurance Plans (ulips)

What Is A Unit Linked Insurance Plan (ulip)?

A Unit Linked Insurance Plan (ULIP) is a type of investment-cum-insurance product that offers both life cover and investment opportunities. It provides the benefits of insurance and investment in a single plan that allows you to invest in various funds according to your risk appetites.

How Do Ulips Differ From Traditional Insurance Plans?

ULIPs differ from traditional insurance plans as they offer a dual benefit of insurance and investment. While traditional plans focus solely on providing life cover, ULIPs enable policyholders to invest in different funds such as equity, debt, or balanced funds, thus offering investment opportunities along with insurance cover.

What Are The Key Features Of Ulips?

The key features of ULIPs include flexibility in premium payment, the option to switch between different funds, partial withdrawal facility, life cover, and the potential for higher returns. ULIPs also offer tax benefits under the Income Tax Act, making them a popular investment choice.

How Does The Premium Allocation Work In Ulips?

When you pay a premium for a ULIP, a certain percentage of the premium goes towards the cost of insurance, and the remaining amount is invested in the funds chosen by the policyholder. The premium allocation charges are deducted by the insurance company before allocating the units to the policyholder’s account.

Conclusion

Unit Linked Insurance Plans (ULIPs) offer individuals the dual benefits of insurance and investment. With their flexible nature, ULIPs allow policyholders to customize their investment portfolios based on their risk appetite and financial goals. By providing the opportunity to invest in equity, debt, or a combination of both, ULIPs offer potential for long-term wealth creation.

Additionally, the tax benefits and life insurance coverage make ULIPs a favorable choice for individuals seeking financial protection. Consider ULIPs as a valuable investment option for a secure and prosperous future.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a Unit Linked Insurance Plan (ULIP)?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A Unit Linked Insurance Plan (ULIP) is a type of investment-cum-insurance product that offers both life cover and investment opportunities. It provides the benefits of insurance and investment in a single plan that allows you to invest in various funds according to your risk appetites.” } } , { “@type”: “Question”, “name”: “How do ULIPs differ from traditional insurance plans?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “ULIPs differ from traditional insurance plans as they offer a dual benefit of insurance and investment. While traditional plans focus solely on providing life cover, ULIPs enable policyholders to invest in different funds such as equity, debt, or balanced funds, thus offering investment opportunities along with insurance cover.” } } , { “@type”: “Question”, “name”: “What are the key features of ULIPs?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The key features of ULIPs include flexibility in premium payment, the option to switch between different funds, partial withdrawal facility, life cover, and the potential for higher returns. ULIPs also offer tax benefits under the Income Tax Act, making them a popular investment choice.” } } , { “@type”: “Question”, “name”: “How does the premium allocation work in ULIPs?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “When you pay a premium for a ULIP, a certain percentage of the premium goes towards the cost of insurance, and the remaining amount is invested in the funds chosen by the policyholder. The premium allocation charges are deducted by the insurance company before allocating the units to the policyholder’s account.” } } ] }

Leave a comment