Flood Insurance Zone identifies areas prone to flooding and determines the need for flood insurance coverage. In these zones, property owners are required to obtain flood insurance to protect against potential flood damage.

Living in a flood-prone area can increase the risk of property damage, making flood insurance a necessary investment for many homeowners. Flood Insurance Zones are designated by the Federal Emergency Management Agency (FEMA) based on factors such as historical flood data, elevation, and proximity to bodies of water.

These zones help insurance providers assess the level of risk involved in insuring a property and set premiums accordingly. It is important for property owners to understand their zone designation and the associated requirements for flood insurance coverage to ensure adequate protection. By knowing your Flood Insurance Zone, you can make informed decisions to safeguard your property against potential flood-related risks.

Credit: http://www.tdi.texas.gov

Understanding Flood Insurance Zones

Different Flood Zones Explained

Flood zones categorize areas based on flood risk. Zones can range from high risk to low risk.

Common flood zones include AE, VE, and X zones. Each zone has different implications.

AE zones are moderate to high-risk areas prone to flooding. VE zones are coastal areas with potential wave hazards.

X zones have minimal flood risk and lower insurance premiums.

Implications Of Flood Zones On Insurance Premiums

Flood zone directly affects insurance costs. High-risk zones result in higher premiums.

Properties in VE zones usually have the highest premiums due to coastal vulnerability.

Insurance rates for X zones tend to be more affordable compared to high-risk zones.

Factors To Consider

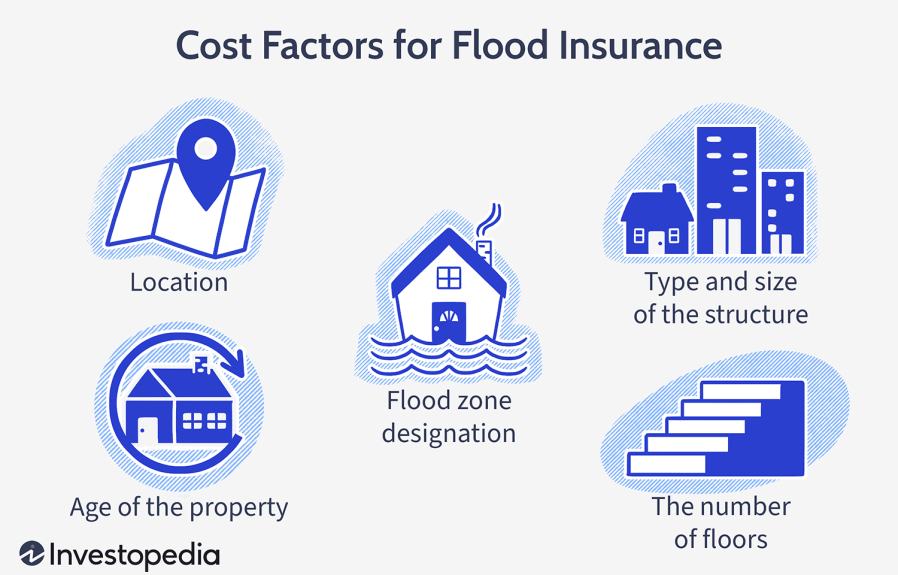

When it comes to purchasing flood insurance, there are several important factors to consider that can help you make an informed decision. Two key factors that play a significant role in determining the necessity and cost of flood insurance are the location of your property and its flood risk assessment, as well as the property value and reconstruction costs. Let’s explore these factors in more detail below.

Location And Flood Risk Assessment

The location of your property is crucial when determining the need for flood insurance. Certain areas are more susceptible to flooding due to their proximity to bodies of water, coastal areas, or even local floodplains. It’s important to know whether your property is located within a designated flood zone and to understand the flood risk assessment for that area.

An effective way to determine your property’s flood risk assessment is by referencing the Flood Insurance Rate Map (FIRM). These maps are designed to identify the specific flood zone areas, providing valuable information to property owners and insurers. If your property falls within a high-risk flood zone, it’s highly recommended to obtain flood insurance to safeguard your investment.

Property Value And Reconstruction Costs

Another critical factor to consider when purchasing flood insurance is the value of your property and its potential reconstruction costs in the event of a flood. Flood damage can be financially devastating, as it can lead to structural damages, property loss, and the need for expensive repairs or reconstruction.

Assessing the value of your property and estimating the reconstruction costs can help determine the appropriate coverage level for your flood insurance policy. It’s important to consider the various aspects of your property, such as the size, construction materials, and unique features when evaluating its value and potential repair expenses.

By understanding the property value and potential reconstruction costs, you can ensure that your flood insurance policy adequately covers any potential damages, providing you with peace of mind in the face of a flood-related disaster.

Types Of Coverage Available

Flood insurance provides protection for your property and possessions. Knowing the types of coverage available is essential for making informed decisions about your insurance needs.

Building Coverage

Building coverage safeguards the physical structure of your property, including the foundation, electrical and plumbing systems, HVAC equipment, built-in appliances, and permanently installed carpeting over an unfinished floor.

Contents Coverage

Contents coverage helps protect your personal belongings such as furniture, clothing, electronics, and other valuable items. This type of coverage extends to portable air conditioners, microwaves, dishwashers, and carpets that are not included in the building coverage.

Additional Living Expenses Coverage

Additional living expenses coverage can cover the costs of temporarily living away from your home if it becomes uninhabitable due to a flood. This could include hotel bills, food expenses, and other necessary living costs during the restoration of your property.

Choosing The Right Coverage

When facing the decision of flood insurance, it’s essential to ensure that you have the right coverage to protect your property and belongings. Here’s how to assess your risks and needs and compare different policies to find the coverage that best suits your situation.

Assessing Your Risks And Needs

Firstly, it’s crucial to evaluate the potential risks of flooding in your area and the value of your property and possessions. Take into account factors such as your property’s location in a flood zone, historical flood data, and the cost to replace your assets if they were damaged from a flood. Understanding these risks will help you determine the necessary coverage for adequate protection.

Comparing Different Policies

Once you’ve assessed your risks and needs, it’s time to compare different flood insurance policies. Consider the coverage limits, deductibles, premiums, and the specific perils covered by each policy. Look for endorsements or additional coverages that may be beneficial based on your individual situation. By comparing these factors, you can select a policy that provides comprehensive protection against potential flood damages.

Tips For Finding Affordable Options

When it comes to finding flood insurance in a flood insurance zone, there are ways to make it more affordable. Here are some tips to help you secure affordable options that provide adequate coverage.

Taking Advantage Of Government Programs

- Check for federal flood insurance programs

- Explore community-based programs

- Consider discounts or subsidies available

Evaluating Deductibles And Coverage Limits

- Assess different deductible options

- Consider adjusting coverage limits

- Compare premium costs for different combinations

Credit: http://www.tdi.texas.gov

Importance Of Reviewing Coverage Regularly

Reviewing your flood insurance coverage regularly is essential to ensure you have adequate protection against potential risks. By reassessing risk factors and adjusting coverage as needed, you can establish a comprehensive and up-to-date policy that financially safeguards your property. Over time, factors like changes in weather patterns, local infrastructure, or even alterations to flood zones might impact your property’s vulnerability to flooding risks. Therefore, taking proactive measures to review and update your coverage is crucial for avoiding unpleasant surprises in case of an unfortunate event.

Reassessing Risk Factors

Reassessing risk factors should top your list when it comes to reviewing your flood insurance coverage. Factors like new building projects in the area, nearby bodies of water, or alterations in flood maps can dramatically change your property’s vulnerability to flooding. It’s imperative to stay aware of these changes and understand how they might affect your coverage. By assessing and keeping up with the latest information regarding flood risks in your area, you can make informed decisions about your coverage needs.

Adjusting Coverage As Needed

Adjusting your flood insurance coverage as needed is a proactive step towards protecting your property and ensuring comprehensive coverage. If you’ve made significant improvements or renovations to your property, it’s essential to reflect these changes in your policy. Additionally, changes in the value of your property or alterations to personal belongings might require adjustments to your coverage amounts. Regularly reviewing and updating your coverage ensures that you’re adequately protected and don’t end up underinsured in the event of a flood.

By taking the time to reassess risk factors and adjust coverage as needed, you demonstrate your commitment to protecting your property from potential flood damage. Remember, reviewing your flood insurance policy regularly offers you the peace of mind that comes with knowing your coverage aligns with your current circumstances and provides adequate financial protection.

Common Mistakes To Avoid

When it comes to flood insurance, there are several common mistakes that people often make. By being aware of these pitfalls, you can better protect yourself and your belongings in case of a flood.

Underestimating Flood Risks

Many individuals assume their property is safe from flooding, which can lead to devastating consequences. It’s crucial to recognize the potential risks and take appropriate measures to safeguard your home.

Neglecting Coverage For Personal Belongings

Having insurance for your property is essential, but don’t forget about your personal belongings. Neglecting coverage for items inside your home can result in substantial financial loss in the event of a flood.

Final Thoughts On Flood Insurance Zone Selection

Ensuring Comprehensive Protection

When selecting a flood insurance zone, it’s crucial to ensure comprehensive protection for your property. Take into account the specific risks associated with each zone and choose a policy that provides coverage in all relevant scenarios. Consider not only the current flood risks but also any potential changes in the future, such as developments in infrastructure or land use that could affect the likelihood of flooding. Prioritize a policy that offers the broadest protection within your budget, giving you peace of mind in the face of uncertain weather patterns and environmental changes.

Seeking Professional Guidance If Unsure

If you are unsure about which flood insurance zone is best for your property, it’s wise to seek professional guidance. Enlist the expertise of a licensed insurance agent or flood risk specialist who can assess your property’s specific vulnerabilities and recommend the most suitable coverage. Professional guidance can help you navigate the complexities of flood insurance zones and ensure that you make an informed decision that aligns with your protection needs. Don’t hesitate to reach out for assistance if you’re uncertain about how to proceed with selecting the right flood insurance zone.

Credit: http://www.facebook.com

Frequently Asked Questions On Who Flood Insurance Zone

What Are Flood Insurance Zones?

Flood insurance zones are areas designated by FEMA based on flood risk assessment. They help determine insurance rates and building regulations.

How Do I Find Out My Flood Insurance Zone?

You can find your flood insurance zone by using FEMA’s Flood Map Service Center or contacting your local government’s floodplain management office.

Why Do I Need To Know My Flood Insurance Zone?

Knowing your flood insurance zone helps you understand your risk of flooding and helps you make informed decisions about protecting your property.

Conclusion

With the increasing frequency of extreme weather events, understanding flood insurance zones has never been more crucial. Knowing your level of flood risk can help you make informed decisions about protecting your property and finances. By consulting flood maps and assessing your property’s location, you can determine whether flood insurance is necessary.

Remember, taking proactive measures now can save you from potential devastation in the future. Stay prepared and ensure a safer future for you and your loved ones.

Leave a comment