Renters need renters insurance to protect their personal belongings and provide liability coverage in case of accidents. Renting a home or apartment comes with its own set of risks.

From theft and vandalism to accidents and unexpected disasters, there are many potential dangers that can result in significant financial loss. Renters insurance provides valuable protection for tenants by covering the cost of replacing personal belongings that are damaged or stolen, as well as offering liability coverage in case someone is injured on the rental property.

Having renters insurance provides peace of mind and ensures that renters are not left financially vulnerable in the face of unforeseen events. It’s a small investment that can save renters from large financial burdens and make the renting experience more secure.

Credit: http://www.rentecdirect.com

The Importance Of Renters Insurance

Renting a home brings comfort and convenience, but it’s vital to remember that unforeseen events can occur at any time. This highlights the importance of renters insurance which provides crucial safeguards for tenants.

Protection For Personal Belongings

Renters insurance offers protection for personal belongings such as furniture, electronics, and clothing in case of theft, fire, or other disasters. This coverage ensures that your possessions are safeguarded.

Liability Coverage For Accidents

It also includes liability coverage for accidents that may occur within your rented property. This safeguards you in case someone gets injured on your premises or property damage happens.

Credit: http://www.statefarm.com

Understanding Coverage Limits

Understanding coverage limits is an essential aspect of renters insurance that every renter should be aware of. It determines the extent of protection offered by the policy and ensures that you have adequate coverage for your belongings and liability. In this section, we will dive deeper into two important factors related to coverage limits: determining the value of your belongings and liability coverage limits.

Determining The Value Of Your Belongings

Determining the value of your belongings is a crucial step in understanding coverage limits. It helps you assess the amount of coverage needed to protect your personal property against unexpected events like theft, fire, or water damage.

When estimating the value of your belongings, take into account all the items that you would have to replace in the event of a loss. This includes furniture, electronics, clothing, appliances, and even smaller items like jewelry or artwork. Creating an inventory of your possessions and their estimated value can assist in this process.

Remember, the more accurate your valuation, the better prepared you will be if you need to file a claim. It’s worth taking the time to document your belongings and keep a record of purchase receipts, which can help substantiate the value of your items.

Additionally, some insurance providers offer special coverage options for high-value items such as expensive jewelry or antique furniture. These options can give you peace of mind, knowing that even your most precious possessions are adequately protected.

Liability Coverage Limits

Liability coverage is another crucial aspect of renters insurance. It provides financial protection in case someone gets injured while visiting your rented property or if you accidentally cause damage to someone else’s property.

Understanding your liability coverage limits ensures that you are adequately protected from potential lawsuits or hefty expenses resulting from accidents. The coverage limits determine the maximum amount the insurance company will pay in such cases.

Typically, renters insurance policies offer liability coverage ranging from $100,000 to $1 million. It’s important to evaluate your personal circumstances and consider the potential risks involved. For example, if you frequently host gatherings at your rented property or own a dog, you may want to opt for higher liability coverage limits to safeguard against unforeseen incidents.

Remember, it’s always better to be over-prepared than underprepared when it comes to liability coverage. Adequate protection can provide you with peace of mind and financial security.

In conclusion, understanding coverage limits is key to ensuring that your renters insurance policy adequately protects your belongings and liability. By determining the value of your belongings accurately and evaluating your liability coverage needs, you can make informed decisions and select the right policy that suits your unique requirements.

Common Misconceptions About Renters Insurance

Renters insurance is often overlooked by renters due to several misconceptions surrounding its necessity and cost. Understanding these common misconceptions can shed light on the importance and affordability of renters insurance.

Assuming Landlord’s Insurance Covers Personal Belongings

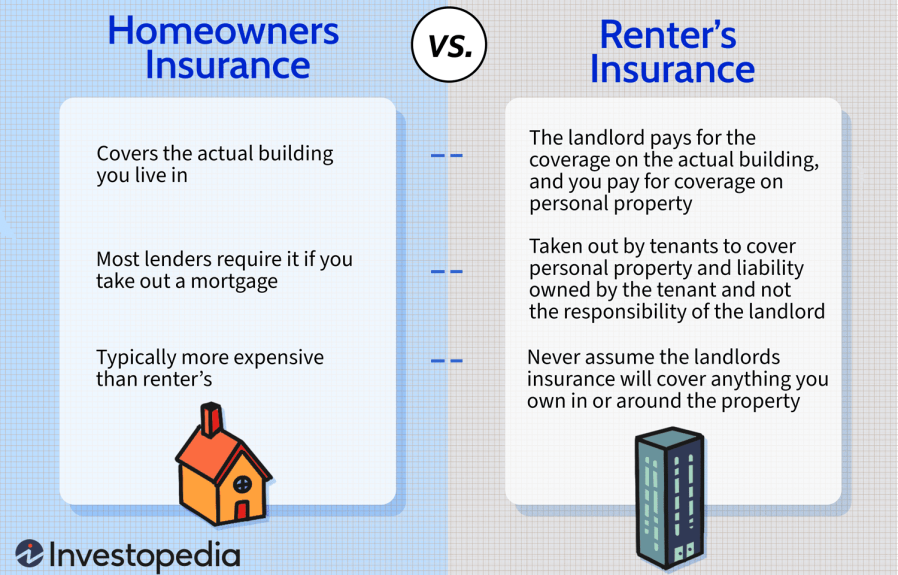

One common misconception about renters insurance is that the landlord’s insurance will cover the loss or damage of personal belongings. However, this is not the case. The landlord’s insurance typically only covers the structure of the building and any included appliances, but it does not protect the tenant’s personal possessions. Therefore, it is essential for renters to obtain their own renters insurance to protect their belongings in the event of theft, fire, or other covered perils.

Belief That Renters Insurance Is Expensive

Many renters believe that renters insurance is costly, and they may deem it as an unnecessary expense. In reality, renters insurance is quite affordable, often costing less than a dinner out each month. The financial protection and peace of mind it provides far outweigh the minimal monthly cost. By dispelling the misconception that renters insurance is expensive, more renters can secure the protection they need without burdening their budget.

By debunking these common misconceptions surrounding renters insurance, renters can recognize the importance and value of obtaining coverage for their personal belongings and liability protection. Renters insurance not only provides financial security but also offers invaluable peace of mind, making it a crucial investment for any renter.

:max_bytes(150000):strip_icc()/Renters-insurance-4223009-final-a125edb41c2f4a4a980ef2cf069d7723.png)

Credit: http://www.investopedia.com

Benefits Of Renters Insurance

Renters insurance offers numerous benefits that provide peace of mind and financial security for tenants. Protecting your personal belongings and providing coverage for additional living expenses, renters insurance is an essential investment for safeguarding your well-being.

Replacement Of Damaged Or Stolen Belongings

Renters insurance ensures that your personal belongings are protected in the event of theft, damage, or loss due to covered perils such as fire or water damage. If your belongings are damaged or stolen, your renters insurance policy can help cover the cost of replacements, enabling you to recover and move forward without bearing the full financial burden.

Coverage For Additional Living Expenses

In the unfortunate event that your rental unit becomes uninhabitable, renters insurance can provide coverage for additional living expenses such as hotel stays, meals, and other essential needs. This valuable coverage ensures that you and your family are not left financially strained in a challenging situation, offering support when you need it most.

Factors To Consider When Choosing A Policy

When selecting a renters insurance policy, renters should consider coverage limits, deductibles, additional riders, and the insurance provider’s reputation. These factors play a crucial role in ensuring comprehensive protection for personal belongings and liability coverage.

Factors to Consider When Choosing a Policy When it comes to renters insurance, choosing the right policy is essential. But with so many options available, it can be overwhelming to know where to start. That’s why considering certain factors can make the decision-making process much easier. By taking into account the cost of premiums, extent of coverage, and deductibles, you can ensure that you have the right renters insurance policy that meets your needs and budget. H3: Cost of Premiums The cost of premiums is an important factor to consider when choosing a renters insurance policy. Premiums vary among insurance providers, and it’s crucial to find a balance between affordability and adequate coverage. Comparing quotes from multiple insurers can help you find the most competitive rates. Additionally, factors such as your location, the value of your personal belongings, and the deductible amount will influence the cost of premiums. While it may be tempting to go for the cheapest option, it’s essential to ensure that the coverage meets your needs. H3: Extent of Coverage and Deductibles The extent of coverage and deductibles are other crucial factors to consider when selecting a renters insurance policy. It’s important to understand what the policy covers and what it doesn’t. A comprehensive policy typically covers damages caused by fire, theft, vandalism, and certain natural disasters. Additionally, it may provide liability coverage in case someone gets injured on your rented property. On the other hand, deductibles are the amount you need to pay out of pocket before the insurance coverage kicks in. Lower deductibles mean higher premiums, while higher deductibles mean lower premiums. It’s important to strike a balance based on your financial situation and risk tolerance. To make the right decision, it’s recommended to create a list of your priorities and specific needs. This can include the value of your possessions, the area where you live, and any potential risks you want coverage for. By understanding these factors, you can choose a renters insurance policy that offers the right balance of cost, coverage, and deductibles for your unique circumstances. Don’t forget to regularly review your policy to ensure it still meets your changing needs. With the right insurance, you can have peace of mind knowing that your belongings are protected and you are financially secure.Steps To Take When Filing A Claim

Filing a renters insurance claim can feel overwhelming, but knowing the right steps to take can make the process smoother. Here are the essential steps to follow when initiating a claim after experiencing a loss or damage.

Documenting Losses

Immediately document all damages or losses by taking photos, recording videos, and keeping detailed notes of the items affected.

- Write down the date and time of the incident.

- Make a list of all damaged items with their estimated value.

- Gather receipts or purchase records to validate the value of your possessions.

Contacting The Insurance Company

Notify your renters insurance company as soon as possible after the incident.

- Provide all documentation and information requested by the insurer.

- Follow the claims process outlined by your insurance company promptly.

- Stay in touch with your claims adjuster for updates on your claim status.

By following these steps diligently, you can ensure a swift and fair resolution when filing a renters insurance claim.

Reviewing Common Exclusions

While renters insurance offers crucial protection for your belongings, it’s essential to understand that not all items and situations are covered. Reviewing common exclusions will help you make informed decisions when choosing and maximizing your policy. Let’s take a closer look at two significant exclusions you should be aware of: High-Value Items Coverage and Natural Disasters Exclusions.

High-value Items Coverage

When it comes to protecting your high-value items, such as jewelry, fine art, or collectibles, most standard renters insurance policies have coverage limits. These limits typically fall far below the actual value of these items, leaving you vulnerable to substantial financial loss in the event of theft, damage, or loss. To ensure adequate protection, you may need to consider purchasing additional coverage options for your valuable possessions.

One option is to schedule these items separately on your policy, providing detailed descriptions, appraisals, and the respective values. By doing so, you establish a specific coverage amount for each item, guaranteeing that your precious belongings are fully protected. Keep in mind that choosing this additional coverage might increase your premium slightly, but the peace of mind it offers is invaluable.

Natural Disasters Exclusions

While renter’s insurance can provide extensive coverage for a range of perils, it’s important to be aware of the exclusions related to natural disasters. Primarily, natural disasters like earthquakes and floods are often excluded from standard renters insurance policies. These calamities can cause significant damage to your personal property, leaving you with substantial financial burdens.

If you live in an area prone to such natural disasters, it’s crucial to explore additional coverage options to safeguard your belongings. Earthquake insurance can be purchased as a separate policy or added as an endorsement to your existing renters insurance. This will provide coverage for damages resulting from seismic activities. Similarly, flood insurance can be obtained from the National Flood Insurance Program (NFIP) if your area is eligible and offers protection against flood-related damages.

By understanding these common exclusions related to high-value items coverage and natural disasters, you can take proactive steps to ensure you have the most comprehensive renters insurance policy for your needs. Remember, where standard policies fall short, additional coverage options can step in to safeguard your valuable possessions and protect you from the financial aftermath of unforeseen events.

Tips For Getting The Most Out Of Renters Insurance

Having renters insurance provides peace of mind and financial protection in the event of unforeseen circumstances. However, to maximize the benefits of your policy, it’s essential to understand the necessary steps for getting the most out of your renters insurance. By regularly updating your inventory, understanding policy renewal procedures, and taking proactive measures, you can ensure that you are fully covered when the need arises.

Regularly Updating Inventory

Periodically updating your inventory of possessions is crucial for ensuring that you have adequate coverage. Create a detailed list of your belongings, including descriptions, receipts, and photographs. Store this information in a secure place, such as a cloud-based storage system, to facilitate the claims process in case of loss or damage. Additionally, consider documenting high-value items through appraisals or professional evaluations to accurately reflect their worth in your policy coverage.

Understanding Policy Renewal Procedures

Be proactive in understanding the renewal procedures of your renters insurance policy. Stay informed about any changes in coverage, premiums, or deductibles that may occur upon renewal. Awareness of these factors allows you to make informed decisions about maintaining or adjusting your coverage based on your evolving needs or circumstances. It’s advisable to review your policy with your insurance provider annually to ensure that it aligns with your current situation.

Frequently Asked Questions On Why Do Renters Need Renters Insurance

Why Is Renters Insurance Important For Tenants?

Renters insurance provides financial protection for your personal belongings and liability coverage if someone is injured in your rental property. It also offers additional living expenses if your rental becomes uninhabitable due to a covered peril.

What Does Renters Insurance Cover?

Renters insurance typically covers personal property, liability protection, and additional living expenses. It protects against theft, fire, vandalism, and certain natural disasters. It also provides coverage for medical payments if someone is injured on your rented property.

How Much Renters Insurance Do I Need?

The amount of renters insurance you need depends on the value of your personal belongings and the level of liability coverage you want. It’s important to conduct a home inventory to determine the value of your possessions and ensure they are adequately covered.

Conclusion

In a nutshell, renters insurance is a must-have for anyone who is renting a home or apartment. It provides protection against unforeseen events such as theft, fire, and accidents. Not only does it cover your personal belongings, but it also offers liability coverage if someone is injured on the premises.

With the affordable cost of renters insurance, it would be foolish not to have this essential safeguard in place. So, don’t wait until it’s too late – get yourself renters insurance today and enjoy the peace of mind it brings.

Leave a comment