Malpractice insurance and professional indemnity are not the same thing. Malpractice insurance covers negligence or errors specific to medical professionals, while professional indemnity insurance covers negligence or errors in any professional service.

Professional services require protection against potential legal claims that may arise due to errors or negligence in their work. This is where professional indemnity insurance plays a vital role. It provides coverage for damages caused by mistakes, omissions, or breaches of professional duty.

However, it is important to note that professional indemnity insurance is not the same as malpractice insurance, which is specific to the medical field. Malpractice insurance focuses on covering medical professionals against claims related to medical errors, negligence, or malpractice. Understanding the distinction between these two types of insurance is crucial for professionals in various industries to ensure they have the appropriate coverage.

Coverage

Coverage:

Understanding the coverage provided by Malpractice Insurance and Professional Indemnity is crucial for professionals to mitigate risks.

Scope Of Malpractice Insurance

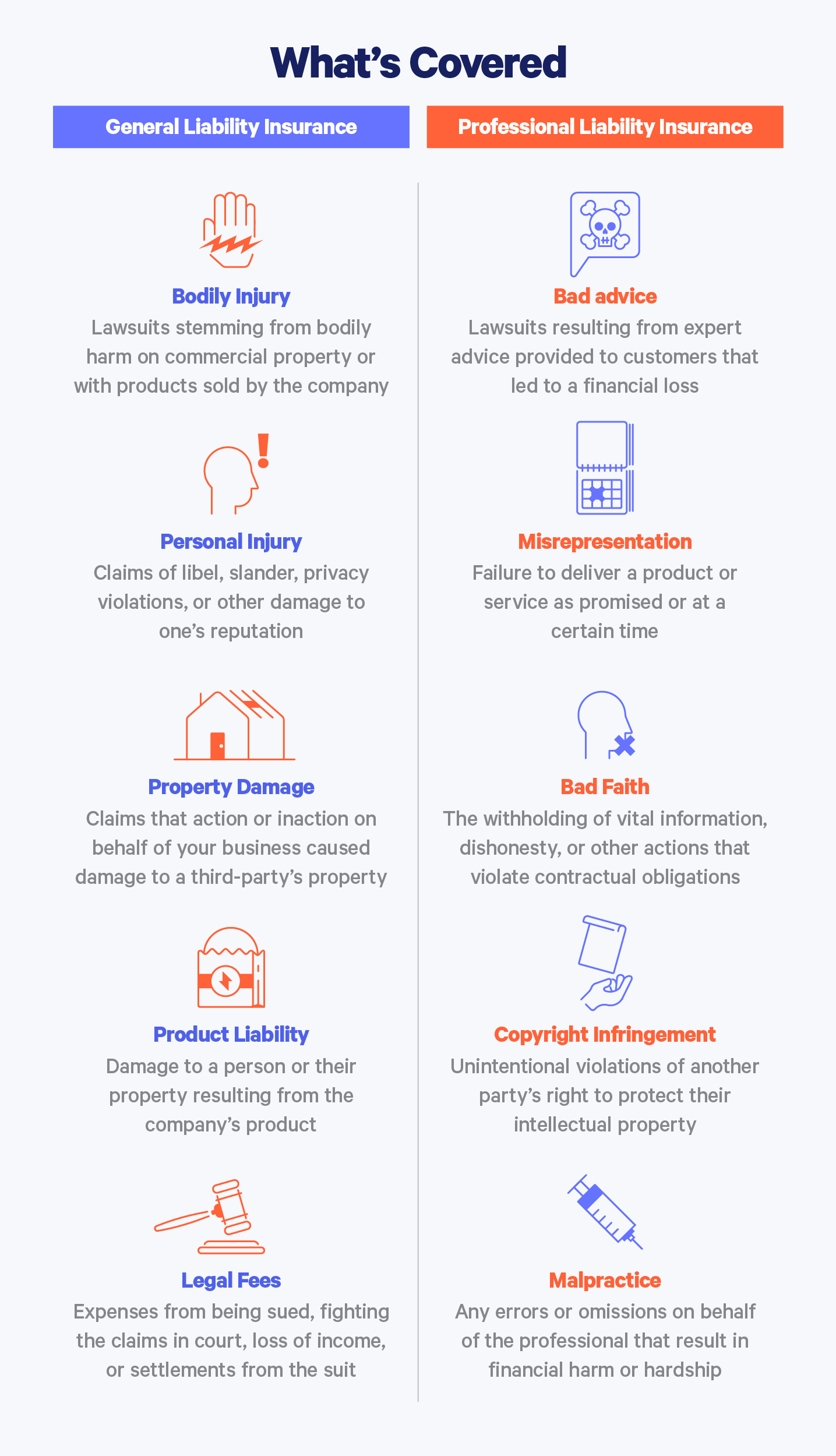

Malpractice Insurance focuses on protecting professionals from liability claims due to negligence, errors, or omissions in their services.

It covers legal fees, settlements, and judgments resulting from malpractice claims against the professional.

- Protects against claims of professional negligence.

- Provides financial coverage for legal defense.

- Helps in settlements and judgments related to malpractice.

Scope Of Professional Indemnity

Professional Indemnity Insurance safeguards professionals against claims of financial loss or damages resulting from their professional advice or services.

It offers protection for legal costs and compensation following claims of negligence, errors, or omissions.

- Covers financial losses due to professional advice.

- Assists in legal costs for defense against claims.

- Provides compensation for damages caused by professional services.

Policyholders

Policyholders often confuse malpractice insurance with professional indemnity, yet they serve distinct purposes in protecting professionals from liability risks. While both cover financial and legal issues arising from errors or negligence, it’s essential for policyholders to understand the differences for comprehensive coverage.

Policyholders play a crucial role in the world of insurance. They are the individuals or entities that purchase insurance policies and receive coverage for a variety of risks. When it comes to malpractice insurance and professional indemnity, understanding who needs these types of coverage is key. Let’s delve into the specific groups that benefit from these policies.Who Needs Malpractice Insurance?

Malpractice insurance is typically associated with healthcare professionals, but its importance extends beyond this industry. Here are several groups that should consider obtaining malpractice insurance: – Doctors and Physicians: From surgeons to primary care physicians, anyone involved in the medical field can benefit from malpractice insurance. It provides protection against claims arising from medical errors, negligence, or wrongful treatment. – Dentists: Dental professionals also face the risk of malpractice claims due to errors in treatment or complications. Malpractice insurance ensures they have financial protection in case of a lawsuit or damage claims. – Lawyers: Attorneys are legally obligated to act in the best interests of their clients. However, mistakes can occur, leading to potential lawsuits. Malpractice insurance helps lawyers cover legal costs and damages resulting from such claims. – Architects and Engineers: These professionals design and oversee complex construction projects. Mistakes or oversights in their work can result in significant financial losses for their clients. Malpractice insurance offers coverage for claims related to design errors, construction defects, or project delays. – Accountants and Financial Advisors: Professionals in the financial sector, such as accountants or financial advisors, handle clients’ sensitive financial matters. Mistakes or improper advice can lead to significant financial harm. Malpractice insurance provides coverage in case of claims arising from errors, omissions, or negligence.Who Needs Professional Indemnity?

Professional indemnity insurance, sometimes referred to as errors and omissions insurance, is essential for professionals who provide specialized services and advice. Here are a few examples of individuals and industries that should consider professional indemnity coverage: – Consultants and Freelancers: Independent consultants and freelancers provide expert advice and services to clients. In the event of an error or omission, professional indemnity insurance protects them from financial losses due to potential lawsuits or claims. – IT Professionals: With the increasing reliance on technology, IT professionals play a vital role in businesses. However, mistakes in software development, system implementation, or data handling can have severe consequences. Professional indemnity insurance safeguards IT professionals against claims arising from these errors. – Real Estate Agents: Real estate transactions involve significant financial investments. If disputes arise due to errors, misrepresentation, or negligence, professional indemnity insurance for real estate agents offers financial protection. – Media and Marketing Professionals: Advertising agencies, graphic designers, and other individuals in the media and marketing industry face potential claims related to copyright infringement, misleading advertising, or breach of contract. Professional indemnity insurance helps mitigate the financial burden of these claims. – Insurance Brokers: Insurance brokers connect individuals and businesses with suitable insurance policies. Errors in providing advice or arranging coverage can have severe consequences. Professional indemnity insurance provides coverage for claims arising from mistakes or negligence. By understanding who needs malpractice insurance and professional indemnity coverage, policyholders can ensure they have appropriate protection in their respective industries. Whether it’s doctors, architects, consultants, or IT professionals, obtaining the right insurance safeguards their financial well-being and provides peace of mind in their professional pursuits.Cost

Malpractice insurance and professional indemnity may sound similar but they serve different purposes. Malpractice insurance covers negligence or errors, while professional indemnity covers damages from professional advice or service. Understanding their differences can help you make informed decisions for your specific needs.

Factors Influencing Malpractice Insurance Costs

` Malpractice insurance and professional indemnity insurance may seem similar, but they have distinct differences, including in their costs. When evaluating the cost of malpractice insurance, several factors come into play. Providers take into account the type of healthcare services, years of experience, location, and the history of malpractice claims. In addition, the overall limits and deductibles of the policy and the scope of coverage also influence the cost. `Factors Influencing Professional Indemnity Costs

` Professional indemnity insurance, on the other hand, is tailored for various professions, including lawyers, architects, and financial advisors. The cost can be influenced by the specific field of expertise, years of experience, location, and claims history. Moreover, the chosen coverage limits and deductibles can also have an impact on the price of the policy. Medical professionals should be aware that malpractice insurance and professional indemnity insurance are tailored to their respective industries, and understanding the factors influencing their costs can help in making informed decisions.

Credit: http://www.generalliabilityshop.com

Claims Process

When it comes to the claims process, understanding the differences between filing claims with malpractice insurance and professional indemnity is crucial for professionals in various fields. Both types of insurance are designed to protect professionals from lawsuits, but how claims are handled varies significantly.

Filing Claims With Malpractice Insurance

1. Notify your malpractice insurance provider as soon as you become aware of a potential claim.

2. Provide all necessary documentation and details related to the claim, including any communication with the client or patient.

3. The insurance company will conduct an investigation and determine if the claim is covered under the policy.

Filing Claims With Professional Indemnity

1. Contact your professional indemnity insurance provider as soon as you become aware of a potential claim against you.

2. Provide all relevant information and documentation regarding the claim, including any communication with the client or third party.

3. The insurer will assess the claim and determine whether it falls within the scope of the policy.

Regulations

Understanding the regulations surrounding malpractice insurance and professional indemnity is crucial for professionals in various industries. Both types of insurance serve as protection against claims of negligence or professional errors, but they have distinct legal requirements. In this section, we will explore the legal requirements for malpractice insurance and professional indemnity separately.

Legal Requirements For Malpractice Insurance

In many countries, particularly in the healthcare field, malpractice insurance is a legal requirement for professionals. These regulations aim to ensure that patients receive compensation if they experience harm or injury due to the actions or negligence of healthcare providers.

Legal Requirements For Professional Indemnity

On the other hand, professional indemnity insurance is often a legal necessity for professionals in industries such as architecture, engineering, accounting, and law. These regulations are in place to safeguard clients and provide them with financial protection if they suffer losses as a result of professionals’ mistakes or misconduct.

Various regulatory bodies and professional associations dictate the specific requirements for professional indemnity insurance. These requirements may vary depending on the nature of the profession and its associated risks. It is essential for professionals to stay up-to-date with the regulatory guidelines and ensure they meet the necessary insurance obligations.

Credit: http://www.bimakavach.com

Comparison

Comparison:

Key Differences Between Malpractice Insurance And Professional Indemnity

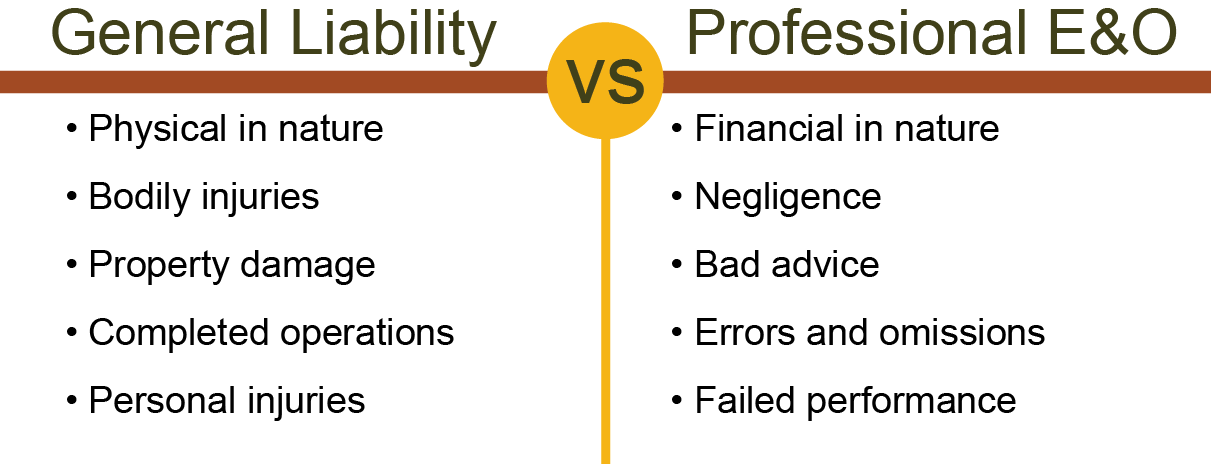

- Scope: Malpractice insurance typically covers negligence resulting in harm, while professional indemnity covers a broader range of professional mistakes.

- Industries: Malpractice insurance is commonly associated with medical professionals, whereas professional indemnity caters to various industries like law, accounting, and consulting.

- Regulation: Malpractice insurance requirements are often legally mandated for certain professions, whereas professional indemnity is usually a choice for professionals.

- Claims: Malpractice claims usually involve harm to a third party, while professional indemnity claims can involve financial loss or damage to reputation.

Similarities Between Malpractice Insurance And Professional Indemnity

- Protection: Both types of insurance provide financial protection in case of professional errors or negligence.

- Costs: Premiums for malpractice insurance and professional indemnity are influenced by factors such as the level of coverage and the professional’s experience.

- Risk Management: Both policies encourage risk management practices to minimize the likelihood of claims and protect the insured’s reputation.

Credit: http://www.embroker.com

Frequently Asked Questions Of Is Malpractice Insurance The Same As Professional Indemnity

Is Malpractice Insurance The Same As Professional Indemnity?

Malpractice insurance and professional indemnity insurance are similar in that they both protect professionals against liabilities resulting from their work. However, malpractice insurance is specifically for medical professionals, while professional indemnity insurance is for a broader range of professions such as lawyers, consultants, and architects.

Why Do Professionals Need Professional Indemnity Insurance?

Professionals need professional indemnity insurance to protect themselves from legal claims and financial loss resulting from errors, omissions, or negligence in their work. It provides coverage for legal costs and damages, ensuring the continuity of the business and fostering client confidence.

What Does Professional Indemnity Insurance Cover?

Professional indemnity insurance covers legal defense costs, compensation for clients’ financial loss due to professional negligence, protection against libel and slander claims, and safeguarding business reputation. It also extends to cover the costs of investigations and regulatory proceedings related to professional conduct.

Conclusion

To sum it up, professional indemnity and malpractice insurance may seem similar, but they have notable differences. While malpractice insurance primarily focuses on medical professionals and their liability, professional indemnity covers a broader range of professions and protects against various forms of professional negligence.

It is crucial for professionals to understand the distinction and ensure they have the appropriate coverage to safeguard their career and reputation. Whether you are a doctor, lawyer, or consultant, having the right insurance is essential in today’s litigious world.

Leave a comment