The Canada Pension Plan (CPP) Statement of Contributions provides a detailed record of your earnings and contributions towards your CPP benefits over your working years. This statement outlines your total contributions, credited earnings, and eligibility for CPP benefits in retirement.

Understanding your CPP Statement can help you plan for your future financial well-being by knowing how much you have invested in the CPP and estimating your potential benefits upon retirement. By regularly reviewing your Statement of Contributions, you can track your progress towards a secure retirement and make informed decisions about your financial future.

It is essential to stay updated on your CPP contributions to ensure you are on track for a comfortable retirement.

Credit: http://www.chegg.com

What Is The Canada Pension Plan (cpp)?

The Canada Pension Plan (CPP) is a government-run program that provides retirement income and benefits to eligible Canadians. The CPP Statement of Contributions outlines an individual’s total contributions made towards their CPP. It is an essential document for tracking and estimating future CPP benefits.

What is the Canada Pension Plan (CPP)?Overview

The Canada Pension Plan (CPP) is a social insurance program designed to provide financial assistance to Canadians in retirement.Purpose

The CPP ensures that Canadians have a reliable source of income during their retirement years, supplementing their savings and other pension plans. The CPP Statement of Contributions outlines a person’s contributions to the plan, showcasing their entitlement to benefits upon retirement.Key Points:

– CPP provides financial support during retirement. – Statement of Contributions details individual contributions. – Supplements other savings and pensions. Understanding your CPP Statement of Contributions is vital in planning for a secure financial future.Why Is It Important To Understand Your Cpp Statement Of Contributions?

Understanding your CPP Statement of Contributions is crucial for securing your retirement and knowing your eligibility.

Securing Your Retirement

The CPP Statement of Contributions provides valuable insights into your contributions and benefits to ensure a financially stable retirement.

Knowing Your Eligibility

Reviewing your CPP Statement helps you determine if you meet the eligibility criteria for receiving pension benefits in the future.

How To Access Your Cpp Statement Of Contributions

Accessing your CPP Statement of Contributions is a straightforward process. Simply log in to your My Service Canada Account to view and download the statement, providing you with important information about your Canada Pension Plan contributions and eligibility.

One important document that individuals in Canada should be familiar with is the Canada Pension Plan (CPP) Statement of Contributions. This statement provides a detailed summary of your CPP contributions and can be helpful for retirement planning and understanding your pension entitlements. So, how can you access your CPP Statement of Contributions? Let’s explore the different methods below.

Online Method

If you prefer a convenient and quick way to access your CPP Statement of Contributions, you can do so online. The Government of Canada provides a user-friendly portal called My Service Canada Account (MSCA) where you can securely view and download your statement. Utilizing this online method offers several benefits such as immediate access to your most up-to-date statement and the ability to monitor any changes.

To access your CPP Statement of Contributions using the online method, follow these simple steps:

- Visit the official website of the Government of Canada.

- Sign in to your My Service Canada Account or create a new account if you don’t have one already.

- Once logged in, navigate to the CPP section or search for the specific option to access your Statement of Contributions.

- Click on the option to view or download your CPP Statement of Contributions.

- Review the document and save it for your reference.

Requesting A Copy

If you prefer a non-digital method or encounter any issues accessing your CPP Statement of Contributions online, you can request a copy by contacting Service Canada, the government agency responsible for CPP administration. Requesting a copy is a straightforward process, and Service Canada representatives are available to assist you.

To request a copy of your CPP Statement of Contributions, follow these steps:

- Find the contact information for your nearest Service Canada office or access their toll-free number from their official website.

- Reach out to Service Canada through phone, email, or in-person visit to initiate your request.

- Provide the necessary identification information and explain your request for a copy of your CPP Statement of Contributions.

- Follow any additional instructions provided by the Service Canada representative.

- Receive your CPP Statement of Contributions either through mail or email, depending on your preference and Service Canada’s procedures.

Regardless of the method you choose, accessing your CPP Statement of Contributions is an essential step in planning for your retirement and ensuring you have a clear understanding of your pension contributions. Remember to regularly review your statement to stay informed about your CPP contributions and make informed decisions about your future.

Credit: worthwhile.typepad.com

Understanding The Information On Your Cpp Statement Of Contributions

The Canada Pension Plan (CPP) Statement of Contributions is a crucial document that provides you with essential details about your contributions and projected benefits. Understanding the information on your CPP Statement of Contributions is key to planning for your retirement and ensuring that you receive the benefits you are entitled to.

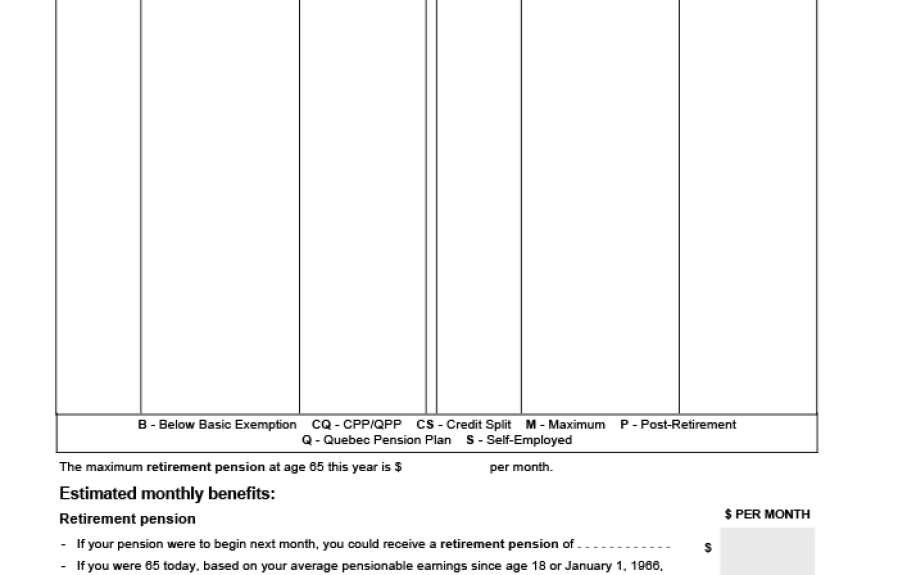

Years Of Contribution

Years of contribution on your CPP Statement of Contributions refer to the number of years you have made contributions to the CPP. This section provides a summary of all the years for which you have contributed to the plan. It is an important indicator of your eligibility for CPP benefits and can help you assess the level of income support you can expect to receive in retirement.

Contributions Made

The Contributions Made section of your CPP Statement of Contributions outlines the actual contributions you have made to the Canada Pension Plan. It demonstrates the amount of money you have put into the plan over the years of your employment. This information is crucial for calculating the amount of CPP benefits you will be eligible to receive upon retirement.

Pensionable Earnings

The Pensionable Earnings information on your CPP Statement of Contributions outlines the total earnings on which you have made contributions to the CPP. The statement provides a breakdown of your annual earnings that are considered pensionable, which is essential for determining the level of benefits you can expect to receive when you start collecting CPP.

Calculating Your Cpp Retirement Benefits

Understanding how your Canada Pension Plan (CPP) Statement of Contributions impacts your retirement benefits is crucial for planning your financial future. The CPP Statement of Contributions provides valuable information about your earnings and contributions throughout your working years, which directly affects the amount of CPP retirement benefits you are eligible to receive.

Formula

The formula used to calculate your CPP retirement benefits is based on the average pensionable earnings and the number of years you contributed to the CPP. It takes into account your earnings, up to a maximum yearly limit, and your contributions over your working years, providing a comprehensive picture of your potential retirement income.

Average Pensionable Earnings

Your Average Pensionable Earnings (APE) is a key factor in determining your CPP retirement benefits. It is calculated by taking your total earnings over your working years and dividing it by the number of years in which you contributed to the CPP. This figure is then used to determine the amount of your monthly CPP retirement benefits.

Credit: http://www.uslegalforms.com

Factors That Can Affect Your Cpp Retirement Benefits

As you review your CPP Statement of Contributions in Canada, consider factors that can impact your retirement benefits. Changes in income, contributions, and retirement age can influence the amount you receive from the Canada Pension Plan. Stay informed to optimize your benefits for the future.

Factors that can affect your CPP retirement benefits Planning for retirement can be a complex and overwhelming task, especially when it comes to understanding how the Canada Pension Plan (CPP) statement of contributions works. Your CPP retirement benefits are influenced by a variety of factors, and being aware of these can help you make informed decisions for your future. In this section, we will discuss two key factors that can affect your CPP retirement benefits: early or late retirement and credited contributions.Early Or Late Retirement

When it comes to your CPP retirement benefits, the age at which you choose to retire can have a significant impact. Taking early retirement means that you start receiving your CPP pension before the age of 65, while opting for late retirement means you delay receiving your pension until after the age of 65. Early retirement can result in a reduction in your monthly CPP pension payments. This reduction is calculated based on the number of months you receive your pension before turning 65. On the other hand, late retirement can lead to increased monthly CPP pension payments. For each month you delay receiving your pension after turning 65, your benefits are enhanced.Credited Contributions

Credited contributions are another important factor that can affect your CPP retirement benefits. The amount of CPP pension you receive is determined by your total contributions made throughout your working years. However, there may be gaps in your contribution history, such as periods when you were unemployed or didn’t contribute to CPP. To account for these gaps, the CPP uses a system of credited contributions. This means that if you had low or no earnings during certain periods, you may still receive credits as if you had made contributions. These credited contributions help ensure that your CPP retirement benefits are not negatively impacted by periods of lower earnings or unemployment. It is important to note that the amount of credited contributions you receive depends on various factors, including the number of years you contributed to the CPP, the average earnings in the years you contributed, and your age when you become eligible for CPP retirement benefits. Understanding the factors that can affect your CPP retirement benefits, such as early or late retirement and credited contributions, can help you make informed decisions to maximize your pension payments. By considering these factors and planning accordingly, you can take control of your financial future and ensure a comfortable retirement.Reviewing Your Cpp Statement Of Contributions Regularly

Ensure you regularly review your CPP Statement of Contributions.

Double-check for any errors or inaccuracies in your CPP Statement of Contributions.

Taking Action Based On Your Cpp Statement Of Contributions

Are you ready to make the most out of your CPP Statement of Contributions? Exploring how you can take action based on this valuable document is key to maximizing your retirement planning.

Supplementing Your Retirement Savings

Evaluate your CPP Statement to understand your projected benefits. Determine if you need to enhance your savings for a comfortable retirement.

- Consider contributing to a Registered Retirement Savings Plan (RRSP) or Tax-Free Savings Account (TFSA).

- Consult financial advisors to create a tailored investment plan.

Seeking Professional Advice

If you are uncertain about your CPP Statement, seeking advice from financial experts is crucial.

- Meet with a financial planner to review your retirement goals.

- Discuss strategies to optimize your CPP benefits.

Frequently Asked Questions Of Canada Pension Plan (cpp) Statement Of Contributions

What Is A Canada Pension Plan (cpp) Statement Of Contributions?

The Canada Pension Plan (CPP) statement of contributions is a detailed record of your annual CPP contributions and benefits accrued. It provides valuable information about your pension entitlement and helps you plan for retirement.

How Can I Access My Cpp Statement Of Contributions?

You can easily access your CPP statement of contributions online through the My Service Canada Account. Simply log in using your credentials and navigate to the “CPP Statement of Contributions” section to view or download the statement.

Why Is It Important To Review My Cpp Statement Of Contributions?

Reviewing your CPP statement of contributions is crucial for understanding your pension entitlement and ensuring the accuracy of your contribution record. It allows you to identify any discrepancies, track your earnings, and make informed decisions regarding your retirement planning.

Conclusion

Ensure the security and peace of mind for your retirement with the Canada Pension Plan (CPP) Statement of Contributions. Easily accessible and comprehensible, this detailed document provides a comprehensive overview of your contributions and benefits. Stay informed about your future financial stability and potential retirement income by regularly reviewing and understanding your CPP Statement of Contributions.

Take control of your retirement journey today!

Leave a comment