A retirement plan on W2 is a program offered by an employer to help employees save for retirement. This plan allows employees to contribute a portion of their earnings, which is then deducted from their W2 income, providing tax benefits.

It helps individuals accumulate savings for their retirement years, ensuring financial security when they stop working. Additionally, employers may offer matching contributions to encourage employees to save. By participating in a retirement plan on W2, employees can take advantage of potential investment growth and enjoy the flexibility to choose from various investment options.

Overall, this plan serves as a valuable tool in planning for a financially stable retirement.

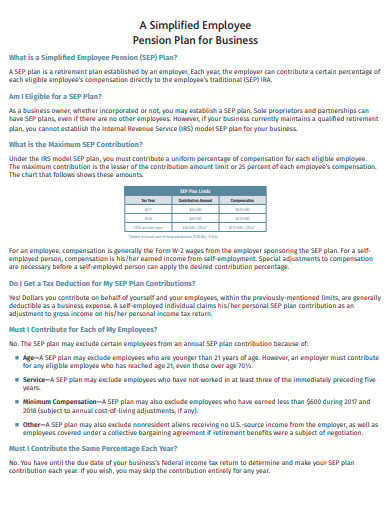

Credit: simplified-employee-pension-form.gcglagos.org

Importance Of Retirement Planning

Retirement planning is crucial for building financial security and ensuring a comfortable lifestyle when you retire. It involves setting aside funds during your working years to support yourself in your retirement.

Building Financial Security

By planning for retirement on W2, you secure a stable financial future, preventing financial stress later.

- Save: Contribute regularly to your retirement account to accumulate funds.

- Invest: Grow your savings through strategic investments for long-term financial security.

- Diversify: Spread your investments across different assets to minimize risks.

Ensuring A Comfortable Lifestyle

Retirement planning allows you to enjoy your golden years without financial worries.

- Budget: Plan your expenses wisely to make your retirement savings last longer.

- Healthcare: Consider health insurance and medical expenses in your retirement plan.

- Lifestyle: Factor in your desired lifestyle in retirement to ensure a comfortable living.

Credit: districtcapitalmanagement.com

Understanding Retirement Plans On W2

Retirement plans on W2 are an essential aspect of planning for your future financial security. Whether you are just starting your career or nearing the end of it, understanding retirement plans on a W2 is crucial to make informed decisions about your retirement. In this article, we will explore the different types of retirement plans available and the benefits they offer.

Types Of Retirement Plans

Retirement plans on W2 come in various forms, each designed to suit different needs and circumstances. Here are some of the most common types of retirement plans:

1. 401(k) Plan:

The 401(k) plan is one of the most popular employer-sponsored retirement plans. It allows employees to contribute a portion of their salary to their retirement savings on a pre-tax basis. These contributions can be invested in various investment options, such as stocks, bonds, and mutual funds. The best part is that some employers also match a percentage of the employee’s contributions, helping to boost their retirement savings even further.

2. Traditional IRA:

A Traditional IRA (Individual Retirement Account) is a retirement savings account that individuals can contribute to on their own. Contributions to a traditional IRA are typically tax-deductible, which means you can reduce your taxable income by the amount of your contribution. The funds in a traditional IRA grow tax-deferred until you withdraw them during retirement.

3. Roth IRA:

A Roth IRA is similar to a traditional IRA with one significant difference – contributions to a Roth IRA are made with after-tax dollars. While you don’t get immediate tax benefits, qualified withdrawals from a Roth IRA are tax-free. This means that any earnings and growth within the account are tax-free when taken out during retirement, making it an attractive option for those anticipating higher tax rates in the future.

4. Pension Plan:

A pension plan is a retirement plan sponsored by an employer that guarantees a specific benefit amount to employees upon retirement. The employer typically manages and funds the pension plan, providing employees with a fixed income during their retirement years. Although less common these days, pension plans are still offered by certain companies, particularly in the public sector.

Benefits Of Retirement Plans On W2

Retirement plans on W2 offer several benefits that can significantly impact your financial well-being in retirement. Here are some of the advantages of having a retirement plan on your W2:

- Tax Advantages: Retirement plans on W2 provide tax advantages, such as tax-deferred growth or tax-free withdrawals during retirement.

- Employer Contributions: Many employers offer matching contributions, which means your employer will contribute a certain percentage of your salary to your retirement account.

- Savings Discipline: Retirement plans on W2 help instill a savings discipline by automatically deducting contributions from your paycheck.

- Compound Growth: By starting early and consistently contributing to your retirement account, you can take advantage of compound growth over time, allowing your savings to grow exponentially.

- Retirement Security: Having a retirement plan ensures you have a source of income when you are no longer working, providing financial security in your golden years.

Understanding the different types of retirement plans and the benefits they offer is essential in planning for your retirement. Consider consulting with a financial advisor to help determine the most appropriate retirement plan for your specific needs and goals. Start planning and saving for your retirement today to secure a brighter future.

How Retirement Plans On W2 Work

Retirement plans on W2 are a crucial component in securing a financially stable future. Understanding how these plans work is essential for anyone looking to capitalize on the benefits offered. By exploring the mechanics of retirement plans on W2, you can gain insight into how these plans operate, the contributions and deductions involved, and the overall impact on your financial future.

Contributions And Deductions

Retirement plans on W2 are funded through contributions made by employees and, in some cases, employer contributions. Employees can opt to have a percentage of their pay deducted pre-tax and contributed to their retirement plan, ensuring that the funds are invested for their future. These contributions are a proactive way to secure financial stability post-employment.

Employer Matching Contributions

Employer matching contributions are a valuable benefit provided by some companies as part of their retirement plans on W2. This entails the employer matching a certain percentage of the employee’s contributions to their retirement plan, effectively doubling the impact of the employee’s individual contributions. Employer matching contributions serve as an added incentive for employees to participate in maximizing their retirement plan benefits and help them secure a more financially stable future.

:max_bytes(150000):strip_icc()/IRA_V1_4194258-7cf65db353ac41c48202e216dfbd46ee.jpg)

Credit: http://www.investopedia.com

Choosing The Right Retirement Plan On W2

Assessing Your Financial Goals

When deciding on a retirement plan on W2, the first step is to assess your financial goals. Consider how much you want to save for retirement and at what age you plan to retire. Additionally, think about your current and future financial obligations, such as paying off debts and covering living expenses. It’s crucial to have a clear understanding of your financial goals before choosing a retirement plan.

Considering Employer Match And Tax Benefits

Another important factor to consider when choosing a retirement plan on W2 is the employer match and tax benefits. Look into whether your employer offers a matching contribution to your retirement savings. This can significantly boost your savings over time. Additionally, explore the tax benefits associated with different retirement plans, such as the ability to defer taxes on contributions or receive tax-free withdrawals upon retirement.

Common Mistakes To Avoid

Retirement planning is a crucial aspect of financial stability and security in the golden years of life. However, it’s essential to be aware of the common mistakes to avoid when it comes to retirement plans on W2 forms. By understanding these potential pitfalls, you can better navigate the complexities of retirement savings and ensure a more prosperous future.

Underestimating Retirement Needs

One of the most prevalent mistakes individuals make is underestimating their retirement needs. It’s easy to assume that your current lifestyle will seamlessly transition into retirement, but this often leads to financial struggles later on. Remember, during retirement, there may be new expenses, such as increased healthcare costs or post-retirement plans, which require additional financial support.

Neglecting To Review And Adjust Plans

Neglecting to review and adjust your retirement plan regularly can also hinder your financial goals. Life is dynamic, and circumstances can change over time. Whether it’s a new job, a salary raise, or even a shift in personal priorities, it’s vital to reassess your retirement plan periodically. By doing so, you can ensure that you’re on track and make any necessary adjustments to maximize your savings potential.

Maximizing Your Retirement Savings

If you are a W2 employee, it’s essential to maximize your retirement savings to secure your financial future. Understanding the options available can help you take advantage of every opportunity to boost your retirement fund. In this blog post, we will explore how you can optimize your retirement plan on W2 through catch-up contributions and investment options.

Taking Advantage Of Catch-up Contributions

Employer-sponsored retirement plans, such as 401(k) or 403(b), offer catch-up contributions for individuals aged 50 and above. This provision allows eligible employees to make additional contributions beyond the standard limit, enabling them to accelerate their retirement savings.

Understanding Investment Options

When planning for retirement on W2, it’s crucial to familiarize yourself with different investment options available within your retirement plan. From mutual funds to ETFs, understanding the various investment vehicles can help you make informed decisions to grow your retirement savings.

Planning For Retirement At Different Life Stages

Retirement planning is crucial at different life stages. Whether you are just starting your career or approaching retirement age, it’s essential to have a W2 retirement plan in place.

Starting Early In Your Career

In your 20s and 30s, you have the advantage of time on your side. Start contributing to your W2 retirement plan early to take advantage of compound interest.

- Focus on maxing out employer-matched contributions.

- Diversify your retirement portfolio for long-term growth.

- Consider investing in low-cost index funds for higher returns.

Approaching Retirement Age

As you near retirement, it’s important to reassess your W2 retirement plan to ensure you are on track to meet your financial goals.

- Review your retirement accounts and adjust your investment strategy.

- Consider delaying retirement to increase your Social Security benefits.

- Consult a financial advisor to create a comprehensive retirement plan.

Seeking Professional Guidance

Seeking Professional Guidance:

Consulting Financial Advisors

Financial advisors provide personalized retirement plans based on individual needs and goals.

They offer expert advice and strategies to optimize retirement savings.

Financial advisors assist in creating a secure financial future for retirement.

Utilizing Retirement Planning Tools

Retirement planning tools help in assessing retirement needs and projecting future expenses.

These tools aid in creating a structured retirement savings plan for long-term security.

Utilizing retirement planning tools ensures a well-prepared and stable retirement.

Frequently Asked Questions Of What Is Retirement Plan On W2

What Is A Retirement Plan On W2?

A retirement plan on W2 refers to contributions made by an employer to an employee’s retirement account. These contributions are deducted from the employee’s salary before taxes, providing tax advantages. The most common retirement plans on W2 include 401(k) and pension plans.

How Does A Retirement Plan On W2 Work?

A retirement plan on W2 works by allowing employees to save for retirement through payroll deductions. The employer may match a percentage of the employee’s contributions. The funds are then invested in various assets to grow over time, providing a source of income in retirement.

What Are The Benefits Of A Retirement Plan On W2?

The benefits of a retirement plan on W2 include tax advantages, employer matching contributions, and the opportunity for long-term growth of savings. It provides financial security in retirement and helps employees build a substantial nest egg for their future.

How To Choose The Right Retirement Plan On W2?

Choosing the right retirement plan on W2 involves considering factors such as employer match, investment options, fees, and the employee’s individual financial goals. It’s important to assess the plan’s features and benefits to make an informed decision that aligns with one’s retirement objectives.

Conclusion

Retirement plans on W2 provide a valuable opportunity for employees to save for their future. By contributing a portion of their income to these plans, individuals can not only save on taxes but also secure a comfortable retirement. With the various options available, it is essential for employees to understand the benefits and rules associated with their retirement plan.

By taking advantage of these plans, individuals can pave the way for a financially secure future.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a Retirement Plan on W2?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A retirement plan on W2 refers to contributions made by an employer to an employee’s retirement account. These contributions are deducted from the employee’s salary before taxes, providing tax advantages. The most common retirement plans on W2 include 401(k) and pension plans.” } } , { “@type”: “Question”, “name”: “How does a Retirement Plan on W2 Work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A retirement plan on W2 works by allowing employees to save for retirement through payroll deductions. The employer may match a percentage of the employee’s contributions. The funds are then invested in various assets to grow over time, providing a source of income in retirement.” } } , { “@type”: “Question”, “name”: “What are the Benefits of a Retirement Plan on W2?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The benefits of a retirement plan on W2 include tax advantages, employer matching contributions, and the opportunity for long-term growth of savings. It provides financial security in retirement and helps employees build a substantial nest egg for their future.” } } , { “@type”: “Question”, “name”: “How to Choose the Right Retirement Plan on W2?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Choosing the right retirement plan on W2 involves considering factors such as employer match, investment options, fees, and the employee’s individual financial goals. It’s important to assess the plan’s features and benefits to make an informed decision that aligns with one’s retirement objectives.” } } ] }

Leave a comment