Yes, you can get liability insurance without a car. This type of insurance is commonly referred to as “non-owner car insurance” and provides coverage if you borrow or rent a car.

Liability insurance is a type of insurance coverage that protects individuals from legal claims and financial losses if they are found responsible for causing injury or property damage to others. While it is typically associated with car ownership, there are situations where you may need liability insurance even if you don’t own a car.

For instance, if you frequently rent cars or borrow vehicles from friends or family, it’s important to have liability coverage to protect yourself in case of an accident. Fortunately, you can obtain liability insurance without a car through a policy known as non-owner car insurance. This type of insurance provides coverage for bodily injury and property damage liability, offering peace of mind and financial protection when you are driving a vehicle that you don’t own.

Types Of Liability Insurance

When it comes to types of liability insurance, there are a few key options you can consider to protect yourself financially.

Personal Liability Umbrella Policy

A personal liability umbrella policy offers additional liability coverage beyond what your standard policies provide.

Renter’s Insurance With Liability Coverage

Renter’s insurance covers liability for accidents that occur in your rental property.

Credit: http://www.facebook.com

Instances Where Liability Insurance Is Beneficial

Liability insurance is a type of coverage that provides financial protection in case you are found legally responsible for causing harm or damage to someone else. While liability insurance is usually associated with owning a car, there are instances where you might need this coverage even if you don’t own a vehicle. Below, we discuss two situations where liability insurance becomes beneficial: renting vehicles and renting property.

Renting Vehicles

When you rent a vehicle, whether it’s for a short trip or a long vacation, liability insurance can offer vital protection. Rental companies usually provide their own liability coverage, but this might not be sufficient to cover all costs if you were to cause an accident. Additionally, some rental companies may require you to provide proof of liability coverage before renting a vehicle. Therefore, obtaining liability insurance before renting a vehicle is highly recommended.

Renting Property

Liability insurance can also prove to be advantageous when you are renting property, such as an apartment or house. Accidents can happen, and if someone is injured while visiting your rented property, you might be held responsible for their medical expenses and other damages. Having liability insurance can help protect you from financial loss and provide coverage if legal action is taken against you. It’s advisable to check with your landlord or rental agency to determine the minimum liability coverage required.

Comparing Costs

When it comes to purchasing liability insurance, comparing costs is an essential step in making an informed decision. Whether you own a car or not, understanding the cost differences between liability insurance with and without a car is crucial. By comparing these costs, you can determine the most cost-effective option for your individual needs.

Cost Of Liability Insurance Without A Car

Liability insurance without a car typically costs less than traditional car insurance policies. Since you’re not insuring a vehicle, the premiums for liability insurance without a car are significantly lower. Without the additional coverage for physical damage to a vehicle, the cost of liability insurance is primarily based on the coverage limits and individual risk factors.

Cost Of Liability Insurance With A Car

On the other hand, liability insurance when coupled with a car involves additional factors that impact the cost. The cost of liability insurance with a car includes coverage for potential physical damage to the vehicle, as well as liability coverage for bodily injury and property damage. Consequently, the premiums for liability insurance with a car are generally higher than those without a car.

Legal Requirements

Legal requirements for liability insurance without a car can vary depending on state laws and alternative forms of financial responsibility. Understanding these legal stipulations is crucial for individuals seeking liability coverage without owning a vehicle.

State Laws And Liability Insurance

State laws mandate different requirements regarding liability insurance, which may or may not apply to individuals without a car. Some states may stipulate that all motorists maintain a minimum level of liability coverage, regardless of vehicle ownership. Alternatively, there are states where liability insurance is only mandatory for vehicle owners.

Alternative Forms Of Financial Responsibility

For individuals without a car, alternative forms of financial responsibility can serve as a substitute for traditional liability insurance. These alternatives, such as surety bonds or cash deposits, may fulfill legal mandates in place of a standard policy. It’s important to research and verify which alternative forms are acceptable in your state to ensure compliance with legal requirements.

Getting Liability Insurance

If you don’t own a car, you might be wondering whether it’s possible to get liability insurance. The good news is, you can! Liability insurance is not limited to just car owners. It is a type of insurance that provides coverage for bodily injury and property damage that you may cause to others. In this article, we will explore how you can obtain liability insurance without owning a car.

Applying For Standalone Liability Insurance

If you don’t own a car but still want the protection that liability insurance offers, you have the option to apply for standalone liability insurance. This type of insurance covers you for liability situations that may occur outside of owning and driving a car.

When applying for standalone liability insurance, you will need to provide information about yourself, such as your name, address, and contact details. You will also need to disclose any previous claims or incidents you have been involved in, as this might affect your eligibility and premium amount.

It is important to note that standalone liability insurance usually does not provide coverage for damages to your own property or injuries to yourself. It is purely for liability situations involving others. Therefore, if you are looking for coverage for your personal belongings or injuries, you might need additional policies.

Considerations When Adding Liability Coverage

If you are a non-car owner and are considering adding liability coverage to an existing insurance policy, there are a few things to keep in mind. Typically, liability coverage can be added to homeowner’s insurance or renter’s insurance policies.

When adding liability coverage to your existing policy, consider the following:

- Check the coverage limits: Ensure that the liability coverage limits offered meet your specific needs. Depending on your circumstances, you may want higher coverage limits to provide sufficient protection in case of a liability claim.

- Review the premium: Adding liability coverage to your existing policy will likely increase the premium. Take time to evaluate the cost and make sure it fits within your budget.

- Understand the exclusions: Familiarize yourself with the policy exclusions and any situations that might not be covered by the liability insurance. It’s essential to understand the scope of your coverage to avoid any surprises in the event of a claim.

By considering these factors when adding liability coverage to an existing insurance policy, you can ensure that you have the protection you need without owning a car.

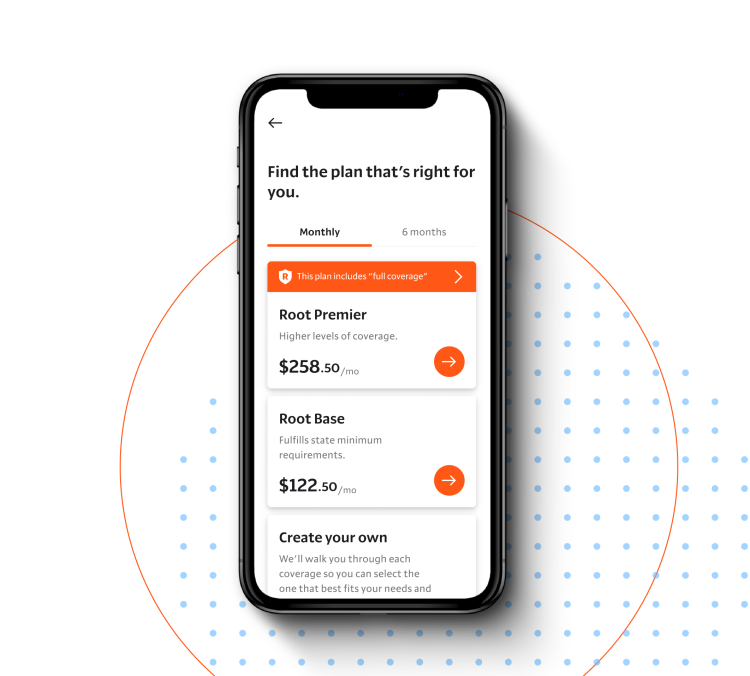

Credit: http://www.joinroot.com

Understanding Coverage Limits

Factors Influencing Coverage Limits

Insurance providers determine coverage limits based on various factors like driving history and location.

Your coverage limit may be impacted by the type of policy you choose and the insurer’s guidelines.

Avoiding Underinsured Situations

Always review your policy to ensure it adequately covers any potential liabilities that may arise.

Being underinsured can lead to financial risks in case of accidents or property damage.

Coverage Extensions And Exclusions

When it comes to liability insurance, it’s important to understand the coverage extensions and exclusions that may apply, especially when you don’t own a car. Liability insurance is typically associated with owning and driving a vehicle, but what options are available if you want liability coverage without a car?

Understanding Optional Extensions

While most liability insurance policies are designed for car owners, there are certain optional extensions that can provide coverage for individuals without a car. These extensions are typically available as endorsements to a standard liability policy, allowing you to tailor your coverage to your specific needs.

Some common examples of optional extensions include:

- Rented or borrowed vehicle coverage: This extension provides liability coverage when you rent or borrow a car, giving you peace of mind knowing you’re protected in case of an accident.

- Non-owned vehicle coverage: If you frequently drive a car that isn’t owned by you, such as a friend or family member’s vehicle, this extension can provide liability coverage should an accident occur.

- Named driver coverage: If you’re listed as a named driver on someone else’s car insurance policy, this extension can provide liability coverage while you’re driving that vehicle.

These optional extensions can be a smart choice for individuals without a car who want to ensure they are protected in case of an accident. However, it’s important to carefully review and understand the terms and conditions of these extensions to ensure they meet your specific needs.

Common Liability Coverage Exclusions

While liability insurance is designed to protect you financially in the event of an accident, there are certain exclusions that may apply. These exclusions can vary depending on the insurance company and policy, but it’s important to be aware of them to avoid any surprises.

Some common liability coverage exclusions include:

- Intentional acts: Liability insurance typically does not cover damages caused by intentional acts, such as intentional property damage or bodily harm.

- Business activities: If you’re using your vehicle for business purposes, your personal liability insurance may not provide coverage. In this case, you may need to consider a separate commercial liability policy.

- Racing or other high-risk activities: Engaging in activities such as racing or stunt driving may void your liability coverage, as these activities are often considered high-risk and potentially dangerous.

- Uninsured or underinsured motorists: Liability insurance typically does not provide coverage for accidents involving uninsured or underinsured motorists. To protect against these situations, you may need to consider additional coverage options.

It’s crucial to thoroughly read and understand the terms and conditions of your liability insurance policy to ensure you have the coverage you need and to avoid any potential gaps in protection.

Remember, while these are common coverage extensions and exclusions, the specifics may vary depending on your insurance provider, policy, and local regulations. Always consult with a knowledgeable insurance professional to fully understand your coverage options.

Steps To Take If You Cause Damage

If you accidentally cause damage to someone’s property or injure another person, not having car insurance can be a significant concern. However, even if you do not own a vehicle, it is still possible to obtain liability insurance. Here are the essential steps you need to take if you cause damage without having a car insurance policy.

Contacting Your Insurance Provider

If you have a renter’s insurance policy or are listed on someone else’s policy, contact the insurance provider immediately to report the incident. Provide all the necessary details, including the date, time, and location of the incident, as well as any relevant photos or documentation. Be sure to ask about your coverage limits and any deductibles that may apply to the claim.

Navigating Claims Process

Once you have notified your insurance provider, they will guide you through the claims process. Be prepared to provide a statement about what occurred and cooperate fully with the investigation. It’s essential to understand the timeline for the claim, including when you can expect a resolution and any potential financial responsibilities you may have.

Credit: http://www.facebook.com

Frequently Asked Questions Of Can You Get Liability Insurance Without A Car

Can I Purchase Liability Insurance Without Owning A Car?

Yes, you can buy non-owner car insurance, also known as liability insurance, which provides coverage when you drive someone else’s car. This type of insurance can protect you from potential liabilities if you cause an accident while driving a vehicle you don’t own.

What Does Liability Insurance Cover If I Don’t Own A Car?

Non-owner car insurance primarily provides liability coverage, which covers bodily injury and property damage you may cause in an accident. This type of insurance does not cover damages to the vehicle you are driving. It offers protection for situations when you drive a car but don’t own it.

Why Would I Need Liability Insurance Without Owning A Car?

Non-owner liability insurance can be essential if you frequently borrow or rent vehicles. It provides financial protection when driving cars that you don’t own. Whether using a friend’s car or renting one, having this type of insurance can save you from costly expenses in case of an accident.

Conclusion

Liability insurance is not exclusive to car owners. Even if you don’t own a car, you can still obtain liability insurance to protect yourself from potential financial losses in the event of an accident or injury. It’s important to explore your options and find a policy that suits your needs, whether you’re a driver or not.

Don’t assume that car ownership is a prerequisite for obtaining liability insurance – take the time to research and ensure you have the necessary coverage.

Leave a comment