Landlord Property Insurance, also known as rental property insurance, is a policy that covers landlords against various risks and damages specifically related to their rental properties. It provides protection for the structure of the property, as well as landlord’s personal belongings, liability coverage, and loss of rental income in case of an unforeseen event, such as fire, theft, or natural disasters.

This type of insurance is crucial for landlords as it safeguards their investment and provides financial security in case of property damage or incidents involving tenants. Without insurance, landlords may be left responsible for costly repairs, legal expenses, or loss of rental income, making landlord property insurance an essential component of a landlord’s risk management strategy.

Importance Of Landlord Property Insurance

Landlord property insurance is crucial for protecting your property investment and ensuring financial security.

Protecting Property Investment

Landlord property insurance shields your investment from damages caused by unforeseen events.

Liability Coverage For Landlords

This insurance provides coverage for legal liabilities that landlords may face due to property-related incidents.

Credit: m.facebook.com

Key Coverage Areas

Landlord property insurance provides coverage for a range of critical areas, including property damage, liability, and loss of rental income. It safeguards landlords against financial loss due to unforeseen events such as fire, theft, or natural disasters. Additionally, it offers protection against legal disputes and medical expenses for injured parties on the property.

If you’re a landlord, it’s crucial to protect your investment with landlord property insurance. This type of insurance provides coverage for a range of events and liabilities that you may encounter as a property owner. Let’s explore the key coverage areas provided by landlord property insurance:

Property Damage Coverage

Property damage coverage is an essential component of landlord property insurance. It protects your property against various perils, including fire, lightning, windstorm, hail, explosion, vandalism, and more. With property damage coverage, you can have peace of mind knowing that you have financial protection in case any unfortunate events damage your property.

Loss Of Rental Income Coverage

Loss of rental income coverage is another critical aspect of landlord property insurance. Suppose your property becomes uninhabitable due to a covered peril, such as a fire or storm damage. In that case, loss of rental income coverage will compensate you for the income you would have earned from tenants during the time it takes to repair or replace the property. This coverage helps ensure that you don’t face financial hardship if your rental property becomes temporarily unrentable.

Liability Protection

Liability protection is vital for landlords to safeguard themselves against potential lawsuits. Landlord property insurance includes liability coverage that protects you in case someone is injured on your property and holds you responsible for their injuries. It also covers legal costs if you need to defend yourself in a lawsuit related to your rental property. Liability protection is crucial for landlords as it shields them from potentially significant financial losses.

Benefits Of Landlord Property Insurance

When you own a property and rent it out to tenants, landlord property insurance is a crucial investment. It provides protection and peace of mind for landlords, covering them in various scenarios. Understanding the benefits of landlord property insurance can help you make an informed decision about whether to invest in this type of coverage.

Financial Protection

Landlord property insurance offers financial protection against damages to your property caused by events such as fire, vandalism, storms, and other perils. This coverage also extends to structures on the property, such as garages or sheds, providing you with the reassurance that your investment is safeguarded.

Legal Protection

Legal protection is a crucial aspect of landlord property insurance. In cases where a tenant or third party holds you responsible for an injury or property damage, this insurance can provide coverage for legal expenses and any settlements, alleviating potential financial strain from legal disputes.

Peace Of Mind

Investing in landlord property insurance provides peace of mind by ensuring that you are protected in various circumstances that could otherwise lead to significant financial burdens. Knowing that your property and finances are safeguarded can alleviate stress and allow you to focus on managing your rental property effectively.

Choosing The Right Policy

When it comes to landlord property insurance, choosing the right policy is crucial to protect your investment. Assessing property needs and comparing insurance quotes are essential steps in finding the most suitable coverage for your rental property.

Assessing Property Needs

Before diving into the insurance market, it’s important to assess the specific needs of your rental property. Consider the type of property you own, its location, and the level of coverage you require. Taking into account factors such as the property’s age, condition, and any additional features, such as a swimming pool or detached garage, is essential in securing comprehensive coverage.

Comparing Insurance Quotes

Once you have a clear understanding of your property’s needs, it’s time to compare insurance quotes. Reach out to multiple insurance providers and request quotes based on the information you’ve gathered. Ensure that the quotes include all the necessary coverage options and are tailored to your property’s specific requirements. Uncover the full extent of coverage offered by each policy, including protection against property damage, liability claims, loss of rental income, and potential legal expenses.

Cost Factors

When it comes to landlord property insurance, the cost varies based on several factors. Understanding these cost factors can help you choose the right policy for your investment property. Let’s take a closer look at three key factors that influence the cost of landlord property insurance.

Location Of Property

The location of your property plays a significant role in determining the cost of landlord property insurance. Properties located in high-risk areas, such as regions prone to natural disasters like hurricanes or earthquakes, typically have higher insurance premiums. This is because the risk of property damage or loss is greater in these areas. Additionally, properties in urban areas with higher crime rates may also have higher insurance costs, as the risk of vandalism or burglary increases. On the other hand, properties in low-risk areas enjoy lower insurance premiums due to the reduced likelihood of claims.

Property Value And Type

The value and type of property you own is another important cost factor to consider. Higher-value properties generally require higher insurance coverage, as the cost of repairs or rebuilding is typically more expensive. Different types of properties, such as single-family homes, multi-unit buildings, or commercial properties, may also have varying insurance costs. Commercial properties, for example, may require additional coverage for liability or business interruption, increasing the overall insurance premium. It’s important to accurately assess the value and type of your property to ensure appropriate coverage.

Coverage Limits

Coverage limits refer to the maximum amount an insurance policy will pay out for a covered loss. Higher coverage limits provide greater protection but also result in higher insurance premiums. The more coverage you require, whether for property damage, liability, or loss of rental income, the higher the cost of your insurance policy. It’s crucial to evaluate your specific needs and weigh them against your budget to determine the appropriate coverage limits. Keep in mind that insufficient coverage may leave you exposed to financial risks in the event of a claim.

Credit: http://www.statefarm.com

Common Exclusions

Wear And Tear Exclusions

In landlord property insurance, wear and tear damages are usually excluded.

This means damages due to old age or gradual deterioration are not covered.

Certain Natural Disasters Exclusions

Earthquakes, floods, and hurricanes may be excluded in standard policies.

Separate coverage might be needed for such events for full protection.

Tips For Making A Claim

Landlord property insurance is essential for protecting your investment. Here are some helpful tips for making a claim and ensuring you get the coverage you need.

Documenting Property Condition

Before making a claim, document the property condition thoroughly. Take photos, videos, and written notes of any damages.

Notifying Insurance Company Promptly

Time is crucial! Alert your insurance company promptly after any incident or damage occurs.

Credit: http://www.facebook.com

Frequently Asked Questions On What Is Landlord Property Insurance

What Does Landlord Property Insurance Cover?

Landlord property insurance typically covers the building’s structure, fixtures, and fittings against damage or loss caused by fire, theft, vandalism, and certain natural disasters. It may also provide liability coverage if a tenant or visitor is injured on the property.

Why Do Landlords Need Property Insurance?

Landlords need property insurance to protect their investment and assets. It provides financial coverage for damages to the property, including the building and its contents. Additionally, it offers liability protection in case of accidents or injuries on the rented property.

How Much Does Landlord Property Insurance Cost?

The cost of landlord property insurance varies based on factors such as the property’s location, size, age, and specific coverage needs. On average, landlords can expect to pay between $500 to $2000 annually for a standard policy, although individual quotes may differ.

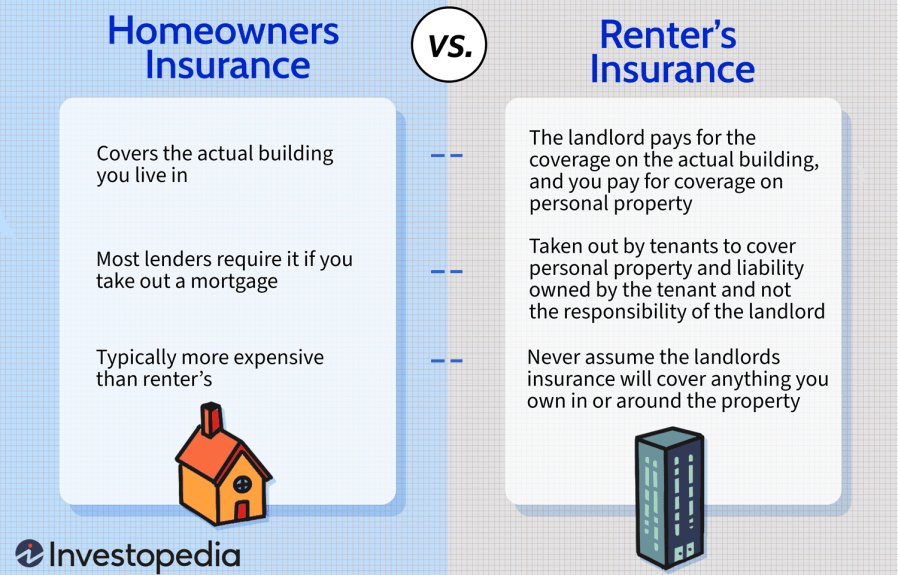

Can I Require Tenants To Get Renters Insurance?

Yes, landlords have the right to require tenants to purchase renters insurance. This can help protect the tenant’s personal belongings and liability, which are not covered by the landlord’s property insurance. Requiring renters insurance can benefit both parties in the event of unforeseen incidents.

Conclusion

To sum up, landlord property insurance provides crucial protection for property owners from financial risks. It safeguards against potential damages and liabilities that may arise due to unforeseen events such as natural disasters, accidents, or tenant negligence. By investing in this insurance, landlords can have peace of mind knowing their assets are covered, allowing them to focus on their rental business.

Protecting your property is an essential step in smart property management. So don’t wait, get landlord property insurance today.

Leave a comment