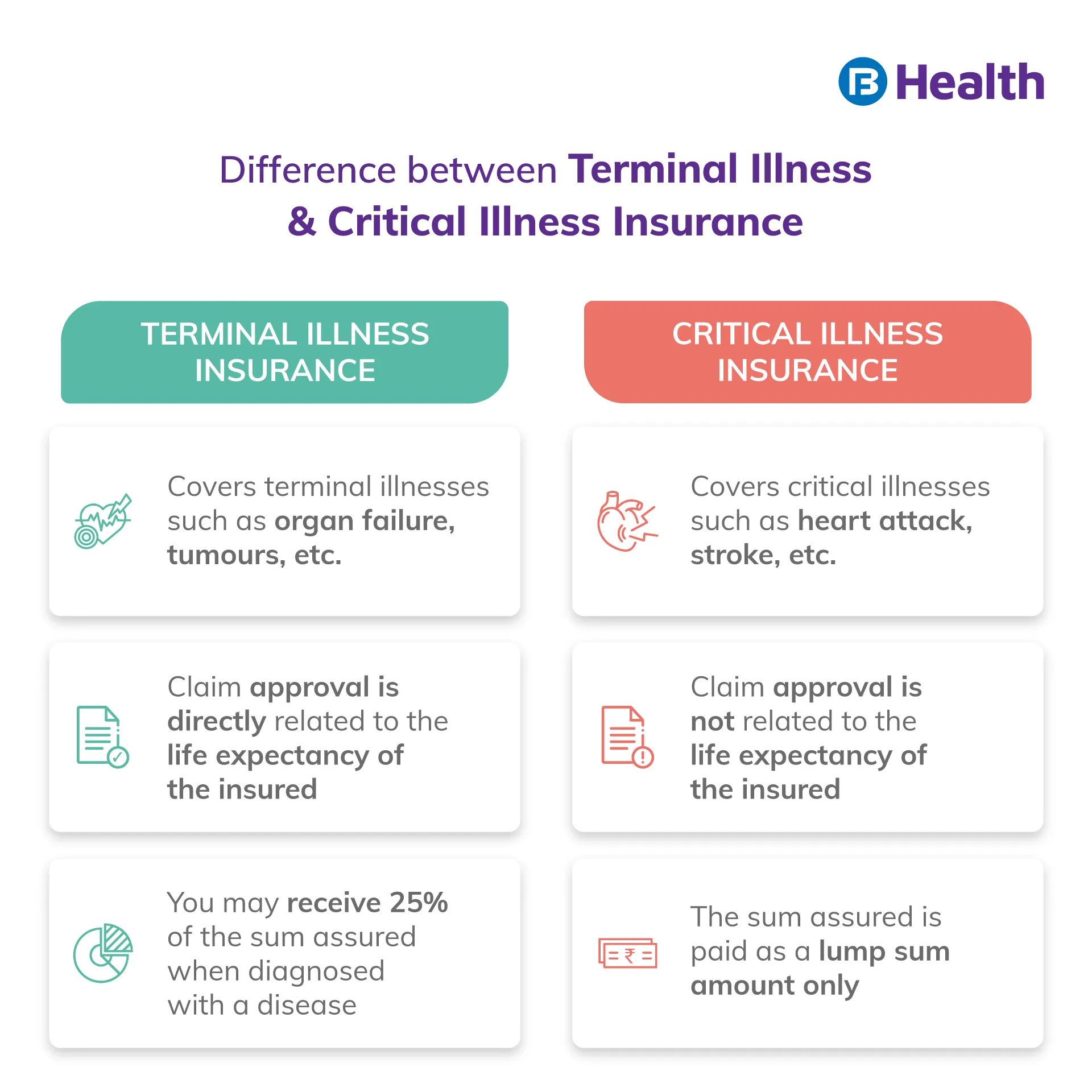

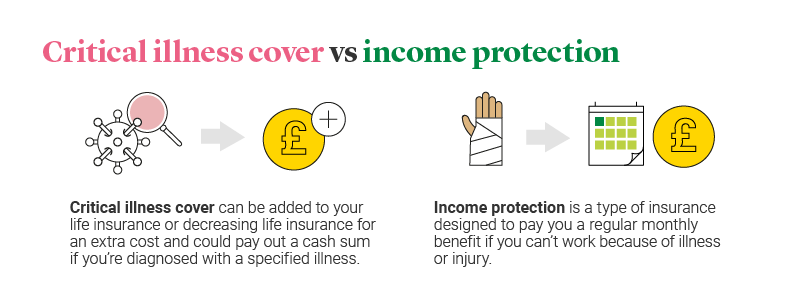

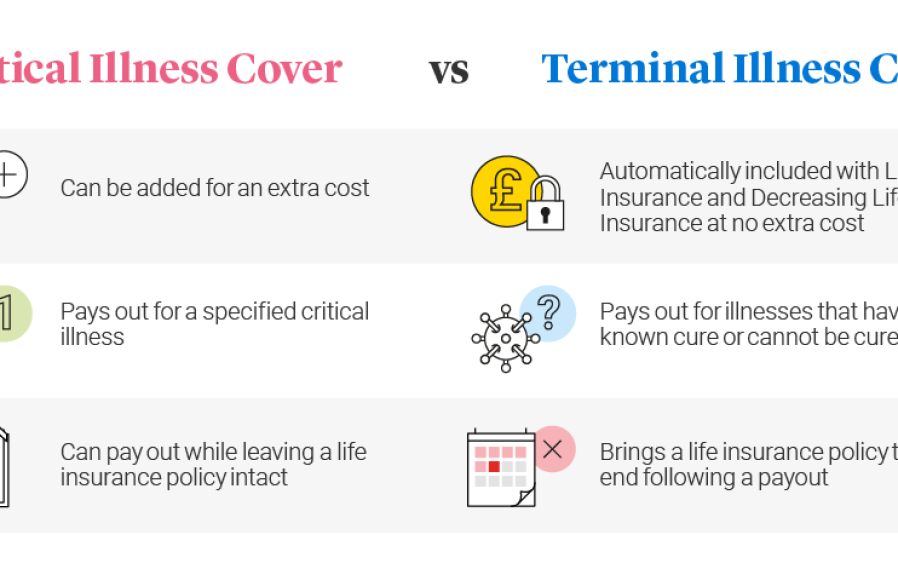

Critical illness cover and terminal illness cover are two types of insurance policies that provide financial protection in case of serious health conditions. Critical illness cover pays out a lump sum if the policyholder is diagnosed with a specific illness listed in the policy, while terminal illness cover pays out if the policyholder is diagnosed with a condition that is expected to cause death within a certain time frame, typically 12 months.

These insurance policies are designed to provide financial support during difficult times and can be a valuable addition to your overall financial plan. As you consider your insurance options, understanding the differences between critical illness cover and terminal illness cover is essential in making an informed decision.

Coverage Comparison

Critical Illness Cover and Terminal Illness Cover are two types of insurance that offer financial protection in case of serious health issues. Let’s compare the coverage benefits of these two:

Critical Illness Cover Benefits

- Covers a wide range of critical health conditions

- Provides a lump sum payment upon diagnosis

- Allows for flexibility in using the payout

- Offers peace of mind for the policyholder and family

Terminal Illness Cover Benefits

- Specifically covers terminal illnesses with a limited life expectancy

- Provides financial assistance during end-of-life care

- Offers support for medical treatment and expenses

- Gives the policyholder control over their final arrangements

:max_bytes(150000):strip_icc()/critical-illness-insurance-who-needs-it.asp-V1-be632d10985e47dcb0508f2537b91c94.jpg)

Credit: http://www.investopedia.com

Key Differences

When it comes to protecting ourselves and our loved ones, insurance is a crucial consideration. Two types of insurance that often confuse people are Critical Illness Cover and Terminal Illness Cover. While both aim to provide financial support during medical emergencies, they have distinct differences. Understanding these differences is essential to make an informed decision about which type of cover is right for you. In this article, we will explore the key differences between Critical Illness Cover and Terminal Illness Cover.

Nature Of Illnesses Covered

Understanding the nature of illnesses covered is vital when choosing the appropriate insurance. Critical Illness Cover offers protection against specific life-threatening illnesses, such as cancer, heart attack, stroke, and kidney failure. It provides a lump-sum payment upon the diagnosis of any covered illness, allowing policyholders to have access to immediate funds for medical treatments or other expenses.

On the other hand, Terminal Illness Cover is designed to provide financial assistance in the event of a terminal condition. It is triggered when a doctor certifies that the policyholder has a limited life expectancy, usually within 12 to 24 months. Terminal Illness Cover pays out the agreed sum assured in a lump sum to assist with end-of-life expenses or to fulfill any remaining financial obligations.

Payout Conditions

Another crucial difference lies in the payout conditions of these two types of insurance. In Critical Illness Cover, the policyholder is eligible for a payout only when they are diagnosed with a covered illness and survive a specific waiting period, typically 28 days. If the policyholder passes away during this waiting period, the insurance does not pay out the sum assured.

On the other hand, Terminal Illness Cover provides a payout when a terminal condition is diagnosed, regardless of the waiting period or whether the policyholder survives for a specified period. This means that if a policyholder is diagnosed with a terminal illness, they can receive the payout immediately, even if their life expectancy is longer than the waiting period specified in Critical Illness Cover.

Furthermore, it’s important to note that Terminal Illness Cover is typically included as a standard feature in most life insurance policies, whereas Critical Illness Cover is an optional add-on that incurs an additional premium.

Policy Flexibility

Critical Illness Cover: Offers flexibility in policy terms and renewability. It allows policyholders to customize their coverage according to their needs and budget, ensuring peace of mind in the face of potential serious illnesses and medical emergencies.

Terminal Illness Cover: Also provides policy flexibility, giving individuals the option to tailor their coverage in alignment with their specific requirements and financial capabilities. This ensures that they are adequately protected in the event of a terminal diagnosis.

Policy Terms And Renewability

Critical Illness Cover typically provides long-term coverage, with the option to renew the policy at the end of the term. This ensures continued protection against critical illnesses, allowing for peace of mind and financial security.

Terminal Illness Cover also offers policy renewal options, providing the opportunity for continuous coverage in the unfortunate event of a terminal diagnosis.

Premium Costs

Critical Illness Cover: Premium costs may vary based on factors such as age, health status, and coverage amount. It offers the flexibility to choose a premium that aligns with the individual’s budget while ensuring comprehensive coverage.

Terminal Illness Cover: Similarly, premium costs for terminal illness cover can be tailored to meet specific budgetary constraints, allowing for reliable protection without overextending financially.

Credit: http://www.bajajfinservhealth.in

Claim Process

When it comes to securing your financial stability in the event of a critical illness or terminal illness, understanding the claim process is crucial. Both Critical Illness Cover and Terminal Illness Cover offer important protection, but their claim processes differ. Let’s delve into the claim processes for both types of coverage to help you make an informed decision.

Critical Illness Claim Process

Claiming under a Critical Illness Cover involves adhering to specific criteria for the policy. Here’s a breakdown of the typical claim process:

- Diagnosis: The policyholder must be diagnosed with an illness covered by the policy.

- Notification: Once diagnosed, the policyholder should promptly notify the insurance provider about the illness.

- Documentation: Submit proper medical documentation to support the claim, including doctor’s reports, test results, and treatment history.

- Assessment: The insurer will review the submitted documentation to assess the validity of the claim.

- Decision: Upon approval, the insurer will process the claim payout according to the policy terms.

Terminal Illness Claim Process

On the other hand, the claim process for Terminal Illness Cover is different, given the nature of the coverage. Here’s a concise outline of the claim process:

- Terminal Diagnosis: The policyholder receives a confirmed terminal illness diagnosis.

- Notification: Promptly notify the insurance provider about the terminal illness diagnosis.

- Assessment: The insurer assesses the diagnosis to determine its terminal nature as per the policy terms.

- Payout: If the diagnosis aligns with the policy provisions, the insurer will process the claim and provide the payout.

Factors To Consider

When choosing between Critical Illness Cover and Terminal Illness Cover, there are several important factors to consider. These factors can help you make an informed decision that suits your specific needs and circumstances.

Your Health Status

Your current health status plays a crucial role in determining which type of cover is more appropriate for you. If you have a pre-existing medical condition or are at a higher risk of developing certain illnesses, Critical Illness Cover may be the better option. This type of cover provides financial protection in case you are diagnosed with a critical illness specified in your policy, such as heart disease, cancer, or stroke. On the other hand, if you are in good health and have no known medical conditions, Terminal Illness Cover may be more suitable. This cover pays out a lump sum if you are diagnosed with a terminal illness and have a prognosis of a limited life expectancy, typically less than 12 months.

Family Medical History

Another important consideration is your family medical history. If your family has a history of certain critical illnesses, such as cancer or heart disease, you may be at a higher risk of developing these conditions yourself. In such cases, having Critical Illness Cover can provide peace of mind, knowing that you are financially protected in the event of a diagnosis. However, if there is no significant family history of critical illnesses and you are more concerned about a sudden and unexpected terminal illness, Terminal Illness Cover may be a more suitable choice for you.

| Factors to Consider | Critical Illness Cover | Terminal Illness Cover |

|---|---|---|

| Your Health Status | Provides financial protection for a range of critical illnesses, suitable if you have pre-existing medical conditions or are at higher risk. | Offers a lump sum payout if diagnosed with a terminal illness and have a prognosis of limited life expectancy. |

| Family Medical History | Can provide peace of mind if you have a family history of critical illnesses. | Less relevant if there is no significant family history and you are more concerned about a sudden and unexpected terminal illness. |

Ultimately, the decision between Critical Illness Cover and Terminal Illness Cover depends on your individual circumstances and priorities. It’s important to carefully evaluate your health status, family medical history, and the specific coverage offered by each type of policy. By considering these factors, you can choose the cover that best aligns with your needs and offers the most appropriate financial protection for you and your loved ones.

Choosing The Right Cover

When deciding between Critical Illness Cover and Terminal Illness Cover, it is crucial to understand the differences to choose the right policy for your needs.

Assessing Individual Needs

- Consider: Age, health status, and financial obligations.

- Assess: Coverage amount needed for medical expenses and family support.

- Key Factors: Critical Illness for serious medical conditions vs. Terminal Illness for end-of-life care.

Consulting With Financial Advisors

- Engage: Financial professionals for personalized recommendations.

- Expertise: Evaluate critical vs. terminal illness coverage based on the individual’s situation.

- Benefit: Advised on the most suitable policy for comprehensive protection.

Credit: http://www.legalandgeneral.com

Frequently Asked Questions For Critical Illness Cover Vs Terminal

What Is Critical Illness Cover?

Critical illness cover is a type of insurance that provides a lump sum payment if the policyholder is diagnosed with a serious illness listed in the policy. It helps to alleviate financial burden during a health crisis.

How Does It Differ From Terminal Illness Cover?

Critical illness cover pays out upon diagnosis of a serious illness, while terminal illness cover pays out if the policyholder is diagnosed with a terminal illness that is likely to result in death within a specified time frame.

Is Critical Illness Cover Necessary If I Have Terminal Illness Cover?

While terminal illness cover provides support if faced with a terminal diagnosis, critical illness cover serves a different purpose by providing financial help when diagnosed with a serious, but not necessarily terminal, illness. Both coverages can complement each other to provide comprehensive protection.

What Are The Key Benefits Of Critical Illness Cover?

Critical illness cover offers financial security by providing a lump sum payment upon diagnosis of a serious illness, helping to cover medical expenses, household bills, or other financial obligations during a difficult time.

Conclusion

Considering both critical illness cover and terminal illness cover is crucial when planning for the unexpected. The former provides financial protection during serious illnesses, while the latter provides coverage in the event of a terminal diagnosis. Assessing individual needs and obtaining comprehensive insurance can provide peace of mind and support during challenging times.

Adequate research and consultation with professionals can help make informed decisions that align with personal circumstances and priorities.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is critical illness cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Critical illness cover is a type of insurance that provides a lump sum payment if the policyholder is diagnosed with a serious illness listed in the policy. It helps to alleviate financial burden during a health crisis.” } } , { “@type”: “Question”, “name”: “How does it differ from terminal illness cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Critical illness cover pays out upon diagnosis of a serious illness, while terminal illness cover pays out if the policyholder is diagnosed with a terminal illness that is likely to result in death within a specified time frame.” } } , { “@type”: “Question”, “name”: “Is critical illness cover necessary if I have terminal illness cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “While terminal illness cover provides support if faced with a terminal diagnosis, critical illness cover serves a different purpose by providing financial help when diagnosed with a serious, but not necessarily terminal, illness. Both coverages can complement each other to provide comprehensive protection.” } } , { “@type”: “Question”, “name”: “What are the key benefits of critical illness cover?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Critical illness cover offers financial security by providing a lump sum payment upon diagnosis of a serious illness, helping to cover medical expenses, household bills, or other financial obligations during a difficult time.” } } ] }

Leave a comment