Yes, endowment policies are related to life insurance and savings. Endowment policies combine life insurance with an investment component.

They provide a lump sum payout at the end of the policy term, offering a form of savings along with life insurance protection. As a policyholder, you make regular premium payments towards the policy, and upon maturity, you receive the accumulated amount.

Endowment policies can provide financial security for your loved ones in case of your death, as well as a savings vehicle for future needs. They are suitable for individuals looking for a disciplined way to save and protect their loved ones financially. However, it’s important to carefully review the terms and conditions before investing in an endowment policy to ensure it aligns with your financial goals and needs.

What Is An Endowment Policy

An endowment policy is a type of life insurance policy that provides both a savings and insurance component. It offers a lump sum payout after a specified term or upon the policyholder’s death. Understanding the essential features and benefits of an endowment policy is crucial for making informed financial decisions.

Definition

- Endowment policy combines savings and insurance elements

- Offers a payout at the end of the policy term or on death

Key Features

- Guaranteed lump sum payout at the end of the policy term

- Provides life insurance coverage for the policyholder

- Offers tax benefits on premiums paid

- Flexibility to customize the policy based on individual needs

:max_bytes(150000):strip_icc()/endowment_loan.asp-final-2fac3f4b39284f58beedff2c056576ff.jpg)

Credit: http://www.investopedia.com

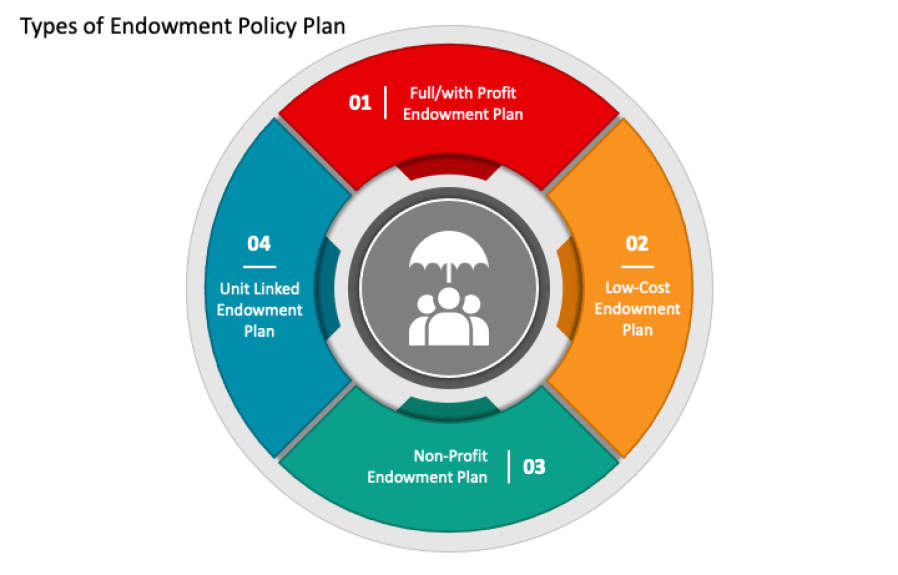

Types Of Endowment Policies

Types of Endowment Policies:

With-profit Endowment Policy

An endowment policy that offers profits to the policyholder based on the insurer’s performance.

Unit-linked Endowment Policy

An endowment policy where investments are linked to units in a fund, providing potential investment growth.

Benefits Of Endowment Policies

Endowment policies offer a diverse range of benefits related to financial security and long-term savings. These policies provide a lump sum payout upon maturity, along with life cover and potential bonuses. With endowment policies, individuals can make strategic investments while safeguarding their future financial goals.

Savings And Investment

One of the key benefits of endowment policies is that they provide a unique combination of savings and investment opportunities. With an endowment policy, you can set aside a portion of your income regularly, which acts as a disciplined savings mechanism. By doing so, you gradually build up a large sum of money over time, which can be used for various purposes, such as funding your child’s education, buying a new home, or even planning for your retirement.

Unlike traditional savings accounts that offer minimal returns, endowment policies come with an investment component. The premiums you pay are typically invested in a diversified portfolio of stocks, bonds, and other financial instruments. This allows your money to grow at a higher rate compared to regular savings accounts, where interest rates may be low. Over the long term, the returns from the investment component of an endowment policy can significantly enhance the value of your savings.

Life Insurance Coverage

Another significant benefit of endowment policies is the inclusion of life insurance coverage. While traditional savings accounts only focus on helping you accumulate funds, endowment policies provide an added layer of financial protection for your loved ones. In the event of your untimely demise, the policy ensures that your beneficiaries receive a lump sum payout, which can help them maintain their quality of life, meet financial obligations, and cope with the loss.

Life insurance coverage offered by endowment policies serves as a safety net, providing peace of mind for you and your family. It ensures that even in the face of adversity, your loved ones are protected financially. With the dual benefits of savings and life insurance coverage, an endowment policy offers a comprehensive solution to your financial planning needs.

Credit: http://www.westernsouthern.com

Factors To Consider Before Investing In An Endowment Policy

When considering investing in an endowment policy, there are several crucial factors to keep in mind. Endowment policies are long-term savings plans that provide a combination of insurance coverage and investment opportunities. To make an informed decision about whether an endowment policy is the right choice for you, it’s important to carefully evaluate certain key aspects.

Policy Term

The policy term refers to the duration of the endowment policy. Before investing, consider whether the policy term aligns with your long-term financial goals. Look for a policy term that provides adequate time for your investment to grow and mature.

Premiums

When contemplating an endowment policy, carefully assess the premiums involved. Understand the commitment and consistency required for premium payments. Ensure that the premium amount fits within your budget and won’t strain your finances.

Risks

Evaluate the potential risks associated with the endowment policy. Understand the level of risk involved in the underlying investments and how it may affect the policy’s performance over time. Be aware of any potential financial exposure you may face.

Returns

Examine the potential returns offered by the endowment policy. Consider the projected growth of your investment over the policy term. Assess the anticipated returns and compare them to other investment options to ensure the policy offers a competitive rate of return.

Comparing Endowment Policies With Other Investment Options

Endowment policies are a popular investment option, but are they the best choice for your financial goals? Let’s explore the pros and cons of endowment policies by comparing them with other investment options. Understanding how endowment policies stack up against alternatives like fixed deposits and mutual funds can help you make an informed decision about where to invest your money.

Fixed Deposits

Fixed deposits, also known as term deposits, are a low-risk investment option offered by banks and financial institutions. They provide a guaranteed return over a fixed period, typically ranging from a few months to several years. The interest rates on fixed deposits are relatively stable and can often be higher than those offered by savings accounts. However, the returns may not always keep pace with inflation, which can impact the purchasing power of your savings over time. Additionally, fixed deposits lack the potential for higher returns that other investment options, such as mutual funds, can offer.

Mutual Funds

Mutual funds are investment vehicles that pool money from multiple investors to invest in a diversified portfolio of stocks, bonds, or other securities. They offer the potential for higher returns than traditional savings accounts or fixed deposits, but also come with a higher level of risk. Mutual funds are subject to market fluctuations, and there is no guarantee of returns. Nevertheless, they provide an opportunity for capital appreciation over the long term, making them a popular choice for those seeking to grow their wealth. On the downside, mutual funds also come with management fees and other expenses, which can eat into your overall returns.

:max_bytes(150000):strip_icc()/endowment.asp-final-4f4dec28b91946f6803202501b923af6.jpg)

Credit: http://www.investopedia.com

Understanding Surrender Value And Maturity Benefits

An endowment policy provides surrender value and maturity benefits for policyholders. Understanding these benefits is crucial for those considering this type of policy.

Understanding Surrender Value and Maturity Benefits Calculating Surrender Value One of the key components of an endowment policy is the surrender value. The surrender value refers to the amount of money that policyholders receive when they choose to terminate their policy before its maturity date. It is important to understand how the surrender value is calculated as it can significantly impact your decision-making process. The formula for calculating the surrender value of an endowment policy is as follows: Surrender Value = (Total Paid-Up Value) – (Surrender Charges) The total paid-up value is the sum of all the premiums paid towards the policy, excluding any additional riders or bonuses. On the other hand, the surrender charges represent the fees deducted by the insurance company for early termination. These charges can vary and often reduce over time as the policy approaches its maturity date. Maturity Benefits Apart from surrender value, another crucial aspect of endowment policies is the maturity benefits. Maturity benefits refer to the sum of money that policyholders receive when their policy reaches its maturity date. Unlike surrender value, which is paid out when a policy is terminated prematurely, maturity benefits are received only upon the policy’s completion. Maturity benefits are calculated based on the policy’s sum assured and any applicable bonuses. The sum assured represents the guaranteed amount that the policyholder will receive at maturity, while bonuses, such as annual bonuses or terminal bonuses, are additional amounts that accumulates over the policy’s duration. To calculate the maturity benefits, the formula is as follows: Maturity Benefits = (Sum Assured) + (Accrued Bonuses) Understanding the surrender value and maturity benefits is crucial for making informed decisions regarding your endowment policy. Whether you are considering surrendering your policy or eagerly awaiting its maturity, knowing how these values are calculated will help you evaluate the financial implications and make the appropriate choices. In conclusion, the surrender value and maturity benefits are key aspects of an endowment policy. Understanding how to calculate the surrender value and knowing what to expect at maturity will ensure you can make informed decisions about your policy. Whether you decide to surrender your policy early or wait for its maturity, knowing the financial implications can help you plan for the future.Common Misconceptions About Endowment Policies

Endowment Policies Are Same As Term Insurance

Endowment policies involve savings element, unlike term insurance which offers pure protection.

Endowment Policies Are Only For Tax Savings

Endowment policies provide both savings and life insurance, not just for tax benefits.

Tips For Choosing The Right Endowment Policy

An endowment policy is a long-term investment that combines savings and life insurance in a single package. When it comes to choosing the right endowment policy, careful consideration is essential. Here are some important tips to help you make an informed decision:

Assessing Financial Needs

Begin by assessing your current financial situation and future goals. Determine the amount of coverage you need and the duration of the policy. Consider your financial responsibilities and how much you can afford to invest.

Reviewing Policy Terms And Conditions

Review the terms and conditions of the endowment policy carefully. Pay attention to the maturity benefits, premium payment terms, surrender value, and any additional features or riders included in the policy.

Comparing Multiple Policies

It is crucial to compare multiple endowment policies from different insurance providers. Make sure to evaluate the benefits, rates of return, charges, and reputation of the insurance company before making a decision.

Frequently Asked Questions For Are Endowment Policy Related

What Is An Endowment Policy?

An endowment policy is a life insurance contract that pays a lump sum after a specific term or on the death of the policyholder. It combines life insurance coverage with an investment component, offering a savings scheme. This provides a financial cushion for family members in case of the policyholder’s demise.

How Does An Endowment Policy Work?

An endowment policy works by providing life insurance coverage while also accumulating a cash value over time. The policyholder pays regular premiums, which are invested by the insurance company. At the end of the policy term or upon the policyholder’s death, the accumulated cash value is paid out.

It serves as a form of savings and protection.

What Are The Benefits Of An Endowment Policy?

The benefits of an endowment policy include providing financial security to the policyholder’s beneficiaries in the event of the policyholder’s demise. Additionally, it offers a disciplined savings avenue with the potential for attractive returns. Endowment policies also provide tax benefits, making them a popular choice for long-term financial planning.

Can An Endowment Policy Be Surrendered?

Yes, an endowment policy can be surrendered before the completion of its term. By surrendering the policy, the policyholder receives the surrender value, which is the accumulated cash value minus any applicable surrender charges. However, surrendering the policy early may result in financial penalties and loss of potential benefits.

Conclusion

Understanding the intricacies of endowment policies is crucial for anyone looking to safeguard their financial future. Not only do these policies provide a life cover component, but they also offer the opportunity for long-term savings and potential investment growth. By considering factors such as your financial goals, risk appetite, and time horizon, you can make an informed decision on whether an endowment policy is the right choice for your personal circumstances.

With professional advice and careful analysis, you can navigate the world of endowment policies and secure your financial well-being.

Leave a comment