Pension plans are retirement savings vehicles that help individuals save money for their future. These plans allow employees to contribute a portion of their income, often matched by their employer, with the funds accumulating over time to provide income during retirement.

Having a pension plan is a crucial component of financial planning as it offers a reliable source of income after retirement. By contributing to a pension plan, individuals can ensure a comfortable and secure future, with regular income payments that can supplement other retirement savings.

Pension plans typically offer various investment options, allowing individuals to choose the level of risk and potential return that aligns with their financial goals. Additionally, some pension plans may also offer additional benefits such as survivor benefits for a spouse or other beneficiaries. Whether through a workplace pension or an individual retirement plan, investing in a pension is a smart move towards a financially stable retirement.

Credit: http://www.kotaklife.com

Current State Of Pension Plans

Pension plans play a crucial role in ensuring financial security for individuals in their retirement years.

Defined Benefit Plans

Defined benefit plans guarantee a set amount of money to employees upon retirement based on factors like salary and years of service.

Defined Contribution Plans

Defined contribution plans involve employees and employers contributing to an individual account, with the retirement benefit depending on the account’s performance.

Recent years have seen a shift towards defined contribution plans due to their cost-effectiveness and flexibility.

Challenges Faced By Pension Plans

Pension plans play a crucial role in ensuring financial security for retirees. However, these plans are not without their challenges. In this section, we will explore some of the key challenges faced by pension plans.

Economic Uncertainty

One of the major challenges faced by pension plans is the unpredictable nature of the economy. Economic uncertainty can have a significant impact on pension fund investments, leading to volatile returns. This can jeopardize the solvency of pension plans and put retirees’ financial well-being at risk.

During economic downturns, pension funds may incur losses, making it difficult to meet the pension obligations. On the other hand, during periods of economic growth, the rising cost of living and inflation can erode the purchasing power of pension payments over time. These fluctuations make it challenging for pension plans to ensure a stable income for retirees.

Changing Demographics

Another challenge faced by pension plans is the changing demographics of the workforce. With an aging population and longer life expectancy, pension plans are dealing with a larger number of retirees and a smaller number of active workers contributing to the fund.

This demographic shift puts strain on the sustainability of pension plans, as the ratio of retirees to workers increases. As a result, pension plans may face difficulties in balancing the income and expenses, potentially leading to a shortfall in funds and affecting the ability to pay out pensions in the long term.

Moreover, the changing demographics also bring forth the issue of generational inequity. Younger generations may have to bear a heavier burden in supporting the growing number of retirees, which can create intergenerational tensions and disparities in the distribution of resources.

Risks To Retirement Savings

When it comes to planning for retirement, one of the most crucial aspects to consider is the potential risks that could impact your pension plan. These risks have the potential to significantly affect the amount of money you have available for your retirement.

Market Volatility

Market volatility can pose a significant risk to retirement savings. Fluctuations in the stock market can lead to sudden decreases in the value of your pension plan, which may result in a lower retirement income than anticipated. It’s essential to diversify your portfolio to mitigate the impact of market volatility.

Inadequate Funding

Inadequate funding is another risk that individuals face when it comes to retirement savings. This occurs when the pension plan or retirement account is not adequately funded, resulting in a shortfall of funds when the time comes to retire. It’s crucial to regularly review your contributions and ensure that you are saving enough to sustain your desired lifestyle during retirement.

Strategies To Safeguard Pension Plans

Strategies to Safeguard Pension Plans

Protecting your pension plan is crucial for a secure retirement. Implementing effective strategies can help to ensure the stability and growth of your pension funds. Here are some key strategies to safeguard your pension plan for the long term.

Diversification

Diversifying your pension plan is essential to reduce the risk of losses. By spreading your investments across various asset classes such as stocks, bonds, and real estate, you can mitigate the impact of market fluctuations on your pension funds. Diversification helps to create a balanced portfolio that can withstand turbulent market conditions while potentially generating higher returns.

Regular Monitoring

Regularly monitoring your pension plan is vital to assess its performance and make necessary adjustments. By actively reviewing the investment allocations and evaluating the fund’s growth, you can identify any potential risks or opportunities for improvement. This proactive approach allows you to make informed decisions and ensure that your pension plan remains aligned with your long-term financial goals.

Individual Retirement Savings Options

Saving for retirement is crucial in ensuring a secure financial future. For individuals who want to take control of their retirement savings, there are several options available. Two popular individual retirement savings options are the 401(k) and the IRA. Let’s take a closer look at each:

401(k)

The 401(k) is a retirement savings plan sponsored by employers, allowing employees to save a portion of their salary on a pre-tax basis. This means that the money you contribute to a 401(k) is deducted from your salary before taxes are applied. The advantage of this is that it reduces your taxable income, potentially lowering your overall tax liability. Employers often offer a matching contribution, where they match a certain percentage of the employee’s contribution, up to a specific limit. This is essentially free money that can significantly boost your retirement savings.

With a 401(k), you can choose how to invest your contributions from a selection of investment options provided by your employer. These options typically include stocks, bonds, and mutual funds. The earnings from your investments in a 401(k) grow tax-deferred until you withdraw them during retirement.

One important thing to note about 401(k) plans is that there are contribution limits set by the Internal Revenue Service (IRS). For 2021, the maximum amount you can contribute to your 401(k) is $19,500, with an additional $6,500 catch-up contribution allowed for individuals aged 50 and over.

Ira

An IRA, or Individual Retirement Account, is a retirement savings account that individuals can open independently. Unlike a 401(k), an IRA is not sponsored by an employer. There are two main types of IRAs: Traditional IRAs and Roth IRAs.

A Traditional IRA allows you to make tax-deductible contributions, meaning you can lower your taxable income for the year in which you make the contribution. The earnings from investments in a Traditional IRA grow tax-deferred until withdrawal during retirement. However, when you withdraw funds from a Traditional IRA in retirement, you will owe taxes on those distributions.

On the other hand, a Roth IRA offers tax-free growth potential. Contributions to a Roth IRA are made with after-tax dollars, meaning you don’t get a tax deduction for your contributions. However, when you withdraw funds from a Roth IRA in retirement, those withdrawals are tax-free. This can be especially advantageous if you anticipate being in a higher tax bracket during retirement.

Like the 401(k), there are contribution limits for IRAs. For 2021, the maximum annual contribution to an IRA is $6,000, with an additional $1,000 catch-up contribution allowed for individuals aged 50 and over.

Both the 401(k) and the IRA have their own advantages and considerations. Depending on your personal financial situation and goals, one option may be more suitable for you than the other. It is important to carefully evaluate your options and consider factors such as employer matching contributions, tax implications, and investment choices when deciding which individual retirement savings option is right for you.

Credit: http://www.iciciprulife.com

Role Of Government In Pension Security

Ensuring pension security is crucial, and governments play a pivotal role in safeguarding pension plans. Let’s delve into how governments ensure the pension security of citizens.

Regulatory Framework

Governments establish regulatory frameworks to supervise and regulate pension plans, ensuring compliance and protecting beneficiaries.

Safety Nets

Governments provide safety nets to protect pensions in case of financial instability or bankruptcy of pension providers.

Importance Of Financial Planning

Financial planning plays a crucial role in securing a stable and comfortable future. It involves making strategic decisions to effectively manage our money and achieve our financial goals. When it comes to retirement, having a well-thought-out financial plan is essential, and a significant aspect of that plan is the pension plan. In this section, we will discuss the importance of financial planning in relation to pension plans.

Early Planning

Starting early is key when it comes to financial planning for retirement. The earlier we begin saving and investing, the more time our money has to grow. By starting early, we can take advantage of the power of compound interest, allowing our investments to multiply over time. This gives us a higher chance of building a substantial pension fund and enjoying a comfortable retirement.

Additionally, starting early allows us to set realistic retirement goals and create a step-by-step roadmap to achieve them. By engaging in early planning, we can account for unexpected expenses, inflation, and potential market fluctuations, ensuring that we are well-prepared for any eventuality.

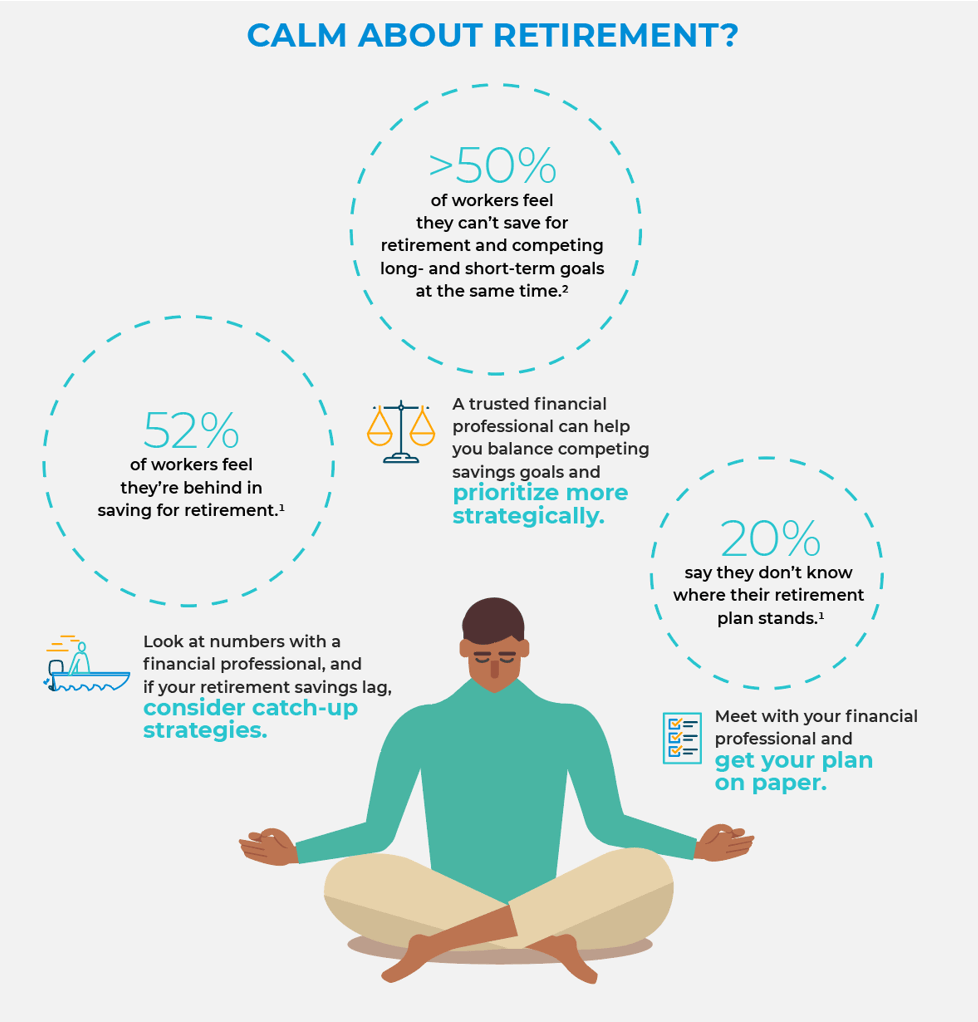

Professional Guidance

While it is possible to create a financial plan on our own, seeking professional guidance can greatly enhance our chances of success. Financial advisors can provide valuable insights and personalized recommendations tailored to our unique financial situation and retirement goals.

These professionals can help us analyze our current financial status, project our future needs, and make informed decisions regarding our pension plan and other investment options. Their expertise can help us navigate complex financial concepts, optimize our investments, and mitigate potential risks.

By working with a financial advisor, we can ensure that our pension plan aligns with our long-term goals and that we are making the most of the available resources. Their objective guidance allows us to approach financial planning with confidence and make informed decisions that optimize our retirement prospects.

Credit: http://www.pacificlife.com

Conclusion & Future Outlook

Pension plans play a crucial role in providing financial security for individuals during their retirement years. As we navigate through an ever-changing world, it’s essential to stay in tune with emerging trends and long-term strategies for optimizing pension plans. In this section, we will delve into the future outlook of pension plans, exploring emerging trends and long-term strategies to ensure a robust and steady retirement fund.

Emerging Trends

Keeping abreast of emerging trends is paramount in shaping the future of pension plans. Technology integration, ESG investing, and personalization are emerging as significant trends in the pension landscape. Leveraging technology to streamline pension management processes, integrating ESG factors into investment decisions, and providing personalized pension options are pivotal for enhancing the efficiency and appeal of pension plans.

Long-term Strategies

Employing steadfast long-term strategies is instrumental in ensuring the sustainability and growth of pension plans. Diversification of investment portfolios, actuarial risk management, and innovative product development are imperative for long-term success. By diversifying investments, effectively managing actuarial risks, and innovating new products tailored to evolving retirement needs, pension plans can adapt and thrive amidst changing economic landscapes.

Frequently Asked Questions Of Are Pension Plan

What Are Pension Plans?

A pension plan is a retirement investment that provides a steady income post-retirement. It’s a long-term savings strategy for financial security.

How Do Pension Plans Work?

Pension plans work by employees and employers contributing funds to a dedicated retirement account, which is then invested to grow over time, resulting in a regular income post-retirement.

What Are The Types Of Pension Plans?

There are two main types of pension plans: defined benefit plans, which provide a specific benefit upon retirement, and defined contribution plans, where the retirement benefit depends on the amount contributed and investment performance.

Why Should I Consider A Pension Plan?

A pension plan offers financial security and stability during retirement, ensuring a steady income flow when you are no longer working and dependent on a regular paycheck.

Conclusion

Considering the pros and cons of pension plans, it is evident that they offer financial security and peace of mind for retired individuals. With guaranteed income and potential tax advantages, pension plans can be a reliable source of retirement funds.

However, it is important to assess individual circumstances and explore alternative options to ensure the best financial future. Planning ahead, seeking professional advice, and diversifying investments are key factors for a successful retirement strategy. Ultimately, each individual should carefully evaluate their needs and goals to make the right decision about pension plans.

Leave a comment