Term insurance years are typically between 10-30 years, offering temporary coverage for a specific period. Term insurance provides financial protection for your loved ones in the event of your death.

It is a cost-effective way to ensure that your family is financially secure in case of any unforeseen circumstances. Term insurance offers a straightforward and affordable solution to protect your family’s financial future. By paying a premium for a specified term, you can provide a financial safety net for your loved ones.

It is essential to understand the terms of your policy and choose a coverage period that aligns with your family’s needs. Term insurance years allow you to tailor your coverage to meet your specific financial goals and obligations. Consider consulting with a financial advisor to help you determine the ideal term insurance plan for your family’s long-term security.

Credit: http://www.gg-insurance.com

Understanding Term Insurance

Welcome to our guide on Understanding Term Insurance.

What Is Term Insurance?

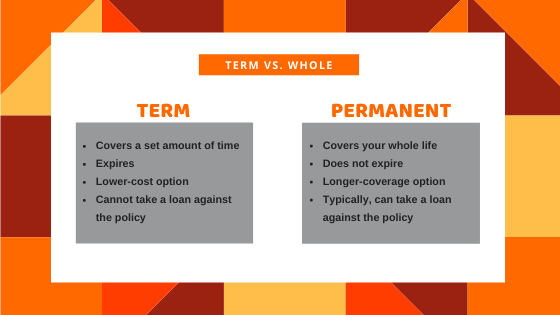

Term insurance is a type of life insurance that provides coverage for a specified “term” or period of time.

How Does Term Insurance Work?

When you purchase term insurance, you pay a premium for a set number of years in exchange for a death benefit that is paid out to your beneficiaries if you pass away during the term.

Pros And Cons Of Term Insurance

- Pros:

- Low premiums

- Simple and straightforward

- Provides coverage for a specific period

- Cons:

- No cash value

- Doesn’t provide coverage for life

- Renewal can be expensive after the initial term

Expiration Of Term Insurance

Term insurance offers financial protection for a specified period, but what happens when the term comes to an end?

Duration Of Term Insurance

Term insurance typically lasts for a specific number of years, such as 10, 20, or 30 years.

What Happens When Term Insurance Expires?

- When the term insurance expires, the coverage ceases, and no benefits are paid out.

- You have the option to renew the policy, but the premiums may increase significantly.

- If you do not renew or convert the policy, you lose the protection it provided.

Options After Term Insurance Expiration

When your term insurance reaches its expiration date, it’s crucial to consider your options carefully. Do you want to continue with the same policy, or explore different insurance avenues that might better suit your needs? Here are three options to consider:

Renewing your term insurance policy allows you to extend the coverage for an additional period. This can be a practical choice if you still require temporary coverage to protect your loved ones or financial obligations. The process is typically straightforward, involving a simple application and a premium adjustment. Remember that premiums may increase upon renewal, so carefully review and compare different quotes to find the best deal.

If you now find yourself needing coverage for the long term, converting your term insurance policy to a permanent life insurance plan could be a smart move. Permanent life insurance offers lifelong protection, builds cash value over time, and may even allow you to access that cash value for financial needs during your lifetime. Converting your policy usually requires submitting an application form and making any necessary adjustments to the coverage level and premium amount.

If neither renewing nor converting your policy seems appealing, it’s essential to research and consider other insurance options. Different types of insurance, such as whole life insurance, universal life insurance, or variable life insurance, may offer a better fit for your current circumstances and future goals. These policies often provide additional benefits beyond a death benefit, such as the potential for increased cash value or investment opportunities. Take the time to speak with a qualified insurance professional and discuss your needs to find the most suitable option for you.

Remember, the key is to assess your financial situation and evaluate the coverage required to protect your loved ones and fulfill your obligations. By carefully considering and exploring your options after term insurance expiration, you can make an informed decision that provides you with the peace of mind and security you need.

Credit: m.facebook.com

Factors To Consider

When deciding on term insurance years, it is crucial to consider your financial obligations, family’s needs, and long-term financial goals. Evaluating your coverage amount and term length for adequate protection is essential for a secure financial future. Additionally, comparing quotes from different insurers can help you find the most suitable policy for your specific circumstances.

Factors to Consider: When securing term insurance, there are several crucial factors that need to be taken into account. These include age and health, financial goals and obligations, coverage needs and lifestyle. These factors play a significant role in determining the suitable term insurance policy for an individual. Age and health: One of the primary considerations when selecting term insurance is age and health. Being younger and healthier often leads to lower premiums. Additionally, individuals with pre-existing health conditions may require special consideration when choosing a policy. Financial goals and obligations: Understanding one’s financial objectives is essential when purchasing term insurance. This includes considering debts, future expenses, and the needs of dependents. By evaluating these, individuals can ascertain the appropriate coverage amount to protect their loved ones financially. Coverage needs and lifestyle: Awareness of the lifestyle and coverage needs also play a crucial role in determining the ideal term insurance plan. Different individuals have different lifestyles that require varying levels of coverage. By considering this, individuals can select a policy that meets their specific needs. In conclusion, taking these factors into account can help individuals make well-informed decisions when purchasing term insurance.Renewing Term Insurance

When it comes to financial security, renewing term insurance is an important consideration. As the policy term nears its end, it’s crucial to understand the renewal process, requirements, as well as the pros and cons of renewing term insurance.

Renewal Process And Requirements

The renewal process of term insurance generally involves contacting the insurance provider to express your desire to renew the policy. Requirements may include updating personal information, health assessments, and paying the renewal premium. Missing the renewal deadline can lead to policy lapse, so it’s important to stay informed about the renewal date.

Pros And Cons Of Renewing Term Insurance

Renewing term insurance provides the benefit of continued financial protection for your loved ones. However, the premium for renewed term insurance may be higher, particularly if your health has deteriorated. Evaluating your current financial situation and insurance needs is crucial before deciding whether to renew.

Converting To Permanent Life Insurance

Converting to permanent life insurance is a smart financial move that can provide long-term benefits and greater financial security for you and your loved ones. Permanent life insurance offers lifelong coverage, a cash value component, and the option to build cash value over time. If you have a term life insurance policy that is about to expire or you’re simply looking to secure coverage for the rest of your life, converting to permanent life insurance might be the right choice for you.

What Is Permanent Life Insurance?

Permanent life insurance is a type of life insurance policy that provides coverage for your entire life as long as the required premium payments are made. Unlike term life insurance, which provides coverage for a specific number of years, permanent life insurance is designed to last a lifetime. One of the key features of permanent life insurance is its cash value component.

Benefits Of Converting To Permanent Life Insurance

Converting your term life insurance policy to a permanent one can offer several advantages:

- Lifelong coverage: By converting to permanent life insurance, you can ensure that you have coverage for your entire lifetime, regardless of any changes in your health or circumstances.

- Accumulation of cash value: When you convert to permanent life insurance, you have the opportunity to build cash value over time. This cash value can be accessed through policy loans or withdrawals and can provide a financial safety net or be used for future expenses.

- Greater flexibility: Permanent life insurance offers more flexibility compared to term insurance. You have the option to adjust your coverage amount or premium payments, depending on your changing needs and financial situation.

- Tax advantages: Permanent life insurance policies can provide tax advantages. The cash value growth is generally tax-deferred, meaning you don’t have to pay taxes on the growth until you withdraw it.

- Estate planning: If estate planning is a concern for you, converting to permanent life insurance can be a valuable tool. The death benefit can help cover any estate taxes, ensuring that your loved ones receive the full value of your estate.

Converting to permanent life insurance gives you the opportunity to secure lifetime coverage and enjoy the benefits of cash value accumulation, flexibility, tax advantages, and peace of mind. It’s important to evaluate your specific needs and consult with a financial professional to determine if converting to permanent life insurance is the right choice for you.

Exploring Other Insurance Options

Whole life insurance provides coverage for your entire life with a guaranteed death benefit. This type of policy also includes a cash value component that grows over time.

Universal life insurance offers flexibility in premium payments and coverage amounts. It allows you to adjust your policy as your needs change over time.

Combination policies, also known as hybrid insurance, combine features of different types of insurance into one policy. These policies offer both protection and investment components.

:max_bytes(150000):strip_icc()/Investopedia-terms-termlife-6451fde927474d4f8a81a5681efd393f.jpg)

Credit: http://www.investopedia.com

Frequently Asked Questions On Are Term Insurance Years

What Is Term Insurance And How Does It Work?

Term insurance is a type of life insurance that provides coverage for a specific period of time, known as the term. If the insured person passes away during the term, the beneficiaries receive a payout, also known as the death benefit.

It is a cost-effective way to secure financial protection for your loved ones.

What Is The Ideal Duration For A Term Insurance Policy?

The duration of a term insurance policy depends on various factors such as age, financial obligations, and future financial needs of the insured. Generally, the ideal duration is until retirement age or until all major financial obligations, like mortgage payments, are completed.

A financial advisor can help determine the best term length for you.

Can I Extend The Coverage Of My Term Insurance Policy?

Yes, some term insurance policies offer the option to extend coverage beyond the initial term. This is usually done through a policy renewal or conversion option. It’s important to review the terms of your policy and consult with your insurance provider to understand the available options for extending coverage.

What Happens If I Outlive The Term Of My Term Insurance Policy?

If you outlive the term of your term insurance policy, the coverage will expire without any payout. However, some policies may offer a conversion option or the ability to renew the policy for an additional term. It’s important to review your policy terms and explore available options as the term nears its end.

Conclusion

Term insurance years hold great significance in protecting the financial interests of individuals and their loved ones. With its affordable premiums and adaptable coverage periods, term insurance offers peace of mind in times of uncertainty. Its flexibility to cater to specific needs and the option to convert to a permanent policy make it a valuable investment.

Whether safeguarding your family’s future or covering debts, term insurance years make financial planning more secure and accessible. Take the time to explore your options and choose the best term insurance policy that aligns with your unique needs and circumstances.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is term insurance and how does it work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Term insurance is a type of life insurance that provides coverage for a specific period of time, known as the term. If the insured person passes away during the term, the beneficiaries receive a payout, also known as the death benefit. It is a cost-effective way to secure financial protection for your loved ones.” } } , { “@type”: “Question”, “name”: “What is the ideal duration for a term insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “The duration of a term insurance policy depends on various factors such as age, financial obligations, and future financial needs of the insured. Generally, the ideal duration is until retirement age or until all major financial obligations, like mortgage payments, are completed. A financial advisor can help determine the best term length for you.” } } , { “@type”: “Question”, “name”: “Can I extend the coverage of my term insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, some term insurance policies offer the option to extend coverage beyond the initial term. This is usually done through a policy renewal or conversion option. It’s important to review the terms of your policy and consult with your insurance provider to understand the available options for extending coverage.” } } , { “@type”: “Question”, “name”: “What happens if I outlive the term of my term insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “If you outlive the term of your term insurance policy, the coverage will expire without any payout. However, some policies may offer a conversion option or the ability to renew the policy for an additional term. It’s important to review your policy terms and explore available options as the term nears its end.” } } ] }

Leave a comment