Yes, home insurance companies can raise your premium based on various factors such as filed claims, changes in coverage, and market conditions. Welcome to the world of home insurance, where the safety and security of your abode are at the forefront.

While home insurance provides essential protection, you may wonder if your premium can ever go up. The short answer is yes. Home insurance companies have the right to increase your premium based on several factors. Understanding these factors can help you make informed decisions regarding your coverage.

We will delve into the reasons behind premium increases and the steps you can take to mitigate these costs. So let’s dive in and demystify the intricacies of home insurance premiums.

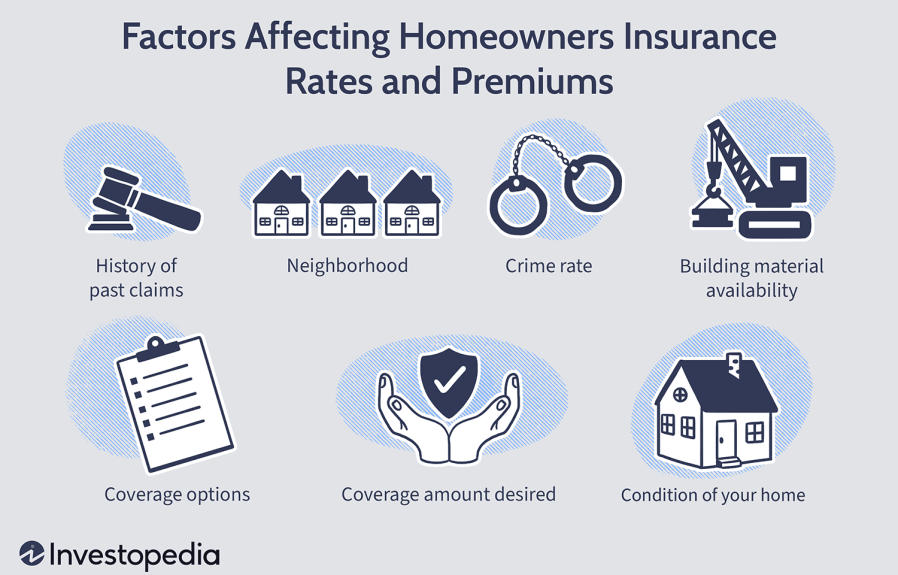

Factors Influencing Home Insurance Premiums

Location-based Risk Factors

Locations prone to natural disasters may lead to higher premiums due to increased risks.

Building Materials And Construction Type

Properties with fire-resistant materials may have lower premiums compared to those with higher risk materials.

Age And Condition Of The Property

The age and condition of a property can impact insurance costs, as older or poorly maintained properties present higher risks.

Claim History And Premium Increases

Raising the premium rates is a common practice among home insurance companies, and one of the factors they consider while determining the premium increase is the claim history of the policyholder. Your previous claims can have a direct impact on the amount you pay for your home insurance. Insurance companies analyze your claim history to assess the level of risk you pose as a policyholder. The number and severity of claims you have made in the past act as indicators of the likelihood of future claims. Here is an insight into how your claim history affects your premium rates and what you can expect as a policyholder when it comes to premium increases.

The frequency and severity of claims play a significant role in determining whether your premium will increase. Insurance companies analyze your claim history to determine if you are prone to making multiple claims or if your claims are of high severity. If you have a history of filing multiple claims for various issues such as water damage, theft, or fire, insurers may view you as a higher risk and increase your premiums accordingly.

Similarly, the severity of your claims plays a crucial role in determining the premium increase. If you’ve had major claims for significant incidents like extensive structural damage or total loss, insurers may consider you more likely to file future claims and adjust your premium accordingly. Keep in mind that insurance providers aim to align the premiums with the associated risk, and a history of frequent or severe claims can result in a higher premium for policyholders.

| Factors Considered by Insurance Companies: |

|---|

| Number of claims filed |

| Severity of claims |

| Types of claims |

Insurance companies assess these factors collectively to determine the potential risk you pose as a policyholder. Although filing legitimate claims is an essential aspect of utilizing your insurance coverage, it is crucial to understand that a history of multiple or severe claims can result in increased premiums in the future. Therefore, it’s vital to weigh the benefits of filing a claim against the potential long-term impact on your premium rates.

Methods Used By Insurance Companies To Adjust Premiums

When it comes to home insurance, many policyholders wonder whether insurance companies can raise their premiums. The answer is yes, as insurance companies have various methods to adjust premiums based on different factors. Understanding these methods can help homeowners make informed decisions about their insurance coverage. Let’s take a closer look at the methods used by insurance companies to adjust premiums.

Rate Increases

Insurance companies may implement rate increases as a way to adjust premiums. This could be due to factors such as inflation, increased construction costs, or changes in the overall risk profile of the insured property. In some cases, rate increases may also be influenced by broader economic trends or legislative changes impacting the insurance industry.

Policy Limit Adjustments And Deductibles Changes

Another method used by insurance companies to adjust premiums is by making changes to policy limits and deductibles. By raising policy limits or adjusting deductibles, insurers can modify the level of coverage and associated risk, consequently impacting the premium amount. Policyholders should review and understand any changes made to their policy limits and deductibles to assess the impact on their premiums.

Discounts And Credits

Insurance companies also adjust premiums through the provision of discounts and credits. Policyholders may qualify for discounts based on factors such as home security systems, multiple policy bundles, or favorable claims history. These discounts and credits can help lower the overall premium amount, making it important for homeowners to explore potential savings opportunities offered by their insurance provider.

“` Note: The content is crafted to be engaging and informative, focusing on the methods used by insurance companies to adjust premiums. The use of HTML syntax along with H3 headings, paired with concise and straightforward language, creates a user-friendly and SEO-optimized blog post section.:max_bytes(150000):strip_icc()/calculating-premium.asp_sketch_revised-a342201375164378925271cdad1f1929.png)

Credit: http://www.investopedia.com

Regulations Limiting Premium Increases

Regulations Limiting Premium Increases: Home insurance companies may be restricted in raising premiums due to state laws and insurance company policies.

State Laws And Regulations

- Each state has specific laws dictating how much home insurance premiums can increase.

- These laws help protect consumers from excessive rate hikes by insurance companies.

Insurance Company Policies

- Insurance companies set their own policies that may limit how often and by how much premiums can be raised.

- Some companies offer discounts or rewards for customers who have few or no claims.

Options To Manage Premium Increases

Home insurance companies have the right to raise your premium based on various factors such as the age and condition of your home, its location, and even your claims history. While these premium increases may be unavoidable, there are several options available to homeowners to manage and potentially reduce these increases.

Reviewing And Comparing Policies

One effective way to manage premium increases is by regularly reviewing and comparing policies from different home insurance companies. By doing so, you can ensure that you are getting the best coverage at the most competitive price. Take the time to understand the details of each policy and compare the coverage limits, deductibles, and exclusions.

Making Home Improvements To Reduce Risk

Another option to manage premium increases is by making home improvements that reduce the risk of potential damages. Home insurance companies often offer discounts for certain safety features such as security systems, smoke alarms, and reinforced windows and doors. By investing in these upgrades, not only can you enhance the safety of your home, but you may also be eligible for lower premiums.

Seeking Discounts Or Bundling Policies

Many home insurance companies provide various discounts that can help offset premium increases. These discounts may be available based on factors such as your age, occupation, or even your membership in certain organizations. Additionally, bundling multiple policies such as home and auto insurance with the same company can often lead to discounted premiums.

When facing premium increases from your home insurance company, exploring these options can be proactive steps to manage the costs and potentially reduce your premiums. By reviewing and comparing policies, making home improvements to reduce risk, and seeking discounts or bundling policies, homeowners can take control of their insurance expenses.

Credit: http://www.theglobeandmail.com

Communication About Premium Changes

Communication about Premium Changes is an essential aspect of home insurance, as it directly impacts a policyholder’s financial obligations. Home insurance companies must effectively communicate any changes to an individual’s premium, providing clear and transparent information. This ensures that policyholders are aware of any fluctuation in their home insurance costs and can make informed decisions about their coverage.

Notification Requirements

Home insurance companies are required to provide written notification to policyholders in advance of any premium changes. This notification should clearly outline the reasons for the increase, any additional coverage or changes in risk factors that have influenced the adjustment, and the date when the new premium will come into effect. The notification should be delivered through means agreed upon with the policyholder, such as email, physical mail, or through the insurer’s online portal.

Seeking Clarification

Policyholders have the right to seek clarification from their home insurance company regarding any premium adjustments. They can communicate directly with their insurance agent or contact the customer service department to request detailed information about the factors contributing to the change in premium. This provides policyholders with the opportunity to fully understand the reasons for the increase and to assess whether any adjustments can be made to mitigate the impact on their financial obligations.

Legal Recourse For Unreasonable Premium Increases

Can home insurance companies raise your premium without a valid reason? As a homeowner, it’s important to know your rights and the options available to you if you feel that your insurance company is unreasonably increasing your premium. In this section, we will explore two avenues of legal recourse that you can consider: filing a complaint with regulatory authorities or seeking legal advice.

Filing A Complaint With Regulatory Authorities

If you believe that your home insurance premium increase is unjustified, you have the right to file a complaint with regulatory authorities. These organizations are responsible for overseeing insurance companies and ensuring fair practices. To file a complaint, follow these steps:

- Gather all relevant documents, such as your policy, premium notices, and any communication with your insurance company regarding the increase.

- Research the regulatory authority that oversees insurance companies in your state.

- Visit the regulatory authority’s website and locate their complaints section.

- Follow the instructions provided, which may include filling out a complaint form or contacting a specific department.

- Provide all requested information and supporting documents to strengthen your case. Clearly explain why you believe the premium increase is unreasonable.

- Submit your complaint and wait for a response from the regulatory authority. They will investigate the matter and take appropriate action.

Seeking Legal Advice

If filing a complaint with regulatory authorities doesn’t yield satisfactory results, or if you simply wish to explore other options, seeking legal advice may be the next step. Consulting with an attorney who specializes in insurance law can help you understand your legal rights and potential courses of action. Here are a few key steps to follow:

- Research and find an attorney experienced in insurance law.

- Schedule a consultation to discuss your case and understand the options available to you.

- During the consultation, provide all relevant documents and explain the circumstances surrounding the premium increase.

- Listen to the attorney’s advice and ask any questions you may have.

- If you decide to proceed with legal action, work closely with your attorney to gather additional evidence and build a strong case.

- Follow your attorney’s guidance throughout the legal process.

Summary And Conclusion

Home insurance companies do have the ability to raise your premium based on various factors such as claims history and property value. It is important to review your policy regularly and compare rates from different providers to ensure you are getting the best coverage at the most affordable price.

Summary and Conclusion Understanding the Factors Influencing Premium Changes Factors like location and past claims impact home insurance premium changes. Diverse variables affect how much you pay yearly. Be mindful of these influences to anticipate premium adjustments effectively. Steps to Take in Response to Premium Increases Consult your insurance provider if you notice a sudden rise in premiums. Understand the reasons behind the increase and evaluate your coverage needs. Compare quotes from other companies to ensure you’re getting the best rate. Don’t hesitate to explore options and switch to save money.

Credit: http://www.tdi.texas.gov

Frequently Asked Questions On Can Home Insurance Companies Raise Your Premium

Can Home Insurance Companies Raise Your Premium Without Notice?

Yes, home insurance companies can raise your premium, but typically they must provide you with proper notice. The specifics of how much notice they must give can vary by state and policy, so it’s important to understand your rights as a policyholder.

Being proactive and staying informed about potential rate increases can help you avoid any surprises.

What Factors Can Cause An Increase In Home Insurance Premiums?

Several factors can lead to an increase in home insurance premiums, including a history of claims, changes in the value of your home, or an increase in the risk of your area. Additionally, if you make significant changes to your home or add additional coverage, such as a new pool or an extension, your premium may also go up.

How Can I Avoid A Home Insurance Premium Increase?

To potentially avoid a home insurance premium increase, you can look into bundling your policy with another type of insurance, improving your home’s security features, such as installing a security system, or maintaining a good credit score. Additionally, regularly reviewing and updating your policy can help ensure you are getting the best rates available.

Conclusion

Home insurance companies have the ability to raise your premium based on various factors such as claims history, changes in risk assessment, and market conditions. It’s important to regularly review your policy and shop around for competitive rates to ensure you’re getting the best coverage at the best price.

By staying informed and proactive, you can make informed decisions and potentially avoid unexpected premium hikes. Remember, knowledge is power in the world of insurance.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Can home insurance companies raise your premium without notice?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, home insurance companies can raise your premium, but typically they must provide you with proper notice. The specifics of how much notice they must give can vary by state and policy, so it’s important to understand your rights as a policyholder. Being proactive and staying informed about potential rate increases can help you avoid any surprises.” } } , { “@type”: “Question”, “name”: “What factors can cause an increase in home insurance premiums?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Several factors can lead to an increase in home insurance premiums, including a history of claims, changes in the value of your home, or an increase in the risk of your area. Additionally, if you make significant changes to your home or add additional coverage, such as a new pool or an extension, your premium may also go up.” } } , { “@type”: “Question”, “name”: “How can I avoid a home insurance premium increase?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To potentially avoid a home insurance premium increase, you can look into bundling your policy with another type of insurance, improving your home’s security features, such as installing a security system, or maintaining a good credit score. Additionally, regularly reviewing and updating your policy can help ensure you are getting the best rates available.” } } ] }

Leave a comment