Yes, you can obtain fire insurance in California. Living in California comes with its fair share of risks, and wildfires are among the most prevalent.

Protecting your home from potential fire damage is of utmost importance. The good news is that there are insurance companies in California that offer fire insurance policies to safeguard your property and belongings. Fire insurance can provide financial coverage for any losses resulting from fire-related incidents, including damage to your home, personal belongings, and additional living expenses.

It’s essential to research and choose a reputable insurance provider to ensure you have the necessary coverage in case of a fire emergency. By obtaining fire insurance, you can have peace of mind knowing your home is protected from the potential devastation caused by wildfires.

Credit: http://www.chhs.ca.gov

Understanding Fire Insurance In California

Types Of Fire Insurance

Standard Fire Insurance: Offers coverage for fire-related damages to the property.

Importance Of Fire Insurance

- Protects Property: Safeguards against fire damage.

- Financial Security: Assists in recovering losses from fire incidents.

- Peace of Mind: Provides assurance in case of fire emergencies.

Key Factors To Consider

When it comes to protecting your property and belongings from the ever-present risk of wildfires in California, fire insurance is an essential investment. However, navigating the world of fire insurance can be daunting without the proper knowledge. To ensure you make an informed decision, here are some key factors to consider:

Wildfire Risk Assessment

Before you choose a fire insurance policy, it is crucial to assess the wildfire risk specific to your location. Due to the diverse geography of California, certain areas are more susceptible to wildfires than others. Be sure to take into account factors such as proximity to forests, historical fire incidents, and local climate patterns. Consulting with local fire authorities or using online tools can help determine the level of risk associated with your property.

Coverage Options

Understanding the different coverage options available is vital when selecting your fire insurance policy. These options typically include dwelling coverage, which protects the structure of your property, and personal property coverage, which covers your belongings. Additionally, some policies may offer coverage for additional living expenses in the event that your home becomes uninhabitable due to a fire. It is essential to carefully review and compare the coverage limits, exclusions, and deductibles of different policies to find the one that best suits your needs.

In conclusion, when considering fire insurance in California, conducting a wildfire risk assessment and thoroughly understanding the coverage options available are key factors in making the right choice. By taking these factors into account, you can safeguard your home and belongings, providing peace of mind in the face of the unpredictable nature of wildfires.

Navigating Legal Requirements

When it comes to obtaining fire insurance in California, it’s crucial to navigate the legal requirements to ensure you have the necessary coverage in place. Understanding the state regulations and distinguishing between mandatory and optional coverage can help you make informed decisions for protecting your property.

Mandatory Vs. Optional Coverage

When acquiring fire insurance in California, it’s important to be aware of the distinction between mandatory and optional coverage. Mandatory coverage refers to the minimum requirements set by the state, while optional coverage provides additional protection that you can choose to include in your policy.

Understanding State Regulations

California has specific regulations in place to protect homeowners and business owners from fire-related risks. Familiarizing yourself with these regulations can ensure that your insurance policy aligns with the state’s requirements, giving you peace of mind in the event of a fire-related incident.

Choosing The Right Policy

When it comes to fire insurance in California, selecting the right policy is crucial. With the prevalence of wildfires in the state, it’s essential to ensure that your property and assets are adequately protected. Here are important factors to consider when choosing the right fire insurance policy:

Comparing Different Providers

Comparing and evaluating the offerings of various insurance providers is vital. Take the time to research and compare the coverage and rates offered by different companies in California. Look for reputable providers who have a strong track record of prompt claims processing and high customer satisfaction.

Customizing Coverage

When seeking fire insurance in California, it’s essential to customize your coverage to align with your specific needs. Whether you own a home, commercial property, or rental units, customizing your policy allows you to tailor the coverage to your unique requirements. Consider features like additional living expenses coverage, replacement cost coverage, and wildfire protection endorsements.

Dealing With Insurance Claims

Dealing with insurance claims can be a challenging process, especially when it comes to fire insurance in California. However, understanding the filing process and having some tips for a smoother claim experience can alleviate the stress and ensure you get the coverage you need in a timely manner.

Filing Process

When it comes to filing a fire insurance claim in California, there are important steps you should take to ensure a smooth process. Follow these guidelines:

- Contact Your Insurance Company: As soon as the fire occurs, notify your insurance company immediately. They will guide you on the steps to take and provide you with the necessary forms to initiate your claim.

- Document the Damage: Take photographs and videos of the damage caused by the fire. This visual evidence will serve as proof and make it easier for the insurance company to assess the extent of the loss.

- Keep All Receipts: Collect and keep all receipts related to fire damage repairs or temporary living arrangements. These receipts will help support your claim for reimbursement later.

- Cooperate Fully: Be ready to cooperate fully with the insurance adjuster assigned to your claim. They may request additional documents or information to process your claim effectively.

Tips For A Smoother Claim Experience

To ensure a smoother fire insurance claim experience, consider the following tips:

- Review Your Policy: Familiarize yourself with the details of your fire insurance policy. Understanding what is covered and what is not can help set realistic expectations.

- Document Your Belongings: Create an inventory of your belongings, including their values, before a fire occurs. This will make it easier to provide a comprehensive list of items lost or damaged in the event of a claim.

- Seek Professional Help: It can be beneficial to hire a public insurance adjuster who can advocate for you during the claims process. They have experience navigating insurance policies and know how to negotiate with insurance companies.

- Keep Records Organized: Keep all related documents, such as insurance policies, claim forms, and receipts, in a safe and easily accessible place. Staying organized will save you time and headaches when submitting your claim or following up on it.

By following these filing process guidelines and implementing the tips for a smoother claim experience, you can navigate the fire insurance claim process with confidence and increase your chances of getting the coverage you need in California.

Mitigating Fire Risks

Mitigating Fire Risks:

Home Safety Measures

It’s crucial to enforce preventive measures within your home.

- Regularly clean your gutters and roof.

- Install smoke alarms in key areas.

- Keep flammable materials away from the house.

Community Preparedness Efforts

Engage with your community to enhance fire preparedness.

- Organize neighborhood drills and training sessions.

- Create emergency response plans with neighbors.

- Stay informed about local fire risks and regulations.

Recent Developments And Challenges

The increasing frequency of wildfires in California due to climate change has posed new challenges for homeowners to access fire insurance.

The intensified heat waves and prolonged droughts have elevated the risk of fires, making insurance companies more cautious in underwriting policies.

Recent legislative changes in California have aimed to address the complexities of fire insurance availability and affordability.

New regulations have been enacted to ensure that insurance companies cannot deny coverage solely based on wildfire risk.

Credit: convoyofhope.org

Expert Advice And Resources

When it comes to obtaining fire insurance in California, it’s crucial to consult with professionals and utilize useful resources. Expert advice and resources play a significant role in navigating the complexities of fire insurance and ensuring that you have the necessary coverage in place. Here’s a breakdown of important considerations and valuable resources in this process.

Consulting With Professionals

Consulting with professionals is an essential step when seeking fire insurance in California. When addressing the unique fire risks in the state, it’s crucial to seek guidance from qualified insurance agents who have a deep understanding of California’s fire insurance landscape. These professionals can provide personalized recommendations and help tailor an insurance policy to meet your specific needs and circumstances.

Useful Websites And Tools

Utilizing useful websites and tools can significantly aid in the process of obtaining fire insurance in California. The California Department of Insurance website offers valuable information and resources related to fire insurance regulations and consumer rights. Additionally, utilizing online insurance comparison tools can help you identify and compare various fire insurance policies available in the market, enabling you to make an informed decision about your coverage.

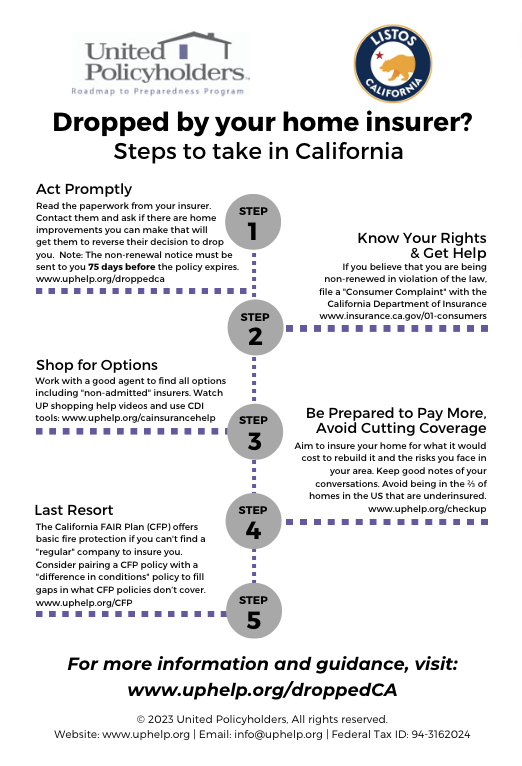

Credit: uphelp.org

Frequently Asked Questions For Can I Get Fire Insurance In California

How Important Is Fire Insurance In California?

Fire insurance is crucial in California due to the high risk of wildfires. It provides protection for your property and belongings in case of fire damage.

What Does Fire Insurance Cover In California?

Fire insurance typically covers damage to your home, personal belongings, additional living expenses during repairs, and liability protection. It’s essential for safeguarding your assets.

Are There Specific Requirements For Fire Insurance In California?

Yes, California has specific requirements for fire insurance coverage due to the state’s high wildfire risk. It’s important to understand these requirements to ensure adequate protection.

Can I Get Fire Insurance If I Live In A High-risk Area?

Yes, you can still obtain fire insurance if you live in a high-risk area in California. However, the premiums may be higher due to the increased risk.

Conclusion

If you reside in California and are concerned about protecting your property from fire damage, obtaining fire insurance is crucial. It ensures that you have financial assistance to rebuild and recover in case of fire-related emergencies. By consulting with insurance agents and understanding the coverage options available, you can find a suitable fire insurance policy that safeguards your investment and offers peace of mind.

With the right protection in place, you can navigate the challenges posed by wildfires and protect what matters most to you.

Leave a comment