The Canada Pension Plan (CPP) is a government-run program in Canada that provides a source of income to individuals upon retirement, disability, or death. It is mandatory for most Canadian employees and employers to contribute to the CPP fund, which is then invested to generate income for future pension payments.

The CPP aims to ensure financial security for individuals during their retirement years, and it is administered by the Canadian government’s social security agency, Service Canada. The amount individuals receive from the CPP is based on their contributions and the number of years they have made contributions, as well as their age at the time of eligibility.

History Of Canada Pension Plan

Establishment Of Cpp

The Canada Pension Plan was established in 1965 to provide retirement, disability, and survivor benefits to eligible contributors.

Evolution Of Cpp Over The Years

- In 1966, the CPP started providing retirement pensions to contributors.

- In 1971, disability benefits were added to the plan to support individuals unable to work due to a severe and prolonged disability.

- By the late 1970s, the CPP underwent reforms to enhance benefits and sustainability.

During the 1980s, changes were made to the CPP to adjust contribution rates and improve the financial stability of the plan.

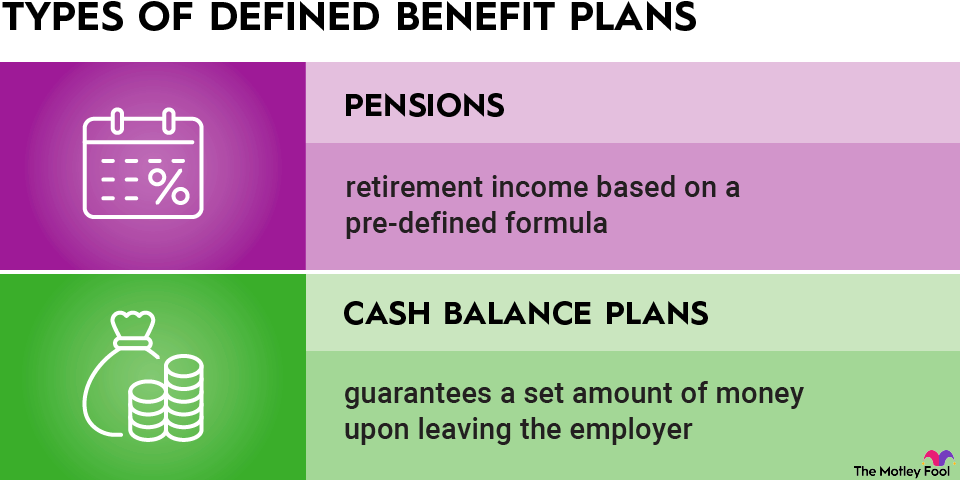

Credit: http://www.fool.com

Qualifications For Canada Pension Plan

The Canada Pension Plan (CPP) is a government-sponsored program that provides financial support to eligible Canadians and their families. To qualify for CPP benefits, there are certain qualifications you need to meet. These qualifications are divided into three main categories: age requirements, contribution requirements, and disability requirements. In this section, we will focus on the age requirements for the Canada Pension Plan.

Age Requirements

To be eligible for CPP benefits, you need to reach a specific age. The age at which you can start receiving CPP benefits is not fixed and can vary depending on your situation.

If you are applying for CPP retirement benefits, the earliest age you can start receiving them is 60. However, if you choose to start receiving benefits before reaching the age of 65, your monthly payments will be reduced. On the other hand, if you decide to delay receiving CPP benefits and wait until after the age of 65, your monthly payments will increase. It’s important to note that you can apply for CPP benefits as early as nine months before you want your payments to start.

Additionally, there is also a maximum age at which you can start receiving CPP benefits. The latest age you can start receiving CPP retirement benefits is 70. If you decide to delay receiving benefits beyond this age, you will not receive any additional credits or increases in your monthly payments.

Contribution Requirements

Another important qualification for CPP benefits is meeting the contribution requirements. To be eligible for CPP benefits, you need to have made enough contributions to the plan during your working years. These contributions are deducted from your earnings, and the amount you contribute each year is based on your income.

The required number of contribution years to qualify for CPP benefits is based on the average earnings in Canada. Every year, a set amount of earnings is considered the maximum pensionable earnings (YMPE). You need to contribute to the CPP for a minimum of one-third of the YMPE for each calendar year in order to earn a contribution credit. These contribution credits accumulate over time and determine your eligibility for CPP benefits.

It’s important to keep track of your contributions to ensure you have made enough to qualify for CPP benefits. Your annual CPP statement of contributions, which is mailed to you after the end of each year, provides detailed information on your contributions and how they affect your eligibility for CPP benefits.

Types Of Benefits Offered

Canada Pension Plan offers various types of benefits, including retirement pensions, survivor benefits, and disability benefits. These benefits provide financial support to Canadians throughout different stages of their lives.

Canada Pension Plan (CPP) offers various types of benefits to eligible individuals. These benefits include retirement pension, disability benefits, and survivor benefits. Each type of benefit serves a specific purpose, catering to the different needs of individuals in various life circumstances.Retirement Pension

Retirement pension is one of the primary benefits offered by the Canada Pension Plan. It is designed to provide a monthly income to individuals who have contributed to the CPP during their working years. The amount of the retirement pension is based on the individual’s contributions and the age at which they begin receiving the pension.Disability Benefits

The CPP also provides disability benefits to individuals who are unable to work due to a severe and prolonged disability. This benefit offers financial support to those who are no longer able to earn income due to their disability, helping them maintain a certain standard of living.Survivor Benefits

In the unfortunate event of a contributor’s death, the CPP offers survivor benefits to their eligible family members. These benefits aim to provide financial support to surviving spouses, common-law partners, and dependent children. The survivor benefits help ensure that the family members are financially supported after the contributor’s passing. “`Calculation Of Canada Pension Plan Benefits

The Canada Pension Plan (CPP) provides retirement, disability, and survivor benefits to eligible contributors and their families. Understanding the calculation of CPP benefits is crucial for individuals planning for retirement or seeking assistance due to disability.

Contribution Amounts Considered

The CPP benefits calculation takes into account the amount contributed by the individual over their working years. It considers the individual’s contributory period, which is the years the individual contributed to the CPP and the earnings during those years.

Maximum Benefits Calculation

The maximum CPP retirement pension is based on the individual’s contributions and the age at which the pension starts. Benefits are calculated using a formula that considers the average lifetime earnings and changes in the Yearly Maximum Pensionable Earnings (YMPE) set by the government.

Application Process For Cpp Benefits

The Canada Pension Plan (CPP) is a government-administered program that provides financial support to Canadians in their retirement. To be eligible for CPP benefits, individuals need to meet certain criteria and follow the application process. This section will outline the eligibility criteria and detail how to apply for CPP benefits.

Eligibility Criteria

To qualify for CPP benefits, individuals must meet the following eligibility criteria:

- Age: Applicants must be at least 60 years old to start receiving the CPP retirement pension or between 60 and 70 years old to choose when to start receiving it.

- Contributions: You must have made valid contributions to the CPP for at least one-quarter of the calendar years in your entire contributory period.

- Earnings: Applicants must have had earnings from work in Canada and made at least one valid contribution to the CPP.

- Residence: Individuals must have resided or be currently residing in Canada for at least four years after turning 18.

Meeting these eligibility criteria is crucial to be eligible for CPP benefits. Once you fulfill these requirements, you can proceed to the application process.

How To Apply

Applying for CPP benefits can be done online, by mail, or in person. Follow these steps to ensure a smooth application process:

- Gather necessary documents: Before starting the application, gather the required documents such as your Social Insurance Number, birth certificate, proof of residency, and employment history.

- Choose the application method: Decide whether you want to apply online, by mail, or in person at a Service Canada Centre.

- Complete the application: Fill out the CPP application form accurately and provide all the necessary information.

- Submit the application: Depending on your chosen method, submit the completed application form along with any supporting documents.

- Wait for processing: After submitting your application, wait for the CPP authorities to review and process your application.

- Receive your CPP benefits: Once approved, you will start receiving your CPP benefits, either through direct deposit or by mail.

It is important to follow these steps carefully and provide accurate information to avoid any delays or issues in receiving your CPP benefits.

Factors Affecting Cpp Benefits

Impact Of Other Pensions

Having other pensions can affect the amount of CPP benefits received.

Alex’s blog post discussed the CPP definition in detail.

Early Or Late Application Consequences

Applying early or late can impact the CPP benefits that you receive.

SEO experts recommend optimizing content for search engine ranking.

Cpp Enhancement And Changes

CPP Enhancement and Changes: The Canada Pension Plan (CPP) has seen proposed enhancements and recent updates to provide improved benefits to Canadians.

Proposed Enhancements

The proposed enhancements to the CPP aim to increase the retirement benefits that Canadians receive.

Recent Updates

Recent updates to the CPP ensure that it continues to meet the evolving needs of Canadians.

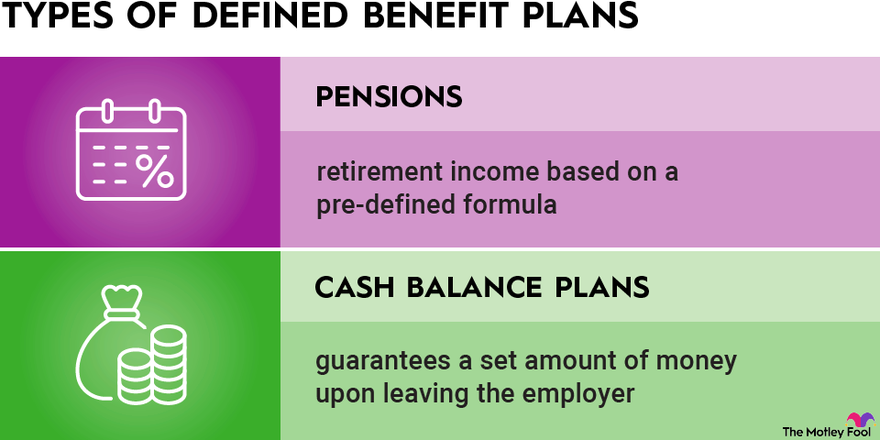

Credit: http://www.fool.com

Managing Cpp Benefits

Managing your Canada Pension Plan (CPP) benefits is an important aspect of planning for your retirement. By understanding the tax implications and options for receiving payments, you can make informed decisions to maximize your CPP benefits.

Tax Implications

Understanding the tax implications of CPP benefits is crucial for effective financial planning. CPP benefits are taxable, and the amount you receive may impact your tax liability. It’s important to consider the potential tax consequences when budgeting for your retirement income.

Options For Receiving Payments

When it comes to receiving CPP payments, individuals have several options to choose from. You can start receiving CPP as early as age 60 or defer it until age 70, with corresponding adjustments to the amount of benefits you’ll receive. Additionally, you have the option to receive a lump sum payment or choose a monthly payment schedule.

:max_bytes(150000):strip_icc()/retirement-planning.asp-FINAL-ed21279a08874c54a3a0f4858866e0b6.png)

Credit: http://www.investopedia.com

Frequently Asked Questions For Canada Pension Plan Definition

What Is The Canada Pension Plan?

The Canada Pension Plan (CPP) is a social insurance program that provides retirement, disability, and survivor benefits to eligible contributors and their families. It is a valuable source of income for Canadians during their retirement years.

Who Is Eligible For Canada Pension Plan?

Workers in Canada who have made contributions to the CPP and their employers are eligible for CPP benefits. Self-employed individuals who have contributed to the CPP are also eligible. Additionally, certain criteria must be met to qualify for CPP benefits.

How To Apply For Canada Pension Plan Benefits?

To apply for Canada Pension Plan benefits, applicants can do so online, by mail, or in person at a Service Canada office. The necessary documents and information must be provided to ensure a smooth and efficient application process.

What Is The Canada Pension Plan Contribution Rate?

The contribution rate for the Canada Pension Plan is set at a specific percentage of an individual’s pensionable earnings. Employers and employees both contribute to the CPP, and the contribution rate may change over time based on regulations and policies.

Conclusion

The Canada Pension Plan (CPP) is a government-sponsored program designed to provide retired Canadians with a stable income. By contributing a portion of our earnings throughout our working years, we can ensure financial security in our retirement. The CPP ensures that all Canadians can retire with dignity and peace of mind.

Start planning for your future today by learning more about the CPP and taking advantage of its benefits. Your retirement awaits!

Leave a comment