The Canada Pension Plan Investment Board (CPPIB) is a large institutional investor responsible for managing the investments of the Canada Pension Plan. By adhering to strict investment criteria and leveraging its global expertise, CPPIB seeks to generate sustainable, long-term returns for Canadian pensioners.

The Canada Pension Plan Investment Board (CPPIB) plays a crucial role in managing the investments of the Canada Pension Plan. As a large institutional investor, CPPIB follows stringent investment guidelines and utilizes its extensive global knowledge to generate sustainable and long-term returns for Canadian pensioners.

With a focus on responsible investing and risk management, CPPIB strategically allocates funds across a diverse range of asset classes and geographies. This approach ensures the preservation and growth of the pension fund, ultimately benefiting the pensioners who rely on it for their financial security. With a strong track record and commitment to excellence, CPPIB continues to serve as a leading investment institution in Canada.

History Of Cppib

Establishment And Evolution

The Canada Pension Plan Investment Board (CPPIB) was established in 1997 as an independent entity to manage and invest funds on behalf of the Canada Pension Plan.

Initially focused on domestic investments, CPPIB has evolved over the years to become one of the largest and most influential global investors.

Key Milestones

- 2000: CPPIB expands its investment mandate to include international markets.

- 2006: The CPPIB surpasses $100 billion in assets under management.

- 2012: CPPIB opens its first international office in Hong Kong.

Credit: http://www.amazon.com

Strategic Investment Approach

The Canada Pension Plan Investment Board (CPPIB) takes a strategic and prudent approach to its investments, focusing on long-term value creation and sustainable growth. With a diverse portfolio and global investment focus, CPPIB employs a strategic investment approach that ensures the effective management and growth of the Canada Pension Plan (CPP) funds.

Diversification Strategy

CPPIB’s diversification strategy plays a crucial role in its investment approach. By investing in a wide range of asset classes across diverse sectors and geographies, CPPIB mitigates risk and maximizes returns. Through a robust risk management framework, CPPIB carefully balances its portfolio to include investments in equities, fixed income, real estate, infrastructure, and other alternative investments.

This diversification strategy not only offers stability but also provides resilience during market volatility. By spreading its investments across multiple industries and regions, CPPIB reduces exposure to any single economic or market risks, safeguarding the long-term sustainability of the CPP funds. This approach enables CPPIB to consistently deliver strong returns for the benefit of Canadian contributors and beneficiaries.

Global Investment Focus

CPPIB adopts a global investment focus to take advantage of attractive investment opportunities worldwide. Recognizing the potential for growth and value creation in emerging markets, CPPIB actively seeks investments in regions such as Asia, Europe, and Latin America. This global approach not only diversifies the portfolio but also exposes CPPIB to a broader range of investment prospects.

Furthermore, CPPIB’s global perspective allows it to leverage its expertise and network across different markets, gaining valuable insights and establishing fruitful partnerships. By investing internationally, CPPIB contributes to Canada’s economic growth and solidifies its position as a global leader in pension fund management.

In conclusion, the strategic investment approach of CPPIB, with its diversification strategy and global investment focus, serves as a foundation for ensuring the long-term sustainability and growth of the Canada Pension Plan funds. By making calculated and smart investment decisions, CPPIB strives to deliver strong returns while mitigating risk, ultimately benefiting the millions of Canadians who rely on CPP for their retirement.

Maximizing Returns

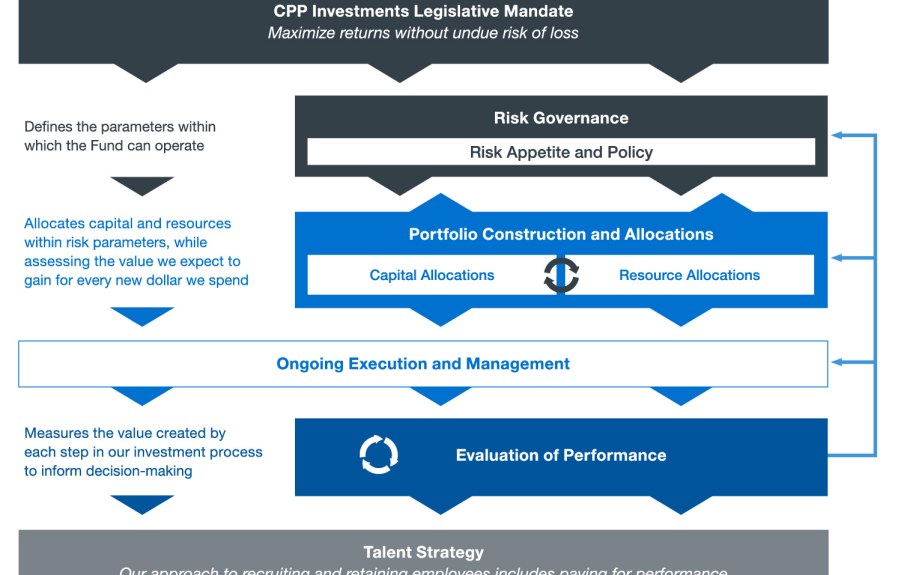

Canada Pension Plan Investment Board (CPPIB) has established itself as a global leader in pension fund management, with a focus on maximizing returns for its beneficiaries. Through strategic asset allocation and rigorous risk management practices, CPPIB aims to achieve sustainable long-term performance while mitigating potential downsides.

Asset Allocation Strategies

CPPIB employs a diversified approach to asset allocation, aiming to optimize returns while managing risk. By strategically allocating funds across various asset classes such as public equities, private equities, infrastructure, real estate, and fixed income, CPPIB seeks to capitalize on opportunities and navigate market fluctuations.

Risk Management Practices

CPPIB emphasizes robust risk management practices to safeguard its portfolio against potential threats. Through thorough due diligence, stress testing, and ongoing monitoring, CPPIB endeavors to identify and mitigate risks promptly, ensuring the preservation of capital and the achievement of long-term investment objectives.

:max_bytes(150000):strip_icc()/Modern-Portfolio-V2-9a0e2a7c92764f0cb194615eaedcdd76.jpg)

Credit: http://www.investopedia.com

Notable Investments

The Canada Pension Plan Investment Board (CPPIB) is known for its strategic and diverse investments across various sectors. The board’s notable investments in real estate holdings and infrastructure projects have made a significant impact on the global market.

Real Estate Holdings

CPPIB has a strong foothold in the real estate sector, with investments in prime properties globally. Acquiring high-quality assets in key markets across the world, CPPIB’s real estate portfolio boasts a diverse range of properties, including residential, office, retail, and industrial assets.

Infrastructure Investments

CPPIB has established itself as a major player in the infrastructure investment space with a focus on sustainable and long-term projects. The board’s infrastructure investments span across various sectors, including energy, transportation, and utilities, contributing to global development and economic growth.

Performance And Impact

The Canada Pension Plan Investment Board has shown strong performance and significant impact on the global investment landscape. With a strategic approach and diversified portfolio, it continues to deliver sustainable returns.

Historical Investment Returns

The Canada Pension Plan Investment Board (CPPIB) has consistently delivered impressive historical investment returns. Through its strategic investment approach, CPPIB aims to achieve long-term financial sustainability for the Canada Pension Plan (CPP). Over the years, CPPIB’s investment strategy has generated strong returns, ensuring that the CPP remains well-funded for future generations. CPPIB’s investment approach is guided by a diversified portfolio that spans various asset classes and geographies. By investing globally, CPPIB aims to capture opportunities in both developed and emerging markets, minimizing risk and maximizing returns. This approach has enabled CPPIB to navigate different market cycles, delivering consistent performance and growth. In terms of historical investment returns, CPPIB has an impressive track record. According to its latest annual report, CPPIB achieved a net investment return of X% over the past Y years. This robust performance underscores CPPIB’s commitment to managing and growing the CPP fund responsibly. CPPIB’s long-term investment horizon allows it to take advantage of investment opportunities that may deliver value over time. By balancing risk and reward, CPPIB aims to generate sustainable returns that contribute to the financial stability of the CPP. This commitment to delivering strong historical investment returns is a testament to CPPIB’s dedication to maximizing the value of the assets under its management.Economic Contributions

CPPIB’s investment activities have not only generated positive financial returns but have also made significant economic contributions. Through its investments, CPPIB plays a vital role in supporting economic growth, job creation, and innovation across various industries. CPPIB’s investments cover a wide range of sectors, including infrastructure, real estate, private equity, public equities, and more. These investments contribute to the development of key infrastructure projects, such as transportation networks, renewable energy facilities, and social infrastructure. By funding these projects, CPPIB helps stimulate economic activity and improve the quality of life for Canadians. Furthermore, CPPIB’s investments in companies, both domestic and international, play a crucial role in fostering innovation and entrepreneurship. By providing capital and support to businesses, CPPIB helps drive technological advancements, creating new products, services, and job opportunities. This support for innovation not only benefits the companies themselves but also contributes to the overall economic growth of the regions in which they operate. In addition, CPPIB’s commitment to responsible investing ensures that its economic contributions align with sustainable development goals. By considering environmental, social, and governance factors in its investment decisions, CPPIB promotes long-term economic growth that is both environmentally and socially responsible. In conclusion, the performance and impact of the Canada Pension Plan Investment Board are evident in its historical investment returns and economic contributions. Through its strategic investment approach, CPPIB aims to generate strong returns for the CPP while supporting economic growth and sustainability. By continually delivering robust performance and making responsible investment choices, CPPIB ensures the long-term financial stability of the CPP and contributes to the well-being and prosperity of Canadians.

Credit: http://www.cppinvestments.com

Future Outlook

The Canada Pension Plan Investment Board (CPPIB) has a promising future ahead as it continues to navigate the ever-evolving investment landscape.

Forecasted Investment Trends

Emerging markets and sustainable investments are projected to be key focuses for CPPIB in the coming years.

Technological advancements will play a significant role in shaping the investment strategies of CPPIB moving forward.

Expansion And Growth Strategies

CPPIB aims to diversify its portfolio by exploring opportunities in new sectors and regions globally.

The organization plans to enhance its risk management practices to ensure sustainable growth and resilience against market fluctuations.

Frequently Asked Questions Of Canada Pension Plan Investment Board

What Is The Canada Pension Plan Investment Board (cppib)?

The Canada Pension Plan Investment Board (CPPIB) is a professional investment management organization responsible for investing CPP funds.

How Does The Canada Pension Plan Investment Board Operate?

The CPPIB operates independently from the government and aims to maximize returns without undue risk.

What Types Of Investments Does The Canada Pension Plan Investment Board Make?

The CPPIB makes investments across public and private markets globally, including equities, fixed income, real assets, and infrastructure.

How Does The Canada Pension Plan Investment Board Contribute To The Canadian Economy?

The CPPIB’s investments contribute to the growth and sustainability of the Canadian economy by investing in various industries and sectors.

Conclusion

To sum up, the Canada Pension Plan Investment Board (CPPIB) has set itself apart as a global investment leader, managing pension funds with strong financial returns and a responsible investment approach. With a diversified portfolio and a long-term investment horizon, CPPIB is well-positioned to navigate the constantly evolving financial landscape.

Its commitment to sustainable investments and earning the trust of its beneficiaries makes it a key player in the investment world. Stay informed about CPPIB’s latest ventures and contributions to the global economy.

Leave a comment