No, you do not need full coverage insurance if you have gap insurance. Gap insurance specifically covers the difference between what you owe on your car loan and the actual cash value of your vehicle in the event of a total loss.

It does not provide coverage for damages or liabilities that occur in an accident, which is where full coverage insurance comes into play. While gap insurance can be a valuable addition to your policy, it should not be considered a substitute for full coverage insurance in terms of protection against accidents, theft, or other incidents.

It is important to understand the specific coverage and limitations of each type of insurance to ensure you have adequate protection.

The Importance Of Full Coverage Insurance

Coverage Provided By Full Coverage Insurance

Full coverage insurance provides comprehensive protection for your vehicle, covering damages from various incidents beyond a standard policy like theft, vandalism, or natural disasters.

Benefits Of Full Coverage Insurance

- Peace of mind that your vehicle is protected

- Financial security in case of accidents or theft

- Ability to repair or replace your car without major out-of-pocket expenses

- Comprehensive coverage for a wide range of potential mishaps

Credit: http://www.facebook.com

Understanding Gap Insurance

Gap insurance is an important coverage option that all car owners should be familiar with. It provides financial protection in the event of a total loss or theft of a vehicle. However, many people are unsure about whether they really need full coverage insurance if they have gap insurance. To clear up any confusion, let’s take a closer look at what gap insurance is and the coverage it provides.

What Is Gap Insurance?

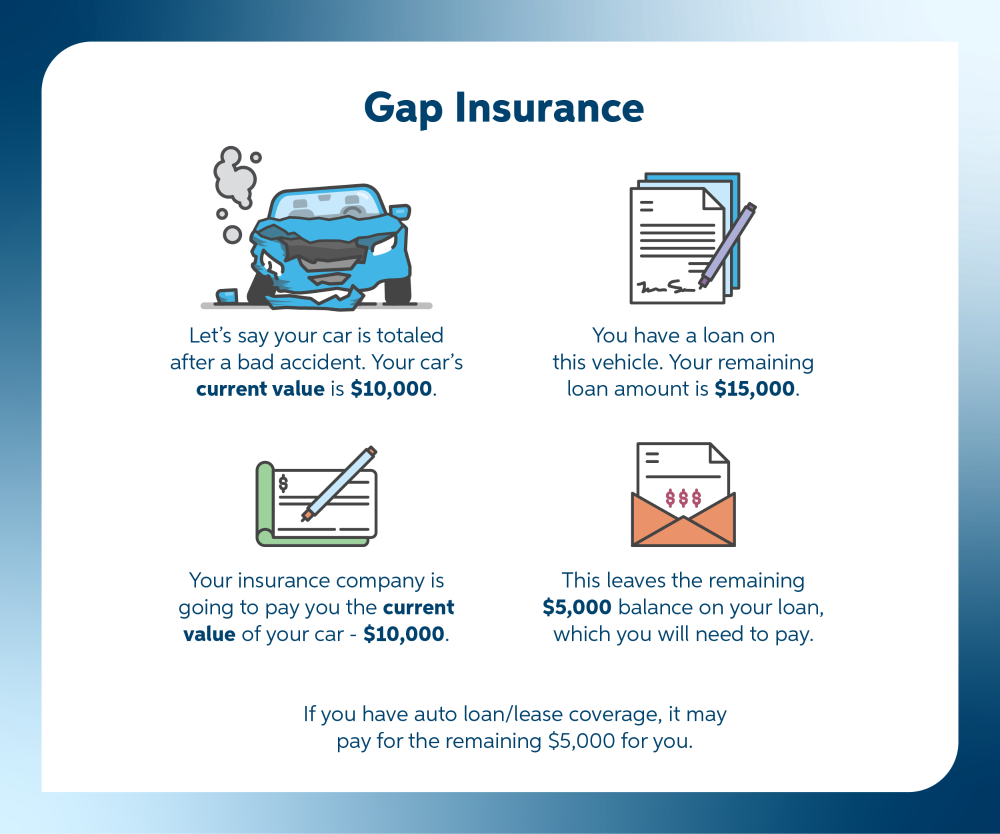

Gap insurance, also known as guaranteed asset protection insurance, is designed to bridge the gap between the amount owed on a car loan or lease and the vehicle’s actual cash value. For example, let’s say you purchased a brand new car for $30,000 and took out a loan to finance it. After a few months of driving, the car is involved in an accident and deemed a total loss. While your insurance company may cover the actual cash value of the car, which might be $25,000, you still owe $28,000 on your loan. This is where gap insurance comes in.

Gap insurance will cover the $3,000 difference between the car’s actual cash value and the amount left on your loan, ensuring that you are not left with a hefty bill to pay off. This can be particularly beneficial if you have a car loan with a high-interest rate or if you made a small down payment on the vehicle.

Coverage Provided By Gap Insurance

Now that we understand what gap insurance is, let’s talk about the coverage it provides. Gap insurance primarily covers the gap between the actual cash value of the car and the amount remaining on your loan or lease. It typically includes the following:

- Principal Balance Coverage: This covers the difference between the actual cash value of the car and the amount you owe on your loan or lease.

- Depreciation Coverage: Gap insurance may provide coverage for any additional depreciation that occurs after the purchase of the vehicle.

- Insurance Deductible Coverage: In some cases, gap insurance may cover your insurance deductible, reducing the out-of-pocket expenses you would have to pay.

It’s important to note that gap insurance doesn’t cover everything. It generally doesn’t cover regular car insurance deductibles, mechanical repairs, or any other outstanding debts you may have related to the vehicle.

In conclusion, while gap insurance provides valuable financial protection in the event of a total loss or theft of a vehicle, it does not replace the need for full coverage insurance. Full coverage insurance, which includes liability coverage, collision coverage, and comprehensive coverage, is still necessary to protect against damages, injuries, or other incidents that may occur while driving your car. By having both gap insurance and full coverage insurance, car owners can ensure they have comprehensive protection for their vehicle and financial well-being.

Differences Between Full Coverage And Gap Insurance

Understanding the contrast between full coverage and gap insurance is crucial to making informed decisions about your insurance needs. Let’s delve into the coverage comparison and cost differences between these two types of insurance, helping you determine whether you may need both.

Coverage Comparison

Full coverage insurance typically includes liability, comprehensive, and collision coverage, offering a wide-ranging protection for your vehicle. It covers the costs associated with damages resulting from accidents, theft, vandalism, and natural disasters. On the other hand, gap insurance, short for guaranteed asset protection, specifically fills the gap between the amount you owe on your car loan and the actual cash value of the vehicle if it’s totaled or stolen.

Cost Differences

While the cost of full coverage insurance can be higher due to its comprehensive nature, gap insurance is generally more affordable. The premium for gap insurance is usually a fraction of the cost of full coverage insurance. However, the cost variance is to be expected given the difference in coverage and the specific risks each insurance type addresses.

Credit: http://www.beckinsurance.com

When Full Coverage Insurance Is Sufficient

Driving Habits And Risk Assessment

Your driving habits and the level of risk you encounter on the road play a significant role in determining if you need full coverage insurance. If you have a cautious and low-risk driving style, you may find that full coverage is sufficient to protect you in most scenarios.

Types Of Vehicles

The type of vehicle you drive also influences whether full coverage insurance is adequate. Newer, higher-value vehicles often benefit from full coverage, as it provides comprehensive protection in the event of an accident or theft.

Instances Where Gap Insurance Is Essential

Explore the different instances where having gap insurance is essential to protect your financial investment. Whether you’ve recently purchased a new car or are currently leasing a vehicle, understanding these scenarios can help you make informed decisions regarding your insurance coverage.

New Car Purchases

When purchasing a new car, it’s crucial to consider the depreciation factor. As soon as you drive off the dealer’s lot, your vehicle starts losing value. This depreciation can result in a significant gap between the outstanding balance on your auto loan and the actual cash value of your car. Gap insurance becomes essential in such cases to bridge the financial gap in the event of theft, total loss, or accident where your vehicle is beyond repair.

Leasing Vehicles

Leasing a vehicle comes with its own set of considerations. While the monthly lease payments are typically lower than those of financing a new car, the car itself does not belong to you. In leasing agreements, you are responsible for any damages or losses that may occur during the lease term. Gap insurance protects you from potential financial burdens if the leased car is stolen or declared a total loss. It covers the difference between what you owe to the leasing company and the actual cash value of the vehicle, minimizing your liability.

Financial Protection And Peace Of Mind

Ensuring you have adequate insurance coverage is vital for protecting your financial well-being and providing peace of mind. In the event of an accident or theft, full coverage insurance combined with GAP insurance can offer comprehensive protection.

Scenario Analysis

Should you find yourself in a situation where your vehicle is declared a total loss, having full coverage insurance along with GAP insurance ensures that you are financially safeguarded. This combination can cover the outstanding balance on your auto loan in the event that the actual cash value of your vehicle is lower than what you owe.

Risk Mitigation

By having both full coverage insurance and GAP insurance, you can mitigate the financial risks associated with car accidents and theft. In the face of unforeseen circumstances, this dual coverage provides a safety net that prevents you from facing significant financial loss.

Potential Drawbacks Of Each Insurance Type

Limitations Of Full Coverage Insurance

Full coverage insurance may have high premiums for some drivers.

- It may not cover the entire cost of a new car.

- Deductibles can still be costly.

Drawbacks Of Gap Insurance

Gap insurance is mainly designed for new car owners.

- Coverage is limited to specific situations.

- Gap insurance may not be necessary for all car owners.

Making An Informed Decision

When it comes to deciding whether to invest in full coverage insurance when you already have gap insurance, it is crucial to make an informed decision. Considering various factors and seeking professional advice can help you determine the best insurance coverage for your needs. Below are some essential steps to guide you in making this important decision.

Consultation With Insurance Provider

Before making any definitive decisions, it is advisable to consult with your insurance provider. Discussing your current coverage and understanding the benefits and limitations of your gap insurance can provide valuable insights. Your provider can also guide you in determining whether full coverage insurance is necessary in your unique circumstances.

Assessing Personal Needs And Circumstances

Every individual’s insurance needs are different, and therefore, it is crucial to assess your personal circumstances. Consider factors such as your driving habits, the value of your vehicle, and your financial capability to cover potential losses. By evaluating these aspects, you can make an informed decision on whether investing in full coverage insurance is a practical choice for you.

Credit: http://www.amazon.com

Frequently Asked Questions For Do I Need Full Coverage Insurance If I Have Gap

What Does Full Coverage Insurance Include?

Full coverage insurance typically includes liability, collision, and comprehensive coverage. It provides broader protection for your vehicle in various situations, offering peace of mind for drivers.

Can I Have Gap Insurance Without Full Coverage?

Yes, you can have gap insurance without full coverage. Gap insurance is designed to cover the “gap” between the amount you owe on your auto loan and the vehicle’s actual cash value.

Is Full Coverage Insurance Mandatory With Gap Insurance?

Full coverage insurance is not mandatory with gap insurance, but having comprehensive and collision coverage may provide added protection in the event of an accident or other unforeseen circumstances.

Conclusion

While gap insurance can be beneficial in covering the difference between your car’s actual cash value and what you owe on it, it does not provide complete coverage. Full coverage insurance offers additional protection for your vehicle, including coverage for theft, vandalism, and non-collision damages.

Consider your individual circumstances and consult with an insurance professional to determine the best coverage for your needs.

Leave a comment