Life insurance policies do work by providing financial protection to beneficiaries upon the insured individual’s death. In a world where unexpected events can occur at any time, having a life insurance policy ensures that loved ones are not burdened with financial difficulties when the insured passes away.

It offers a way to replace lost income, cover funeral expenses, pay off debts, and provide security for the future. Life insurance policies provide peace of mind, knowing that loved ones are protected even in the event of the unexpected.

Whether it’s term insurance, whole life insurance, or universal life insurance, these policies can help safeguard a family’s financial well-being and provide a meaningful legacy for generations to come.

The Basics Of Life Insurance

Life insurance is a financial product that provides a payout to beneficiaries upon the insured individual’s death.

It offers peace of mind by ensuring financial protection for loved ones in the event of the policyholder’s passing.

Life insurance policies can be broadly categorized into two main types: term life insurance and whole life insurance.

- Term Life Insurance: Provides coverage for a specified term, typically ranging from 10 to 30 years.

- Whole Life Insurance: Offers coverage for the entire lifetime of the insured individual, along with a cash value component.

Each type of policy has its own features and benefits, catering to different financial needs and goals.

Benefits Of Life Insurance

Life insurance provides numerous benefits that can offer financial security and peace of mind for you and your loved ones. From ensuring financial stability for your family to potential tax advantages, life insurance policies can play a vital role in protecting your financial future.

Financial Security For Loved Ones

Life is unpredictable, and it’s essential to plan for the unexpected. One of the primary advantages of life insurance is the financial security it provides for your loved ones after your passing. When you have a life insurance policy in place, it ensures that your family members are protected and financially supported.

Financial stability: Life insurance payouts can replace lost income, cover outstanding debts, and help your family maintain their current standard of living. This financial stability can ease their burden during a difficult time and allow them to focus on healing and moving forward.

Covering vital expenses: Life insurance can also cover essential expenses such as mortgage payments, education costs, and daily living expenses. This ensures that your loved ones can continue their lives without major disruptions, providing them with the necessary resources to maintain stability.

Tax Advantages Of Life Insurance

Tax-free death benefit: One of the significant advantages of life insurance is the tax-free nature of the death benefit. If your beneficiaries receive a payout from your policy upon your passing, they typically don’t have to pay income tax on the proceeds, making it easier for them to manage their finances during a difficult time.

Tax-deferred cash value growth: Some types of life insurance policies, such as whole life or universal life, have a cash value component. The cash value grows over time on a tax-deferred basis, meaning you won’t have to pay taxes on the growth until you withdraw the funds. This tax advantage can be especially beneficial for individuals looking to accumulate wealth or plan for retirement.

Policy loans: In certain cases, policyholders can take out loans against the cash value of their life insurance policies. Unlike traditional loans, policy loans are generally tax-free, meaning you won’t have to pay taxes on the borrowed funds. This feature can provide you with a valuable financial resource during emergencies or unexpected expenses.

Life insurance policies are designed to protect you and your loved ones by offering financial security and potential tax advantages. By understanding the benefits they provide, you can make informed decisions and ensure the well-being of your family’s financial future.

Common Misconceptions About Life Insurance

Life Insurance Is Only For The Elderly

Many people believe that life insurance is something that only older individuals need to worry about. However, this is a misconception. Life insurance is important for people of all ages, including young adults and parents. Life insurance can provide financial security for your loved ones in the event of your unexpected passing, regardless of your age.

Life Insurance Is Expensive

Another common misconception is that life insurance is costly. Contrary to popular belief, life insurance policies can be quite affordable, especially if you start at a younger age and are in good health. There are various types of life insurance policies with different coverage options and premium costs, so it’s important to explore your options and find a policy that fits your budget and needs.

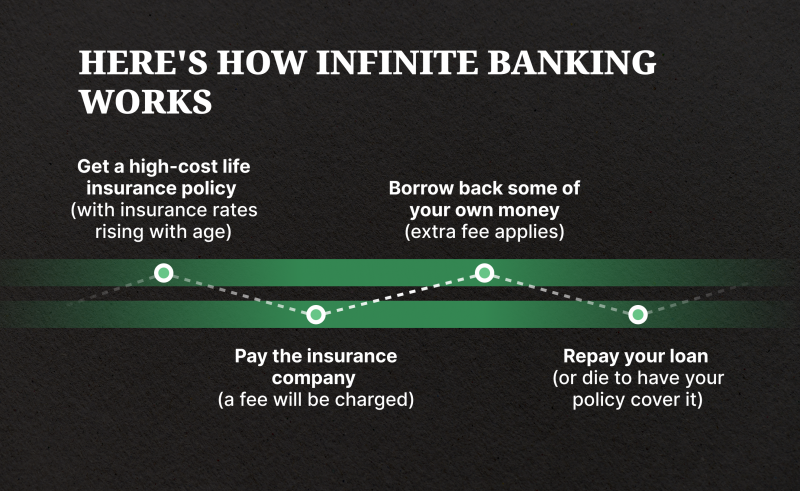

Credit: http://www.linkedin.com

How Life Insurance Policies Work

Life insurance policies work by providing financial protection to the policyholder’s beneficiaries in the event of their death. The policyholder pays regular premiums, and upon their passing, the insurer pays out a lump sum benefit to the beneficiaries. This financial safety net ensures the loved ones are financially secure during a difficult time.

Life insurance policies are designed to provide financial protection to your loved ones in the event of your death. Understanding how these policies work is crucial in making informed decisions about your financial future. In this section, we will explore the key aspects of life insurance policies, including premium payments and death benefit payout.

Premium Payments

When you purchase a life insurance policy, you’ll be required to make regular premium payments to the insurance company. These payments are usually made on a monthly or yearly basis and ensure that your policy remains active. The amount of your premium is determined by several factors, including your age, health condition, and the coverage amount you choose.

It’s important to note that the premium payments you make are not refundable and do not accumulate as cash value. They solely serve the purpose of keeping your policy active and providing financial protection for your beneficiaries.

In some cases, you may have the option to choose between different premium payment methods. For example, you can opt for a level premium, where the amount remains the same throughout the policy term, or a graded premium, where the cost increases gradually over time.

Death Benefit Payout

The death benefit is the amount of money that is paid out to your designated beneficiaries upon your death. This is the main purpose of a life insurance policy – to provide financial support to your loved ones when they need it the most.

The death benefit is typically tax-free and can be used by your beneficiaries in any way they see fit. Whether it’s paying off debts, covering funeral expenses, or securing their financial future, the death benefit provides your family with the resources they need during a difficult time.

It’s important to determine the appropriate death benefit amount when obtaining a life insurance policy. This amount should be enough to cover your outstanding debts, support your family’s living expenses, and ensure their financial stability in the long run. Considering factors such as inflation and future financial goals can help you determine an appropriate death benefit amount.

| Pros of Life Insurance Policies | Cons of Life Insurance Policies |

|---|---|

|

|

Factors To Consider When Choosing A Life Insurance Policy

Factors to consider when choosing a life insurance policy include your financial needs, age, health condition, and long-term goals. Research and compare different policies to ensure you find one that works best for you.

Coverage Amount

Adequate coverage ensures your loved ones are financially secure.

Term Length Vs. Permanent Coverage

Choosing between temporary and lifelong security depends on your needs.

Consider the formula for calculating the coverage amount:

| Coverage Needs | Income Replacement | Debts and Expenses | Children’s Education |

|---|---|---|---|

| Calculation | Current annual income x number of years | Loan, mortgage, and final expenses | Estimated educational costs |

- Evaluate your current financial situation carefully.

- Consider your family’s future needs.

- Ensure the coverage amount aligns with your long-term goals.

Choose a policy that meets your financial needs and ensures your family’s well-being.

Alternatives To Life Insurance

While life insurance is a popular choice for financial security, there are also other options worth considering. Investment accounts and savings plans are two common alternatives to traditional life insurance. Let’s take a closer look at each of these options.

Investment Accounts

Investment accounts are a viable alternative to traditional life insurance. These accounts allow individuals to grow their assets over time through a variety of investment options, such as stocks, bonds, and mutual funds. Unlike life insurance, investment accounts do not typically include a death benefit. However, they offer the potential for greater financial growth and can serve as a valuable long-term asset.

Savings Plans

Savings plans are another alternative to life insurance. These plans allow individuals to set aside a portion of their income for future financial needs. Whether it’s for retirement, education, or emergency funds, savings plans offer flexibility and control over one’s finances. While they may not provide the same level of protection as life insurance, savings plans can help individuals build a financial safety net for themselves and their loved ones.

Myths Vs. Facts: Debunking Common Life Insurance Misconceptions

When it comes to life insurance, there are often many misconceptions that can prevent individuals from purchasing a policy. In this section, we will debunk some common myths and provide you with the facts about life insurance. Understanding these misconceptions can help you make an informed decision and ensure the financial security of your loved ones.

Life Insurance Is A Scam

One of the most common misconceptions about life insurance is that it is a scam. However, this couldn’t be further from the truth. Life insurance is a legitimate and essential financial tool that provides a safety net for your family in the event of your untimely demise.

Life insurance works by paying out a lump sum of money, known as the death benefit, to your beneficiaries when you pass away. This money can be used to cover funeral expenses, outstanding debts, mortgage payments, and provide financial support for your loved ones in your absence.

Some people may have heard stories of insurance companies not paying claims, which has resulted in the misconception that life insurance is a scam. While it’s true that insurance fraud exists, the majority of life insurance claims are paid out without any issues.

It’s important to do your due diligence before purchasing a policy, researching different insurers, and reading customer reviews. This will help you find a reputable insurance company that you can trust.

You Don’t Need Life Insurance If You’re Single

Another common misconception is that life insurance is only necessary for those who are married or have dependents. However, this is not entirely accurate. Even if you are single, life insurance can still provide valuable benefits.

Firstly, if you have any outstanding debts such as student loans or credit card bills, a life insurance policy can ensure that these financial obligations are taken care of after your passing. Without life insurance, your loved ones may be burdened with these debts.

Secondly, life insurance can serve as a financial tool for future financial goals. For example, if you have a mortgage and plan to buy a house one day, a life insurance policy can ensure that your mortgage is paid off in the event of your death.

Lastly, purchasing life insurance when you are young and healthy can be a smart financial decision. Life insurance premiums are typically based on factors such as age and health. By getting coverage early, you can lock in lower premiums that will remain the same throughout the duration of your policy.

In conclusion, life insurance is not a scam, and it can provide valuable benefits even if you’re single. Understanding these facts will help you make an informed decision about life insurance and secure the financial future of your loved ones.

Credit: liquidity-provider.com

Making Informed Decisions With Life Insurance

Understanding life insurance policies is crucial for financial security. It’s essential to consult with experts and keep policies up-to-date for optimal protection.

Consulting With Financial Advisors

Financial advisors help navigate the complexities of life insurance. They offer personalized guidance based on individual needs and financial goals.

Reviewing And Updating Your Policy Regularly

Regularly reviewing and updating your policy ensures it aligns with current circumstances. This proactive approach enhances coverage and adapts to life changes.

Credit: http://www.brightway.com

Frequently Asked Questions For Do Life Insurance Policies Work

Are Life Insurance Policies Worth The Investment?

Yes, life insurance policies are worth it as they provide financial protection for your loved ones in case of your untimely demise. It offers peace of mind and ensures that your family’s financial needs are taken care of.

How Does A Life Insurance Policy Work?

Life insurance policy works by paying a premium in exchange for a lump sum payment to your beneficiaries upon your death. It provides financial security to your loved ones, covering expenses such as funeral costs, debts, and ongoing living expenses.

What Are The Benefits Of Having A Life Insurance Policy?

Having a life insurance policy provides financial protection for your family and loved ones. It offers peace of mind, ensures their well-being, and helps cover expenses such as mortgage payments, education fees, and daily living expenses in your absence.

Conclusion

To recap, life insurance policies indeed work effectively in providing financial protection and peace of mind to individuals and their loved ones. By allowing beneficiaries to receive a lump sum payout, life insurance ensures that their future needs are taken care of, whether it be paying off debts, covering funeral expenses, or securing a stable financial future.

With various types of policies available, individuals can select one that best suits their unique circumstances and financial goals. Ultimately, life insurance serves as a crucial tool for safeguarding the financial well-being of individuals and their families.

Leave a comment