No, disability insurance does not end at 65. However, the benefits you receive may change depending on your age and the terms of your policy.

Disability insurance is designed to provide income replacement in the event that you are unable to work due to a disability. While many disability insurance policies have a maximum age at which benefits are paid out, it is not necessarily tied to the age of 65.

Instead, the age at which disability insurance benefits end can vary depending on the specific policy. It’s important to review the terms and conditions of your disability insurance policy to understand when your coverage will end and what benefits you are eligible to receive.

Understanding Disability Insurance

Definition Of Disability Insurance

Disability insurance provides protection in case of an injury or illness that prevents an individual from working.

Types Of Disability Insurance

- Short-Term Disability Insurance: Offers coverage for a limited period, usually up to six months.

- Long-Term Disability Insurance: Provides coverage for an extended period, sometimes until retirement age.

Credit: blog.adobe.com

Coverage Limits

Disability insurance provides crucial financial protection for individuals who are unable to work due to a disability. However, it’s important to understand that disability insurance coverage may have certain limitations. One such limitation is the age limit for disability insurance.

Age Limit For Disability Insurance

When it comes to disability insurance, age plays a significant role in determining coverage limits. Many disability insurance policies have an age limit for coverage, typically ending at the age of 65.

Reaching the age of 65 does not automatically mean that disability insurance coverage will cease. However, it is important to review the terms and conditions of the policy to fully understand the age limitations and how they may impact coverage.

Factors Influencing Coverage

Several factors can influence the coverage limits of disability insurance, regardless of age:

- Occupation: The nature of your occupation can affect the coverage you are eligible for. Some occupations may have higher risks of disability, and consequently, the coverage offered may be more comprehensive.

- Income: Disability insurance is usually designed to replace a percentage of your income in case of disability. The higher your income, the higher the coverage limit may be.

- Health: Your overall health and medical history can impact the coverage limits of disability insurance. Pre-existing conditions and certain health conditions may have exclusions or limitations within the policy.

- Policy Details: Different insurance providers may have varying terms and conditions for disability insurance coverage. It is essential to carefully review the policy and understand the coverage limits and any restrictions.

By considering these factors, you can gain a better understanding of how disability insurance coverage limits may be determined.

Impact Of Age On Disability Insurance

Disability insurance coverage typically ends at age 65 for most individuals, making it crucial to consider the impact of age on disability insurance. As people age, the risk of disability increases, making it essential to assess the need for alternative financial protection beyond the typical retirement age.

Impact of Age on Disability Insurance As individuals grow older, the impact of age on disability insurance becomes a critical consideration. Understanding how disability insurance may change after the age of 65 is essential for ensuring financial protection during retirement years. Challenges After Age 65 After reaching the age of 65, individuals may face certain challenges in maintaining their disability insurance coverage. Many disability insurance policies have an age limit, typically set at 65, after which coverage may terminate. This can leave individuals vulnerable to financial hardship if they experience a disability after reaching this age. The potential loss of coverage underscores the importance of evaluating options for coverage extension. Options for Coverage Extension Fortunately, there are options available to extend disability insurance coverage beyond the age of 65. Some insurance providers offer provisions for policyholders to continue coverage with adjusted terms and premiums. Additionally, individuals may have the opportunity to secure supplemental coverage or explore alternative insurance products that provide disability protection in later years. In conclusion, the impact of age on disability insurance necessitates proactive planning and consideration of available options for coverage extension. By understanding the challenges and exploring available solutions, individuals can mitigate the potential financial risks associated with disability during their retirement years.

Credit: http://www.cbpp.org

Planning For Retirement

Planning for retirement involves considering various financial aspects, including the continuation of disability insurance coverage. Understanding how disability insurance functions after the age of 65 is crucial for ensuring financial security during retirement. Let’s delve into the considerations for disability insurance in retirement planning.

Reviewing Disability Insurance Needs

As retirement approaches, it’s essential to review your disability insurance policy to assess whether it will continue to provide adequate coverage after the age of 65. Take into account any changes in income, expenses, and overall financial situation to determine if the existing coverage aligns with your retirement goals. Consulting with a financial advisor can help in understanding whether adjustments or supplemental policies are necessary to safeguard against potential financial risks in the post-retirement phase.

Supplementing Coverage Post-retirement

Supplementing disability insurance coverage post-retirement is a proactive approach to mitigate potential income loss due to disability. Consider acquiring a supplemental policy that extends coverage beyond the age of 65. This can provide additional protection and financial peace of mind during the later stages of retirement. It’s also important to explore other insurance options, such as long-term care insurance, which can further enhance the overall financial security during retirement.

Alternatives To Traditional Disability Insurance

While traditional disability insurance provides important coverage for individuals who become disabled before the age of 65, it’s essential to explore alternatives for those who are concerned about losing coverage after reaching retirement age. In this section, we’ll discuss two popular alternatives to traditional disability insurance to help you make an informed decision for your future.

Long-term Care Insurance

Long-term care insurance is a valuable option to consider when preparing for potential disabilities that may require long-term assistance with daily activities as you age. This insurance typically covers expenses associated with in-home care, assisted living facilities, nursing homes, and other related services.

Unlike traditional disability insurance, which focuses on income replacement, long-term care insurance primarily addresses the costs associated with ongoing care and support. It provides you with the financial resources necessary to maintain your quality of life, even if you aren’t able to perform certain activities independently.

When choosing a long-term care insurance policy, it’s important to carefully review the terms and conditions. Look for coverage limits, waiting periods, and any exclusions that may apply. By familiarizing yourself with these details, you can ensure that the policy aligns with your specific needs and preferences.

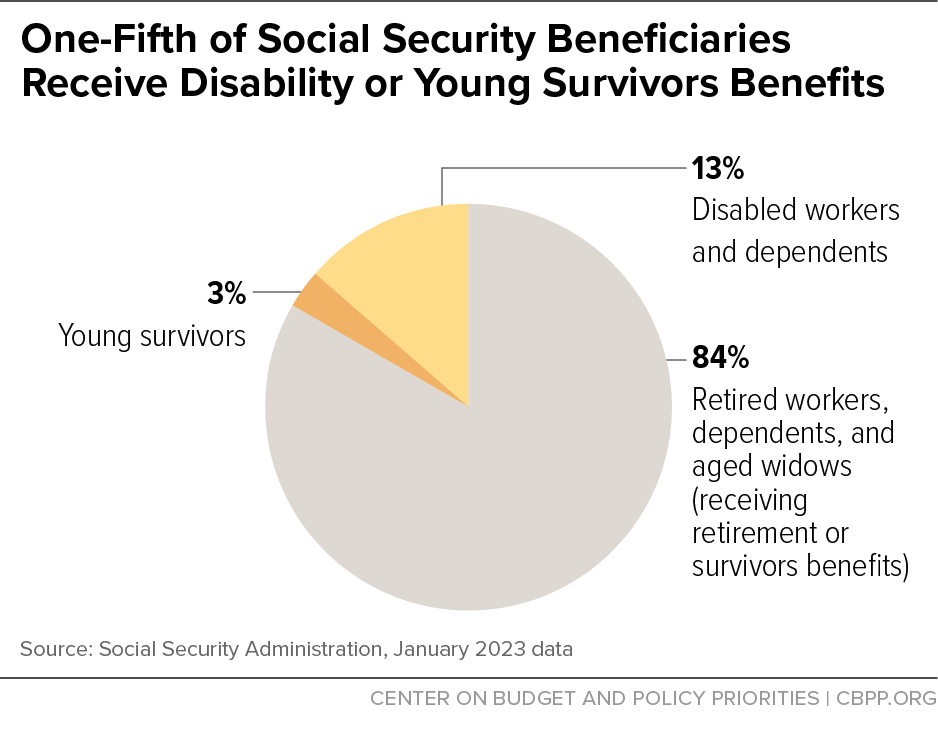

Social Security Disability Benefits

Social Security Disability Benefits, often abbreviated as SSDI, is another alternative to traditional disability insurance that can provide financial support for those who become disabled at any age, including after 65. This program is administered by the Social Security Administration and is available to individuals who have paid into the Social Security system through their employment.

SSDI benefits are based on the individual’s work history and the amount of Social Security taxes paid over the years. These benefits can help cover the costs of living expenses and medical care for individuals who are unable to work due to a disability.

It’s important to note that SSDI benefits require a waiting period after becoming disabled before you can start receiving payments. Additionally, eligibility criteria and the amount of benefits can vary depending on factors such as your work history and age at the time of disability.

Before relying solely on Social Security Disability Benefits as an alternative to traditional disability insurance, it’s crucial to understand the potential limitations and consider supplementing this coverage with other options, such as long-term care insurance, to ensure comprehensive protection for your future needs.

Legal Considerations

Individuals who have disability insurance and are approaching the age of 65 may wonder about their legal rights regarding coverage. It is essential to understand the protections in place to safeguard their benefits during this transitional period.

There are specific regulations and enforcement mechanisms that govern disability insurance beyond the age of 65. It is crucial for policyholders to be informed about how these rules apply to them as they navigate this stage in their coverage.

Ensuring Comprehensive Coverage

Disability insurance provides comprehensive coverage beyond the age of 65, ensuring financial protection for individuals in case of disability. With disability insurance, you can have peace of mind knowing that your income is safeguarded even after retirement age.

< p >Ensuring comprehensive coverage is crucial when it comes to disability insurance for individuals reaching the age of 65. It is essential to consult with financial advisors and customize disability insurance plans to provide the best protection. < p >Before reaching the age of 65, it’s important to consult with financial advisors to review your disability insurance. They can provide valuable insights on coverage options. < p >Customizing disability insurance plans based on individual needs ensures adequate coverage at age 65 and beyond. Tailoring the policy can enhance financial security.:max_bytes(150000):strip_icc()/retirement-planning.asp-FINAL-ed21279a08874c54a3a0f4858866e0b6.png)

Credit: http://www.investopedia.com

Frequently Asked Questions Of Does Disability Insurance End At 65

Is Disability Insurance Coverage Available After The Age Of 65?

Yes, disability insurance may continue after the age of 65 depending on the specific policy terms and conditions. Some policies have a specific age limit, while others may offer coverage for a longer period.

What Happens To Disability Insurance When You Turn 65?

At the age of 65, some disability insurance policies may expire, while others might have special clauses and provisions allowing coverage to continue. It’s important to review your policy details to understand how it applies to your situation.

Can I Purchase Disability Insurance After The Age Of 65?

Generally, it can be challenging to purchase new disability insurance after the age of 65. However, some insurers may offer limited options or specialized coverage. Discuss your specific needs with an insurance professional to explore available options.

Conclusion

To sum up, disability insurance does not necessarily end at the age of 65. While some policies may terminate at this age, others continue to provide coverage until retirement or even for life. It is crucial for individuals to carefully review their policy terms and conditions to understand the specific limitations and benefits.

Seeking professional advice can help in making informed decisions about disability insurance and securing financial protection for a lifetime.

Leave a comment