Yes, home insurance does automatically renew, typically on an annual basis. Home insurance policies commonly include an automatic renewal clause, ensuring that coverage continues without any gaps or interruptions.

This means that unless you cancel or make changes to your policy, it will renew automatically each year. Renewal premiums may vary depending on factors such as claims history, property value, or changes in coverage. Understanding your policy’s renewal process is crucial to avoid any surprises or unnecessary expenses.

It’s recommended to review your policy annually, assess your insurance needs, and compare quotes to make sure you have the best coverage at the most competitive rate. Taking proactive steps can help ensure you have the right protection for your home and belongings.

The Automatic Renewal Process

When it comes to home insurance renewal, the auto-renewal process ensures policy continuation without manual intervention. Home insurance policies typically automatically renew annually unless cancelled by the policyholder. Reviewing and comparing policies can help ensure the best coverage and rates.

How Home Insurance Automatic Renewal Works\

The Automatic Renewal Process: Home insurance automatically renews annually when policyholders agree to this feature. This process ensures continuous coverage without the need for manual renewal each year. \Pros And Cons Of Automatic Renewal\

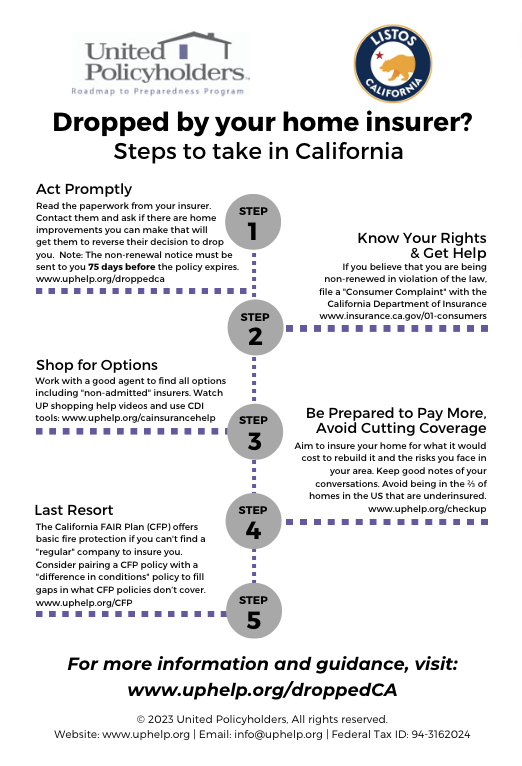

Credit: uphelp.org

Understanding Home Insurance Renewal

Home insurance is an essential aspect of protecting your property and belongings from unforeseen events. One question that often arises is whether home insurance automatically renews or if there are factors that impact the renewal process. In this blog post, we will explore the ins and outs of home insurance renewal and shed light on the factors that can impact this process. Understanding home insurance renewal can help you make informed decisions about your coverage and ensure you have the protection you need.

Factors Impacting Renewal

Several factors can influence whether your home insurance policy will be renewed. Understanding these factors can help you prepare and make any necessary adjustments to your coverage. Some common factors impacting renewal include:

- Claims History: Insurance companies take into account your claims history when deciding whether to renew your policy. A history of frequent claims or large claims may increase the likelihood of a non-renewal or a significant increase in premiums.

- Changes to Risk Profile: If there have been changes to your property that increase the risk of damage or loss, such as adding a swimming pool or remodeling without proper permits, your insurance company may decide not to renew your policy.

- Credit Score: In some cases, insurance companies may consider your credit score as a factor in the renewal process. A poor credit score could result in a non-renewal or an increase in premiums.

- Underwriting Guidelines: Changes to an insurance company’s underwriting guidelines can also impact the renewal of your policy. These guidelines may vary from one company to another and can change over time, affecting the renewal decision.

The Policy Renewal Timeline

Understanding the timeline for policy renewal is crucial to ensure that you don’t experience a coverage gap. Here’s a general outline of the process:

- Notice of Renewal: Your insurance company will typically send you a notice of renewal well in advance of your policy’s expiration date. This notice will outline any changes to your coverage or premiums.

- Reviewing Your Policy: Take the time to review your policy and make sure it still meets your needs. Consider any changes in circumstances that might require adjustments to your coverage.

- Renewing or Shopping around: At this point, you have the option to renew your policy with your current insurance provider or shop around for a better deal. It’s always a good idea to compare quotes from different companies to ensure you’re getting the best coverage at a competitive price.

- Policy Expiration: If you choose to renew, your policy will generally continue without interruption. However, if you decide not to renew or fail to secure new coverage, your policy will expire, leaving you without insurance protection.

Understanding the factors that impact home insurance renewal and the timeline for the renewal process is essential in ensuring that you have continuous coverage. By staying informed and proactive, you can make the necessary adjustments and decisions to protect your home and belongings.

Managing Your Home Insurance Renewal

Reviewing and managing your home insurance renewal is a crucial part of maintaining comprehensive coverage while potentially saving on costs. Understanding the process and recognizing what steps need to be taken can ensure you have the most suitable policy at the best possible rates.

Reviewing Your Policy Annually

Reviewing your policy annually is essential to ensure it adequately reflects any changes in your home and possessions. By reviewing your policy annually, you can make necessary adjustments to your coverage to accommodate any modifications or additions to your property or personal belongings. Understanding the details of your policy and any changes that have occurred in the past year is crucial in ensuring that you possess the most appropriate coverage for your needs.

Negotiating Better Rates

When it comes to managing your home insurance renewal, negotiating better rates can help you save on premiums. Comparing quotes from different insurance providers and leveraging potential discounts can result in significant savings. Considering factors such as increased security measures or maintaining a claims-free record can positively influence negotiations for better rates. Engaging with your current insurer and discussing potential adjustments can also lead to more favorable terms.

Credit: store.nolo.com

Expert Tips For Homeowners

Comparing Quotes Before Renewal

Before your home insurance policy automatically renews, it’s essential to compare quotes from different insurance providers. Always check if there are any new discounts or promotions available. You might find better coverage at a lower price than your current policy, saving you money while ensuring adequate protection for your home. Use online tools to compare quotes from multiple insurance companies to make an informed decision.

Updating Your Coverage Needs

As a homeowner, it’s crucial to review and update your coverage needs regularly. Re-assess the value of your home and its contents as they may have changed since your last renewal. Consider any home improvements, renovations, or new acquisitions that may necessitate additional coverage. Review the policy’s coverage limits and deductibles to ensure they align with your current needs.

Faqs About Home Insurance Renewal

Curious if home insurance renews automatically? Most policies do unless specified otherwise. Be sure to check your policy details.

Can You Cancel Automatic Renewal?

Yes, you can cancel the automatic renewal of your home insurance policy. This gives you the freedom to reassess your insurance needs and possibly find a better deal elsewhere. To cancel the automatic renewal, you typically need to inform your insurance provider in writing or through their online portal. Be sure to check the terms and conditions of your policy for any specific cancellation requirements or deadlines.

What Happens If You Don’t Renew?

If you don’t renew your home insurance policy, several things can happen. First, your coverage will expire, leaving you vulnerable to financial losses in case of accidents, theft, damage, or natural disasters. Without insurance, you would be responsible for covering the costs of repairing or replacing your home and possessions.

Additionally, if you have a mortgage on your home, your lender may require you to have home insurance. Failure to renew your policy may be a breach of your mortgage agreement, which could lead to penalties or even foreclosure.

Moreover, letting your home insurance policy lapse can also have long-term consequences. When you decide to get coverage again, insurance companies may view you as higher risk due to the gap in insurance, resulting in higher premiums or difficulty finding a new policy.

It’s important to stay proactive and prioritize the renewal of your home insurance policy to protect your home, your belongings, and your financial well-being.

:max_bytes(150000):strip_icc()/homeowners-insurance-guide_final-88e7d3469dcc4920977498f08564b234.png)

Credit: http://www.investopedia.com

Frequently Asked Questions Of Does Home Insurance Automatically Renew

Does Home Insurance Renew Automatically?

Yes, in most cases, home insurance policies renew automatically each year. However, it’s crucial to review the policy terms and conditions to fully understand the renewal process. Some insurers may require confirmation or offer the option to opt out of automatic renewal.

Always communicate directly with your insurance provider to ensure a clear understanding.

How Can I Stop My Home Insurance From Renewing?

To prevent automatic renewal, contact your insurance provider before the renewal date. They will guide you on the necessary steps to stop the policy from renewing. Keep in mind that allowing your policy to lapse without arranging an alternative could leave your home unprotected.

Always have a new policy in place before canceling the old one.

Why Should I Review My Home Insurance Policy Before Renewal?

Reviewing your policy annually is critical to ensure your coverage adequately protects your home and belongings. Circumstances may have changed over the year, and your coverage needs could be different. By carefully examining your policy, you can identify any necessary updates or modifications to better meet your evolving needs and circumstances.

Conclusion

It is important to understand the renewal process of your home insurance policy. By reading through your policy documents and communicating with your insurance company, you can determine whether your coverage automatically renews or if you need to take action to continue your protection.

Staying informed and proactive ensures that you have the necessary coverage for your home and belongings. Don’t let your policy lapse, as unexpected events can occur at any time. Stay protected and have peace of mind knowing that your home insurance is up-to-date.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “Does home insurance renew automatically?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, in most cases, home insurance policies renew automatically each year. However, it’s crucial to review the policy terms and conditions to fully understand the renewal process. Some insurers may require confirmation or offer the option to opt out of automatic renewal. Always communicate directly with your insurance provider to ensure a clear understanding.” } } , { “@type”: “Question”, “name”: “How can I stop my home insurance from renewing?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To prevent automatic renewal, contact your insurance provider before the renewal date. They will guide you on the necessary steps to stop the policy from renewing. Keep in mind that allowing your policy to lapse without arranging an alternative could leave your home unprotected. Always have a new policy in place before canceling the old one.” } } , { “@type”: “Question”, “name”: “Why should I review my home insurance policy before renewal?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Reviewing your policy annually is critical to ensure your coverage adequately protects your home and belongings. Circumstances may have changed over the year, and your coverage needs could be different. By carefully examining your policy, you can identify any necessary updates or modifications to better meet your evolving needs and circumstances.” } } ] }

Leave a comment