Homeowners insurance typically pays the policyholder directly rather than the contractor. In the event of a covered loss, you would receive the claim payment.

Understanding how homeowners insurance works when it comes to paying for damages is essential. As a homeowner, knowing whether you or the contractor receives the insurance payment can help streamline the claims process. In most cases, homeowners are responsible for paying the contractor for the repairs or replacements needed after a covered incident.

By being informed about how the payment process works, you can ensure a smooth and efficient resolution to any property damage issues. Let’s explore the nuances of homeowners insurance and how it affects you and the contractors involved in the repair or restoration process.

Credit: teamrenopittsburgh.com

1. Payment Process Explained

The payment process in homeowners insurance can vary based on the situation. Understanding how payments are handled can help you navigate the claims process smoothly.

1.1 Insurance Claim Process

When a claim is filed with homeowners insurance, a thorough assessment of the damage is conducted. The insurance company will review the policy details and determine the coverage amount.

Documentation of the damage, including estimates from contractors, may be required. Once the claim is approved, the payment process begins.

1.2 Payment Responsibility

In most cases, the insurance payment is made directly to the policyholder. The homeowner is then responsible for paying the contractor for the repair work.

If the contractor is preferred by the insurance company, they may directly work with the insurer for payment. It is essential for homeowners to communicate with both parties throughout the process.

Credit: http://www.doi.sc.gov

2. Paying The Contractor

When it comes to paying the contractor for home repairs covered by homeowners insurance, there are various ways in which the payment process can unfold. Understanding these options is essential to ensure a smooth transaction and successful completion of the repairs.

2.1 Direct Payment

Direct payment involves the insurance company issuing the payment directly to the contractor for the covered repairs. This method simplifies the process for homeowners as they do not have to handle the payment themselves.

2.2 Reimbursement

Reimbursement is when homeowners pay the contractor out of pocket for the repairs and then submit a claim to their insurance company for reimbursement. This method requires homeowners to have the funds available initially.

2.3 Contractor’s Agreement

Contractor’s agreement outlines how the payment will be handled between the homeowner, the contractor, and the insurance company. It is crucial to have a clear agreement in place to avoid any payment disputes.

3. Factors Affecting Payments

When it comes to homeowners insurance, the payment is usually made directly to the policyholder, who can then choose to pay the contractor. Several factors, such as the type of policy and the severity of the damage, affect the payment process.

It is important to understand these factors when dealing with homeowners insurance claims.

When it comes to homeowners insurance claims, several factors can affect the payment process. It’s important to understand these factors so you can make informed decisions and navigate the claims process effectively. The three main factors that can impact your payments are:

3.1 Insurance Policy Terms

Your insurance policy terms play a vital role in determining whether you or the contractor will receive the payment. Each policy is different, so it’s essential to review the terms and conditions carefully. Some policies might specify that the payment goes directly to the policyholder, while others may allow for payment to be made directly to the contractor.

Claimants who have agreed to direct payment to the contractor can have peace of mind knowing that the contractor will be compensated for their services. This option can be especially beneficial if you want to avoid out-of-pocket expenses and streamline the payment process.

3.2 Claim Approval

The approval of your insurance claim plays a significant role in whether you receive payment or if it goes directly to the contractor. Insurance companies evaluate each claim based on the information provided, their investigations, and adherence to policy terms. After a thorough assessment, they determine the validity of the claim and approve or deny payment.

As a homeowner, it’s crucial to submit an accurate and detailed claim that demonstrates the extent of the loss or damage. Providing documentation such as photographs, repair estimates, and proof of ownership can support your claim and increase the chances of approval. When your claim is approved, the insurance company will initiate the payment process according to the terms of your policy.

3.3 Deductibles And Limits

Deductibles and limits are another crucial factor affecting payments in homeowners insurance claims. A deductible is the amount you must pay out-of-pocket before the insurance company will cover the remaining portion. It’s important to note that the deductible is typically paid by the policyholder and is not applicable to payments made directly to the contractor.

Additionally, insurance policies often have coverage limits, which are the maximum amount the insurance company will pay for a specific claim. If your claim exceeds the coverage limits, you may be responsible for the remaining costs. Understanding your policy’s deductibles and limits can help you determine your financial responsibility and plan accordingly.

| Factors Affecting Payments | Description |

|---|---|

| Insurance Policy Terms | The policy terms determine whether the payment goes to you or the contractor. |

| Claim Approval | The approval of your claim by the insurance company affects the payment process. |

| Deductibles and Limits | Deductibles and policy limits determine your financial responsibility and coverage. |

By considering these factors and understanding your policy terms, claim approval process, and deductibles, you can navigate the homeowners insurance claim process with confidence. Remember to review your policy thoroughly and communicate clearly with your insurance company to ensure a smooth payment process.

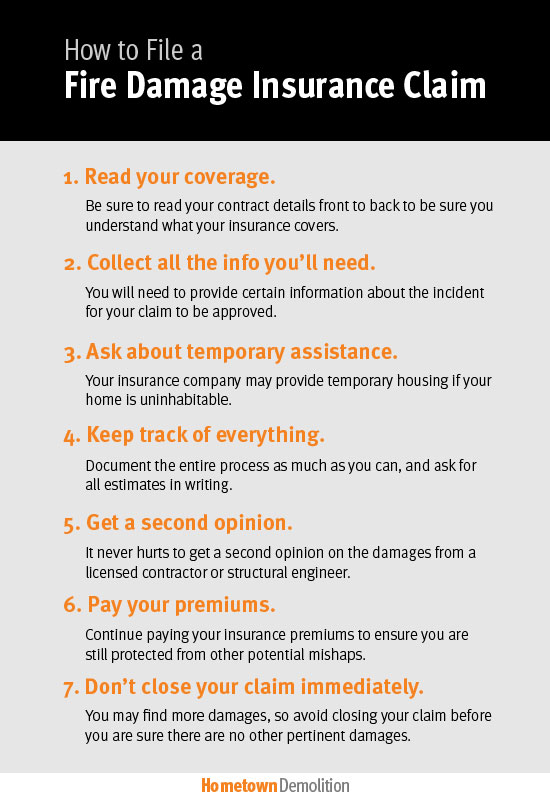

Credit: http://www.hometowndemolitioncontractors.com

4. Insurance Company’s Role

4. Insurance Company’s Role

4.1 Claims Adjuster

When a homeowner files a claim, the insurance company assigns a claims adjuster to assess the damage. The adjuster’s role is to investigate the claim and determine the coverage amount. They may conduct an on-site inspection and gather information to evaluate the claim thoroughly.

4.2 Coordination With Contractor

After the assessment, insurance companies often coordinate with the contractor hired for the repairs. This collaboration ensures that all parties are aligned on the work to be done and the associated costs. Effective communication between the insurance company, homeowner, and contractor is crucial to expedite the repair process.

4.3 Disputes And Mediation

In some cases, disputes may arise between the homeowner, contractor, and insurance company regarding the coverage or repair process. In such instances, mediation can be utilized to resolve conflicts and reach a satisfactory solution. The insurance company plays a pivotal role in facilitating a fair resolution and maintaining a positive relationship with the involved parties.

5. Tips For Homeowners

When dealing with a homeowners insurance claim, it’s important to understand the process and know what to expect. Here are 5 essential tips for homeowners to ensure a smooth and successful insurance claim process.

5.1 Reviewing Insurance Policy

Before starting any home repairs, thoroughly review your homeowners insurance policy. Pay attention to the coverage details, limits, and any exclusions that may apply to the repairs needed. Understanding your policy will help you know what to expect when filing a claim with your insurance company.

5.2 Choosing A Contractor

When selecting a contractor to handle the repairs, it’s crucial to do your due diligence. Research potential contractors and gather multiple bids. Ensure they are licensed, bonded, and insured. Checking references will also give you an idea of their past work performance.

5.3 Documenting Expenses

It’s vital to document all expenses related to the claim. Keep records of any communication with the insurance company, receipts for temporary living expenses if applicable, and receipts for any purchases related to emergency repairs. Thorough documentation will aid in the potential reimbursement process.

6. Common Payment Issues

When filing a homeowners insurance claim, it’s important to understand how the payment process works. While insurance is designed to financially protect homeowners when disaster strikes, there can be common payment issues that arise. Here are some of the most frequent problems homeowners may encounter:

6.1 Delays In Payment

Delays in receiving insurance claim payments can be frustrating and hinder your ability to restore your home promptly. Insurance companies may require extensive documentation, including estimates and proofs of loss, before approving your claim. This process can cause delays, especially if you fail to provide the required information promptly. Additionally, high claim volumes or disputes between the insurance company and contractor can further prolong the payment timeline.

6.2 Unapproved Expenses

One potential hurdle homeowners may face is the discovery of unapproved expenses. While your insurance policy may cover specific damages, there could be limitations or exclusions that result in certain expenses not being paid by the insurance company. It’s essential to thoroughly review your policy and consult with your insurance provider to clarify any grey areas or potential gaps in coverage. This proactive approach can help avoid surprises later on and allow you to plan accordingly.

6.3 Handling Payment Disputes

In some cases, payment disputes may arise between you, your insurance company, and the contractor. Disagreements can occur over the quality of work, approved expenses, or the total claim amount. It’s crucial to maintain effective communication with both your insurance company and the contractor to resolve any conflicts promptly. Often, open dialogue and a willingness to find a mutually beneficial solution can help mitigate payment disputes and ensure a satisfactory outcome.

7. Homeowners Insurance Alternatives

7. Homeowners Insurance Alternatives

7.1 Self-funding For Repairs

Self-funding: cover repair costs independently without insurance involvement.

7.2 Home Warranty

Home Warranty: provides coverage for specific home systems and appliances.

7.3 Personal Loans

Personal Loans: financial option for funding repairs outside insurance claims.

8. Seeking Professional Advice

When dealing with homeowners insurance claims, seeking professional advice is paramount to ensure a smooth and fair resolution. Let’s explore the different experts you can turn to for guidance:

8.1 Insurance Agent Or Broker

An insurance agent or broker can help you understand your policy coverage and navigate the claims process effectively.

8.2 Legal Counsel

Legal counsel can provide expert advice on interpreting your insurance policy and protecting your rights during the claims process.

8.3 Public Adjuster

A public adjuster can assist in assessing the damage, negotiating with the insurance company, and maximizing your claim payout.

Frequently Asked Questions On Does Homeowners Insurance Pay You Or The Contractor

Will My Homeowners Insurance Pay Me Directly For Repairs?

Yes, homeowners insurance typically pays you directly for covered repairs, following the satisfactory completion and verification of the work by the contractor.

Can I Choose My Own Contractor When Making A Homeowners Insurance Claim?

Yes, most homeowners insurance policies allow you to choose your own contractor when making a claim, but it’s essential to check your policy for any specific requirements or restrictions.

What If The Contractor’s Estimate Exceeds My Insurance Coverage?

If the contractor’s estimate exceeds your insurance coverage, you may be responsible for covering the difference unless you have supplemental coverage options available. It’s vital to understand and review your policy to assess potential out-of-pocket costs.

Conclusion

Ultimately, understanding how your homeowners insurance pays out to either you or the contractor is crucial in navigating the claims process. Taking the time to review your policy and consult with your insurance agent can help clarify any uncertainties and ensure that you receive the appropriate reimbursement for repairs or reconstruction.

By having this knowledge, you can confidently respond to unforeseen damages and minimize the financial burden on your shoulders. Trust in your insurance coverage and stay informed to protect your home and investments.

Leave a comment