Insurance may cover car repairs depending on the policy. It’s important to review the specific coverage details.

Car owners should check their insurance policy to determine if repairs are included. Accidents, damages, and other factors may affect coverage for repair costs. Understanding your insurance coverage can help avoid unexpected expenses for car repairs. It’s essential to communicate with your insurance provider to clarify any uncertainties about coverage for repairs.

Remember to review your policy regularly and make necessary adjustments to ensure adequate protection for your vehicle. In the event of repairs, being informed about your insurance coverage can streamline the process and help manage costs effectively.

Credit: http://www.ramseysolutions.com

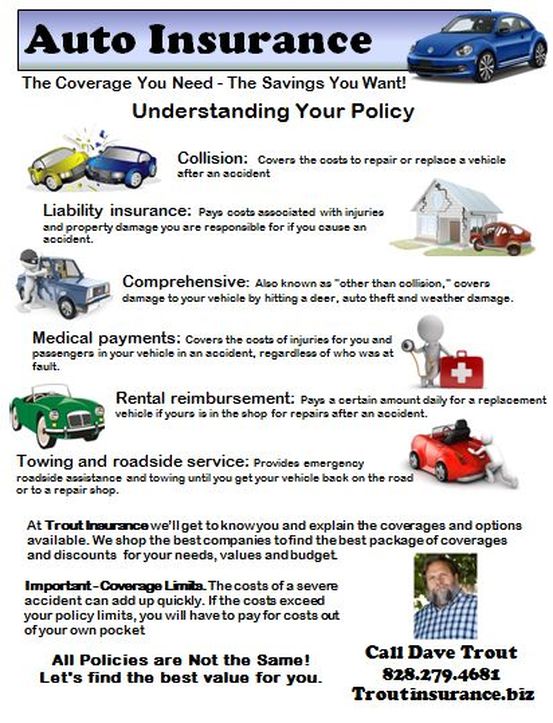

Types Of Car Insurance Coverage

Car insurance offers various types of coverage to protect you financially in case of accidents or damages. Understanding the different types of car insurance coverage can help you make informed decisions when selecting the right policy for your needs. Let’s explore the main categories of car insurance coverage:

Liability Coverage

Liability coverage pays for damages to other people’s property or injuries that result from an accident where you are at fault.

Collision Coverage

Collision coverage helps pay for repairs to your car if it’s damaged in a crash with another vehicle or object.

Comprehensive Coverage

Comprehensive coverage offers protection for damages to your car that are not a result of a collision, such as theft, vandalism, or natural disasters.

Uninsured/underinsured Motorist Coverage

This coverage can help pay for your medical expenses or car repairs if you’re involved in an accident with a driver who doesn’t have insurance or enough coverage.

Insurance Coverage For Car Repairs

Understanding how insurance covers car repairs is crucial for every vehicle owner. Let’s delve into the key aspects.

Understanding The Basics

- Insurance Policies: Car insurance may cover repairs in certain situations.

- Coverage Types: Comprehensive and collision coverage are common for car repairs.

Factors Affecting Coverage

- Policy Terms: Review your policy to understand what repairs are covered.

- Vehicle Age: Newer vehicles may have better repair coverage.

Deductibles And Claims

Deductibles are the out-of-pocket costs before insurance kicks in.

Claims process varies per policy and may affect repair coverage.

Exceptions And Limitations

| Exceptions | Limitations |

|---|---|

| Certain repairs may not be covered. | Coverage limits may apply based on policy terms. |

Essential Factors To Consider

If you own a car, it is important to have insurance coverage to protect yourself and your vehicle in case of an accident or damage. However, when it comes to repairs, not all insurance policies provide the same level of coverage. Before getting your hopes up about your insurance covering repairs for your car, it is crucial to be aware of the essential factors that determine whether or not your policy will cover these expenses.

Policy Details

Before anything else, carefully review the policy details of your insurance coverage. Policies can vary greatly, so it is crucial to understand what is included in your specific policy. Some policies may have a comprehensive coverage option that includes repairs, while others may only cover repairs resulting from accidents or specified incidents. Take the time to review your policy document or contact your insurance provider to have a clear understanding of what repairs are covered.

Distinguishing Between Repair And Maintenance

When thinking about insurance coverage for repairs, it is important to distinguish between repairs and maintenance. Typically, insurance policies cover repairs that are necessary due to accidental damage, such as collisions or theft. On the other hand, regular maintenance tasks, like oil changes or tire rotations, are considered routine and are usually not covered by insurance. Understanding this distinction will help you determine if your insurance will cover the specific repairs your car needs.

Conditions For Repairs

Insurance policies often have certain conditions that must be met for repairs to be covered. For example, your policy may require you to promptly report the incident to your insurance provider, provide evidence or documentation of the damage, and obtain repair estimates from authorized repair shops. Failure to meet these conditions could result in your repair claims being denied, so it is essential to familiarize yourself with the necessary requirements specified in your policy.

Authorized Repair Shops

Another important factor to consider is whether your insurance company has a list of authorized repair shops. Some insurance policies may only cover repairs that are performed by these authorized shops. In such cases, it is crucial to do your research and find out which repair shops are approved by your insurance provider. This not only ensures that your repairs will be covered but also guarantees that the repairs are carried out by trained professionals who meet the standards set by your insurance company.

Credit: http://www.troutinsurance.com

How To Maximize Car Repair Insurance Coverage

When it comes to car repair insurance coverage, understanding how to maximize your benefits can save you time, money, and stress. By knowing your policy, maintaining your vehicle, reporting accidents promptly, and considering supplemental coverage, you can ensure that your car repair expenses are covered effectively.

Know Your Policy

To maximize your car repair insurance coverage, it is crucial to thoroughly understand your insurance policy. Review the terms and conditions, including the coverage limits, deductibles, and any exclusions. Understanding the specifics of your policy will help you make informed decisions when it comes to repairing your car after an accident or mechanical issue.

Regular Maintenance And Inspections

Maintaining your vehicle according to the manufacturer’s recommendations not only ensures its longevity and performance but can also help maximize your insurance coverage. Regular maintenance and inspections can prevent potential issues from escalating into costly repairs, and some insurers may even offer incentives for maintaining a well-kept vehicle.

Prompt Reporting Of Accidents

Reporting accidents to your insurance provider promptly is essential for maximizing your car repair insurance coverage. Delaying the reporting of an accident may result in complications or potential denial of coverage, so it is crucial to notify your insurer as soon as possible after an incident occurs.

Consider Supplemental Coverage

While your standard car insurance policy may cover certain types of repairs, considering supplemental coverage such as mechanical breakdown protection or extended warranty plans can provide added protection. Supplemental coverage can fill potential gaps in your existing policy, offering additional peace of mind and financial security in the event of a repair need.

When Insurance Doesn’t Cover Car Repairs

Exclusions And Exceptions

Insurance may not cover car repairs if the damage is caused by specific exclusions or exceptions outlined in the policy.

For instance, if the car was being used for commercial purposes or the damage occurred due to intentional actions, it might not be covered.

High Deductibles

High deductibles in the insurance policy can lead to situations where the cost of repairs is below the deductible amount, making the insurance company not liable for the repairs. In such cases, the policyholder has to cover the repair expenses out of pocket.

Older Cars And Limited Coverage

Insurance coverage for older cars may be limited, and the policy might not fully cover the cost of repairs for the vehicle. This typically occurs when the repair expenses exceed the actual cash value of the car.

In such scenarios, the policyholder may need to supplement the coverage or consider alternative options to meet the repair costs.

Pre-existing Damage

Insurance may exclude coverage for car repairs related to pre-existing damage. This includes damages that were present before the policy coverage came into effect or damages that occurred due to lack of proper maintenance.

:max_bytes(150000):strip_icc()/comprehensive-insurance.asp-final-3fc81e079d04428e8c1c6456b311c3a1.png)

Credit: http://www.investopedia.com

Frequently Asked Questions For Does Insurance Cover Repairs Car

Does Car Insurance Cover Repairs After An Accident?

Yes, car insurance typically covers repairs after an accident, depending on the policy and the circumstances of the collision. It’s essential to review your specific coverage with your insurance provider to determine what repair costs are included.

Will My Insurance Cover Repair For Mechanical Issues?

Car insurance generally doesn’t cover mechanical issues, unless they result from an accident. Routine maintenance and wear and tear are typically not covered. If you’re unsure about coverage for a specific problem, consult your insurance provider for clarification.

Does Insurance Pay For Repairs If My Car Is Vandalized?

If your car is vandalized, comprehensive car insurance can cover the cost of repairs. It’s crucial to report the incident to the police and your insurance company promptly. An adjuster will assess the damage to determine coverage eligibility.

Can Insurance Cover Repairs For Storm Or Hail Damage?

Comprehensive car insurance often covers repairs for damage from storms, including hail. However, coverage can vary depending on your policy and deductible. Contact your insurance company to discuss the specifics of your coverage for storm-related repairs.

Conclusion

Insurance coverage for car repairs can vary depending on the policy and type of damage. It is crucial to review your insurance policy and understand the terms before making a claim. By filing a claim promptly and providing accurate information, you increase your chances of having the repairs covered.

Remember to communicate with your insurance provider and keep documentation of the repairs to ensure a smooth process. Overall, understanding your insurance coverage and being proactive can help alleviate the financial burden of car repairs.

Leave a comment