Yes, landlord insurance typically covers break-ins. Landlord insurance protects property owners from losses due to theft, vandalism, or damage caused by tenants or intruders.

In addition to break-ins, landlord insurance also provides coverage for other types of risks, such as fire, water damage, and liability claims. It is an essential form of protection for landlords, as it helps safeguard their investment and minimize financial loss.

By having landlord insurance, property owners can have peace of mind knowing that they are financially protected in the event of a break-in or other unforeseen incidents.

Credit: http://www.azibo.com

Understanding Break-ins

Break-ins are unauthorized entries into a property with the intent to commit theft, vandalism, or other illegal activities.

Types Of Break-ins

Residential break-ins: Most common type involving homes and apartments.

Commercial break-ins: Targeting businesses for theft of valuable items or information.

Opportunistic break-ins: Spontaneous, often due to unlocked doors or windows.

Common Entry Points For Break-ins

- Unlocked doors: Inviting easy access for intruders.

- Windows: Often left open or with weak locks.

- Garage doors: Vulnerable if not secured properly.

Coverage In Landlord Insurance

When it comes to protecting your investment property, landlord insurance is an essential safeguard. This type of insurance provides coverage for various risks and perils that landlords face, including break-ins, theft, and vandalism. In this article, we will explore the coverage offered by landlord insurance for break-ins, specifically theft coverage and vandalism coverage.

Theft Coverage

One of the primary concerns for landlords is the possibility of theft or burglary on their rental property. Fortunately, most landlord insurance policies provide coverage for theft. This means that if someone breaks into your rental property and steals your belongings, you may be eligible to make a claim and have the stolen items replaced or reimbursed.

- Theft coverage typically includes protection for:

- Stolen appliances such as refrigerators, stoves, and washers/dryers.

- Electronic devices like televisions, computers, and sound systems.

- Furniture and other personal property that is stolen or damaged during a theft.

Vandalism Coverage

In addition to theft, landlord insurance also offers coverage for vandalism. This is important because vandals can cause significant damage to your rental property, resulting in costly repairs. With vandalism coverage, you can rest assured knowing that you are protected if someone intentionally damages your property.

- Vandalism coverage typically includes protection for:

- Damage caused by graffiti or defacing of walls.

- Broken windows or doors due to vandalism.

- Destruction or theft of fixtures and furnishings.

It’s important to note that landlord insurance does not cover normal wear and tear or damage caused by tenants. However, it does provide coverage for sudden and unexpected incidents, such as break-ins and vandalism. As a landlord, protecting your investment property is crucial, and landlord insurance offers the necessary coverage to ensure your peace of mind.

Exclusions In Landlord Insurance

Exclusions in landlord insurance are important to be aware of as they can impact the coverage of your property. Landlord insurance typically provides protection for various situations, but there are certain limitations and exceptions to coverage that landlords should be mindful of. Understanding these exclusions can help landlords make informed decisions and take necessary steps to safeguard their properties. Here, we delve into the limitations and exceptions in landlord insurance that specifically pertain to break-ins and theft.

Limitations On Coverage

When it comes to break-ins and theft, landlord insurance may have limitations on coverage. In some cases, certain high-value items may not be fully covered. Additionally, the insurance policy may specify a maximum amount for claim settlements related to break-ins or theft. It’s important to review the policy thoroughly to understand these limitations and consider additional coverage if needed.

Exceptions To Coverage

Exceptions to coverage in landlord insurance related to break-ins and theft may include instances of negligence. For example, if the property was left unsecured or if there was a lack of maintenance that contributed to the break-in, the insurance may not provide coverage. Understanding these exceptions can help landlords take proactive measures to mitigate risks and ensure their properties are safeguarded.

Credit: http://www.rentecdirect.com

Enhancing Security Measures

When it comes to protecting your rental property from break-ins, enhancing security measures plays a crucial role. Landlord insurance is designed to provide coverage for damages and losses resulting from break-ins, but taking proactive steps to prevent such incidents can save both time and money. With these security enhancements, you can fortify your property against potential break-ins and ensure that your landlord insurance provides the best possible coverage.

Installing Security Systems

Security systems are a valuable deterrent to intruders and can provide peace of mind for both landlords and tenants. Installing a robust security system that includes motion sensors, alarms, and surveillance cameras can significantly reduce the risk of break-ins. In the event of a break-in, a well-installed security system may also help in capturing evidence and validating insurance claims.

Improving Lighting And Visibility

Ample lighting and good visibility are essential for deterring potential intruders. Brightly lit areas make it harder for burglars to operate under the cover of darkness. Improving the outdoor lighting around the property and ensuring that entry points are well-lit can help significantly in enhancing security. It’s also advantageous to trim bushes and shrubs that may obstruct the view of the property from the street or neighboring homes.

Filing A Claim For Break-ins

To determine if landlord insurance covers break-ins, check your policy for coverage details related to theft and property damage. Ensure to file a claim promptly and provide all necessary documentation and evidence to support your case. Contact your insurance provider for guidance on the claims process for break-ins.

Steps To Take After A Break-in

Secure the Area and Contact the Police

Ensure your safety and the safety of others by securing the area immediately after a break-in. Call the police to report the incident and provide them with any information that may help their investigation. Remember to stay calm and follow their instructions.

Document the Details

Once the area is secure and the authorities have been contacted, take the time to document every detail of the break-in. This includes noting any losses and damages, as well as taking photographs or videos of the scene. Documenting the incident is crucial for your insurance claim.

Contact Your Insurance Company

Inform your insurance company about the break-in as soon as possible. Provide them with all the relevant details, including the police report, your documentation of losses and damages, and any other supporting evidence you may have. Be prepared to answer their questions and follow their instructions on the next steps.

Cooperate with the Insurance Adjuster

Following your initial contact with the insurance company, an adjuster will be assigned to your claim. Cooperating with the adjuster is essential for a smooth claims process. Provide them with all the information they request and be available for any necessary inspections or meetings.

File a Formal Claim

At this stage, you will need to formally file your claim with the insurance company. Fill out any required forms and submit them along with all the supporting documentation you have gathered. Pay close attention to any filing deadlines specified by your insurance policy.

Review and Negotiate the Claim

Once your claim has been filed, the insurance company will review the details and assess the amount of compensation you are eligible for. Review the settlement offer provided by the insurance company carefully, ensuring it covers all your losses and damages. If necessary, negotiate the claim with the adjuster to achieve a fair resolution.

Keep Receipts and Records

Throughout the claims process, it is vital to keep all receipts and records related to any expenses incurred due to the break-in. This includes receipts for repairs, replacements, and any temporary accommodation or increased security measures you may have needed. These records will provide evidence of your financial losses and help support your claim.

Stay in Communication

Maintaining open lines of communication with your insurance company throughout the claims process is essential. Respond promptly to any requests for information or documentation. By staying proactive and engaged, you can help ensure a timely resolution to your claim for the break-in.

Documenting Losses And Damages

Note the Missing Items

Make a comprehensive list of all the items that have been stolen or damaged during the break-in. Include as much detail as possible, such as brand names, model numbers, and estimated values. Organize the list in a clear and logical manner.

Take Photographs

Capture visual evidence of the damages caused by the break-in by taking clear photographs of each affected area or item. Ensure the photographs clearly show the extent of the damages, making it easier for the insurance company to assess the losses.

Retain Repair and Replacement Estimates

If repairs or replacements are required due to the break-in, obtain estimates from reputable contractors or vendors. These estimates will be important in determining the amount of compensation you are eligible to receive from your insurance company. Keep copies of these estimates for your records.

Preserve Evidence

Preserve any physical evidence related to the break-in, such as damaged items or broken locks. Do not dispose of or repair anything until the insurance company has had the opportunity to inspect and assess the damages themselves.

Keep a Loss Diary

Create a loss diary to record any additional information related to the break-in, such as phone conversations with the insurance company, interactions with the police, or updates on repairs and replacements. Documenting these details will help you stay organized and provide a clear timeline of events.

Seek Professional Assistance if Necessary

If you are unsure about any aspect of documenting your losses and damages, consider consulting with a professional, such as a public adjuster or attorney specializing in insurance claims. Their expertise can offer valuable guidance and ensure you are maximizing your claim’s potential.

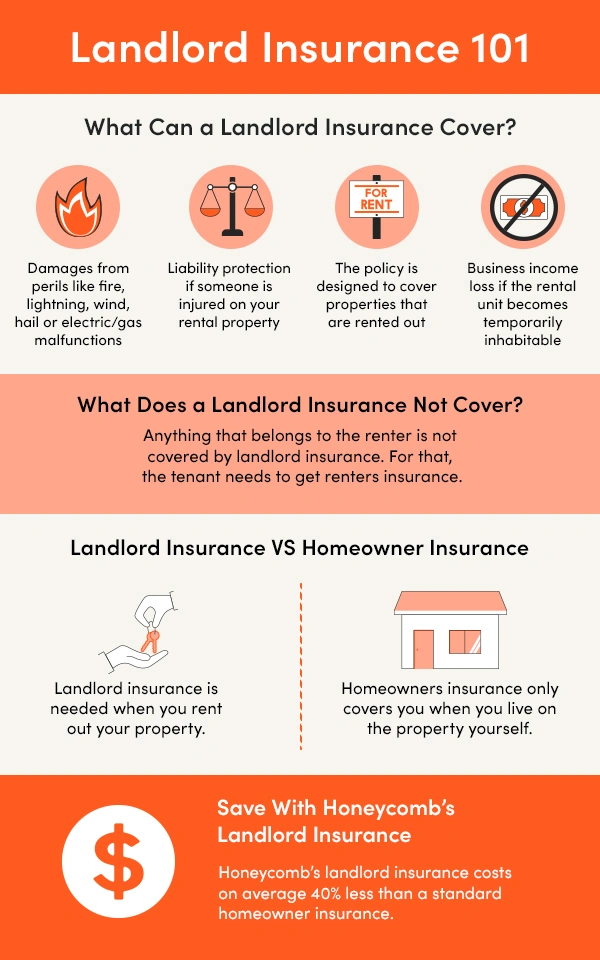

Credit: honeycombinsurance.com

Choosing The Right Policy

When it comes to landlord insurance, it’s crucial to select the most suitable policy to protect your property from break-ins. By understanding the coverage options and factors involved, you can ensure that you are adequately safeguarded.

Factors To Consider When Selecting Coverage

- Location: Consider the crime rate in the area where your rental property is located.

- Property Type: Different types of properties may require specific coverage based on their vulnerabilities.

- Renter Profile: Understanding the background of your renters can impact the risk of break-ins.

Reviewing Policy Limits And Deductibles

- Policy Limits: Ensure that your coverage limits are sufficient to cover the cost of damages resulting from break-ins.

- Deductibles: Evaluate the deductibles to determine your out-of-pocket expenses in case of a break-in.

Frequently Asked Questions Of Does Landlord Insurance Cover Break Ins

Does Landlord Insurance Cover Break-ins?

Yes, landlord insurance typically covers break-ins, providing compensation for stolen items and property damage. It’s crucial to review your specific policy to understand the extent of coverage and any exclusions related to break-ins.

What Steps Should I Take If My Property Is Broken Into?

If your property is broken into, prioritize your safety and notify the authorities. Document the damage, file a police report, and contact your insurance company promptly. Providing thorough documentation and cooperating with the investigation is vital to the claims process.

Are There Any Exclusions For Break-ins In Landlord Insurance?

Most landlord insurance policies have exclusions for break-ins if the property has been unoccupied for an extended period or if there’s evidence of negligence, such as leaving doors/windows unlocked. Review your policy carefully to understand these exclusions.

Can I Add Extra Coverage For Break-ins To My Landlord Insurance?

Some insurance providers may offer additional coverage options for break-ins, such as increased theft protection or coverage for vandalism. Consult with your insurance agent to explore these options and ensure your property is adequately protected.

Conclusion

Landlord insurance does typically cover break-ins, providing financial protection to landlords in the unfortunate event of theft or property damage. However, it is crucial to review the specific policy and its coverage limits to ensure you have adequate protection. By investing in landlord insurance, you can have peace of mind knowing that you are well-prepared for any unforeseen circumstances that may arise.

Leave a comment