Yes, landlord insurance can go up after a claim due to increased risk for the insurer. When a landlord makes a claim on their insurance policy, it indicates a higher likelihood of future claims, which can result in higher premiums.

Landlord insurance is designed to protect rental property owners from financial losses, so when a claim is made, it may affect the insurance company’s perception of risk. The insurer may increase the premium to offset the potential costs of future claims.

It is important for landlords to consider the impact of a claim on their insurance premiums and weigh it against the benefits of making a claim. Regularly reviewing and comparing insurance policies can help landlords find the best coverage options at the most competitive rates.

Factors Influencing Landlord Insurance Premiums

Landlord insurance premiums may increase after making a claim due to various factors that insurers consider.

Type Of Claim Made

The type of claim you make can impact how much your landlord insurance premium increases. For example, claims related to property damage may result in higher rate hikes.

Frequency Of Claims

Frequent claims can significantly raise your landlord insurance premiums as insurers see multiple claims as higher risk. Try to maintain a claim-free record as much as possible.

Impact Of Claim On Premiums

Discovering the impact of a claim on your landlord insurance premiums is vital. Understanding how this affects your immediate premium increase and long-term premium costs is essential for making informed decisions. In this article, we will delve into the details of these two aspects to give you a better understanding of what to expect after making a claim.

Immediate Premium Increase

When you file a claim on your landlord insurance policy, an immediate premium increase is highly likely. Insurers consider claims as a signal of increased risk, leading them to adjust your premiums accordingly. The extent of the increase depends on various factors, including the type and severity of the claim, your claims history, and the specific terms of your insurance policy. It’s important to note that some insurance providers offer “claim forgiveness” programs, which mean your rates won’t increase after your first claim. However, many providers do not offer this feature, so it’s crucial to review your policy details carefully.

Factors affecting immediate premium increase:

- The type and severity of the claim

- Your claims history

- Specific terms of your insurance policy

Considering these factors, it is advisable to consult with your insurance provider to understand how a claim could impact your premiums and to explore any potential ways to mitigate the immediate premium increase.

Long-term Premium Costs

One of the concerns after making a claim on your landlord insurance policy is the potential increase in long-term premium costs. Insurance companies take into account your claims history when determining your premiums. If you have a history of multiple claims or claims with high payouts, insurers may categorize you as a higher-risk policyholder, resulting in higher premiums in the long run.

Ways to minimize long-term premium costs:

- Maintain a claims-free period: By practicing good risk management, such as regular property maintenance and proactive inspections, you can avoid making claims.

- Consider a higher deductible: Opting for a higher deductible reduces your insurer’s risk exposure, which could result in lower premiums. However, ensure that you can comfortably afford the deductible in case a claim is necessary.

- Shop around for competitive rates: Periodically comparing insurance quotes from different providers can help you find better rates and coverage options.

While it is essential to protect your investments as a landlord by having suitable insurance coverage, it’s also crucial to be mindful of the potential impact a claim can have on your premiums. By understanding the immediate premium increase and long-term premium costs associated with a claim, you can make informed decisions to manage your insurance expenses effectively.

Expert Recommendations After Making A Claim

Expert recommendations are crucial following a claim on your landlord insurance policy. Understanding how to mitigate risks and compare insurance options can help you prepare for potential premium increases.

Risk Mitigation Strategies

Implement proactive measures to reduce risks and potential future claims. Regular maintenance, property inspections, tenant screenings, and effective communication can help minimize losses.

Insurance Comparison

After making a claim, comparing insurance options is essential. Obtain quotes from multiple insurers, review coverage limits, deductibles, and exclusions to ensure you’re getting the best value for your premium.

Credit: http://www.rentecdirect.com

Comparing Landlord Insurance Policies

Start of the ‘Comparing Landlord Insurance Policies’ sectionWhen assessing landlord insurance policies, it’s crucial to compare the coverage variations and claim handling procedures. Understanding these aspects can help landlords make an informed decision when selecting the right policy for their rental property.

Start of the ‘Coverage Variations’ subsectionCoverage Variations

Landlord insurance policies may vary in their coverage options, which can influence the premiums and potential rate increases after filing a claim. It’s essential to carefully review and compare the coverage offered by different policies to ensure that they align with your specific needs as a landlord.

- Dwelling Coverage: Provides protection for the physical structure of the rental property, including the walls, roof, and foundation.

- Liability Coverage: Offers financial protection in the event of injury or property damage claims filed by tenants or visitors.

- Loss of Rental Income: Provides coverage for lost rental income during repairs resulting from a covered loss, such as fire or storm damage.

- Personal Property Coverage: Protects landlord-owned furnishings and appliances within the rental unit.

Claim Handling Procedures

Efficient and effective claim handling procedures are crucial considerations when comparing landlord insurance policies. Landlords should seek policies from insurers known for their prompt and fair claims processing. Understanding the claim handling procedures of potential insurers can provide insight into the likelihood of premium increases following a claim.

- Timely Resolution: Look for insurers with a reputation for swift and thorough claim resolution to minimize disruptions to rental income.

- Transparency: Seek insurers that openly communicate the claims process and provide clear guidelines for submitting and tracking claims.

- Past Claims Record: Research the insurer’s history of rate increases following claims and assess the impact on premiums over time.

Negotiating Premiums Post-claim

After filing a claim on your landlord insurance policy, you might be concerned about a potential increase in premiums. While there’s a possibility that your premiums may go up, there are still effective strategies you can employ to negotiate for more favorable terms. By understanding how to approach your insurer and what actions to take, you can potentially minimize the impact of a claim on your future premium rates.

Reviewing Policy Coverage

One crucial step in negotiating premiums post-claim is reviewing your policy coverage in detail. Assess the specific details of your policy and the coverage provided for your rental property. Understanding the terms and conditions will give you a clearer picture of what your insurer is expected to cover, aiding you in making informed arguments during negotiations.

Seeking Professional Advice

Consider seeking the assistance of a professional, such as an insurance broker or a lawyer specializing in insurance matters. These professionals can provide valuable guidance and expert negotiation skills to help you navigate the post-claim process. Their expertise can be instrumental in securing more favorable premiums, especially if you are faced with challenges during negotiations.

Credit: http://www.facebook.com

Mitigating Factors For Premium Increase

When it comes to landlord insurance, one question that often arises is whether or not the premium will go up after filing a claim. While it is true that making a claim can sometimes lead to an increase in premiums, there are several mitigating factors that can help landlords avoid or minimize any premium increase. By considering these factors, landlords can better understand the potential impact of filing a claim and take steps to mitigate any negative effects.

Upgrades To Property Security

One of the key factors that insurers consider when determining premiums is the level of security at the property. By upgrading the security measures in place, landlords can often offset any potential increase in premiums. This can include installing security cameras, alarms, or deadbolt locks. By taking steps to enhance property security and reduce the risk of future claims, landlords demonstrate their commitment to safeguarding the property, which can lead to lower premium rates.

Maintaining Good Claims History

A landlord’s claims history also plays a crucial role in determining insurance premiums. Insurers typically give more favorable rates to landlords with a good claims history, meaning those who have filed fewer or no claims in the past. By maintaining a clean claims record, landlords show insurers that they are responsible and proactive in managing their properties. This can help mitigate any potential premium increase after making a claim, as insurers are more likely to view it as an isolated incident rather than a recurring problem.

It’s important to note that not all claims will lead to a premium increase, especially if the claim was due to factors beyond the landlord’s control, such as natural disasters or extreme weather events. Insurance providers typically differentiate between avoidable and unavoidable claims, and the latter may have less impact on premium rates.

Ultimately, the specific impact of filing a claim on landlord insurance premiums can vary depending on the individual insurer, the nature and frequency of claims, and other factors. By focusing on factors like property security upgrades and maintaining a good claims history, landlords can better position themselves for favorable premium rates and reduce the potential impact of a claim on their insurance costs.

Understanding Insurance Providers’ Policies

Policy Renewal Terms

Insurance companies may review your policy upon renewal for any recent claims. This review could potentially result in premium adjustments. If you’ve made a claim, explore your policy renewal terms to understand potential cost implications.

Customer Loyalty Benefits

Some insurance providers offer loyalty benefits to long-standing customers. These benefits could include discounts or rewards for maintaining a claims-free record. Consider discussing these benefits with your insurer to make the most of your policy.

Future Outlook For Landlord Insurance Premiums

Understanding the future outlook for landlord insurance premiums can help you make informed decisions about your property investments. One key factor to consider is how a claim could impact your insurance costs going forward. Let’s take a closer look at the trends in premium adjustments and the regulatory impact on pricing.

Trends In Premium Adjustments

After filing a claim on your landlord insurance policy, you may wonder if your premiums will increase. While each insurance company has its own policies and guidelines, there are some general trends to be aware of.

- Claims history: Insurance providers typically evaluate your claims history when determining premium adjustments. If you have a history of multiple claims, there’s a greater likelihood that your premiums will go up.

- Severity of the claim: The severity of the claim, such as the total amount of damages and the cost of repairs, can also influence how your premiums are adjusted. Generally, more expensive claims are more likely to result in higher premiums.

- Policy features: Your policy’s features, including deductibles and coverage limits, can also affect premium adjustments. Higher deductibles may result in lower premiums, while lower deductibles could lead to higher premiums.

Regulatory Impact On Pricing

Aside from individual insurance providers’ policies, regulatory factors can also influence landlord insurance premiums. These may include:

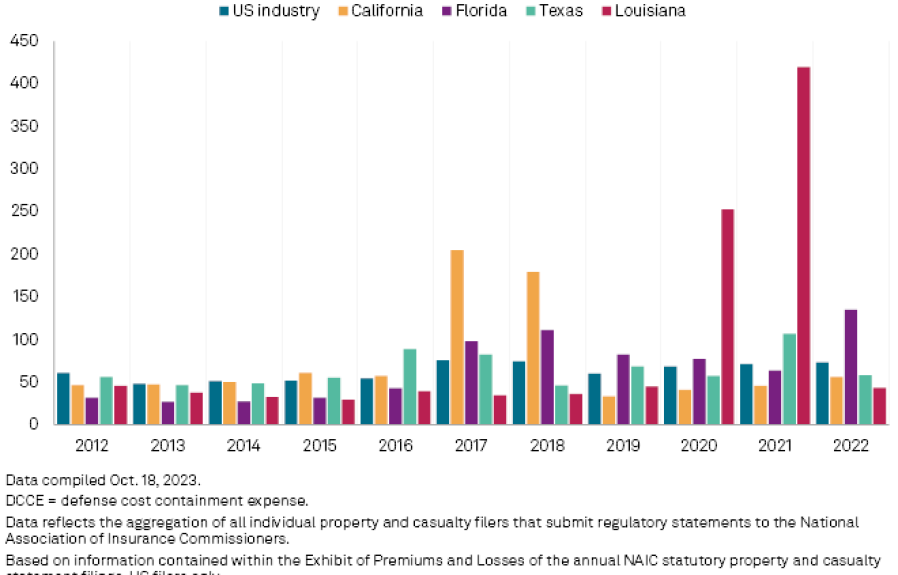

- State regulations: Different states may have varying regulations that impact insurance pricing. For example, some states may have stricter laws regarding premium adjustments after a claim, while others may allow more flexibility.

- Market conditions: The overall market conditions in the insurance industry can also play a role in pricing. Economic factors, regional trends, and the availability of insurance options all contribute to the overall landscape.

- Natural disasters: The occurrence of natural disasters in specific regions can have a significant impact on insurance premiums. Areas prone to hurricanes, earthquakes, or floods may experience higher premiums as insurance companies assess the increased risk.

When it comes to landlord insurance premiums, it’s essential to prioritize risk management and maintain a good claims history. While there is a possibility of premium adjustments after a claim, understanding the trends and regulatory influences can help you anticipate changes and make proactive choices to protect your investment.

Credit: http://www.facebook.com

Frequently Asked Questions On Does Landlord Insurance Go Up After A Claim

Does Making A Claim Affect Landlord Insurance Rates?

Yes, making a claim can lead to increased premiums on landlord insurance. Insurance companies may consider you a higher risk and adjust your rates accordingly. It’s important to weigh the potential increase in premiums against the cost of the claim.

How Much Does Landlord Insurance Increase After A Claim?

The increase in landlord insurance rates after a claim varies. It depends on the extent of the claim, insurance company policies, and your claims history. Expect potential rate hikes, and consider comparing quotes to ensure you’re getting the best deal.

Can I Avoid A Landlord Insurance Rate Increase After A Claim?

It’s not always possible to avoid an increase, but there are strategies to minimize the impact. For example, you can opt for a higher deductible, which may help offset potential rate hikes. Discuss options with your insurance provider.

What Factors Determine The Impact Of A Claim On Insurance Rates?

Several factors influence how a claim affects landlord insurance rates. These include the severity of the claim, your claims history, the insurance company’s policies, and the specifics of your policy. Understanding these factors can help you anticipate potential rate changes.

Conclusion

It’s crucial for landlords to understand the potential consequences of filing an insurance claim. While there isn’t a definitive answer on whether premiums will increase after a claim, it’s important to carefully consider the benefits and drawbacks. Factors such as the nature and frequency of these claims, as well as other individual circumstances, may impact the insurance rates.

Ultimately, seeking guidance from insurance professionals can provide invaluable insights for landlords in making informed decisions.

Leave a comment