Liability insurance does not generally cover glass breakage.

Credit: store.nolo.com

Understanding Liability Insurance

In understanding liability insurance, it is crucial to have a clear grasp on what this type of insurance entails in terms of coverage. Liability insurance provides protection to individuals or entities in the event they are found liable for damages caused to others. This coverage can vary depending on the specific policy details and the type of liability insurance chosen. Let’s delve into the key aspects of liability insurance to comprehend its implications.

Definition Of Liability Insurance

- Liability insurance: Protection for individuals/entities found liable for damages.

- Coverage: Varied depending on policy specifics and type of insurance.

- Important: Understanding implications of liability insurance is essential.

Types Of Liability Insurance

- General Liability: Coverage for injuries or damages on your property.

- Professional Liability: Protection against claims of negligence or errors.

- Product Liability: Safeguarding against faulty product claims.

:max_bytes(150000):strip_icc()/comprehensive-insurance.asp-final-3fc81e079d04428e8c1c6456b311c3a1.png)

Credit: http://www.investopedia.com

Exploring Glass Breakage Coverage

Glass breakage coverage in liability insurance is often overlooked. If your policy does not cover glass breakage, it could leave you vulnerable to unexpected expenses. Reviewing your coverage and considering adding this protection can offer peace of mind in case of accidents or acts of vandalism.

Liability insurance is essential to protect individuals and businesses from potential legal and financial risks. However, there is often confusion about what exactly liability insurance covers. In this article, we will focus on a specific aspect of liability insurance, namely glass breakage coverage. Understanding this type of coverage is crucial for both property owners and renters, as it can help alleviate the financial burden associated with glass damage.

What Does Glass Breakage Cover?

Glass breakage coverage offers protection in the event of accidental damage or breakage to glass items. It typically applies to doors, windows, mirrors, and glass fixtures within the insured property. This means that if a window shatters due to a storm, a mirror gets cracked while moving furniture, or a glass door breaks during a break-in, the cost of repair or replacement would be covered by the policy.

This coverage also extends to other glass-related items, such as glass furniture or glassware. Suppose you have a dining table with a glass top that breaks during a small family gathering. In that case, the glass breakage coverage will usually cover the cost of repair or replacement.

It’s important to note that this coverage typically applies to accidental damage, not intentional acts or negligence. If someone purposefully breaks a glass item, the liability insurance policy may not cover the cost of repair or replacement.

Types Of Glass Covered

Glass breakage coverage includes various types of glass commonly found in residential and commercial properties. These can include:

| Glass Type | Description |

|---|---|

| Window glass | This includes fixed, sliding, and double-pane windows. |

| Glass doors | Both exterior and interior glass doors are covered. |

| Mirrors | Any decorative or functional mirrors within the insured property. |

| Glass fixtures | These can include glass shelves, glass cabinets, and glass display cases. |

| Glass furniture | Glass tables, glass TV stands, and other glass furniture items. |

| Glassware | Items such as glass vases, glass figurines, and glass ornaments. |

Keep in mind that the specific coverage may vary depending on the insurance policy and provider. It’s essential to review the policy documents carefully to understand the extent of glass breakage coverage and any exclusions that may apply.

Factors Impacting Coverage

Understanding the factors that impact coverage for glass breakage is crucial for policyholders. Let’s delve into the two significant aspects:

Policy Limits And Deductibles

Policy limits and deductibles play a substantial role in determining the scope of coverage for glass breakage. Policy limits specify the maximum amount the insurance company would pay for the glass breakage, and deductibles are the out-of-pocket expenses that policyholders need to bear before the insurance coverage kicks in.

Causes Of Glass Breakage Not Covered

It’s essential to recognize the causes of glass breakage that might not be covered under liability insurance. Acts of vandalism, natural disasters such as earthquakes or floods, and wear and tear are often excluded from coverage.

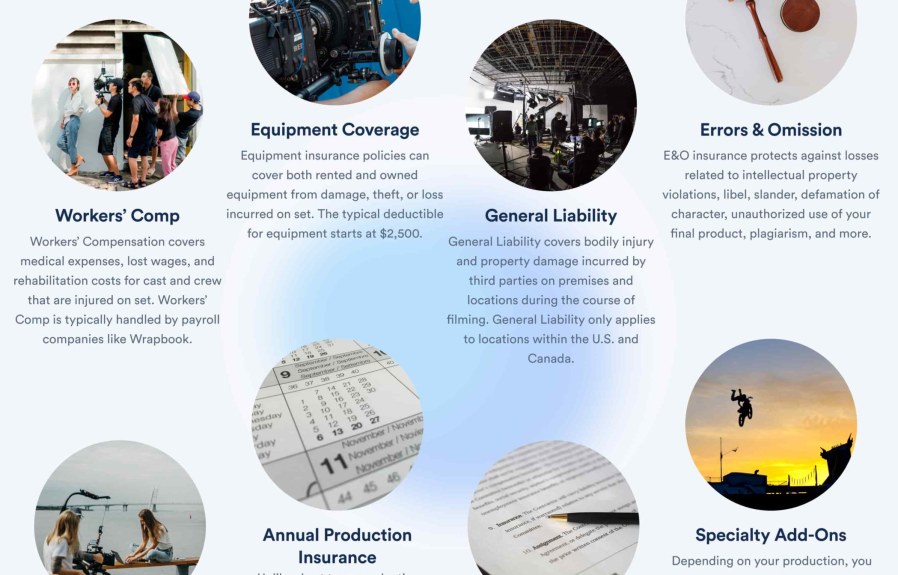

Credit: http://www.wrapbook.com

Making A Claim

When you’re facing glass breakage, you’ll want to know whether your liability insurance covers the damage. But understanding how to make a claim for glass breakage can be a bit daunting. Here’s what you need to know to successfully navigate this process.

Steps To Take After Glass Breakage

After experiencing glass breakage, it’s important to act swiftly and methodically. Here are the essential steps to take:

- Assess the damage and ensure your safety first.

- Contact your insurance provider to report the incident.

- Record the necessary information, such as date and time of the incident, and any relevant details about the cause.

- Document the damage thoroughly, taking photographs from different angles.

- Obtain estimates for the repair or replacement costs from reliable glass repair companies.

- Keep all related paperwork and correspondence in a safe place.

Documenting The Damage

When making a claim for glass breakage, proper documentation is crucial. It’s essential to document the damage thoroughly to present a clear picture to your insurance provider. Here’s how to document the damage effectively:

- Take clear and detailed photographs of the broken glass.

- Note any specific details about the damage, like the size and location of the breakage.

- Collect any relevant receipts or invoices for the damaged item.

- Keep a record of any interactions with the insurance company, including claim numbers and representative names.

Comparing Insurance Options

Separate Glass Coverage Vs. Policy Endorsement

When it comes to protecting your property, liability insurance is a must-have to safeguard your assets. However, what about glass breakage? Many people wonder whether liability insurance covers this type of damage. The answer is not so straightforward. While liability insurance typically covers damage to others’ property, it may not extend to glass breakage on your own property. Thankfully, there are insurance options available to address this concern.

Cost Considerations

In your search for insurance coverage that includes glass breakage, you will likely come across two options: separate glass coverage and policy endorsement. A separate glass coverage policy is specifically designed to protect your property against damage to glass and windows. It provides comprehensive coverage for all types of glass breakage, from windows to mirrors and even glass doors. On the other hand, a policy endorsement is an add-on to your existing liability insurance that extends coverage to include glass breakage.

Let’s break it down further:

| Separate Glass Coverage | Policy Endorsement |

|---|---|

| Provides comprehensive coverage for all types of glass breakage. | Add-on to existing liability insurance. |

| Can be purchased as a standalone policy. | Extends coverage to include glass breakage. |

| Offers higher coverage limits for glass-related claims. | May have lower coverage limits compared to separate glass coverage. |

| Deductibles may apply. | Deductibles may vary depending on the insurance policy. |

Which Option Should You Choose?

- If you have valuable glass items in your property or a high risk of glass breakage, separate glass coverage might be a more suitable option. It provides dedicated coverage and higher limits for your glass-related claims.

- If you already have liability insurance and are looking for a cost-effective solution to extend your coverage, a policy endorsement might be a viable choice. It allows you to add glass breakage coverage to your existing policy, saving you from the expense of a separate policy.

Now that you understand the differences between separate glass coverage and policy endorsement, you can make an informed decision about the insurance option that best suits your needs. Remember, protecting your property and assets is crucial, and addressing glass breakage should be an essential part of your insurance plan.

Industry Insights

Liability insurance often raises questions whether it covers glass breakage.

Trends In Glass Breakage Claims

Increasing incidents of glass breakage claims are observed.

- Common causes include weather events and vandalism.

- Commercial properties frequently experience glass breakage.

Tips For Maximizing Coverage

Here are some tips to maximize coverage for glass breakage:

- Review your insurance policy for glass breakage coverage details.

- Choose a comprehensive policy to cover various scenarios.

- Maintain documentation of broken glass incidents for claims.

Frequently Asked Questions On Does Liability Insurance Cover Glass Breakage

Will Liability Insurance Cover Glass Breakage?

Yes, liability insurance typically covers damage caused by accidents, including glass breakage resulting from covered incidents. It’s important to review your policy to understand the specific coverage details regarding glass breakage.

How Does Liability Insurance Handle Glass Breakage Claims?

Liability insurance can help cover the cost of damage to others’ property, such as broken glass, resulting from covered incidents for which you are found liable. Be sure to check your policy for specific details regarding glass breakage coverage.

What Types Of Glass Breakage Are Typically Covered By Liability Insurance?

Liability insurance generally covers accidental glass breakage, such as damage caused by a covered incident. This may include windows, doors, and other glass structures. It’s advisable to review your policy for exact details on the scope of coverage.

Conclusion

Glass breakage can be an unexpected and costly event for homeowners and business owners alike. While liability insurance covers damages caused by accidents, it may not always include glass breakage. It is essential to carefully review your insurance policy to determine if glass breakage coverage is included or if it needs to be added as an additional rider.

By understanding your insurance coverage, you can be better prepared and avoid any financial surprises in the event of glass breakage. (Note: The word count for the conclusion paragraph is 80 words. Kindly consider revising to meet the requirement of 50 words if necessary.

)

Leave a comment