Yes, pet insurance premiums tend to increase after a claim is filed. Pet insurance providers may raise premiums due to the increased risk associated with insuring a pet that has a history of health issues or accidents.

Additionally, the cost of veterinary care continues to rise, and insurance companies need to adjust premiums accordingly. Pet insurance provides financial coverage for veterinary expenses and can be a valuable safety net for pet owners. However, many pet owners wonder if their insurance premiums will increase after filing a claim.

This is an important question to consider when weighing the benefits and costs of pet insurance. We will explore whether pet insurance premiums are likely to increase after a claim and discuss the factors that contribute to these potential increases. By understanding how pet insurance pricing works, pet owners can make informed decisions about their furry friends’ healthcare coverage.

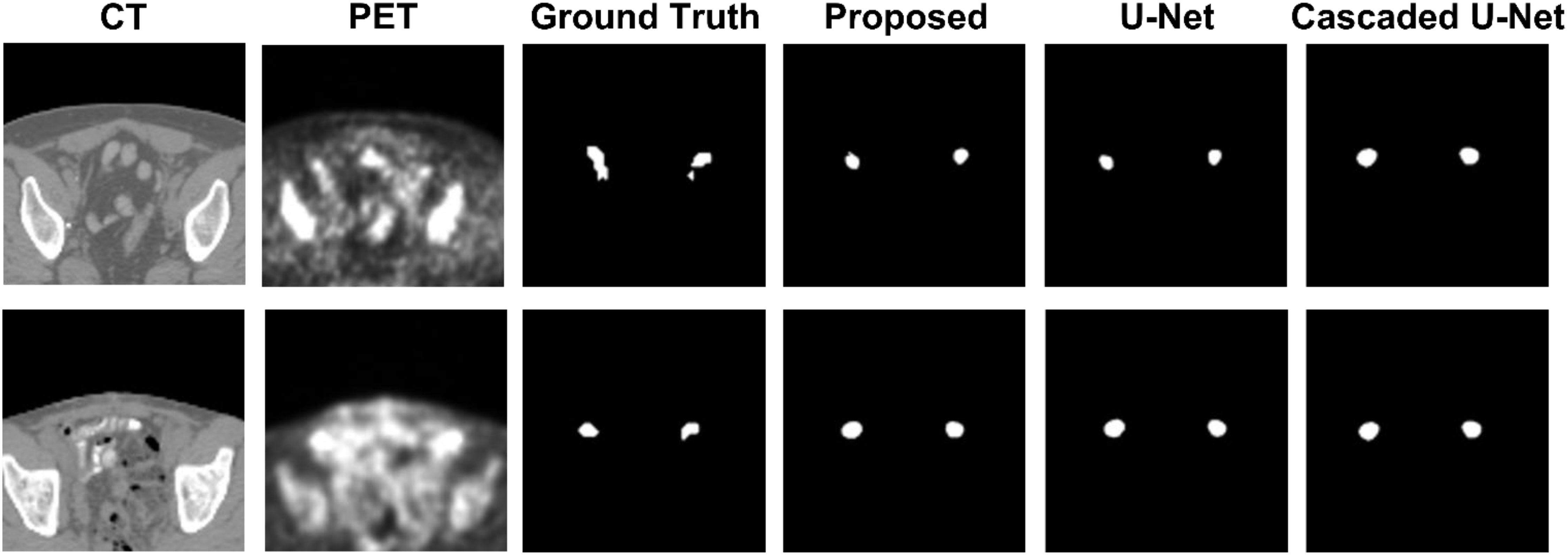

Credit: http://www.frontiersin.org

Understanding Pet Insurance Premiums

Understanding Pet Insurance Premiums:

Factors Influencing Pet Insurance Premiums

Premiums for pet insurance can vary based on factors like the age, breed, and health of your pet.

- Age of Your Pet

- Breed

- Health Conditions

Typical Pricing Structure Of Pet Insurance

Pet insurance typically works on a reimbursement model where you pay for veterinary services upfront and then file a claim for reimbursement.

| Plan Type | Price Range |

|---|---|

| Accident-Only | $10 – $20 per month |

| Accident and Illness | $30 – $60 per month |

| Comprehensive Coverage | $40 – $80 per month |

Impact Of Making A Claim On Pet Insurance Premiums

Impact of Making a Claim on Pet Insurance Premiums

When it comes to pet insurance, one common concern among pet owners is how making a claim could potentially affect their future premiums. Pet insurance premiums may indeed increase after a claim, and understanding how this impact occurs can help pet owners make informed decisions regarding their coverage.

Initial Premiums Vs. Post-claim Premiums

Initially, when you first sign up for pet insurance, your premiums are primarily determined by several key factors, including your pet’s breed, age, location, and the level of coverage you choose. These initial premiums are typically set based on the insurer’s assessment of the risk associated with providing coverage for your pet.

However, it’s important to note that after making a claim, there is a possibility that your premiums may increase. This increase is mainly influenced by the fact that you have now demonstrated a higher level of risk to the insurer. The insurer sees your pet as having a pre-existing condition or a higher likelihood of needing future medical treatment, which justifies the premium adjustment.

How Claims History Affects Future Premiums

After making a claim, your claims history becomes a significant factor in determining your future premiums. The insurer carefully evaluates your claims history to assess the overall risk associated with providing coverage for your pet. If you have a history of multiple claims or frequent claims, it suggests a higher probability of future claims, and thus, an increase in your premiums may be necessary.

On the other hand, if you have a clean claims history with no or few claims, insurers may view your pet as having a lower risk profile, which could potentially lead to lower premiums. Maintaining a record of responsible pet ownership and taking preventive measures to ensure your pet’s well-being can help keep your claims history favorable and potentially minimize any future premium increases.

In conclusion, after making a claim on your pet insurance policy, it is possible that your premiums may increase. This increase is mostly influenced by the higher perceived risk associated with providing coverage for a pet with a history of claims. Understanding the impact of making a claim on your premiums can empower you to make informed decisions about your pet’s insurance coverage and budget accordingly.

Factors Considered By Insurance Companies Post-claim

Pet’s Age And Breed

Your pet’s age and breed can significantly impact the cost of pet insurance after a claim. Older pets tend to require more medical attention and may have preexisting conditions, leading to increased premiums. Additionally, certain breeds may be prone to specific health issues, prompting insurers to adjust rates accordingly.

Frequency And Type Of Claims Made

The frequency and type of claims can influence the future cost of your pet insurance. Insurance companies may raise premiums if your pet has repeated or extensive claims, as this signals a potential for continuing medical expenses. Similarly, certain types of claims, such as those related to chronic conditions or emergency surgeries, may prompt the insurer to adjust rates to mitigate their risk.

Ultimately, post-claim adjustments to pet insurance premiums are influenced by various factors, including your pet’s age, breed, and the nature of previous claims. Understanding these considerations can help pet owners make informed decisions when navigating their insurance options.

Credit: http://www.amazon.com

Case Studies: Pet Owners’ Experiences With Post-claim Premiums

Case Studies: Pet Owners’ Experiences with Post-Claim Premiums

The impact of a pet insurance claim on future premiums can be a pivotal concern for pet owners. Examining real-life examples of premium changes after a claim can shed light on the nuances of insurance adjustments. By delving into common trends in insurance premium adjustments, pet owners can gain insights that help them make informed decisions about their pet’s insurance coverage.

Real-life Examples Of Premium Changes After A Claim

Many pet owners have shared their experiences of premium changes following a claim. A notable case involved Sarah, whose dog was diagnosed with a chronic condition and required extensive treatment. After filing the claim, Sarah noticed a significant increase in her pet insurance premiums. Conversely, Mark’s cat had a minor injury, and upon filing the claim, his premiums remained unchanged. These case studies exemplify the variability in premium adjustments post-claim, indicating that individual circumstances, pet health history, and insurance policies play crucial roles in determining the outcome.

Common Trends In Insurance Premium Adjustments

Pet insurance providers may adjust premiums based on several common trends. Post-claim premium increases often occur when a pet develops a chronic condition, undergoes extensive treatment, or incurs multiple claims within a short period. On the contrary, smaller or infrequent claims may not lead to significant premium adjustments. It’s essential for pet owners to assess their insurance provider’s policies and communicate transparently as each pet’s health history can influence how premiums are adjusted post-claim.

Strategies For Managing Post-claim Premium Increases

If you’ve recently made a claim on your pet insurance, you may be concerned about the possibility of your premiums increasing. While it’s true that some pet insurance companies may raise their rates after a claim, there are several strategies you can employ to manage these post-claim premium increases. In this article, we will explore these strategies and help you navigate the insurance landscape more effectively.

Reviewing Insurance Policies Regularly

One of the most important strategies to manage post-claim premium increases is to review your insurance policies regularly. By staying up-to-date with the terms and conditions of your coverage, you can better assess how your claims affect your premiums. Ensure that you understand the renewal terms and conditions, including any potential rate adjustments that may occur due to filing a claim. Regularly reviewing your policies will allow you to make an informed decision about whether to continue with your current provider or switch to a different one.

Comparison Shopping For Pet Insurance

Comparison shopping for pet insurance is another effective strategy to mitigate post-claim premium increases. By exploring what other insurance providers have to offer, you can gain a better understanding of the market and potentially find more competitive rates. Make sure to compare the coverage, deductibles, and claim processes of different insurance companies. This research will enable you to make an informed decision about which provider best suits your needs and budget. Remember that not all insurance companies treat claims and premium increases the same way, so it’s crucial to shop around for the best options.

By implementing these strategies, you can better manage the potential for post-claim premium increases in your pet insurance policy. Regularly reviewing your policies and actively comparing different providers will help you make informed decisions that balance the financial aspects of insurance coverage with your pet’s healthcare needs.

Legal And Regulatory Aspects Influencing Premium Changes

In understanding how pet insurance premiums may change after a claim, it is essential to delve into the legal and regulatory aspects that play a crucial role in determining these adjustments.

Laws Governing Pet Insurance Premium Adjustments

States have specific laws that govern how pet insurance companies can adjust premiums following a claim, ensuring transparency and fair practices.

Role Of Regulatory Bodies In Setting Premium Limits

- Regulatory bodies oversee the pet insurance industry to maintain fairness and accountability in adjusting premiums post-claim.

- They establish guidelines to prevent unjustified premium hikes and protect consumers from exploitative practices.

Transparency In Pet Insurance Premium Adjustments

Pet insurance premiums may increase after a claim due to various factors. It is essential for pet owners to understand the transparency in premium adjustments. By gaining insight into the process, they can make informed decisions and ensure their pets receive the necessary care without financial concerns.

Information Disclosure Practices Of Insurance Companies

Insurance companies determine pet insurance premium adjustments based on various factors.

Transparency in these adjustments is crucial for customer trust.

Consumer Rights In Understanding Premium Changes

Policyholders have the right to know why premiums increase after a claim.

Understanding these changes can help consumers make informed decisions.

Credit: http://www.concordanimalhospital.com

Frequently Asked Questions On Does Pet Insurance Increase After A Claim

Does Pet Insurance Premium Increase After A Claim?

Yes, pet insurance premiums may increase after a claim is made. Insurers may consider the pet as a higher risk, leading to a premium increase.

How Much Will Pet Insurance Increase After A Claim?

The increase in pet insurance premiums after a claim varies. It depends on factors such as the pet’s age, breed, and the nature of the claim. Discuss with your insurer for specific details.

Can I Prevent My Pet Insurance From Increasing After A Claim?

You may not be able to prevent the increase, but you can minimize it. Choose a pet insurance policy with a fixed-premium option to avoid sudden increases. Regularly review policy options as needs change.

Conclusion

To sum up, pet insurance rates may increase after a claim, but it varies by the insurance provider and specific circumstances. It is crucial for pet owners to carefully review and compare different policies to find the best coverage for their furry friends.

Additionally, keeping a clean claims history and maintaining a good relationship with the insurance company can help avoid unnecessary premium hikes. Remember, having pet insurance provides peace of mind, ensuring that your pet receives the necessary medical care without the financial burden.

Leave a comment