Renters insurance typically does not cover negligence. Negligence is not covered by renters insurance.

Renters insurance is an important protection for tenants, providing coverage for their personal belongings and liability risks. However, it’s crucial to understand that negligence is generally not covered under a standard renters insurance policy. Negligence refers to the failure to exercise reasonable care, resulting in harm or damage to others.

While renters insurance may cover accidental damage caused by the policyholder, such as a fire or water leak, it typically does not extend to intentional or negligent acts. Therefore, tenants should take additional precautions to avoid negligence and consider separate liability insurance for comprehensive coverage. We will explore what renters insurance covers, the limits of its liability coverage, and the importance of being a responsible tenant to prevent negligence.

Importance Of Renters Insurance

Renters insurance is crucial for protecting your personal belongings and providing liability coverage in case of unforeseen events.

Coverage Benefits

Renters insurance covers damages to your personal property due to theft, fire, or natural disasters, ensuring peace of mind.

Cost-effectiveness

- Renters insurance is affordable and can save you from financial burdens by covering various expenses when needed.

- It offers protection against unforeseen events that could result in costly repairs or replacements.

Understanding Negligence In Renters Insurance

When it comes to renting a home, having a renters insurance policy is essential. It provides coverage for your personal belongings and liability protection in case of accidents. However, many renters wonder if their policy covers negligence. In this blog post, we will dive into the topic of negligence in renters insurance, exploring its definition and providing examples to help you understand its implications.

Definition Of Negligence

Negligence, in the context of renters insurance, refers to the failure to exercise reasonable care or caution, resulting in harm or damage to another person’s property. It involves a breach of duty to act in a responsible manner, leading to a loss or injury to someone else. In simpler terms, negligence occurs when someone fails to take the necessary steps to prevent harm or damage.

Examples Of Negligence

Understanding negligence becomes clearer with real-life examples. Here are some instances that depict how negligence can come into play in a renters insurance claim:

- A tenant accidentally leaving the bathtub faucet running, causing water damage not only in their unit but also in the units below.

- Leaving a lit candle unattended, leading to a fire that damages not only the tenant’s belongings but also the neighboring units.

- Failing to lock the main door, resulting in theft or burglary that affects not only the tenant but also adjacent units.

In these scenarios, negligence is evident as the tenant failed to take reasonable care to prevent harm or damage, resulting in losses for themselves as well as others. Renters insurance may provide coverage for these situations, but it’s important to review your policy to understand the specific terms and conditions.

In conclusion, negligence in renters insurance refers to the failure to exercise reasonable care, which can lead to harm or damage to others. Understanding the concept of negligence and its application in real-life situations can help renters determine the extent of their coverage and ensure they are adequately protected.

Coverage Types In Renters Insurance

Renters insurance provides coverage for a variety of incidents, including negligence. Understanding the different coverage types in renters insurance is important for renters to ensure they have appropriate protection. Let’s delve into the specifics of coverage types provided by renters insurance, including personal property coverage and liability coverage.

Personal Property

Renters insurance typically includes coverage for personal property. This coverage extends to belongings such as furniture, electronics, clothing, and other personal items that may be damaged or stolen due to covered perils like fire, theft, or vandalism.

Liability Coverage

Liability coverage is another essential component of renters insurance. This type of coverage can protect you if you are found responsible for causing injury to someone else or damaging their property. It can also provide coverage for legal expenses if a liability claim is filed against you.

Negligence Coverage In Renters Insurance

Renters insurance provides valuable protection for people renting a home or apartment. Many renters may wonder, “Does renters insurance cover negligence?” It’s essential to understand the negligence coverage in renters insurance to ensure full protection. Let’s delve deeper into the intricacies of this coverage.

Limits Of Coverage

Renters insurance typically covers negligence to some extent, but it’s crucial to be aware of the limitations. Coverage for negligence may vary based on the specific policy and insurance provider. It is advisable for renters to review their policy thoroughly to discern the extent of negligence coverage it offers. In some cases, certain types of negligence may not be fully covered by renters insurance, so it’s vital to be cognizant of the various limitations that may apply.

Exclusions

While renters insurance does offer negligence coverage, there are certain exclusions that individuals need to be mindful of. Common exclusions from negligence coverage can include intentional acts, illegal activities, and negligence related to certain high-risk items. Understanding these exclusions is crucial for renters to comprehend the full scope of their coverage and avoid any misunderstandings in the event of a claim.

Filing A Claim For Negligence

Filing a claim for negligence is a crucial step in obtaining fair compensation for damages caused by your actions. It’s important to remember that renters insurance typically covers accidental damages, but negligence can be a gray area. Understanding the process and the documentation required can help you navigate through this situation.

Documentation Required

When filing a claim for negligence, proper documentation is essential to support your case. Here are some important documents you should have:

- Incident Report: Start by filing an incident report with your landlord or property management company. This report will serve as an initial record of the event and provide crucial details about the incident.

- Photographic Evidence: Include clear, date-stamped photographs of the damage caused by your negligence. These pictures can help validate your claim and show the extent of the harm.

- Witness Statements: If there were witnesses to the event, their statements can help corroborate your account. Be sure to obtain their contact information so that your insurance company can reach out to them if necessary.

- Repair or Replacement Estimates: Obtain at least two repair or replacement estimates from reputable professionals. These estimates will help determine the extent of the cost that should be covered by your renters insurance.

- Proof of Negligence: Depending on the circumstances, you may need to provide evidence showing that your actions were indeed negligent. This could include photos or video footage depicting your failure to exercise reasonable care.

- Insurance Policy: Provide a copy of your renters insurance policy to ensure that all necessary terms and conditions are considered during the claims process.

Claims Process

Once you have gathered the required documentation, the claims process for negligence typically follows these steps:

- Contact Your Insurance Company: Inform your insurance company about the incident and provide them with all the necessary details. They will guide you through the next steps and help you understand what is covered under your policy.

- File a Claim: Submit a formal claim, either online or through the insurance company’s claims department. Include all the supporting documents mentioned earlier to strengthen your case.

- Claims Investigation: Your insurer will conduct an investigation to assess the validity of your claim. This may involve reviewing the documentation, contacting witnesses, or inspecting the damage.

- Settlement Negotiation: Once your claim has been deemed valid, your insurance company will proceed with the settlement negotiation process. They may offer a fair compensation amount based on the estimates and documentation you have provided.

- Resolution: If you and your insurance company can agree on a fair settlement amount, your claim will be resolved, and you should receive the compensation accordingly. If there are any disagreements, you may need to seek legal assistance or follow the appeals process outlined in your insurance policy.

Remember, the claims process can vary depending on your insurance provider and the extent of the damages. It’s crucial to familiarize yourself with your policy and understand the specific steps outlined by your insurance company.

Credit: http://www.rentecdirect.com

Preventing Negligence-related Incidents

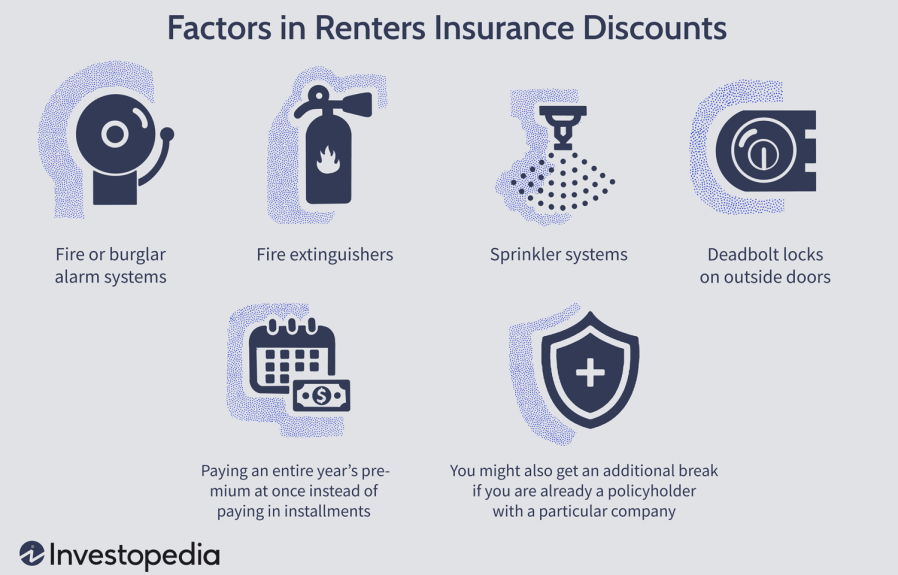

Being proactive in preventing negligence-related incidents is key for renters to ensure their safety and protection under renters insurance. By implementing safety measures and risk mitigation, you can safeguard yourself and your belongings.

Safety Measures

Install smoke detectors in all rooms to mitigate fire risks. Secure windows and doors to prevent unauthorized entry.

Risk Mitigation

Regularly check for water leaks to avoid potential damage. Keep valuable items in a safe or locked cabinet.

Consulting With Insurance Providers

Consulting with insurance providers can clarify if renters insurance covers negligence in certain scenarios. It’s essential to inquire directly with your insurance company to fully grasp the extent of coverage for negligence-related incidents. Understanding the terms and conditions of your policy is crucial to ensure adequate protection in such situations.

When it comes to understanding renters insurance coverage for negligence, consulting with insurance providers can provide valuable insights. This step is crucial for renters wanting to ensure they have the right policy in place to protect themselves and their belongings. Through open and honest communication with an insurance provider, renters can get the necessary information to make informed decisions. Here are two key areas to focus on when consulting with insurance providers:

Policy Customization

Insurance providers can help renters customize their policies to include specific coverage for negligence. By discussing potential scenarios and concerns, renters can work together with their insurance providers to create a comprehensive policy that best suits their individual needs. This customization can involve adding liability coverage to protect against damages caused due to negligence, ensuring peace of mind for renters.

Legal Guidance

Insurance providers can also offer valuable legal guidance to renters when it comes to understanding the legal aspects related to negligence and coverage. They can help explain the terms and conditions of the policy, clarifying any doubts or misconceptions that renters may have. This legal guidance ensures that renters have a clear understanding of their rights, obligations, and potential liability in case of negligence. By seeking advice from insurance providers, renters can make well-informed decisions and feel confident in their coverage.

Credit: http://www.statefarm.com

Conclusion And Takeaways

After reviewing the details of renters insurance coverage related to negligence, it becomes clear that renters insurance can provide valuable protection in situations involving negligence. However, it’s important for renters to proactively manage their risk and carefully review their policies to ensure they have adequate coverage.

Importance Of Reviewing Policies

When it comes to renters insurance, the importance of reviewing policies cannot be emphasized enough. Every renter’s situation is unique, and understanding the specifics of coverage related to negligence is crucial. Reviewing the policy details ensures that renters are aware of the scope of their coverage and any limitations that may apply.

Proactive Risk Management

Proactive risk management is essential for renters to protect themselves from potential liabilities. It involves taking necessary precautions to prevent accidents, damages, or injuries on the rental property. By maintaining a safe environment and adhering to responsible behavior, renters can mitigate the risk of negligence-related incidents.

Credit: http://www.applemoving.com

Frequently Asked Questions For Does Renters Insurance Cover Negligence

Does Renters Insurance Cover Negligence?

Yes, renters insurance typically covers negligence that results in damage to the rented property. This can include accidental damage, such as leaving a tap running and causing water damage, or other types of negligence resulting in covered losses.

What Types Of Negligence Are Covered By Renters Insurance?

Renters insurance generally covers a wide range of negligence-related incidents such as accidental fires, damage caused by overflowed bathtubs, or leaving a candle unattended leading to a fire. It’s important to review your policy to understand the specific coverage provided for negligence-related issues.

Is Negligence Coverage Included In All Renters Insurance Policies?

Most renters insurance policies include coverage for negligence, but the scope of coverage may vary. It’s important to carefully review your policy or consult with an insurance agent to understand the specific terms and conditions related to negligence coverage in your renters insurance policy.

Conclusion

Renters insurance is a crucial investment for tenants as it provides financial protection against unexpected events such as theft or damage to personal belongings. However, it is important to note that negligence is not typically covered under renters insurance policies.

Therefore, it is essential for tenants to practice caution and take necessary steps to prevent accidents and damages in order to avoid any potential liability issues. By understanding the limitations of renters insurance, tenants can make informed decisions and ensure their own safety and financial security.

Leave a comment