Fire insurance comes under the head of “Indirect Expenses” in Tally. Fire insurance is categorized as an indirect expense in Tally.

When organizing and managing financial data in Tally, it is crucial to correctly classify expenses. Fire insurance is considered an indirect expense because it is not directly associated with the production or purchase of goods or services. Instead, fire insurance is an overhead expense incurred to protect business assets against potential fire-related risks.

By categorizing fire insurance under the head of “Indirect Expenses” in Tally, businesses can accurately track and analyze their insurance expenditures alongside other indirect expenses. This allows for effective financial management and decision-making.

Understanding Classifications In Tally

Types Of Accounts In Tally

Tally categorizes accounts under different groups to simplify financial management.

How Tally Organizes Data

Tally organizes data based on the nature of transactions for accurate financial reporting.

Exploring Fire Insurance In Tally

Fire insurance is a crucial aspect of accounting in any business. In Tally, fire insurance falls under the category of indirect expenses. Understanding fire insurance and its importance in accounting is necessary to ensure accurate financial records.

Definition Of Fire Insurance

In simple terms, fire insurance is a type of insurance policy that provides coverage against losses or damages caused by fire. It is designed to protect individuals, businesses, and properties from the devastating effects of fires. By paying regular premiums, policyholders can mitigate the financial risk associated with fire-related incidents.

Importance In Accounting

Fire insurance plays a vital role in accounting as it helps businesses safeguard their assets and maintain financial stability. By including fire insurance expenses in their accounting books, businesses can accurately assess their financial position and allocate funds for potential loss due to fire incidents.

When recording fire insurance in Tally, it is categorized as an indirect expense. Indirect expenses refer to costs incurred in the operation of a business but are not directly related to the production or sale of goods or services.

By categorizing fire insurance as an indirect expense, businesses can assess the overall cost of operations and determine the financial impact of insuring against fire-related risks. Having a clear understanding of fire insurance expenses allows businesses to make informed decisions and efficiently manage their finances.

Classifying Fire Insurance In Tally

Fire insurance is one of the critical components in the accounting process of any organization or business. Under Tally ERP 9, it is important to properly classify fire insurance to ensure accurate and organized accounting records. In this section, we’ll explore where fire insurance falls and how it can be linked to accounts in Tally.

Where Fire Insurance Falls

When classifying fire insurance in Tally, it falls under the category of indirect expenses. It is considered an expense as it involves the payment of premiums to safeguard the assets against fire-related risks. Indirect expenses are essential for the functioning of a business, and fire insurance is no exception.

Linking Fire Insurance To Accounts

Once you understand where fire insurance falls in Tally, the next step is to link it to the appropriate accounts. Fire insurance premium payments should be recorded under the head of ‘indirect expenses’. This allows for accurate tracking and reporting of all expenses related to fire insurance, aiding in financial analysis and decision-making.

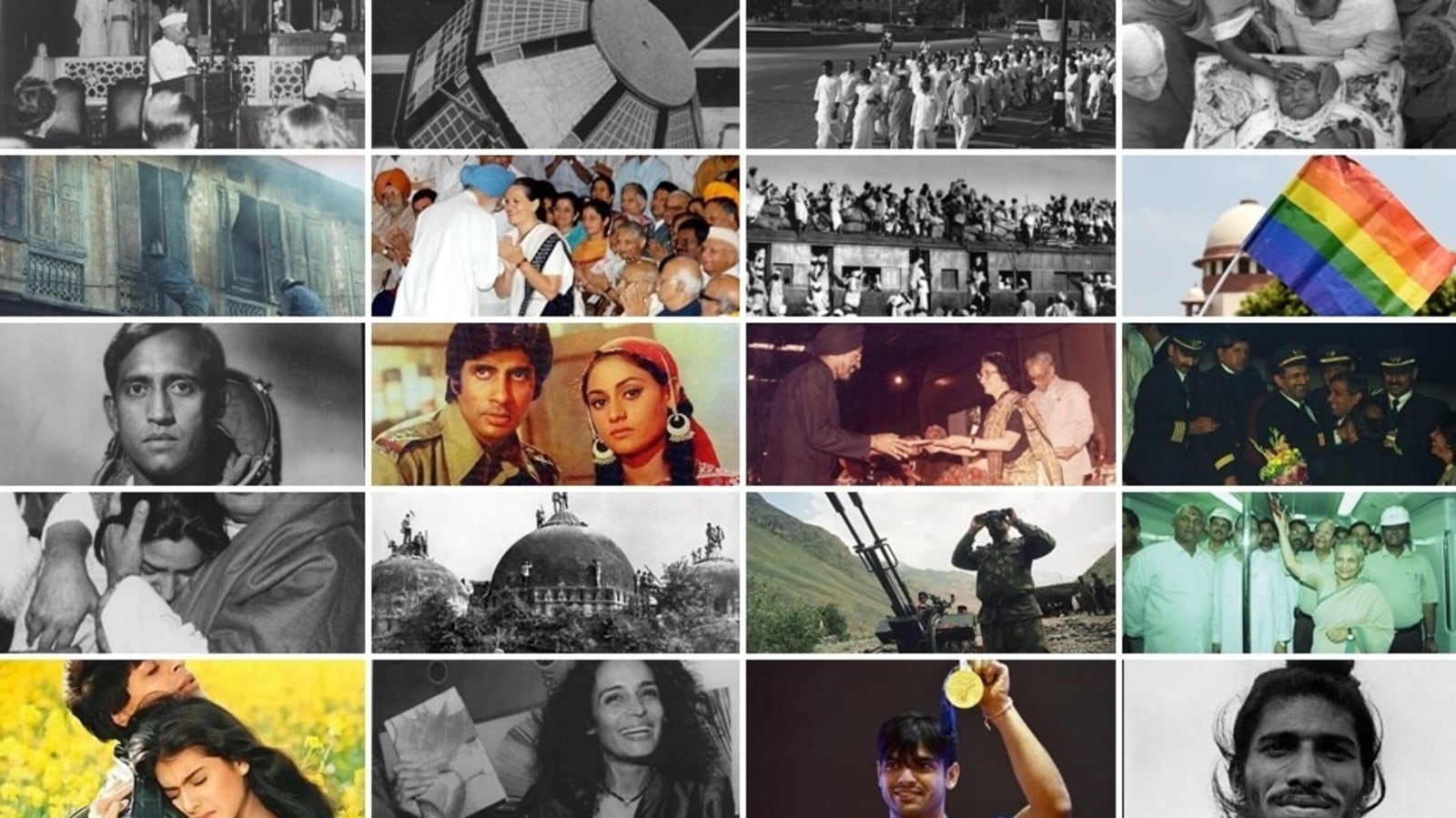

Credit: http://www.hindustantimes.com

Mastering Tally Classification

Fire insurance is an essential aspect of risk management for businesses and individuals. When it comes to managing this in Tally, it’s crucial to understand the classification process to ensure accurate financial reporting and compliance. Let’s dive into the best practices and common errors to avoid when classifying fire insurance in Tally.

Best Practices In Classification

Effective classification of fire insurance in Tally requires a systematic approach. Utilize the following best practices to streamline the process:

- Ensure consistent naming conventions for fire insurance accounts.

- Regularly review and update classification rules to align with regulatory changes.

- Utilize Tally’s built-in classification tools to categorize fire insurance accurately.

Avoiding Common Errors

Preventing errors in the classification of fire insurance is paramount to maintaining accurate financial records. Here are key steps to avoid common mistakes:

- Avoid categorizing fire insurance as a revenue account, as it should be classified as an expense.

- Double-check the accuracy of fire insurance classification to prevent misreporting.

- Regularly reconcile fire insurance accounts to ensure accuracy and identify any discrepancies.

Utilizing Tally Features

To account for fire insurance in Tally, categorize it under the “Insurance” head in the software’s features. By utilizing Tally features effectively, you can easily manage and track your fire insurance expenses within the system.

Creating Custom Groups

In Tally, you have the flexibility to create custom groups to categorize various types of insurance. To create custom groups, follow these steps:

- Go to Gateway of Tally and select Accounts Info.

- Under Accounts Info, select Groups.

- Click on Create to create a new group.

- Enter a Name for the custom group, such as “Insurance Expenses”.

- Choose an appropriate Nature from the available options, such as “Indirect Expenses” or “Expenses”.

- Save the group by pressing Ctrl+A.

Generating Reports

Tally allows you to generate reports that provide insights into your fire insurance expenses. Follow these steps to generate reports:

- Navigate to Gateway of Tally.

- Select Display option.

- Choose Account Books to view the list of available report types.

- Select the relevant report, such as Ledger or Group Summary.

- Specify the required parameters, such as the relevant group or ledger, and the desired time period.

- Finally, click on Enter or press Ctrl+A to generate the report.

By utilizing Tally’s features, you can create custom groups to properly categorize your fire insurance expenses and generate reports that provide valuable insights into your financial data. Take advantage of Tally’s flexibility and convenience to streamline your accounting processes.

Credit: http://www.crisisgroup.org

Ensuring Accuracy

Ensuring Accuracy:

When managing fire insurance in Tally, accuracy is key to prevent discrepancies in financial records. Regular auditing and reconciliation procedures are vital to guarantee the correctness of data.

Regular Auditing

Regular auditing helps to review and cross-check fire insurance transactions entered into Tally. It ensures the accuracy of the records, identifying any errors or inconsistencies promptly.

Reconciliation Procedures

Reconciliation procedures involve comparing the insurance statements with the Tally entries. This process confirms that all fire insurance data in Tally aligns correctly with the actual insurance policies and premiums.

Credit: issuu.com

Frequently Asked Questions Of Fire Insurance Comes Under Which Head In Tally

What Is The Importance Of Fire Insurance In Tally?

Fire insurance in Tally is essential for safeguarding business assets against fire-related risks. It helps in mitigating financial losses and ensuring business continuity.

How To Configure Fire Insurance In Tally Software?

To configure fire insurance in Tally, go to Accounts Info, select Ledgers, create a new ledger for fire insurance, and set the appropriate accounting and inventory allocation.

Can Fire Insurance Be Claimed As A Business Expense In Tally?

Yes, fire insurance can be claimed as a business expense in Tally. It provides financial protection and is considered a prudent investment for business continuity.

Conclusion

To summarize, fire insurance is categorized under the head of “Insurance” in Tally. This classification enables businesses to accurately record all their insurance expenses and claims. By incorporating fire insurance into Tally, companies can efficiently manage their financial transactions and maintain an organized record of their insurance activities.

This simplifies the process of tracking insurance expenditure and provides valuable insights for decision-making. Take advantage of Tally’s comprehensive features to streamline your insurance management effortlessly.

Leave a comment