A group health insurance policy provides coverage for a group of people, such as employees of a company, offering them access to healthcare services. Group health insurance policies are designed to provide financial protection for employees and their families by covering medical expenses for various treatments and services.

This type of policy is often offered by employers as part of their employee benefits package, and it helps to ensure that employees have access to necessary healthcare without incurring high out-of-pocket costs. Group health insurance policies typically offer a range of coverage options, including preventive care, hospitalization, prescription drugs, and specialist visits.

By pooling the risk among a group of individuals, these policies can offer more affordable premiums and comprehensive coverage compared to individual health insurance plans.

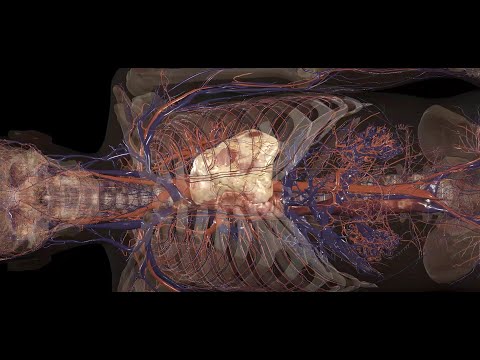

Credit: http://www.umc.edu

The Evolution Of Group Health Insurance

Group health insurance has seen significant transformations over the years, adapting to the changing landscape of healthcare services. From traditional models to modern innovations, the evolution of group health insurance has been shaped by various key drivers of change.

From Traditional Models To Modern Innovations

- Transition from basic coverage to comprehensive plans.

- Incorporation of digital tools for streamlined administration.

- Integration of wellness programs for proactive healthcare.

Key Drivers Of Change In Group Health Insurance

- Rising healthcare costs driving the need for cost-effective solutions.

- Advancements in medical technology influencing coverage options.

- Changing demographics leading to tailored benefits for diverse groups.

Credit: http://www.renown.org

Emerging Trends In Group Health Insurance

Group health insurance policies have been evolving to keep up with the changing dynamics of the healthcare industry. As employers strive to provide comprehensive and cost-effective benefits to their employees, they are embracing emerging trends in group health insurance. These trends reflect a shift towards personalized wellness programs and virtual healthcare services, ensuring that employees have access to the best possible healthcare options.

Personalized Wellness Programs

One of the emerging trends in group health insurance is the introduction of personalized wellness programs. These programs are designed to promote preventive care and encourage employees to take an active role in managing their health. Employers are partnering with wellness providers to offer customized initiatives that cater to the unique needs of their workforce.

These wellness programs often include health risk assessments, biometric screenings, and personalized action plans. Through incentives and rewards, employees are motivated to engage in healthier behaviors, such as regular exercise, balanced nutrition, and stress management. By focusing on preventive care, personalized wellness programs aim to reduce medical costs and enhance overall well-being.

Virtual Healthcare Services

Virtual healthcare services are becoming increasingly popular in group health insurance plans. With the advancement of technology, it has become easier for employees to access healthcare services remotely. Virtual consultations, telemedicine, and online health portals are examples of these services that provide convenient and efficient healthcare solutions.

Virtual healthcare services offer numerous benefits to employees, including faster access to healthcare professionals, reduced wait times, and the ability to seek medical advice from the comfort of their own homes. These services are particularly valuable for employees who face transportation barriers, live in remote areas, or have busy schedules.

Additionally, virtual healthcare services can be cost-effective for both employers and employees. By reducing the need for in-person appointments, they help minimize healthcare expenses and alleviate the burden on traditional healthcare facilities.

Advantages Of Group Health Insurance Policy

Group health insurance policies offer several advantages for both employers and employees. These policies provide cost-effective coverage for employees, ensuring their access to essential healthcare services. Let’s explore the key advantages in detail:

Cost-effective Coverage For Employees

Group health insurance offers a cost-effective solution for employees, as the premiums are typically lower compared to individual health insurance plans. The risk is spread across a larger pool of employees, resulting in reduced costs for each individual. Additionally, employers often contribute to the premium, further lowering the financial burden on employees.

Enhanced Access To Healthcare Services

With group health insurance, employees gain access to a wide network of healthcare providers, which may include specialists, hospitals, and clinics. This increased access ensures timely medical attention and a broader range of medical services. Group policies often cover preventive care and wellness programs, promoting proactive healthcare among employees.

Exclusive Features Of Modern Group Health Insurance Plans

Exclusive Features of Modern Group Health Insurance Plans

Telemedicine Benefits

Telemedicine benefits in group health insurance plans provide members with access to virtual healthcare services, enabling them to consult with medical professionals remotely.

Mental Health And Well-being Support

Modern group health insurance plans prioritize mental health and well-being support by offering access to counseling services, therapy sessions, and mental health resources to ensure holistic wellness.

Impact Of Technology On Group Health Insurance

In today’s digital age, technology has revolutionized every aspect of our lives, including the way we manage our health insurance policies. With the rise of digital platforms and advanced data analytics, group health insurance has become more efficient and tailored to individual needs. Let’s explore the impact of technology on group health insurance.

Digital Platforms For Easy Administration

Gone are the days of cumbersome paperwork and long waiting times. Digital platforms have simplified the administration process for group health insurance policies. These user-friendly platforms allow both employers and employees to seamlessly navigate through various tasks, such as enrollment, claims submission, and policy management.

By leveraging digital platforms, employers can easily add or remove employees from their group health insurance plans with just a few clicks. Likewise, employees can access their policy information, track claims, and receive electronic communications, enhancing transparency and convenience.

Moreover, these platforms often provide intuitive interfaces and interactive tools that facilitate comparison-shopping among different health insurance plans. This empowers employers to choose coverage options that best fit their employees’ needs while ensuring cost effectiveness.

Data Analytics For Tailored Health Solutions

Data analytics has transformed the way group health insurance providers offer personalized solutions to their policyholders. By analyzing vast amounts of health-related data, insurers can identify trends, risks, and opportunities for proactive interventions.

Through data analytics, insurers can identify high-risk individuals and offer targeted wellness programs and preventive measures to mitigate health issues before they escalate. This not only improves individuals’ well-being but also reduces healthcare costs for both employers and insurers.

Additionally, data analytics enables insurers to tailor health insurance coverage based on the specific needs and preferences of policyholders. By considering individuals’ medical histories, demographics, and lifestyle choices, insurers can design plans that provide comprehensive coverage and address unique health challenges.

Furthermore, data analytics allows insurers to continuously monitor the effectiveness of their policies and make data-driven decisions for the benefit of the group as a whole. This ensures that the group health insurance remains relevant and adaptive to changing healthcare trends and needs.

Credit: http://www.prnewswire.com

Challenges Faced By Group Health Insurance Providers

Group health insurance providers face a range of challenges when it comes to offering group health insurance policies. These challenges include managing costs, ensuring compliance with regulations, and meeting the varied needs of different organizations and their employees.

Challenges Faced by Group Health Insurance ProvidersRegulatory Compliance Hurdles

Meeting strict regulations poses a significant challenge for group health insurance providers. Constantly changing laws require extensive resources for compliance.

Providers must stay informed about regulations to ensure their policies adhere to legal standards.

Balancing Innovation With Affordability

Finding a balance between innovative healthcare solutions and affordability is a key challenge faced by group health insurance providers.

Striving to offer cutting-edge services while keeping premiums affordable is no easy task.

Tips For Businesses Choosing Group Health Insurance Plans

Explore essential factors when selecting group health insurance plans for businesses. Consider employee needs, coverage options, costs, and provider networks to ensure optimal policy fit. Comparing quotes from multiple insurers can help identify the best plan for your workforce.

Assessing Employee Needs

Understand what your employees require to make the right decision for health coverage.

Comparing Coverage Options

Analyze different coverage options offered by insurance providers to find the best fit.

Looking Ahead: Future Of Group Health Insurance

As we look ahead to the future of group health insurance, it’s essential to consider the advancements and developments that will shape the landscape of healthcare coverage. From the integration of AI in healthcare management to the continued focus on preventive care, the future of group health insurance promises to bring significant changes that will benefit both employers and employees.

Integration Of Ai In Healthcare Management

The integration of AI in healthcare management is set to revolutionize the way healthcare services are delivered and managed within group health insurance policies. Through the implementation of AI-powered systems, healthcare providers can streamline administrative processes, enhance patient care, and identify patterns in health data to improve outcomes.

Continued Focus On Preventive Care

One of the key pillars of the future of group health insurance is the continued focus on preventive care. By prioritizing preventive measures such as regular health screenings, wellness programs, and lifestyle management, group health insurance policies aim to reduce the incidence of chronic diseases and ultimately lower healthcare costs for both employers and employees.

Frequently Asked Questions On Group Health Insurance Policy

What Is A Group Health Insurance Policy?

A group health insurance policy is a type of health insurance that covers a group of people, such as employees of a company. It provides coverage for medical expenses and is often more cost-effective than individual plans.

How Does A Group Health Insurance Policy Work?

Group health insurance policies work by spreading the risk among the members of the group. The premiums are paid collectively, usually by the employer, and the coverage extends to all eligible members of the group, providing them with access to medical care and services.

What Are The Benefits Of A Group Health Insurance Policy?

Group health insurance policies offer several benefits, including cost savings, broader coverage options, and potential tax advantages for both employers and employees. Additionally, they promote employee retention and satisfaction by providing access to affordable healthcare.

Who Is Eligible For A Group Health Insurance Policy?

Typically, employees of a company, along with their dependents, are eligible for coverage under a group health insurance policy. In some cases, certain regulations may require a minimum number of participants or hours worked for eligibility.

Conclusion

A group health insurance policy offers a range of benefits for employers and employees alike. It provides comprehensive coverage, cost savings, and ensures access to quality healthcare services. By offering a group health insurance plan, employers can attract and retain top talent while employees can enjoy peace of mind knowing their health needs are taken care of.

With its numerous advantages, group health insurance is an essential investment for any organization looking to prioritize the well-being of its workforce.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is a group health insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “A group health insurance policy is a type of health insurance that covers a group of people, such as employees of a company. It provides coverage for medical expenses and is often more cost-effective than individual plans.” } } , { “@type”: “Question”, “name”: “How does a group health insurance policy work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance policies work by spreading the risk among the members of the group. The premiums are paid collectively, usually by the employer, and the coverage extends to all eligible members of the group, providing them with access to medical care and services.” } } , { “@type”: “Question”, “name”: “What are the benefits of a group health insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance policies offer several benefits, including cost savings, broader coverage options, and potential tax advantages for both employers and employees. Additionally, they promote employee retention and satisfaction by providing access to affordable healthcare.” } } , { “@type”: “Question”, “name”: “Who is eligible for a group health insurance policy?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Typically, employees of a company, along with their dependents, are eligible for coverage under a group health insurance policy. In some cases, certain regulations may require a minimum number of participants or hours worked for eligibility.” } } ] }

Leave a comment