Group health insurance is a type of health insurance that provides coverage to a specific group of people, such as employees of a company or members of an organization. It is an important benefit offered by employers to attract and retain talent while ensuring access to affordable healthcare for employees and their families.

With group health insurance, members share the cost of premiums, deductibles, and copayments, helping to make healthcare more affordable. This type of insurance typically offers a wide range of coverage options, including preventive care, hospitalization, prescription drugs, and specialist visits.

It provides peace of mind by offering financial protection against unexpected medical expenses, and it promotes a healthier workforce by encouraging regular healthcare check-ups and preventive measures.

The Basics Of Group Health Insurance

Group health insurance is a type of coverage that provides medical benefits to a group of people, such as employees of a company. It helps to distribute the cost of healthcare among members, making it more affordable and accessible.

Definition Of Group Health Insurance

Group health insurance is a type of health coverage that is provided to a group of people, typically employees of a company. It offers medical benefits to eligible members.

Who Qualifies For Group Health Insurance

Employees of a company that offers group health insurance are usually eligible to enroll. Additionally, some plans may extend coverage to employees’ dependents.

Advantages Of Group Health Insurance

Group health insurance offers numerous advantages, such as lower costs, broader coverage, and the ability to include pre-existing conditions. It also provides financial security, as employees contribute to the premiums and employers typically cover a percentage. Additionally, group health insurance promotes a healthier workforce, resulting in better productivity and morale.

Group health insurance provides numerous advantages for both employers and employees. From cost-effective coverage to broader coverage options, group health insurance offers essential benefits for individuals and companies alike.

Cost-effective Coverage

One of the primary advantages of group health insurance is its cost-effectiveness. By pooling together a large number of individuals, group health insurance enables companies to negotiate lower premiums with insurance providers. This cost savings extends to the employees as well, who pay lower premiums compared to individual health insurance plans.

Moreover, group health insurance allows employers to enjoy tax benefits. In many countries, the premium paid for group health insurance is tax-deductible for employers, reducing their overall healthcare expenses. This financial advantage not only benefits the company’s bottom line but also allows employers to invest in other important areas of their business.

Broader Coverage Options

Another advantage of group health insurance is the broader coverage options it provides. Unlike individual health insurance plans, group health insurance typically offers a range of coverage options and benefits such as preventive care, prescription medications, and even dental and vision care. This comprehensive coverage ensures that employees have access to essential healthcare services that cater to their unique needs.

Additionally, group health insurance often includes coverage for pre-existing conditions, which is a crucial benefit for individuals with medical histories. This means that employees who may have experienced health issues in the past can still obtain coverage through the group health insurance plan, resulting in peace of mind and improved access to healthcare services.

In summary, group health insurance offers significant advantages, including cost-effective coverage and broader coverage options. With its ability to provide affordable premiums and comprehensive benefits, group health insurance ensures that both employers and employees can access essential healthcare services without straining budgets or compromising on care.

Key Features Of Group Health Insurance Plans

Group health insurance plans are beneficial for both employers and employees. Here are some key features that make them stand out:

Inclusion Of Pre-existing Conditions

Group health insurance typically covers pre-existing conditions, which means employees with existing health issues can still receive coverage without facing high premiums or being denied access to healthcare.

Employer Contributions

Employer contributions play a vital role in group health insurance plans. Employers often subsidize a portion of the premium costs, making healthcare more affordable for employees and their families.

Enrollment Process For Group Health Insurance

Group health insurance is an essential employee benefit that provides coverage for a group of individuals, typically employees of a company or members of an organization. The process of enrolling in group health insurance involves specific periods and criteria for eligibility.

Initial Enrollment Period

When a new employee becomes eligible for group health insurance, they typically have an initial enrollment period during which they can sign up for coverage. This window is usually within 30 to 60 days of their employment start date. During this time, employees can review plan options, understand coverage details, and make selections that best suit their needs.

Special Enrollment Periods

Special enrollment periods allow individuals to sign up for group health insurance outside of the initial enrollment period due to specific qualifying events, such as marriage, birth or adoption of a child, or loss of coverage from another plan. These circumstances necessitate a change in insurance coverage, and the special enrollment period provides an opportunity for individuals to make adjustments to their group health insurance plans.

Managing Group Health Insurance Benefits

Managing group health insurance benefits can be a complex task for employers. To ensure a smooth and efficient administration process, employers must be aware of certain key factors. These factors include the addition or removal of employees and changing coverage levels. By understanding these aspects, employers can effectively manage their group health insurance benefits and provide the best healthcare options for their employees.

Addition Or Removal Of Employees

When it comes to managing group health insurance benefits, employers need to be aware of the process for adding or removing employees from their coverage. This is especially important when new employees join the organization or when current employees leave. By following the necessary steps, employers can ensure that their employees have continuous and uninterrupted coverage.

Here’s a step-by-step guide to adding or removing employees:

- For adding new employees:

- Collect the necessary information from the employee, such as their full name, date of birth, and social security number.

- Submit the employee’s information to the insurance provider within the specified timeframe.

- Ensure that the employee receives their insurance cards and is aware of the coverage details.

- For removing employees:

- Notify the insurance provider in a timely manner when an employee leaves the organization.

- Terminate the employee’s coverage at the appropriate date to avoid unnecessary costs or coverage gaps.

- Inform the departing employee about their options for continuing coverage, such as through COBRA.

Changing Coverage Levels

As the needs of employees change over time, employers may need to adjust the coverage levels offered in their group health insurance plan. Whether it’s increasing or decreasing coverage, employers need to understand the process and implications for these changes. This ensures that employees receive the appropriate level of healthcare coverage that meets their needs.

Here are some key factors to consider when changing coverage levels:

- Review the current plan and assess if changes in coverage are necessary based on employee feedback, budget constraints, or industry changes.

- Contact the insurance provider to discuss the options available for changing coverage levels.

- Communicate any changes to employees, providing them with clear information about the new coverage levels and any associated costs or benefits.

- Ensure that the insurance provider updates the necessary documentation and that employees receive updated insurance cards or information.

By effectively managing the addition or removal of employees and changing coverage levels, employers can ensure that their group health insurance benefits remain organized, efficient, and tailored to the needs of their workforce.

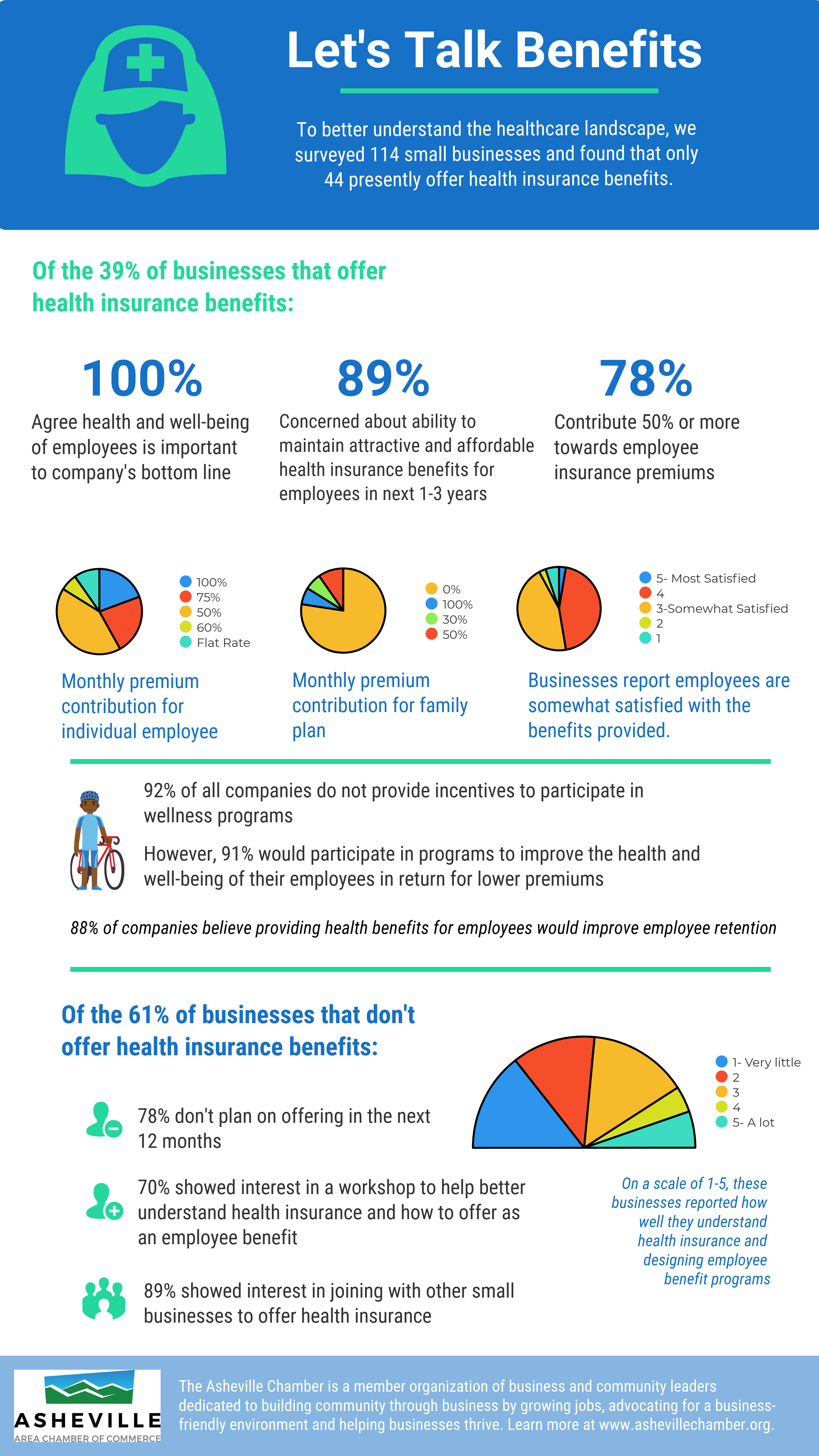

Credit: http://www.ashevillechamber.org

Comparison With Individual Health Insurance

Group health insurance is a type of health coverage that is provided to a group of people, typically employees of a company. It offers coverage to all eligible members of the group under a single policy. When comparing it with individual health insurance, there are some distinct differences in terms of cost and coverage variations.

Cost Differences

- Offers lower premiums due to being procured for a group, spreading the risk and cost.

- Employers often contribute towards the premiums, reducing the financial burden on employees.

- Generally higher premiums as the risk is calculated for an individual.

- Individuals bear the entire cost without employer contributions.

Coverage Variations

- Basic Coverage: Typically, it offers standard benefits and may have some limitations.

- Customization: Employers may have the flexibility to tailor coverage options based on the group’s needs.

- Pre-existing Conditions: Group plans often cover pre-existing conditions without waiting periods.

- Tailored Plans: Provides the freedom for individuals to customize plans according to their specific needs.

- Underwriting: Underwriting process may lead to exclusions or higher premiums for pre-existing conditions.

- Portability: Unlike group plans, individuals can retain coverage when changing jobs or leaving an employer.

Legal Requirements For Offering Group Health Insurance

Understanding the legal requirements for offering group health insurance is crucial for businesses. Compliance with regulations ensures protection for both employers and employees.

Regulations For Small Businesses

Small businesses must meet specific criteria to offer group health insurance. Employers with a certain number of employees are required to provide health insurance benefits.

- Minimum Participation: Small businesses must ensure minimum percentage of employees enroll in the health insurance plan.

- Contribution: Employers are required to contribute a certain amount towards employees’ premiums.

- ERISA Compliance: Compliance with Employee Retirement Income Security Act is essential for small businesses offering health insurance.

Affordable Care Act Compliance

Maintaining compliance with the Affordable Care Act (ACA) is mandatory. Businesses must adhere to ACA regulations for offering group health insurance.

- Essential Health Benefits: Group health insurance plans must cover essential health benefits outlined by the ACA.

- Employer Mandate: Certain businesses must comply with the ACA employer mandate regarding providing health insurance to employees.

- Reporting Requirements: Businesses are required to report on health coverage provided to employees as per ACA guidelines.

Credit: http://www.linkedin.com

The Future Of Group Health Insurance

Group health insurance is evolving rapidly, with new trends and technological innovations shaping the landscape. Businesses need to stay informed about these changes to ensure they provide the best coverage for their employees.

Trends In Group Health Insurance

1. Rising costs of healthcare impacting group insurance premiums.

2. Increased focus on mental health and wellness benefits.

3. Customizable health plans to cater to diverse employee needs.

Technological Innovations In Health Insurance Sector

1. Integration of telemedicine services for convenient healthcare access.

2. Usage of data analytics to personalize insurance offerings.

3. Implementation of AI and chatbots to enhance customer service.

Credit: http://www.calhealth.net

Frequently Asked Questions On Group Health Insurance What Is It

What Is Group Health Insurance?

Group health insurance is a type of health insurance coverage that is offered to a group of people, typically employees of a company. It provides coverage at a lower cost than individual plans and usually includes a range of benefits.

How Does Group Health Insurance Work?

Group health insurance works by spreading the risk across a larger group of people, which can lead to lower premiums. Employers typically cover a portion of the premium costs, and employees may have the option to add dependents to the plan.

What Are The Benefits Of Group Health Insurance?

Group health insurance offers several benefits, including cost savings, comprehensive coverage, and the ability to include family members. It also provides access to a network of healthcare providers and may offer additional wellness programs and services.

Who Is Eligible For Group Health Insurance?

Eligibility for group health insurance typically depends on the employer’s policies. Full-time employees and sometimes part-time employees may be eligible for coverage. Employers may also offer coverage to an employee’s spouse and children.

Conclusion

Group health insurance is a vital coverage option for businesses and their employees. It provides affordable access to medical care, offering financial protection and peace of mind. By pooling risk and costs, employers can offer comprehensive plans that benefit both the company and its workforce.

Whether you’re a small business or a large corporation, investing in group health insurance can be a wise decision that supports the well-being and productivity of your employees.

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What is group health insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance is a type of health insurance coverage that is offered to a group of people, typically employees of a company. It provides coverage at a lower cost than individual plans and usually includes a range of benefits.” } } , { “@type”: “Question”, “name”: “How does group health insurance work?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance works by spreading the risk across a larger group of people, which can lead to lower premiums. Employers typically cover a portion of the premium costs, and employees may have the option to add dependents to the plan.” } } , { “@type”: “Question”, “name”: “What are the benefits of group health insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Group health insurance offers several benefits, including cost savings, comprehensive coverage, and the ability to include family members. It also provides access to a network of healthcare providers and may offer additional wellness programs and services.” } } , { “@type”: “Question”, “name”: “Who is eligible for group health insurance?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Eligibility for group health insurance typically depends on the employer’s policies. Full-time employees and sometimes part-time employees may be eligible for coverage. Employers may also offer coverage to an employee’s spouse and children.” } } ] }

Leave a comment