To get travel insurance, simply visit a reputable insurance provider’s website and apply online. Complete the application with your personal and trip details, then choose a plan and make the payment.

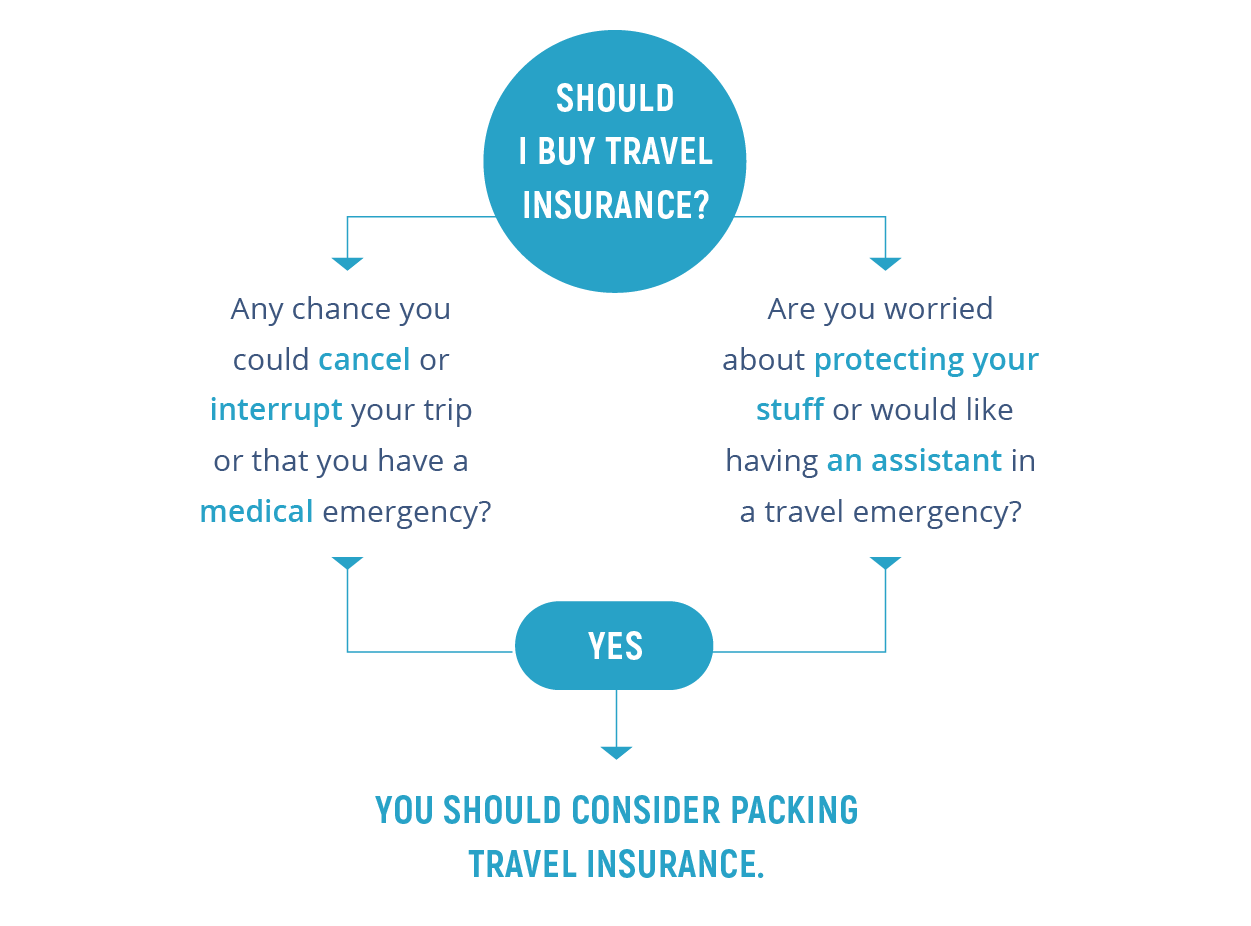

Travel insurance provides financial protection and assistance in case of unexpected events during your travels, such as trip cancellations, medical emergencies, or lost luggage. It’s a crucial investment for peace of mind while exploring the world. Travel insurance offers a safety net for unexpected events that can disrupt or derail your travel plans.

From flight cancellations to medical emergencies, having the right coverage ensures you can travel with confidence. By understanding how to obtain travel insurance and its benefits, you can make informed decisions that protect you and your loved ones on your journeys. Exploring new destinations becomes more enjoyable when you have the reassurance of travel insurance.

Importance Of Travel Insurance

Travel insurance provides essential protection for travelers, ensuring peace of mind and financial security during their journeys.

Peace Of Mind

Travel insurance gives travelers peace of mind knowing they are covered in case of emergencies or unforeseen events.

Financial Protection

Having travel insurance offers financial protection against loss of baggage or personal items, trip cancellations, or medical emergencies while traveling.

Credit: http://www.kurnia.com

Types Of Travel Insurance

When getting travel insurance, it’s essential to understand the different types available to ensure you have the right coverage for your trip. The three main types of travel insurance you should consider are:

Trip Cancellation Insurance

Trip Cancellation Insurance provides coverage if you have to cancel your trip unexpectedly due to covered reasons such as illness, natural disasters, or other unforeseen events.

Medical Insurance

Medical Insurance covers medical expenses incurred while traveling, including emergency medical treatment, dental care, prescription medications, and evacuation to a medical facility if needed.

Baggage Insurance

Baggage Insurance reimburses you for lost, stolen, or damaged luggage during your trip, ensuring you don’t incur additional expenses due to such occurrences.

Factors To Consider

When getting travel insurance, consider factors such as coverage for medical emergencies, trip cancellation, and baggage loss. Additionally, pay attention to the policy’s exclusions, pre-existing conditions, and add-on options for adventure activities or extreme sports. Transparent terms and customer reviews are also valuable for making an informed decision.

Factors to Consider When planning for any trip, it is crucial to prioritize your safety and well-being. One way to do this is by getting travel insurance. Travel insurance provides financial protection and coverage for unexpected events, such as medical emergencies, trip cancellations, and lost luggage. However, choosing the right travel insurance policy can be overwhelming with the myriad of options available. To make an informed decision, there are several key factors to consider.Destination

The destination of your trip plays a significant role in determining the type of travel insurance you need. Some countries may have higher medical expenses or increased risk of theft, which should be taken into account when selecting your coverage. For example, if you are traveling to a remote location with limited medical facilities, it is essential to have coverage for emergency medical evacuation. Conversely, if you are visiting a destination with a high crime rate, theft and loss coverage becomes even more crucial.Duration Of Trip

The duration of your trip is another vital factor to consider when purchasing travel insurance. Shorter trips may require less comprehensive coverage, while longer trips might necessitate extended protection. It is important to check the maximum coverage period of the insurance policy you are considering. Additionally, if you plan on taking multiple trips throughout the year, you may want to consider an annual travel insurance policy to save both time and money.Activities And Sports

The activities and sports you plan to engage in during your trip should also influence your travel insurance decision. If you are participating in adventurous activities like skiing, scuba diving, or hiking, it is essential to ensure your travel insurance covers these activities. Some policies may exclude certain high-risk activities or require additional coverage. Additionally, if you are planning to rent a car, consider getting rental car insurance coverage to protect against any unforeseen accidents or damages. By considering these factors – destination, duration of the trip, and activities and sports – you can choose a travel insurance policy that suits your needs and provides you with peace of mind throughout your journey. Remember, accidents can happen at any time, and having the right insurance coverage can save you from financial burdens and unnecessary stress during your travels.How To Choose The Right Travel Insurance

When planning a trip, one essential component to consider is travel insurance. With a myriad of options available, choosing the right travel insurance can be daunting. To ensure you make the best decision, there are a few key factors to consider. Assessing your needs, comparing plans, and understanding exclusions and limits are crucial steps in selecting the most suitable travel insurance plan.

Assess Your Needs

Start by evaluating your specific travel needs. Consider the duration of your trip, your destination, the activities you plan to engage in, and any pre-existing medical conditions. This assessment will help you determine the level of coverage required for your trip.

Compare Plans

Research and compare various travel insurance plans from different providers. Look for plans that offer comprehensive coverage for medical emergencies, trip cancellations, and other unforeseen events. Compare the cost of each plan and assess the value they provide based on your individual needs.

Consider Exclusions And Limits

Review the fine print of each travel insurance policy to understand the exclusions and limits. Pay close attention to coverage limitations, such as maximum payouts for medical expenses or coverage restrictions for adventure activities. Understanding these details will prevent any surprises when making a claim.

Steps To Get Travel Insurance

Travel insurance can provide peace of mind and financial protection for unexpected events during your trip. To ensure you receive the best coverage for your needs, it’s essential to follow a few key steps to get travel insurance. From researching insurance providers to purchasing a policy, each step plays a crucial role in finding the right coverage. In this guide, we will explore the essential steps to get travel insurance to help you embark on your next adventure with confidence.

Research Insurance Providers

The first step in obtaining travel insurance is to research and compare different insurance providers. Look for companies with a strong reputation, positive customer reviews, and a proven track record of handling claims efficiently. Ensure that the insurance provider is reputable and offers comprehensive coverage for various travel scenarios.

Evaluate Coverage Options

Once you’ve identified potential insurance providers, it’s time to evaluate their coverage options. Understand the type of coverage each provider offers, including medical coverage, trip cancellation protection, and emergency assistance services. Consider the specific needs of your trip and select a policy that provides adequate coverage for your travel requirements.

Get Quotes

After narrowing down your options, request quotes from the insurance providers to compare pricing and coverage. Obtain quotes for the specific coverage you need, comparing premiums, deductibles, and limits for each policy. Ensure that the quotes reflect the level of coverage you require, allowing you to make an informed decision based on both cost and coverage.

Purchase Policy

Once you have selected the ideal insurance provider and policy, it’s time to purchase the policy. Review the terms and conditions thoroughly, ensuring you understand the coverage and limitations of the policy. Complete the purchase process, and keep a copy of the policy documents easily accessible throughout your travels for reference should you need to file a claim.

Credit: http://www.bhtp.com

Documents Required

When it comes to traveling, having the right documents is essential. One document that you should never leave behind is your passport and ID. Additionally, having a copy of your travel itinerary and your medical history can also be important. In this section, we will discuss each of these documents in detail and why they are necessary for getting travel insurance.

Passport And Id

Your passport and ID are the most crucial documents you need when traveling abroad. Your passport serves as your primary identification, allowing you to enter and exit different countries. It is important to ensure that your passport is valid for at least six months beyond your planned travel dates. Additionally, having a photocopy of your passport as a backup is highly recommended. You should also carry an original or a photocopy of a government-issued ID, which can serve as an additional form of identification.

Travel Itinerary

Your travel itinerary is an important document that outlines your trip’s details, including your flight bookings, hotel reservations, and any planned activities. It serves as proof of your intended travel plans and can be requested by travel insurance providers. Having a well-documented and organized itinerary can help the insurance provider understand the purpose and duration of your trip, making it easier for them to assess your insurance needs.

Medical History

Providing your medical history when obtaining travel insurance is crucial, as it helps insurers assess your health risk while you are away from home. By disclosing any pre-existing medical conditions, allergies, or chronic illnesses, you enable insurance providers to offer you suitable coverage. It is recommended to consult with your healthcare provider and carry any relevant medical documents, such as prescriptions or medical reports, to support your medical history information.

Tips For A Smooth Claim Process

Looking for tips to ensure a smooth travel insurance claim process? Check out this insightful article that provides valuable advice and guidance on how to navigate the ins and outs of getting travel insurance and making successful claims, ensuring your trip is worry-free.

Start of Blog Post Section: Tips for a Smooth Claim Process Read the Policy H3 HeadingRead The Policy

Before filing a claim, make sure to thoroughly read and understand your travel insurance policy. Key details such as coverage limits, exclusions, and required documentation are often outlined in the policy document.

Document Everything H3 HeadingDocument Everything

In case of an incident during your travels, document all relevant information. Take photos, keep receipts, and gather any supporting evidence that may be required for your claim submission.

Contact the Insurance Provider H3 HeadingContact The Insurance Provider

Once you are ready to file a claim, promptly contact your insurance provider. They can guide you on the specific steps to take and provide assistance throughout the claims process.

Common Travel Insurance Mistakes To Avoid

Not Reading The Fine Print

Skipping the fine print can lead to misunderstandings and claim denials.

Underestimating Coverage Needs

Ensure you have enough coverage for medical emergencies and trip cancellations.

Waiting Until The Last Minute

Don’t delay getting travel insurance as you risk missing crucial coverage.

Credit: http://www.thaiembassy.com

Frequently Asked Questions Of How Get Travel Insurance

Is Travel Insurance Necessary For My Trip?

Yes, travel insurance is essential as it provides coverage for medical emergencies, trip cancellation, lost luggage, and other unforeseen incidents, ensuring a worry-free travel experience.

How To Choose The Right Travel Insurance Plan?

To select the best travel insurance, consider your destination, trip duration, and activities. Compare coverage for medical expenses, trip cancellation, and baggage loss to find a plan that suits your needs.

What Does Travel Insurance Typically Cover?

Travel insurance typically covers medical expenses, trip cancellation or interruption, baggage loss or delay, emergency evacuation, and other unforeseen incidents during your trip.

Can I Get Travel Insurance For Pre-existing Medical Conditions?

Yes, some travel insurance providers offer coverage for pre-existing medical conditions. It’s crucial to disclose all existing health conditions when purchasing a policy to ensure adequate coverage.

Conclusion

Travel insurance is a vital part of any trip. It provides the necessary protection and peace of mind, ensuring you are covered in case of unforeseen events during your travels. By understanding the benefits, coverage options, and factors to consider, you can make an informed decision on the right travel insurance for your needs.

Don’t leave home without it!

Leave a comment