Disability insurance premiums are calculated based on factors such as age, gender, occupation, and benefit amount. When purchasing disability insurance, there are various factors that come into play when determining the premium amount.

The premium is calculated based on the individual’s age, gender, occupation, and the desired benefit amount. Age is a significant factor because the likelihood of disability typically increases as one gets older. Gender also plays a role since women tend to have higher rates of disability than men.

Occupation is considered because certain jobs have a higher risk of disability than others. Finally, the benefit amount requested by the individual also affects the premium, as a higher benefit amount will lead to a higher cost. By taking these factors into account, insurance providers can accurately calculate disability insurance premiums.

Factors Affecting Disability Insurance Premium

Factors Affecting Disability Insurance Premium:

Age And Health Condition

A person’s age and health status significantly influence disability insurance premium rates.

Occupation And Income Level

The nature of your job and income levels are crucial in determining disability insurance costs.

Coverage Amount And Duration

The coverage amount and duration selected impact the overall premium for disability insurance.

Credit: http://www.amazon.com

Types Of Disability Insurance Policies

There are two main types of disability insurance policies: short-term disability insurance and long-term disability insurance. Each type aims to provide financial protection in the event of a disabling injury or illness, but they differ in terms of duration and coverage. Let’s take a closer look at each of these policies.

Short-term Disability Insurance

Short-term disability insurance is designed to offer coverage for a shorter period, typically ranging from a few weeks to a few months. This type of policy is particularly useful for individuals who require temporary financial assistance due to a sudden illness or injury.

With short-term disability insurance, you’ll receive a percentage of your pre-disability income as benefits during the defined duration of the policy. The exact amount you’ll receive depends on several factors, such as your income before the disability and the terms of your specific policy.

It’s also important to note that short-term disability insurance policies often have a waiting period before benefits begin. This waiting period generally ranges from 0 to 14 days, during which you’ll need to cover your own expenses until the policy kicks in.

Long-term Disability Insurance

Long-term disability insurance, as the name suggests, provides coverage over a longer period if you’re unable to work due to an illness or injury. This type of policy typically kicks in after the expiration of a short-term disability policy, if you have one, or after a waiting period that can range from a few weeks to several months.

Unlike short-term disability insurance, which covers a temporary inability to work, long-term disability insurance can provide benefits for an extended period, ranging from a few months to several years, or even until retirement age. The duration of coverage is outlined in the policy terms and will depend on various factors, including your occupation and the extent of your disability.

Long-term disability insurance policies generally provide a percentage of your pre-disability income as benefits. This can range from 50% to 80% of your earnings, although specific policy terms will determine the exact amount you’ll receive.

When choosing between short-term and long-term disability insurance, it’s crucial to carefully evaluate your specific needs and financial situation. While short-term disability insurance focuses on temporary coverage, long-term disability insurance safeguards against extended periods of disability that may significantly impact your financial stability.

Calculation Methodologies

Calculation methodologies for disability insurance premium vary based on the type of plan and the risk factors involved. Different calculation methods are used to determine the premium rates for disability insurance. In this blog post, we will delve into three common calculation methodologies – flat premium rate, risk-based premium rate, and experience-rated premium rate – to provide a clear understanding of how disability insurance premiums are determined.

Flat Premium Rate

A flat premium rate is a straightforward method of calculating disability insurance premiums. Under this methodology, all insured individuals are charged the same premium rate regardless of their age, occupation, or health status. The premiums are typically determined based on the benefits provided by the policy and are evenly distributed among all policyholders.

Risk-based Premium Rate

The risk-based premium rate takes into account the individual risk factors of the insured individuals. This calculation methodology considers factors such as the applicant’s age, occupation, medical history, and lifestyle habits to determine the appropriate premium rate. Insurers assess the level of risk posed by each applicant and adjust the premium rates accordingly to reflect the perceived risk.

Experience-rated Premium Rate

The experience-rated premium rate is based on the claims experience of a specific group or employer. Insurers analyze the previous disability claims history within the group or organization to calculate the premium rates for the upcoming policy period. If the group has a low incidence of disability claims, the premium rates may be lower, whereas a high claims experience may result in higher premium rates for the group.

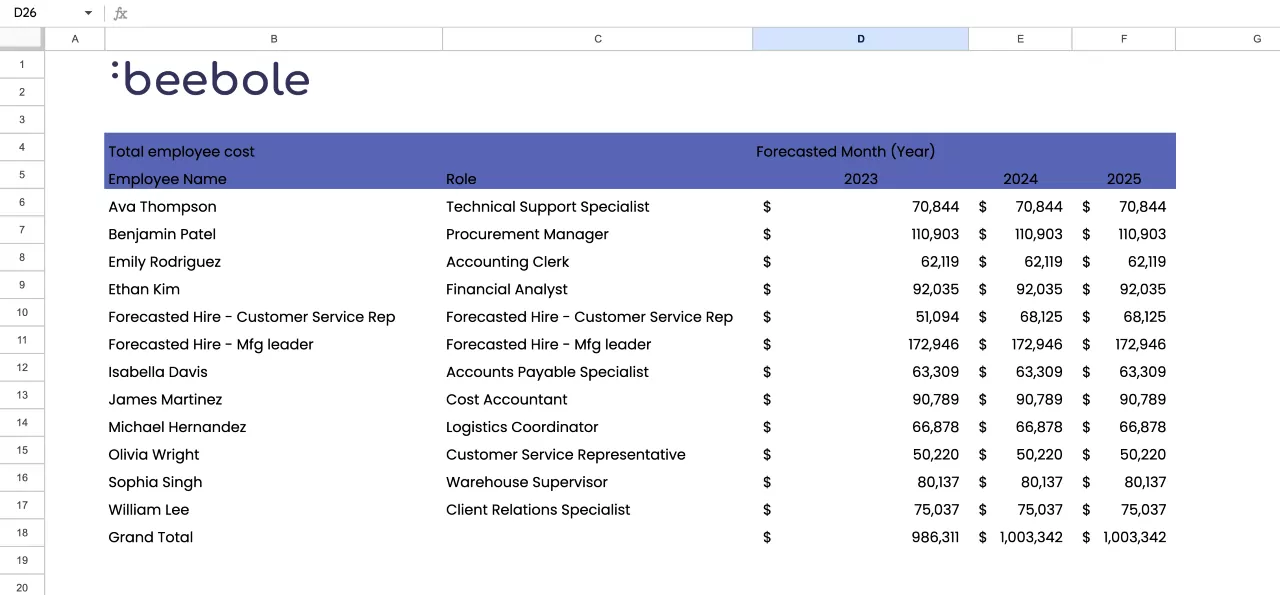

Credit: beebole.com

Additional Features Impacting Premium

When it comes to disability insurance, several additional features can impact the premium you pay for coverage. Understanding these factors is crucial in determining the right disability insurance policy for your needs. These features include riders and add-ons, elimination period, and benefit period.

Riders And Add-ons

Riders and add-ons are additional features that can be included in a disability insurance policy to customize coverage based on individual needs. These features may include options for cost-of-living adjustments, future purchase options, and rehabilitation benefits. Choosing the right riders and add-ons can enhance your coverage but may also impact the premium you pay.

Elimination Period

The elimination period refers to the length of time between when a disability begins and when benefits start to be paid. Typically, the longer the elimination period, the lower the premium. Selecting a longer elimination period can help lower your premium, but it’s important to consider your financial situation and ability to cover expenses during this waiting period.

Benefit Period

The benefit period determines how long benefits will be paid once a disability occurs. Common choices for benefit periods include 2 years, 5 years, to age 65, or even lifetime coverage. Opting for a longer benefit period will increase the premium. Deciding on the right benefit period involves considering your financial needs in the event of a long-term disability.

“`How To Lower Your Disability Insurance Premium

Reducing your disability insurance premium is a smart financial move that can save you money while still providing the coverage you need. By taking a few simple steps, you can effectively lower your premium without sacrificing your peace of mind. Here are some strategies to consider:

Maintaining Good Health

One of the most effective ways to lower your disability insurance premium is to maintain good health. Insurance companies typically assess the risk of insuring an individual based on their health status, including factors such as age, pre-existing conditions, and lifestyle choices. By taking steps to improve your overall health, you can not only reduce your risk of disability but also lower your premium. Here are a few ways to stay healthy and potentially lower your disability insurance costs:

- Eat a balanced diet that includes a variety of fruits, vegetables, and whole grains

- Exercise regularly to improve your cardiovascular health and maintain a healthy weight

- Quit smoking or avoid tobacco products altogether, as smoking can increase the risk of disability

- Limit alcohol consumption, as excessive drinking can negatively impact your health

- Take preventive measures such as getting regular check-ups and vaccinations

Choosing Longer Elimination Periods

The elimination period, also known as the waiting period, is the length of time you must wait before you begin receiving disability benefits. Choosing a longer elimination period can help lower your disability insurance premium. By selecting a longer waiting period, you are essentially self-insuring for a longer period of time before the insurance company starts providing benefits. Here are a few considerations if you are thinking about extending your elimination period:

- Assess your financial situation and determine if you have enough savings to cover your expenses during the extended waiting period

- Consider your current job stability and the likelihood of needing immediate disability benefits

- Calculate the potential cost savings by comparing premiums for different elimination periods

- Talk to a trusted financial advisor or insurance agent to help you make an informed decision

Opting For Multi-life Discounts

Another way to lower your disability insurance premium is by taking advantage of multi-life discounts. If you have a spouse or partner who also needs disability insurance, you may be eligible for a discount by purchasing policies together. Insurers often offer discounted rates for multiple policies to encourage customers to bundle their coverage. Here’s what you need to know about multi-life discounts:

- Contact your insurance provider or agent to inquire about multi-life discount options

- Compare the cost savings of purchasing individual policies versus a joint policy

- Consider the unique circumstances of each person applying for disability insurance

- Review the terms and conditions of the policy to ensure both individuals’ needs are adequately covered

- Consult with a financial advisor or insurance expert to fully understand the benefits and potential drawbacks

Credit: http://www.amazon.com

Common Mistakes To Avoid

Common Mistakes to Avoid when considering disability insurance can impact your financial security. Know the pitfalls and safeguard your future.

Underinsuring Yourself

Many individuals make the mistake of underinsuring themselves when it comes to disability insurance. This can leave you financially vulnerable in case of an unexpected event.

Ignoring Own-occupation Coverage

Own-occupation coverage is crucial in disability insurance policies as it protects you in case you are unable to perform your specific job duties. Ignoring this can be a costly oversight.

Frequently Asked Questions For How Is Disability Insurance Premium Calculated

How Is Disability Insurance Premium Calculated?

There are numerous factors involved in calculating disability insurance premiums. These include age, occupation, health, coverage amount, and waiting period. Insurers will assess these factors to determine the risk of a policyholder filing a disability claim and then calculate the premium accordingly.

Why Do Disability Insurance Premiums Vary?

Disability insurance premiums vary based on individual factors such as age, health, occupation, and coverage amount. Additionally, different insurance companies have varying underwriting guidelines and pricing models, leading to differences in premiums. It’s essential to compare quotes from multiple providers to find the best rate for your circumstances.

What Factors Affect Disability Insurance Premiums?

Several factors can affect disability insurance premiums, including age, health, occupation, coverage amount, and the length of the waiting period. Insurers consider these factors when determining the likelihood of a policyholder making a claim and adjust the premium accordingly.

Can I Lower My Disability Insurance Premiums?

Yes, you can take steps to potentially lower your disability insurance premiums. Maintaining a healthy lifestyle, choosing a longer waiting period, and working in a low-risk occupation can positively impact premiums. It’s also beneficial to compare quotes from different insurance providers to find the most competitive rates.

Conclusion

Understanding how disability insurance premiums are calculated is crucial for individuals seeking adequate coverage. By considering factors such as age, occupation, health history, and desired coverage amount, insurance providers can determine the appropriate premium amount. It is advisable to compare quotes from multiple insurance companies to find the most affordable and comprehensive policy.

The right disability insurance can provide financial security in the event of illness or injury, ensuring peace of mind for individuals and their loved ones.

Leave a comment