Landlord insurance costs can range from $100 to $300 per month, depending on factors such as property location, coverage limits, and risks. Landlord insurance is crucial for protecting rental properties and providing financial security.

As a property owner, having landlord insurance can help mitigate potential liabilities and property damage risks. By paying a monthly premium, landlords can have peace of mind knowing their investment is safeguarded against unforeseen events like tenant damage, natural disasters, or liability claims.

Understanding the cost of landlord insurance per month allows landlords to budget effectively and make informed decisions to protect their rental income and property assets.

Credit: http://www.ccrentalpro.com

What Is Landlord Insurance

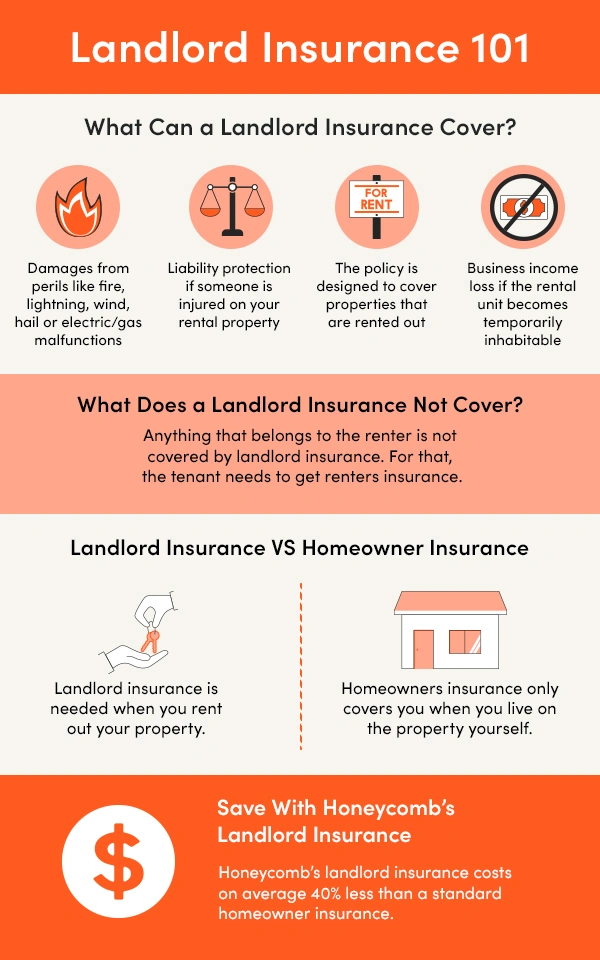

Understanding What is Landlord Insurance is crucial for property owners. Landlord insurance is a policy that protects property owners from financial losses associated with renting out their properties.

Coverage And Benefits

- Property Protection: Safeguards your property against damages caused by fire, natural disasters, or vandalism.

- Liability Coverage: Covers legal expenses if a tenant or visitor is injured on your property.

- Loss of Rental Income: Provides compensation if your property becomes uninhabitable due to damages.

Importance Of Landlord Insurance

- Financial Protection: Shield your investment from unexpected events that could result in financial loss.

- Legal Safeguard: Protect yourself from potential legal disputes with tenants or third parties.

- Peace of Mind: Ensure you have coverage in place to deal with emergencies and unforeseen circumstances.

Credit: honeycombinsurance.com

Factors Affecting Landlord Insurance Cost

Landlord insurance costs can vary significantly based on several key factors. Understanding the elements that influence the price of landlord insurance can help property owners make informed decisions about their coverage. Here are the main factors affecting the cost of landlord insurance:

Location And Property Type

The location of your rental property plays a crucial role in determining the cost of landlord insurance. Areas prone to natural disasters may have higher premiums. The type of property you own, whether it’s a single-family home, apartment building, or condominium, also impacts insurance costs.

Coverage Level

The extent of coverage you select will directly affect your monthly landlord insurance premium. Comprehensive coverage, which includes protection against a wide range of risks like property damage, liability, and loss of rental income, will cost more than basic coverage.

Claim History

Your past history of insurance claims can influence the cost of your landlord insurance. Property owners with a record of frequent claims may face higher premiums as they are considered higher risk. Maintaining a claims-free history can help keep insurance costs in check.

Average Cost Of Landlord Insurance

When it comes to renting out a property, it’s important for landlords to protect their investment with landlord insurance. But how much does this type of insurance cost on average? In this section, we will explore the average cost of landlord insurance, including national averages and regional variances.

National Average

The national average cost of landlord insurance is $1,200 per year, or around $100 per month. However, it’s essential to note that this average can vary significantly based on several factors. These include the location of the property, the age and size of the property, the value of the property, and the coverage options chosen by the landlord.

Regional Variances

When it comes to landlord insurance, regional variances can have a substantial impact on the cost. Let’s take a closer look at these regional differences:

| Region | Average Monthly Cost |

|---|---|

| West Coast | $120 |

| East Coast | $110 |

| Midwest | $90 |

| South | $95 |

As shown in the table above, there are noticeable regional differences in the average monthly cost of landlord insurance. Regions such as the West Coast and East Coast tend to have higher premiums, primarily due to the higher property values and increased risk factors associated with these areas. On the other hand, the Midwest and South typically have lower insurance costs due to the lower property values and lower risk factors.

It’s important for landlords to consider these regional differences when budgeting for landlord insurance. By understanding the average costs in their specific region, landlords can make informed decisions and ensure they have adequate coverage at a reasonable price.+

Saving Strategies For Landlords

As a landlord, it’s important to seek out strategies for saving on landlord insurance, as this can significantly impact your monthly expenses. Implementing these saving strategies for landlords can help you to manage your costs effectively and protect your investment.

Shop Around For Quotes

One effective way to save on landlord insurance is to shop around for quotes from different insurance providers. Comparing prices and coverage options can help you find the most affordable policy that meets your needs.

Bundle Insurance Policies

Consider bundling your landlord insurance with other policies, such as auto or umbrella insurance. Insurance companies often offer discounts for bundling multiple policies, which can result in significant savings over time.

Increase Deductibles

Increasing your deductibles can also lead to lower monthly premiums. While this means paying more out of pocket in the event of a claim, it can ultimately reduce your insurance costs over the long term.

Improve Property Security

Enhancing the security of your rental property can help lower your insurance premiums. Installing security systems, deadbolts, and smoke alarms not only improves safety but can also make your property less risky to insure.

Maintain A Good Claim History

Maintaining a good history of making few or no claims can help lower your insurance costs. Insurance companies are more likely to offer discounts to landlords who demonstrate responsible risk management.

Considerations When Choosing A Policy

When selecting landlord insurance, check coverage, liability limits, and deductible options. Research providers for pricing and customer service ratings. Consider individual property risks and budget constraints for monthly premium affordability.

Considerations When Choosing a Policy When choosing a landlord insurance policy, several key considerations can significantly impact your decision-making process. Understanding your coverage needs, exclusions and limitations, as well as the claims process and customer service, is essential. Coverage Needs Protecting your investment property requires careful consideration of the coverage options provided by different landlord insurance policies. It’s crucial to assess your specific needs, including property damage, loss of rental income, and liability protection to ensure comprehensive coverage. Exclusions and Limitations Familiarize yourself with the exclusions and limitations of each landlord insurance policy. Pay close attention to potential exclusions such as acts of vandalism, natural disasters, or malicious damage. Understanding these limitations will help you avoid potential financial surprises in the event of a claim. Claims Process and Customer Service Before selecting a policy, thoroughly evaluate the claims process and customer service provided by the insurance provider. Ease of filing claims and responsive customer support are essential factors to consider, ensuring a smooth and efficient experience in the event of a claim. Overall, when considering landlord insurance policies, it’s essential to carefully assess your coverage needs, understand the exclusions and limitations, and evaluate the claims process and customer service to make an informed decision.

Credit: http://www.ccrentalpro.com

Additional Coverages Landlords Should Consider

Landlord insurance per month varies based on coverage, location, and property type. Additional coverages landlords should consider include loss of rent, vandalism, and contents insurance. These added protections offer financial security and peace of mind, ensuring comprehensive coverage for unforeseen events.

Rent Guarantee Insurance

Rent Guarantee Insurance is a valuable coverage that landlords should consider to protect themselves from the risk of lost rental income. This type of insurance provides financial protection in the event that a tenant fails to pay their rent. As a landlord, you rely on rental income to cover your expenses, so if a tenant defaults on their payments, it can have a significant impact on your cash flow. With Rent Guarantee Insurance, you can have peace of mind knowing that you will still receive income even if your tenant fails to pay. This coverage typically includes legal expenses to cover the costs of eviction proceedings and provides compensation for lost rent. By choosing this additional coverage, you can protect yourself from potential financial loss and avoid the hassles of pursuing legal action against a non-paying tenant.Legal Expenses Insurance

Legal Expenses Insurance is another essential coverage option for landlords to consider. As a landlord, you may encounter various legal disputes or issues related to your rental property. These can range from disputes with tenants over damage or unpaid rent to legal proceedings for eviction or tenancy contract issues. Legal Expenses Insurance can provide financial protection by covering the costs of legal representation and court fees. With this coverage, you can confidently navigate legal disputes without worrying about expensive legal bills. Whether you need to take legal action against a problem tenant or defend your rights as a landlord, having Legal Expenses Insurance ensures that you have the necessary resources to protect your interests. In conclusion, when it comes to landlord insurance, it’s not just about the basic coverage for property damage or liability. Landlords should also consider additional coverages that can provide financial protection and help mitigate the risks they face. Rent Guarantee Insurance and Legal Expenses Insurance are two essential options that stand out. Rent Guarantee Insurance ensures landlords continue to receive rental income, even if tenants default on payment, while Legal Expenses Insurance covers the costs of legal disputes. By investing in these additional coverages, landlords can safeguard their financial interests and maintain a smooth and worry-free rental operation.Tips To Lower Landlord Insurance Costs

Looking to reduce your landlord insurance expenses? Follow these tips to lower your monthly costs.

Maintain A Good Credit Score

Good credit scores can lead to lower insurance premiums. Regularly check and maintain your credit score.

Invest In Loss Prevention Measures

Installing security systems and safety features can minimize risks and potentially reduce insurance costs.

Update Property Details Regularly

Keep property information up-to-date to ensure accurate coverage and avoid unnecessary fees.

Frequently Asked Questions For How Much Is Landlord Insurance Per Month

How Much Does Landlord Insurance Cost Per Month?

Landlord insurance costs vary based on multiple factors, including the property’s location, size, and coverage needs. On average, the monthly premiums can range from $80 to $150. It’s essential to compare quotes from different insurers to find the best rate for your specific situation.

What Does Landlord Insurance Cover?

Landlord insurance typically covers property damage caused by perils like fire, storms, vandalism, and theft. It also provides liability protection if a tenant or visitor is injured on the property. Additional coverage may include loss of rental income and legal expenses related to tenant disputes.

Is Landlord Insurance Mandatory?

While landlord insurance isn’t legally required, it’s highly recommended for property owners. Unlike standard homeowner’s insurance, landlord insurance covers rental properties and provides specific protections for landlords, such as loss of rental income and liability coverage. It offers financial security and peace of mind for landlords.

Conclusion

To summarize, understanding the cost of landlord insurance per month is crucial for property owners. By considering factors such as location, type of property, coverage options, and provider, landlords can get an idea of the monthly premium they might expect to pay.

It is recommended to shop around, compare quotes, and seek advice from insurance professionals to find the best policy that fits both financial needs and coverage requirements. Protecting your investment with the right insurance can provide peace of mind and safeguard against potential risks.

Leave a comment