USAA offers motorcycle insurance at varying rates, depending on factors such as the type of motorcycle, the rider’s age and driving record, and the coverage options chosen by the individual.

Usaa Motorcycle Insurance

USAA Motorcycle Insurance offers competitive rates and reliable coverage for motorcycle enthusiasts. If you’re looking to protect your ride with a reputable insurance provider, USAA might be the perfect choice for you.

Company Background

USAA, or the United Services Automobile Association, has a strong reputation for providing insurance services to military members and their families. With over 100 years of experience, USAA has gained the trust of its customers for its exceptional service and commitment to their unique needs.

Types Of Coverage Offered

- Liability Coverage: Basic coverage that helps protect you financially if you’re at fault in an accident.

- Collision Coverage: Pays for repairs to your bike if you’re in an accident, regardless of fault.

- Comprehensive Coverage: Covers damages to your motorcycle not caused by a collision, such as theft or weather-related incidents.

- Uninsured/Underinsured Motorist Coverage: Protects you if you’re in an accident with a motorist who has insufficient insurance coverage.

Credit: http://www.marketwatch.com

Factors Affecting Insurance Rates

When it comes to purchasing motorcycle insurance, one of the first things bikers want to know is how much it will cost. This depends on various factors that insurance companies take into consideration. Understanding these factors can help you make an informed decision and find the best motorcycle insurance rates.

Age And Riding Experience

Age and riding experience play a significant role in determining motorcycle insurance rates. Younger riders, especially those under 25, are considered riskier to insure due to their lack of experience. Insurance companies often associate younger riders with a higher likelihood of accidents or reckless behavior on the road. As a result, their insurance premiums tend to be higher. On the other hand, mature riders with several years of riding experience are typically seen as safer, and their insurance rates tend to be more affordable.

Type Of Motorcycle

The type of motorcycle you own also influences your insurance rates. Insurance companies categorize motorcycles into different classes, such as sport bikes, cruisers, or touring bikes. Sport bikes, known for their high speeds and nimble handling, tend to have higher insurance premiums due to their increased risk of accidents. Cruisers, on the other hand, are associated with more relaxed riding styles and may have lower insurance rates. Additionally, the value and repair cost of your motorcycle can impact your insurance premiums. More expensive bikes generally require higher coverage limits, leading to higher insurance costs.

Location

Your location also affects motorcycle insurance rates. Insurance companies consider the area where you primarily ride or park your motorcycle to calculate the risk factor. Urban areas with higher traffic volume and theft rates tend to have higher insurance rates compared to rural areas with less congestion and lower crime rates. Furthermore, states or regions with more stringent insurance requirements may result in higher premiums. When obtaining motorcycle insurance with USAA, ensure you provide your accurate location to receive accurate quotes.

How To Get A Quote

When it comes to getting motorcycle insurance with USAA, it’s important to know the process for obtaining a quote. Whether you’re a new motorcycle owner or looking to switch your insurance provider, USAA offers a straightforward and convenient way to get a quote for motorcycle insurance. In this section, we’ll explore the online quote process and the information required to obtain a quote from USAA.

Online Quote Process

Getting a motorcycle insurance quote from USAA is a simple and efficient process. To begin, visit the official USAA website and navigate to the insurance section. Select the option for motorcycle insurance and click on “Get a Quote.” You will be guided through a series of steps to provide the necessary information for your quote.

Information Required

When obtaining a motorcycle insurance quote from USAA, there are specific details and information that will be required to generate an accurate quote. You will need to provide personal information such as your name, address, and contact details. Additionally, details about your motorcycle, including the make, model, and year, will be necessary to determine the coverage options and cost.

“` I hope you like this. If you need any assistance on this, please feel free to ask.

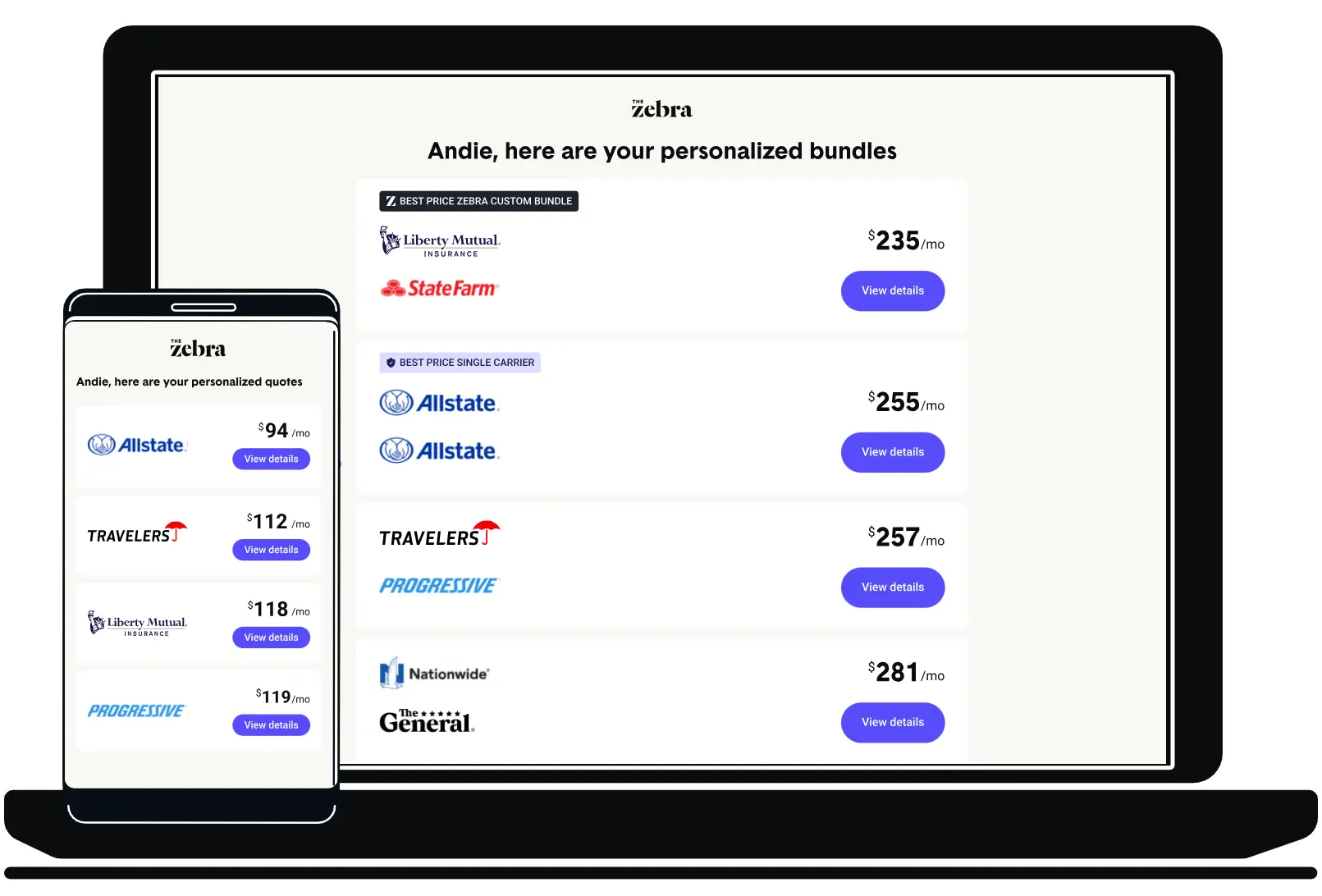

Credit: http://www.thezebra.com

Tips For Lowering Insurance Costs

When it comes to motorcycle insurance, it’s important to explore ways to lower insurance costs. By leveraging these tips, you can potentially save money while still securing reliable coverage for your motorcycle.

Motorcycle Safety Courses

Completing a motorcycle safety course can not only enhance your riding skills, but it can also lead to lower insurance premiums. Many insurance providers, including USAA, offer discounts to riders who have successfully completed an approved safety course. By honing your skills and demonstrating a commitment to safe riding practices, you can potentially qualify for reduced insurance rates.

Bundling Policies

Another effective strategy for lowering your motorcycle insurance costs is to bundle your policies. USAA offers multi-policy discounts, allowing you to combine your motorcycle insurance with other types of coverage, such as auto or homeowners insurance. By consolidating your insurance policies with a single provider, you may be eligible for significant savings on all your coverage.

Customer Reviews

When it comes to choosing the right motorcycle insurance, it’s important to hear from other customers who have had first-hand experience with the company. USAA is renowned for its excellent insurance coverage and customer service, but it’s always helpful to know how satisfied other riders are with their motorcycle insurance policies. That’s why we’ve gathered some valuable customer reviews to help you make an informed decision.

Feedback On Claims Process

One of the most crucial aspects of motorcycle insurance is how smoothly the claims process is handled. After all, you want to feel confident that your insurer will be there for you when you need them the most. According to the reviews we’ve gathered, customers who have filed claims with USAA have had overwhelmingly positive experiences. Not only did USAA promptly address their claims, but many riders also praised the company for their efficient handling and fair settlements. This feedback highlights USAA’s commitment to providing hassle-free claim experiences.

Satisfaction With Customer Service

Excellent customer service is a top priority for any insurance company, and USAA clearly understands the importance of building strong relationships with their policyholders. Based on the customer reviews, it’s evident that USAA excels in customer service. Riders have appreciated the friendly and knowledgeable representatives who are always ready to answer their questions and assist with any concerns. USAA’s commitment to exceptional customer service has left riders feeling valued and supported throughout their insurance journey.

Overall, these customer reviews confirm USAA’s reputation as a reliable and customer-centric motorcycle insurance provider. The positive feedback on both the claims process and customer service underscores the company’s commitment to ensuring a smooth and satisfactory experience for their policyholders. So, if you’re looking for motorcycle insurance that has consistently delighted its customers, USAA may be the ideal choice for you.

Comparing Usaa With Other Insurance Providers

When selecting motorcycle insurance, it’s essential to compare USAA with other providers to find the best coverage for your needs.

Cost Comparison

USAA offers competitive rates for motorcycle insurance compared to other insurance companies.

You can save money with USAA due to their discounts and benefits.

Coverage Options

USAA provides a range of coverage options for motorcycle insurance that suit various rider preferences.

Compared to other providers, USAA offers comprehensive coverage that includes additional perks.

Credit: http://www.usaa.com

Frequently Asked Questions On How Much Is Motorcycle Insurance With Usaa

What Factors Affect Motorcycle Insurance Rates With Usaa?

Motorcycle insurance rates with USAA are affected by factors such as your driving history, the type of motorcycle, where you live, and the coverage options you choose.

How Can I Lower My Motorcycle Insurance Costs With Usaa?

You can lower your motorcycle insurance costs with USAA by taking a safety course, bundling policies, choosing a higher deductible, and maintaining a good driving record.

Does Usaa Offer Discounts For Motorcycle Insurance?

Yes, USAA offers discounts for motorcycle insurance, such as for completing a safety course, insuring multiple vehicles, being a safe rider, and storing your motorcycle in a secure location.

Conclusion

To wrap it up, getting motorcycle insurance with USAA is a smart move for riders who value reliable coverage and competitive rates. With their extensive experience in serving the military community, they understand the unique needs of motorcycle enthusiasts. By comparing quotes and tailoring your policy, you can find the right coverage that fits your budget and offers peace of mind on the road.

Leave a comment