Renters insurance in Toronto typically costs around $20 to $50 per month, depending on coverage options and providers. It is essential for protecting your belongings in case of unforeseen events.

Renters insurance in Toronto offers peace of mind by safeguarding your personal property against theft, damage, and liability risks. With affordable monthly premiums and customizable coverage plans, renters insurance is a wise investment for renters in Toronto. By securing a policy that suits your needs, you can confidently enjoy your rental space knowing that your possessions are protected.

In this guide, we will explore the importance of renters insurance in Toronto and provide valuable insights to help you make an informed decision when selecting a policy.

Credit: http://www.forbes.com

What Is Renters Insurance

Renters insurance is a protective policy that covers personal belongings, liability, and additional living expenses for tenants in Toronto. It provides financial security in case of unforeseen events.

Coverage For Personal Belongings

Renters insurance in Toronto safeguards personal belongings such as furniture, electronics, and clothing from theft, vandalism, or natural disasters like fire or water damage.

Liability Coverage

Liability coverage included in renters insurance protects tenants from potential legal fees or medical expenses if someone gets injured while on the property rented by the policyholder.

Additional Living Expenses

Additional living expenses coverage helps cover costs for temporary housing or food if the rented property becomes uninhabitable due to a covered event, ensuring tenants have a place to stay during repairs.

Benefits Of Renters Insurance

Toronto renters insurance provides financial protection for tenants against theft, damages, and liability risks. This coverage typically costs between $15 to $30 per month, depending on individual factors and coverage limits. In the event of unforeseen events, having renters insurance offers peace of mind and security.

Protection Of Personal Property

Renters insurance safeguards your personal belongings in case of theft or damage.

It includes electronics, furniture, clothing, and other possessions.

Liability Protection

In the event of an accident in your rental unit, liability protection covers damages or injuries.

It also includes legal expenses if you are sued for accidental harm to others.

Reimbursement For Additional Living Expenses

If your rental becomes uninhabitable due to a covered peril, renters insurance covers additional living expenses.

This includes hotel costs and meals above normal expenses.

Factors Influencing Renters Insurance Cost

When it comes to protecting your belongings and ensuring your peace of mind as a renter in Toronto, getting renters insurance is a wise decision. However, you may be wondering about the factors that influence the cost of renters insurance in Toronto. Below, we explore five key aspects that can impact how much you can expect to pay for renters insurance.

Location

Your location within Toronto plays a significant role in determining the cost of your renters insurance. Areas with higher crime rates or a greater risk of natural disasters will generally have higher insurance premiums. Additionally, if you live in an apartment building with a history of break-ins or accidents, the insurance cost may be higher for you.

Coverage Limits

The coverage limits you select for your Toronto renters insurance policy also impact the cost. Higher coverage limits mean greater protection for your belongings but can result in higher premiums. Consider the total value of your possessions and choose coverage limits accordingly, balancing your need for coverage against your budget.

Deductible

The deductible is the amount you are responsible for paying out of pocket before your renters insurance coverage kicks in. Choosing a higher deductible can lower your monthly premiums, but it also means you will have to pay more if you file a claim. Conversely, a lower deductible means higher premiums but less financial burden in the event of a claim.

Claims History

Your claims history plays a role in determining your renters insurance cost in Toronto. Insurers will assess the risk you pose based on past claims you’ve made. If you have a history of filing frequent claims or claims related to high-risk incidents, such as theft or water damage, your premiums may be higher.

Security Measures

The security measures you have in place can influence the cost of your renters insurance in Toronto. Installing a security system, having deadbolts on doors, and using window locks can reduce the risk of theft or vandalism, potentially leading to lower insurance premiums. Inform your insurance provider about any security measures you have implemented to ensure you receive any applicable discounts.

Credit: apollocover.com

How To Find Affordable Renters Insurance

Renters insurance is a crucial expense for many dwellers, helping protect personal belongings and providing liability coverage. As a tenant in Toronto, it’s essential to find a balance between comprehensive coverage and affordability.

Shop Around And Compare Quotes

It’s important to explore various options when seeking affordable renters insurance. Different insurance providers offer diverse coverage options and rates. Compare quotes from multiple insurers to find the best deal for your budget and needs.

Consider Bundling Insurance Policies

Many insurance companies offer discounts for bundling multiple policies. Consider combining your renters insurance with other types of coverage, such as auto insurance, to potentially lower your overall insurance costs.

Raise Deductible

Increasing your deductible can help reduce your monthly premiums. However, it’s imperative to ensure that you can comfortably afford the deductible if you need to file a claim in the future.

Install Safety Features

Improving the security of your rental unit can make you eligible for discounts on renters insurance. Installing safety features such as smoke alarms, burglar alarms, and deadbolt locks can lower your insurance costs.

Improve Credit Score

Your credit score can have an impact on your renters insurance premium. By managing your finances responsibly and improving your credit score, you may be eligible for lower insurance rates. Paying bills on time and reducing outstanding debts can positively influence your credit score.

Tips For Lowering Renters Insurance Premium

When it comes to renters insurance in Toronto, managing your budget is essential. Here are some practical tips to help lower your renters insurance premium:

Maintain A Good Credit Score

Improving your credit score can positively impact your renters insurance premium. Maintaining a good credit score demonstrates financial responsibility and may result in lower insurance rates.

Increase Security Measures

Enhancing the security of your rental unit can lead to reduced insurance costs. Installing a security system, deadbolts, and smoke detectors can help mitigate risks, potentially lowering your premiums.

Choose A Higher Deductible

Opting for a higher deductible can lower your monthly premiums. However, it’s important to ensure that you can afford the higher out-of-pocket costs in the event of a claim.

What Is Not Covered By Renters Insurance

Renters insurance in Toronto typically does not cover damage caused by floods, earthquakes, or certain high-value items like jewelry. It also may not cover losses resulting from intentional acts or illegal activities. It’s important to review the policy to understand the specific exclusions.

Renters insurance provides tenants in Toronto with essential coverage for their belongings and liability. However, it is important to understand that there are certain situations and events that are typically not covered by renters insurance. These exclusions vary from policy to policy, but it’s crucial to have a clear understanding of what is not covered to ensure you have adequate protection.

Damage From Flooding

Flooding can cause extensive damage to your rented property and personal belongings. Unfortunately, renters insurance typically does not cover damages caused by flooding. To protect yourself against flood-related losses, you may need to consider purchasing a separate flood insurance policy. This specific coverage can provide financial protection in the event of water damage resulting from a flood caused by natural disasters, burst pipes, or other water-related incidents.

Damage From Earthquakes

Living in Toronto means being aware of the potential risk of earthquakes. However, standard renters insurance policies do not typically cover damage caused by earthquakes. To safeguard against losses resulting from seismic activity, it’s essential to consider obtaining earthquake insurance. This specialized coverage can provide financial security if your rental property or personal belongings are damaged during an earthquake

Loss Of High-value Items

While renters insurance does offer coverage for your personal belongings, there may be limitations or exclusions when it comes to high-value items such as jewelry, artwork, antiques, or collectibles. Most policies set specific limits on the coverage for these items, which may not fully reimburse you for their full value. To adequately protect these high-value possessions, you may need to purchase additional coverage, known as scheduled personal property coverage or a floater policy. This will ensure that you are adequately compensated in the event of loss, theft, or damage to your valuable items.

Common Renters Insurance Mistakes To Avoid

When securing renters insurance in Toronto, it’s important to steer clear of common pitfalls that can leave you under-protected in the event of a mishap. By being aware of these mistakes, renters can ensure they have adequate coverage. Let’s delve into the key missteps to avoid:

Underestimating The Value Of Personal Belongings

Many renters make the mistake of underestimating the value of their personal belongings, resulting in insufficient coverage. It is essential to take inventory and accurately assess the worth of your possessions to avoid being underinsured.

Not Understanding Policy Coverage

One of the critical errors is not fully comprehending the coverage provided by the policy. Understanding what is included and excluded is crucial to avoid surprises during a claim. Make sure to review the policy details carefully.

Not Updating Policy

Failure to regularly update your policy can lead to gaps in coverage. Life changes, such as acquiring new valuables or moving to a new location, necessitate adjustments to ensure your insurance adequately covers your current situation.

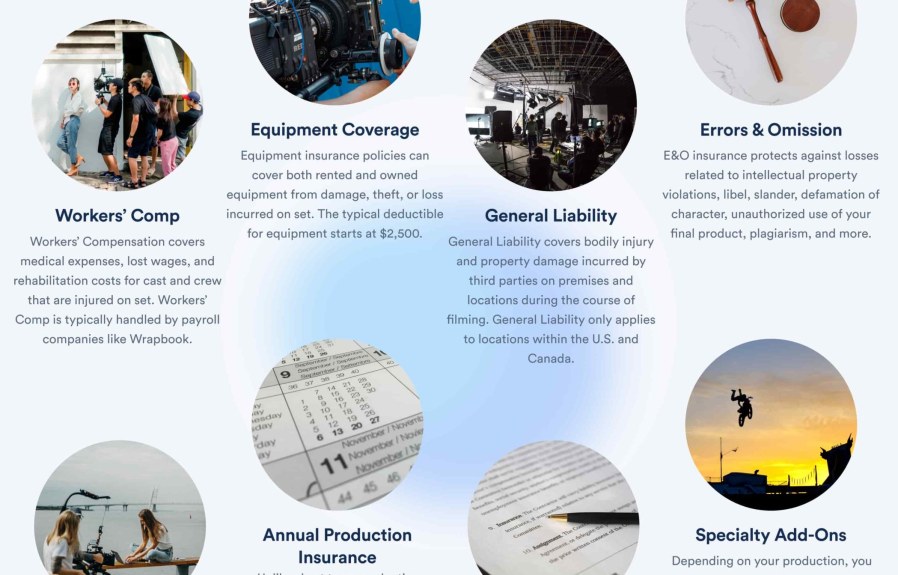

Credit: http://www.wrapbook.com

Frequently Asked Questions Of How Much Is Renters Insurance Toronto

What Does Renters Insurance Cover In Toronto?

Renters insurance in Toronto typically covers personal belongings, liability, and additional living expenses if your rental becomes uninhabitable due to a covered event, such as fire or theft.

How Much Does Renters Insurance Cost In Toronto?

The cost of renters insurance in Toronto varies based on factors like coverage amount, location, and deductible, but it’s generally affordable, often ranging from $15 to $30 per month.

Can Renters Insurance In Toronto Save Money On Car Insurance?

Yes, having renters insurance in Toronto can sometimes qualify you for a multi-policy discount with your car insurance provider, potentially lowering your overall insurance costs.

Is Renters Insurance Mandatory In Toronto, Ontario?

Renters insurance is not legally required in Toronto, Ontario, but it is highly recommended to protect your personal belongings and provide liability coverage in case of accidents.

Conclusion

Renters insurance in Toronto is a smart investment for protecting your belongings and providing peace of mind. While the cost may vary depending on factors such as location, coverage limits, and deductible, the benefits outweigh the expense. By having renters insurance, you can be prepared for unexpected events like theft, fire, or accidents.

Don’t wait until it’s too late – get renters insurance today and safeguard your possessions. Your belongings deserve the protection they deserve.

Leave a comment