Travel insurance to the USA typically costs around $50 to $100 for a short trip. It can vary based on coverage and length of stay.

Planning a trip to the USA can be exciting, but ensuring you have the right travel insurance is essential for peace of mind. Travel insurance can provide coverage for medical emergencies, trip cancellations, lost baggage, and other unforeseen events that may occur during your travels.

In this guide, we will explore the importance of travel insurance, the factors that can influence the cost, and how to choose the best travel insurance plan for your trip to the USA. Let’s delve into the details to help you make an informed decision for your upcoming travel adventure.

Factors Affecting Travel Insurance Cost

In determining the cost of travel insurance to the USA, several key factors come into play. These factors can significantly influence the price you pay for your travel insurance coverage.

Destination

The destination you are traveling to plays a crucial role in determining the cost of your travel insurance. Some destinations may have higher medical expenses, while others may pose greater risks, impacting the overall cost.

Duration Of Trip

The length of your trip is another factor that affects the cost of travel insurance. Longer trips typically require more coverage and therefore come with a higher price tag.

Age Of Traveler

The age of the traveler is a significant factor in determining the cost of travel insurance. Older travelers may face higher premiums as they are considered higher risk for medical emergencies.

Coverage Options

The coverage options you choose will directly impact the cost of your travel insurance. Additional coverage for activities like extreme sports or optional benefits can increase the overall price of the policy.

Credit: http://www.allianztravelinsurance.com

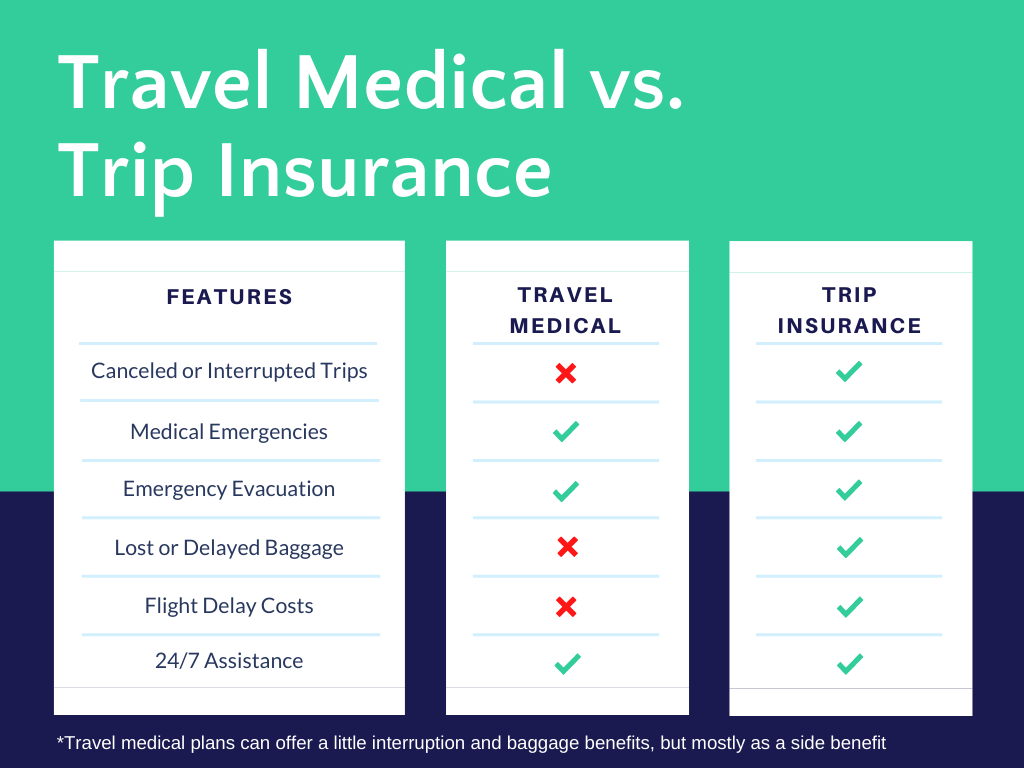

Different Types Of Travel Insurance

Trip Cancellation Insurance

Trip Cancellation Insurance protects your investment in case you need to cancel your trip due to unforeseen circumstances.

Medical Coverage

Medical Coverage ensures you are covered for medical emergencies that may occur during your travels.

Baggage Insurance

Baggage Insurance provides coverage for lost, stolen, or damaged luggage during your trip.

Emergency Assistance

Emergency Assistance offers 24/7 support and services in case of emergencies while traveling in the USA.

Comparing Insurance Providers

When planning a trip to the USA, one important aspect to consider is travel insurance. Having the right insurance coverage can give you peace of mind and protect you financially in case of unforeseen emergencies. But with so many insurance providers out there, how do you choose the right one for your needs? In this section, we will explore some key steps to help you compare insurance providers effectively.

Researching Insurance Companies

Before making a decision, it is crucial to conduct thorough research on insurance companies. Look for well-established providers with a good reputation in the industry. Check if they have experience dealing with travel insurance for the USA specifically, as requirements may vary from other destinations.

Reading Reviews

Reading reviews from other travelers can provide valuable insights into the quality and reliability of insurance providers. Look for reviews that highlight positive experiences and customer satisfaction. Pay attention to any negative feedback, as it can give you an idea of potential issues or limitations.

Getting Multiple Quotes

To ensure you get the best deal, it is advisable to get quotes from multiple insurance providers. Doing so allows you to compare prices and coverage options. Be sure to provide accurate information regarding your travel plans and any pre-existing medical conditions to receive accurate quotes. Remember, the cheapest option may not always offer the most comprehensive coverage.

Examining Policy Details

Once you have narrowed down your options, thoroughly examine the policy details of each insurance provider. Pay close attention to coverage limits, exclusions, deductibles, and any additional benefits offered. Look for policies that align with your specific needs and offer the necessary coverage for your trip to the USA.

By following these steps, you can make an informed decision when comparing insurance providers for your trip to the USA. Remember to consider factors such as reputation, reviews, pricing, and policy details to select the insurance coverage that best suits your requirements.

Credit: covertrip.com

Tips For Finding Affordable Travel Insurance

When searching for travel insurance to the USA, finding the right coverage at a reasonable price can seem like a daunting task. However, with some strategic tips and considerations, it’s possible to secure a suitable plan without breaking the bank.

Shop Around For The Best Price

Comparing multiple insurance providers is essential to finding the best deal. Utilize online comparison tools to easily compare quotes and coverage options from various companies, ensuring that you find the most suitable plan at a competitive price.

Consider Bundling

Many insurance companies offer discounts for bundling different insurance policies. When purchasing travel insurance to the USA, inquire if the provider offers any discounts for combining your travel coverage with other insurance needs, such as home or auto insurance.

Opt For A Higher Deductible

Opting for a higher deductible often results in lower premium costs. Assess your financial situation and travel plans to determine if selecting a higher deductible is a feasible option. While it may mean more out-of-pocket expenses in the event of a claim, it can lead to considerable savings on your premiums.

Evaluate Your Coverage Needs

Carefully assess your travel insurance needs to avoid overpaying for unnecessary coverage. Consider your specific travel destination, the duration of your trip, and any activities you plan to engage in, ensuring that you acquire adequate coverage without paying for superfluous benefits.

Additional Considerations For Travel Insurance

When considering travel insurance to the USA, there are several additional considerations that travelers should keep in mind. These details can make a substantial difference in the coverage and protection offered by the policy.

Pre-existing Medical Conditions

For individuals with pre-existing medical conditions, it’s crucial to understand how the insurance policy addresses these circumstances. Some policies may offer coverage for pre-existing conditions if certain requirements are met, while others may have exclusions or limitations. It’s essential to review the policy thoroughly to ensure that it provides the necessary coverage for any pre-existing medical conditions.

Coverage For Activities And Sports

Travel insurance policies may have specific limitations or exclusions regarding coverage for adventurous activities and sports. It’s important to check whether the policy includes coverage for activities like skiing, scuba diving, or other high-risk sports that you plan to participate in during your trip. Understanding these limitations can help avoid unexpected gaps in coverage.

Trip Cancellation Reasons

Understanding the various reasons for trip cancellation covered by the insurance policy is essential. Policies may include coverage for specific unforeseen events such as illness, natural disasters, or employment issues. Knowing the covered cancellation reasons can help travelers make informed decisions and understand the circumstances under which they can seek reimbursement for canceled trips.

Emergency Medical Evacuation

Emergency medical evacuation coverage is a critical aspect of travel insurance, especially when traveling to the USA. This coverage can be vital in situations where immediate medical attention or evacuation is required. It’s important to review the policy’s terms regarding emergency medical evacuation to ensure that it provides adequate protection in case of medical emergencies.

Credit: http://www.usatoday.com

Understanding Travel Insurance Exclusions

When planning a trip to the United States, it’s important to not only think about your itinerary and the attractions you want to visit but also to consider travel insurance. While travel insurance can provide valuable coverage for various unforeseen circumstances, it’s essential to understand the exclusions that may apply to your policy. By familiarizing yourself with these exclusions, you can ensure that you are fully aware of the coverage limitations and make an informed decision. In this article, we will discuss the most common travel insurance exclusions that you should be aware of, including pre-existing condition exclusions, high-risk activities exclusions, and exclusions for certain destinations.

Common Exclusions

Before purchasing travel insurance, it’s crucial to know what events and situations may not be covered by your policy. Common exclusions can vary among insurance providers but may typically include:

- War or acts of terrorism

- Governmental actions, such as travel advisories or restrictions

- Pre-existing medical or health conditions

- Financial default of a travel company or organization

- Travel to destinations with active conflicts or political unrest

Pre-existing Condition Exclusions

Many travel insurance policies have exclusions when it comes to pre-existing medical conditions. These exclusions typically mean that any claims related to a medical condition that existed prior to the effective date of the policy will not be covered. It’s essential to thoroughly review the policy’s definition of pre-existing conditions to understand the scope of coverage regarding your health.

High-risk Activities Exclusions

If you plan on engaging in high-risk activities during your trip to the United States, such as skydiving, bungee jumping, or skiing, it’s vital to check if these activities are covered by your travel insurance policy. Some policies may exclude coverage for injuries or accidents related to high-risk activities. Make sure to carefully read the policy wording or contact your insurance provider for clarification.

Exclusions For Certain Destinations

When traveling to specific destinations, there may be exclusions or restrictions in your travel insurance policy. This could be due to factors such as ongoing political unrest, civil wars, disease outbreaks, or other risks associated with that particular location. Double-check the policy documentation or consult with your insurance provider to ensure you understand any exclusions or limitations associated with your desired destination.

Frequently Asked Questions For How Much Is Travel Insurance To Usa

What Factors Affect The Cost Of Travel Insurance To The Usa?

When determining the cost of travel insurance to the USA, several factors come into play, including the length of stay, age of the traveler, and coverage limits. Additionally, the type of travel insurance plan and any pre-existing medical conditions may impact the overall cost.

Are There Different Types Of Travel Insurance Plans For The Usa?

Yes, there are various types of travel insurance plans available for trips to the USA. These may include comprehensive coverage, medical-only plans, and trip cancellation/interruption insurance. Each plan offers different benefits and coverage levels, so it’s essential to choose the one that suits your specific travel needs.

How Can I Find The Best Deal On Travel Insurance To The Usa?

To find the best deal on travel insurance to the USA, consider obtaining quotes from multiple providers, comparing coverage options and prices. Additionally, reviewing customer reviews and seeking recommendations can help in making an informed decision. It’s essential to prioritize coverage that aligns with your travel needs while staying within your budget.

Conclusion

Travel insurance is essential when planning a trip to the USA. As we have seen, the cost of travel insurance varies depending on factors such as your age, duration of stay, and the amount of coverage you need. It is crucial to compare different insurance providers to find the best price that suits your needs.

Remember, investing in travel insurance is a small price to pay for peace of mind, knowing that you will be protected in case of any unforeseen circumstances during your trip. So, before you embark on your next adventure, don’t forget to secure travel insurance.

Safe travels!

{ “@context”: “https://schema.org”, “@type”: “FAQPage”, “mainEntity”: [ { “@type”: “Question”, “name”: “What factors affect the cost of travel insurance to the USA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “When determining the cost of travel insurance to the USA, several factors come into play, including the length of stay, age of the traveler, and coverage limits. Additionally, the type of travel insurance plan and any pre-existing medical conditions may impact the overall cost.” } } , { “@type”: “Question”, “name”: “Are there different types of travel insurance plans for the USA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “Yes, there are various types of travel insurance plans available for trips to the USA. These may include comprehensive coverage, medical-only plans, and trip cancellation/interruption insurance. Each plan offers different benefits and coverage levels, so it’s essential to choose the one that suits your specific travel needs.” } } , { “@type”: “Question”, “name”: “How can I find the best deal on travel insurance to the USA?”, “acceptedAnswer”: { “@type”: “Answer”, “text”: “To find the best deal on travel insurance to the USA, consider obtaining quotes from multiple providers, comparing coverage options and prices. Additionally, reviewing customer reviews and seeking recommendations can help in making an informed decision. It’s essential to prioritize coverage that aligns with your travel needs while staying within your budget.” } } ] }

Leave a comment